Solve H-K

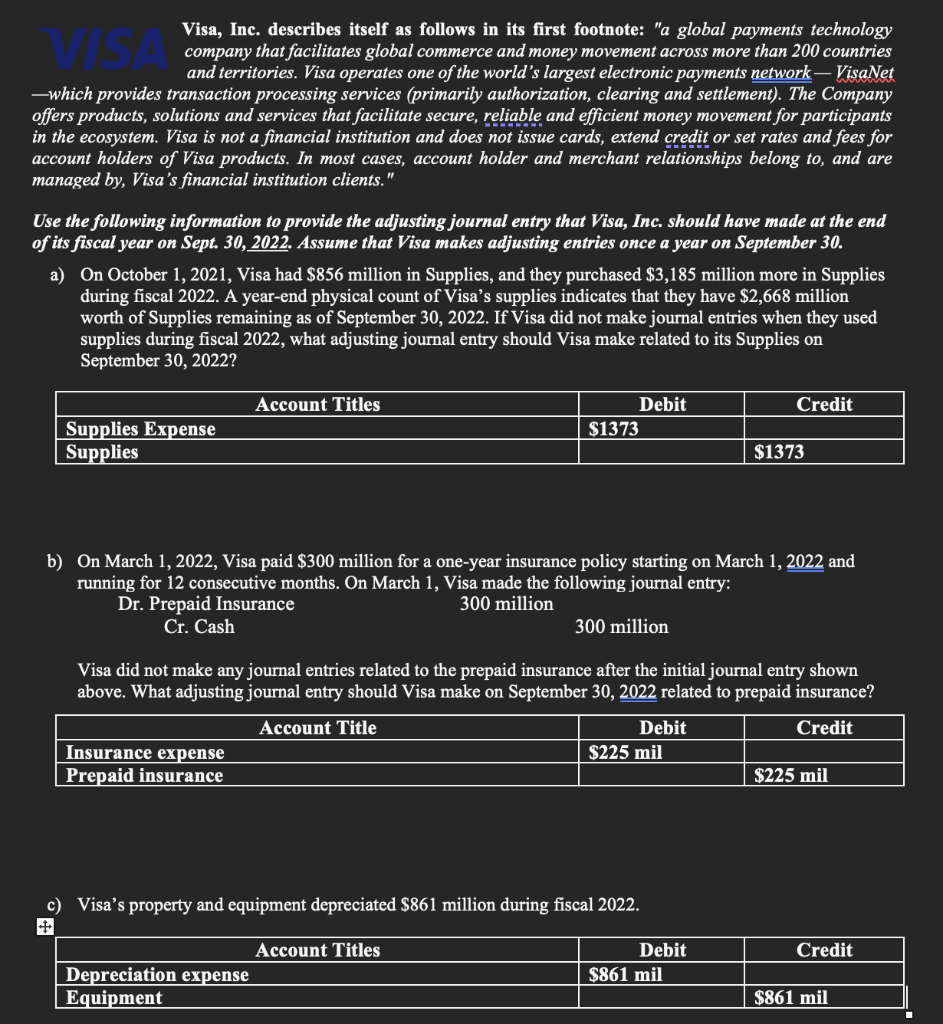

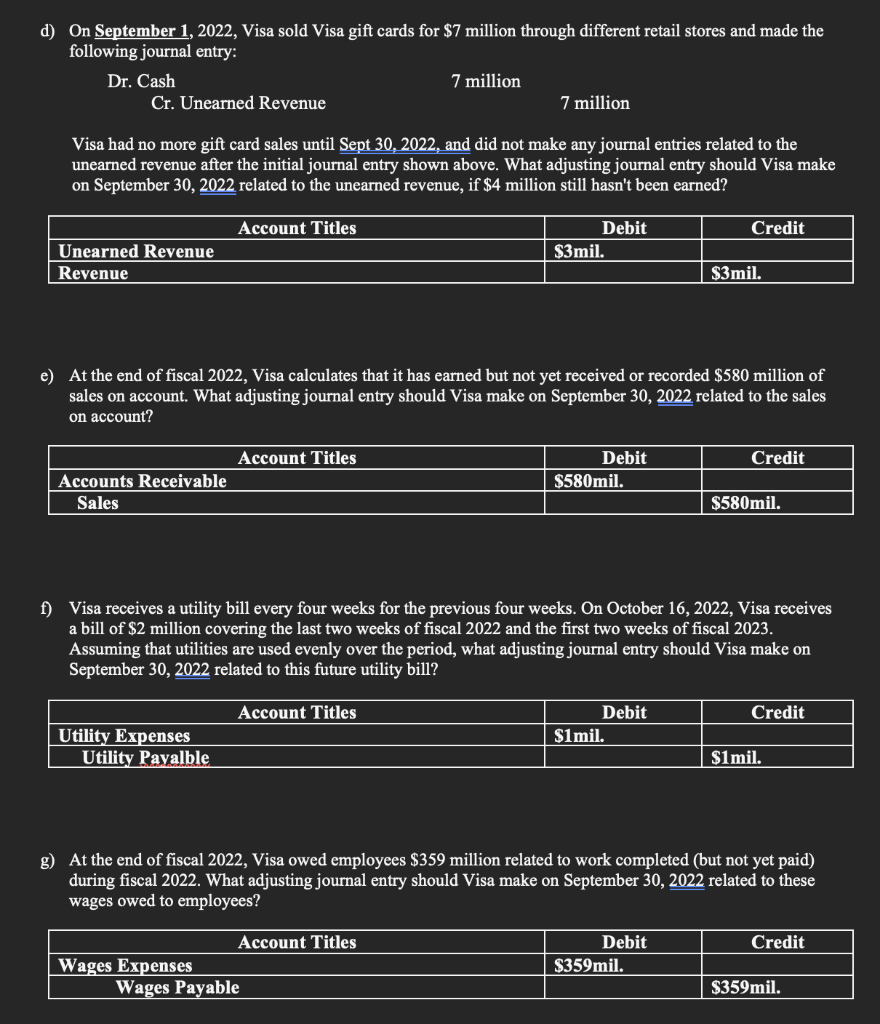

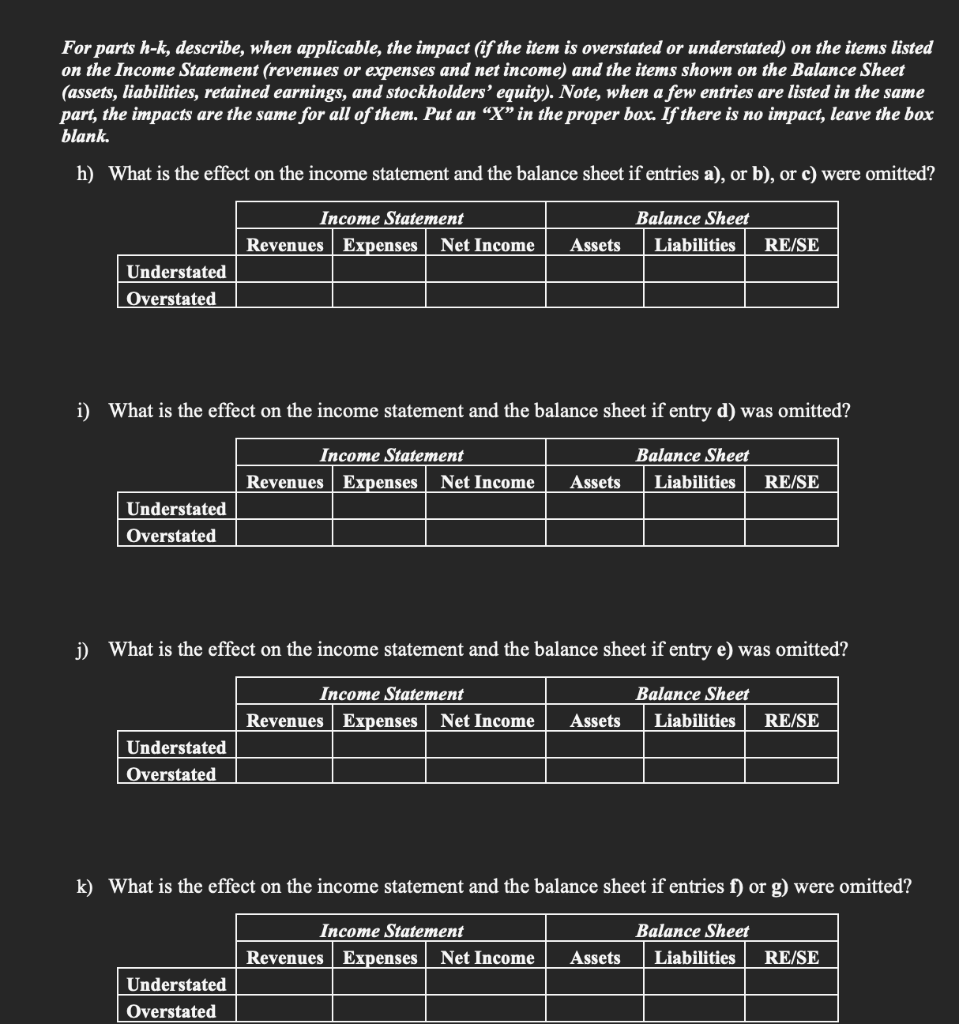

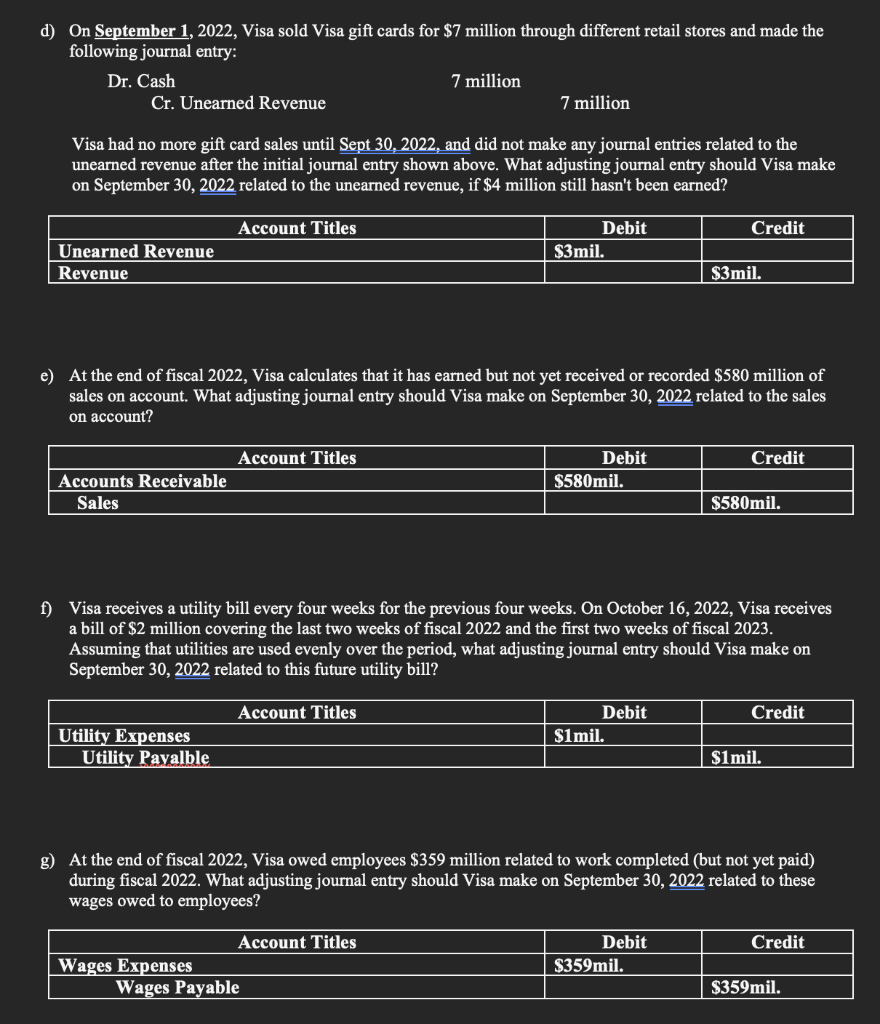

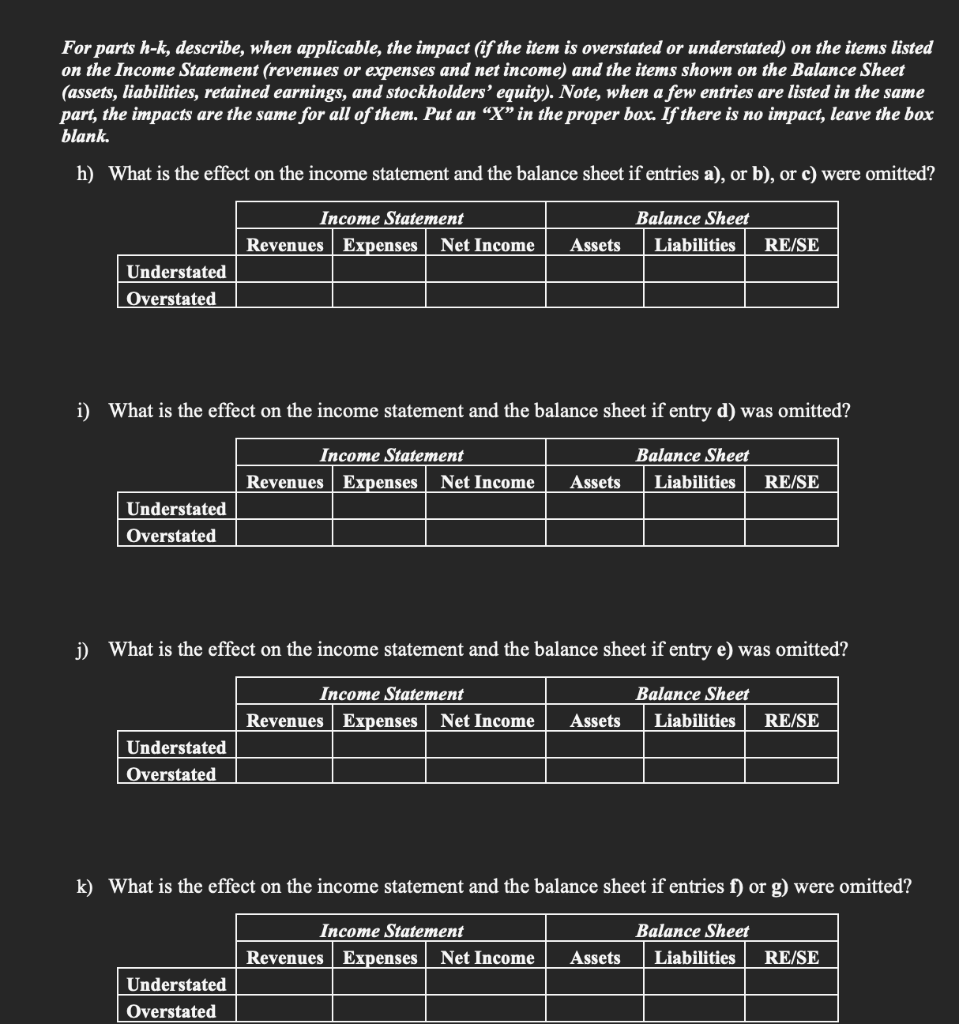

Visa, Inc. describes itself as follows in its first footnote: "a global payments technology company that facilitates global commerce and money movement across more than 200 countries and territories. Visa operates one of the world's largest electronic payments network - Visanet - which provides transaction processing services (primarily authorization, clearing and settlement). The Company offers products, solutions and services that facilitate secure, reliable and efficient money movement for participants in the ecosystem. Visa is not a financial institution and does not issue cards, extend credit or set rates and fees for account holders of Visa products. In most cases, account holder and merchant relationships belong to, and are managed by, Visa's financial institution clients." Use the following information to provide the adjusting journal entry that Visa, Inc. should have made at the end of its fiscal year on Sept. 30, 2022. Assume that Visa makes adjusting entries once a year on September 30. a) On October 1, 2021, Visa had $856 million in Supplies, and they purchased $3,185 million more in Supplies during fiscal 2022. A year-end physical count of Visa's supplies indicates that they have $2,668 million worth of Supplies remaining as of September 30, 2022. If Visa did not make journal entries when they used supplies during fiscal 2022, what adjusting journal entry should Visa make related to its Supplies on September 30, 2022? b) On March 1, 2022, Visa paid $300 million for a one-year insurance policy starting on March 1, 2022 and running for 12 consecutive months. On March 1, Visa made the following journal entry: Dr. Prepaid Insurance Cr. Cash 300 million 300million Visa did not make any journal entries related to the prepaid insurance after the initial journal entry shown above. What adjusting journal entry should Visa make on September 30, 2022 related to prepaid insurance? c) Visa's property and equipment depreciated $861 million during fiscal 2022. d) On September 1,2022, Visa sold Visa gift cards for $7 million through different retail stores and made the following journal entry: Visa had no more gift card sales until Sept 30, 2022, and did not make any journal entries related to the unearned revenue after the initial journal entry shown above. What adjusting journal entry should Visa make on September 30, 2022 related to the unearned revenue, if $4 million still hasn't been earned? e) At the end of fiscal 2022, Visa calculates that it has earned but not yet received or recorded $580 million of sales on account. What adjusting journal entry should Visa make on September 30,2022 related to the sales on account? f) Visa receives a utility bill every four weeks for the previous four weeks. On October 16, 2022, Visa receives a bill of $2 million covering the last two weeks of fiscal 2022 and the first two weeks of fiscal 2023. Assuming that utilities are used evenly over the period, what adjusting journal entry should Visa make on September 30,2022 related to this future utility bill? g) At the end of fiscal 2022, Visa owed employees $359 million related to work completed (but not yet paid) during fiscal 2022. What adjusting journal entry should Visa make on September 30, 2022 related to these wages owed to employees? For parts h-k, describe, when applicable, the impact (if the item is overstated or understated) on the items listed on the Income Statement (revenues or expenses and net income) and the items shown on the Balance Sheet (assets, liabilities, retained earnings, and stockholders' equity). Note, when a few entries are listed in the same part, the impacts are the same for all of them. Put an " X " in the proper box. If there is no impact, leave the box blank. h) What is the effect on the income statement and the balance sheet if entries a), or b), or c) were omitted? i) What is the effect on the income statement and the balance sheet if entry d) was omitted? j) What is the effect on the income statement and the balance sheet if entry e) was omitted