Answered step by step

Verified Expert Solution

Question

1 Approved Answer

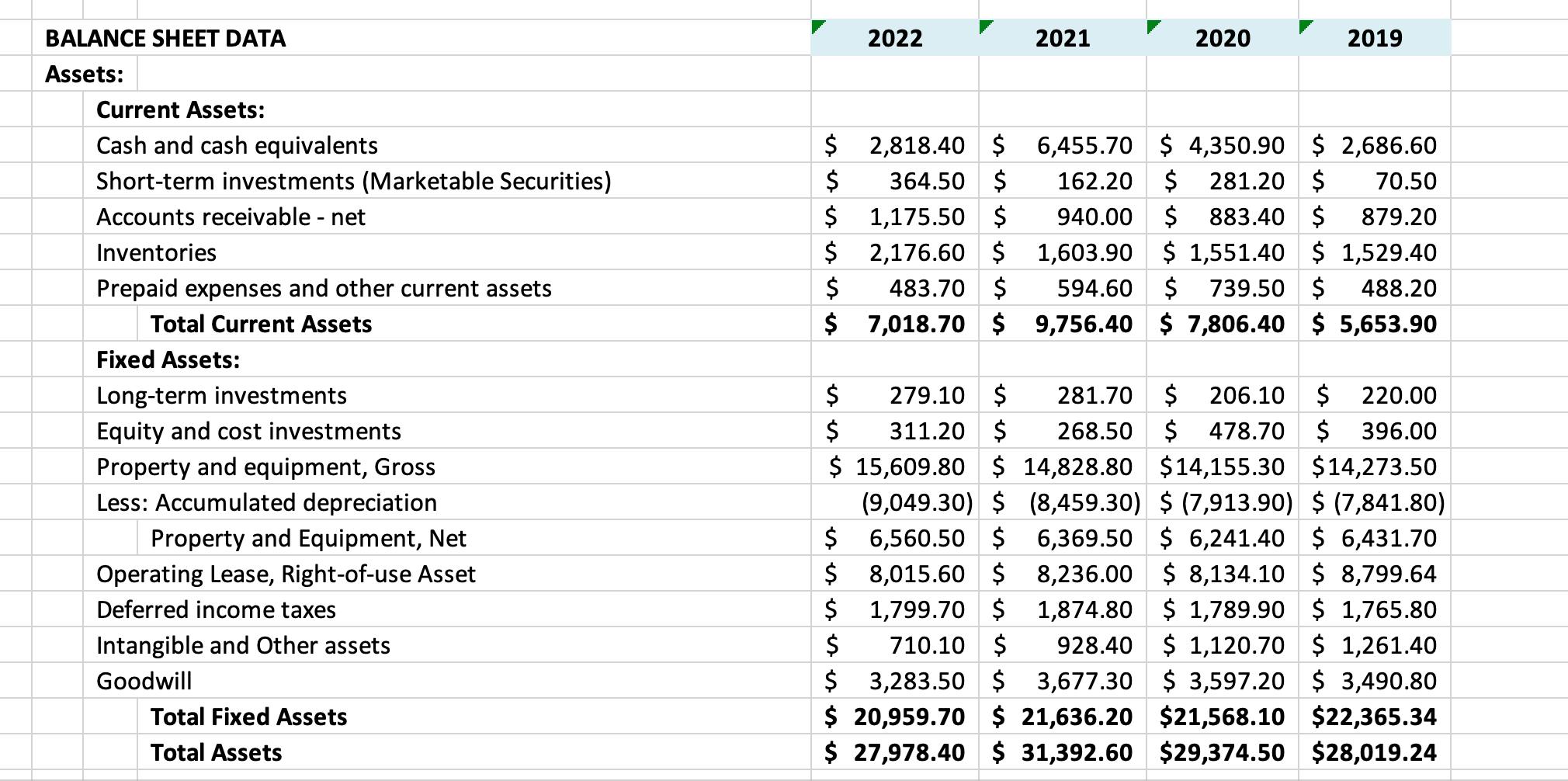

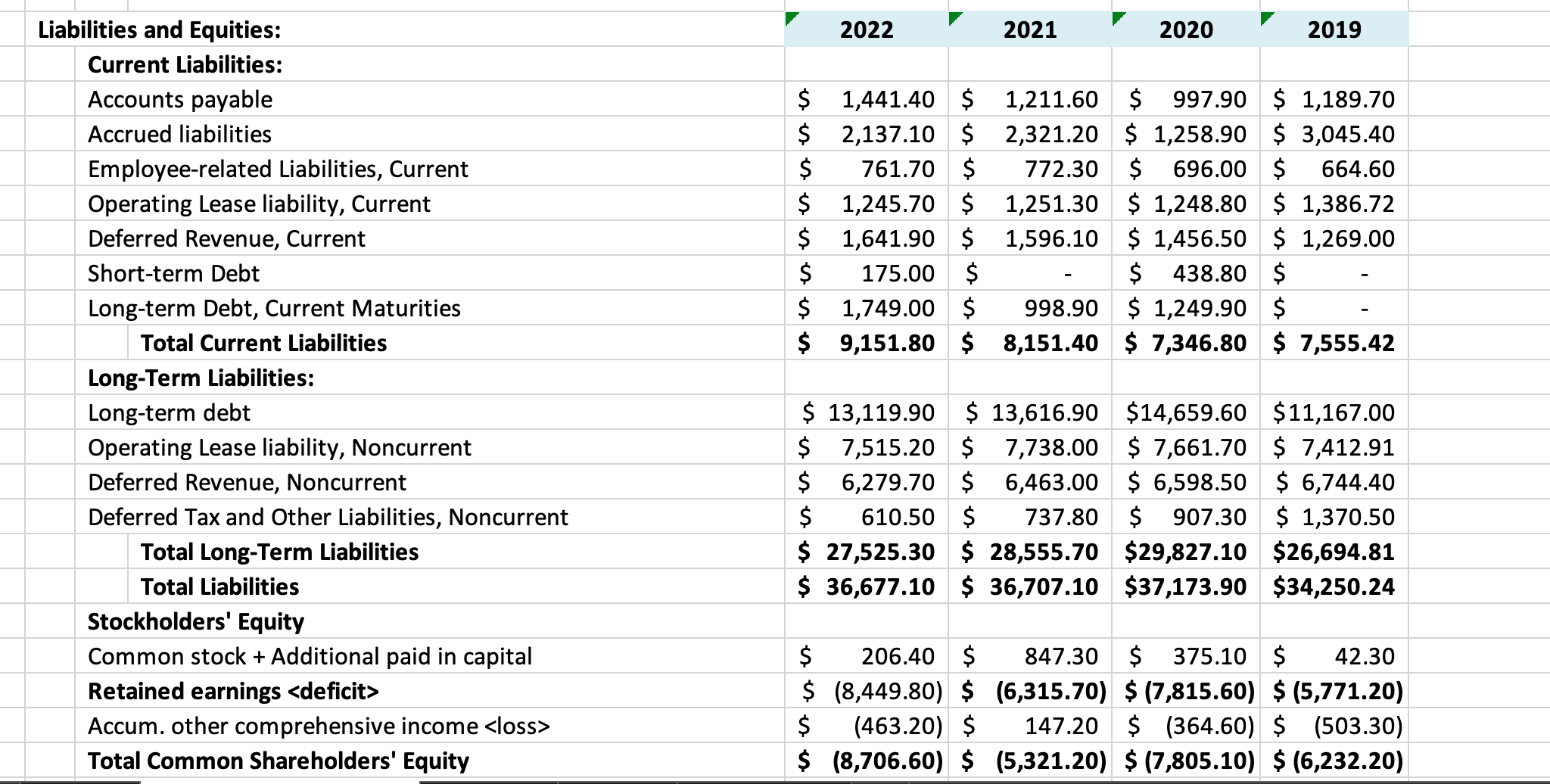

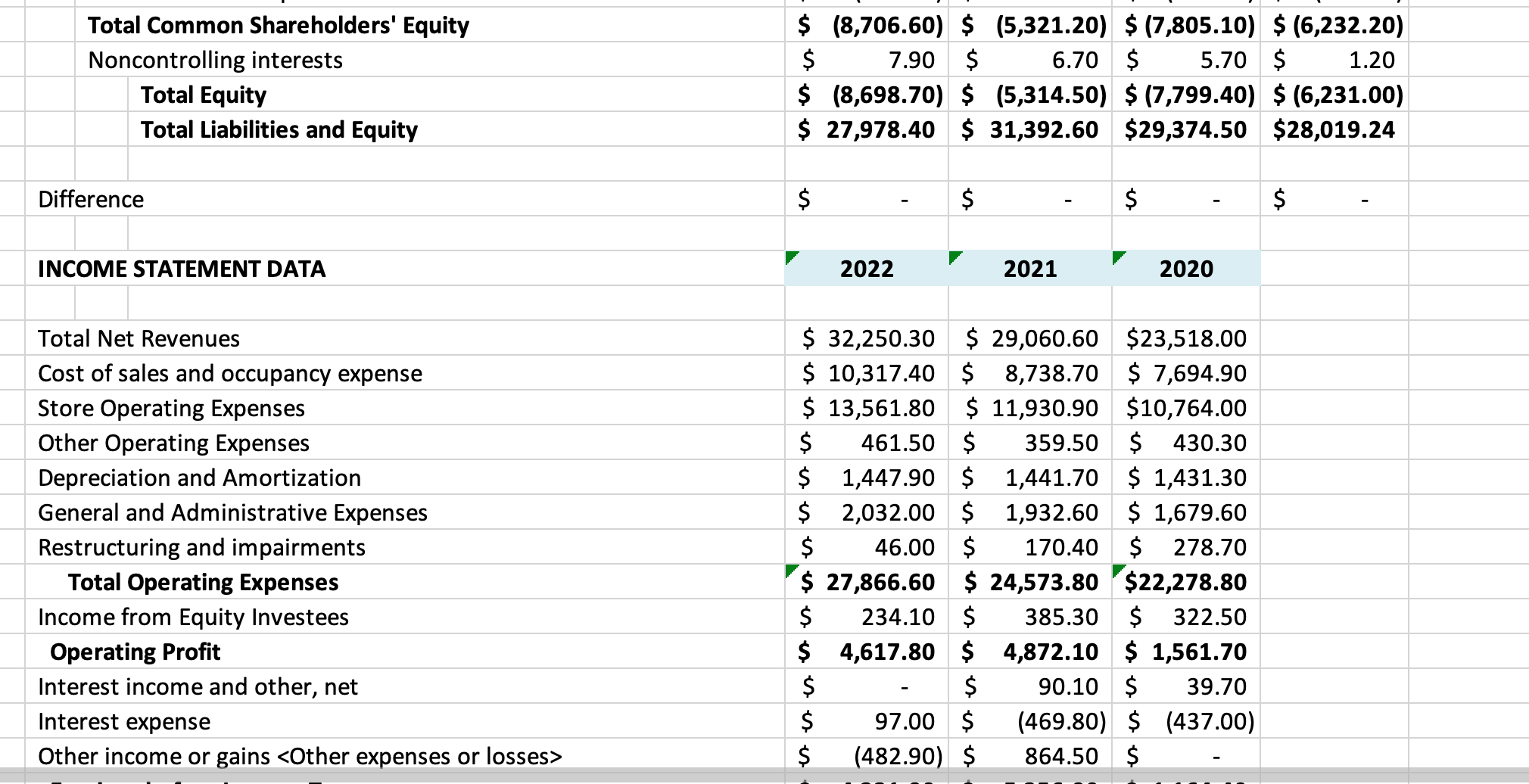

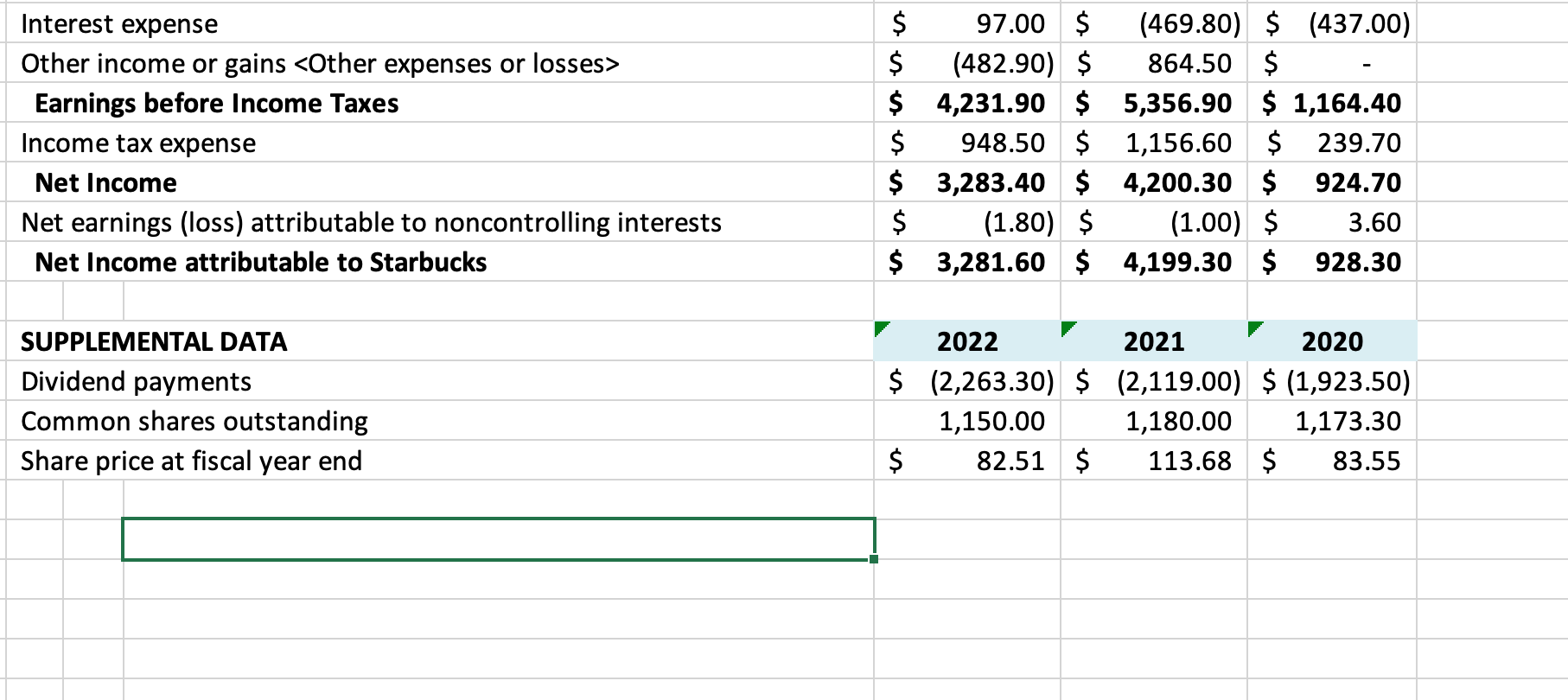

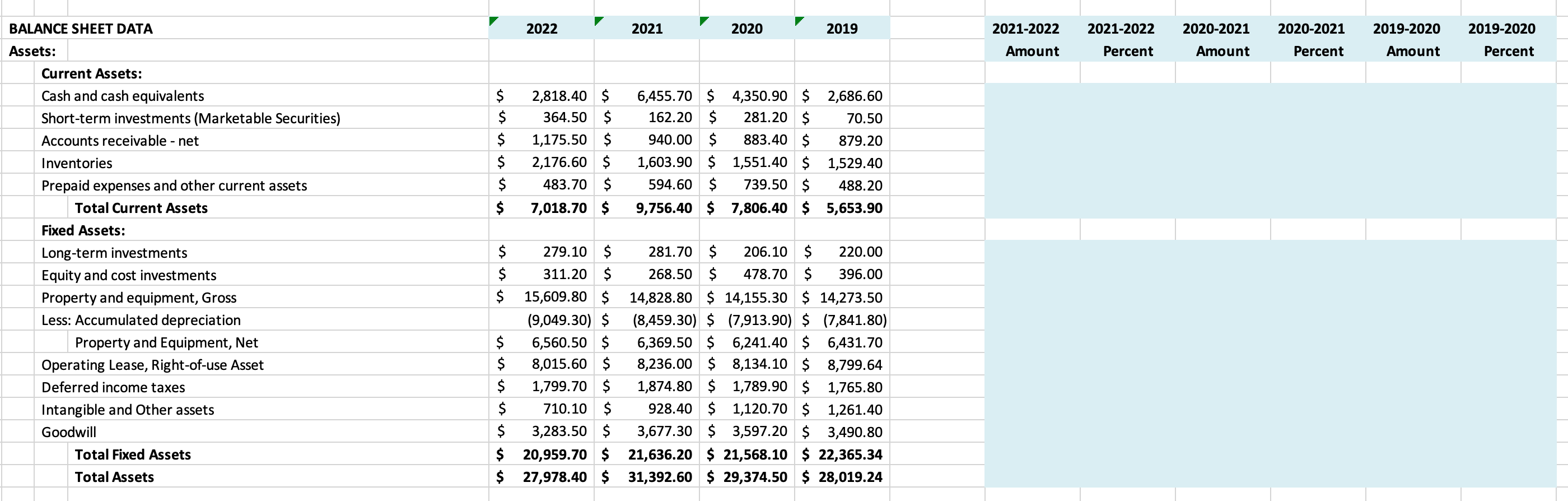

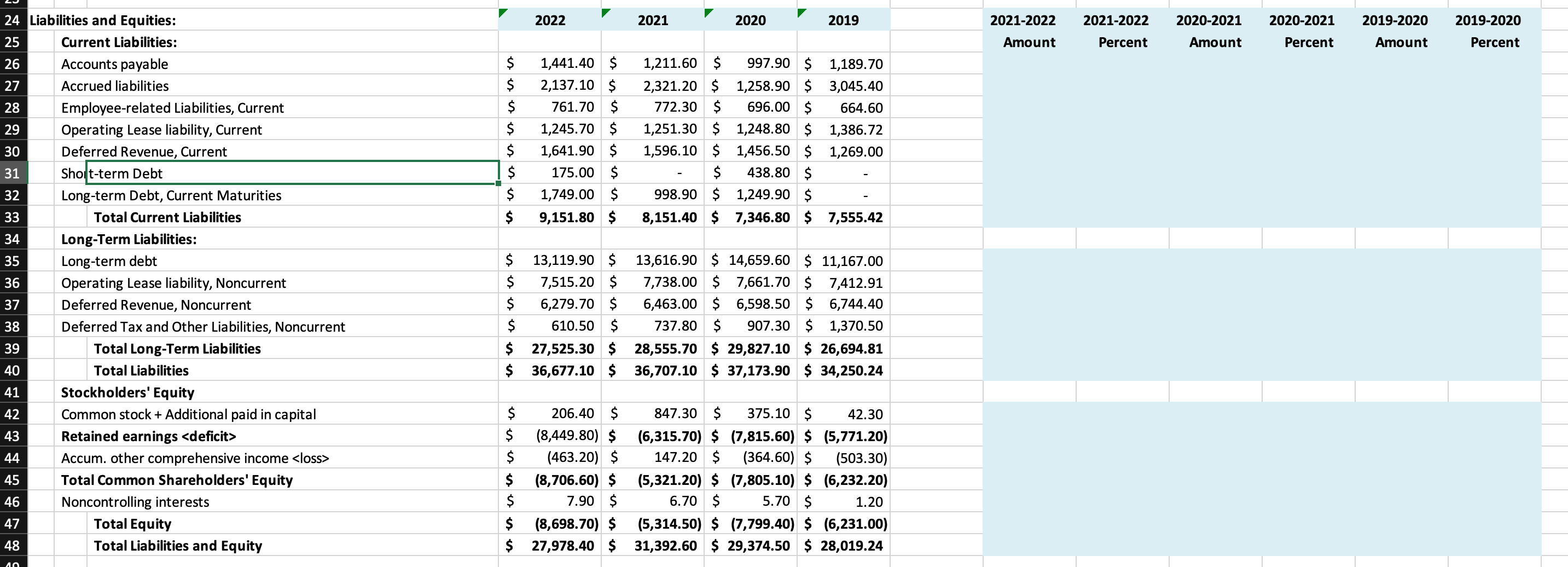

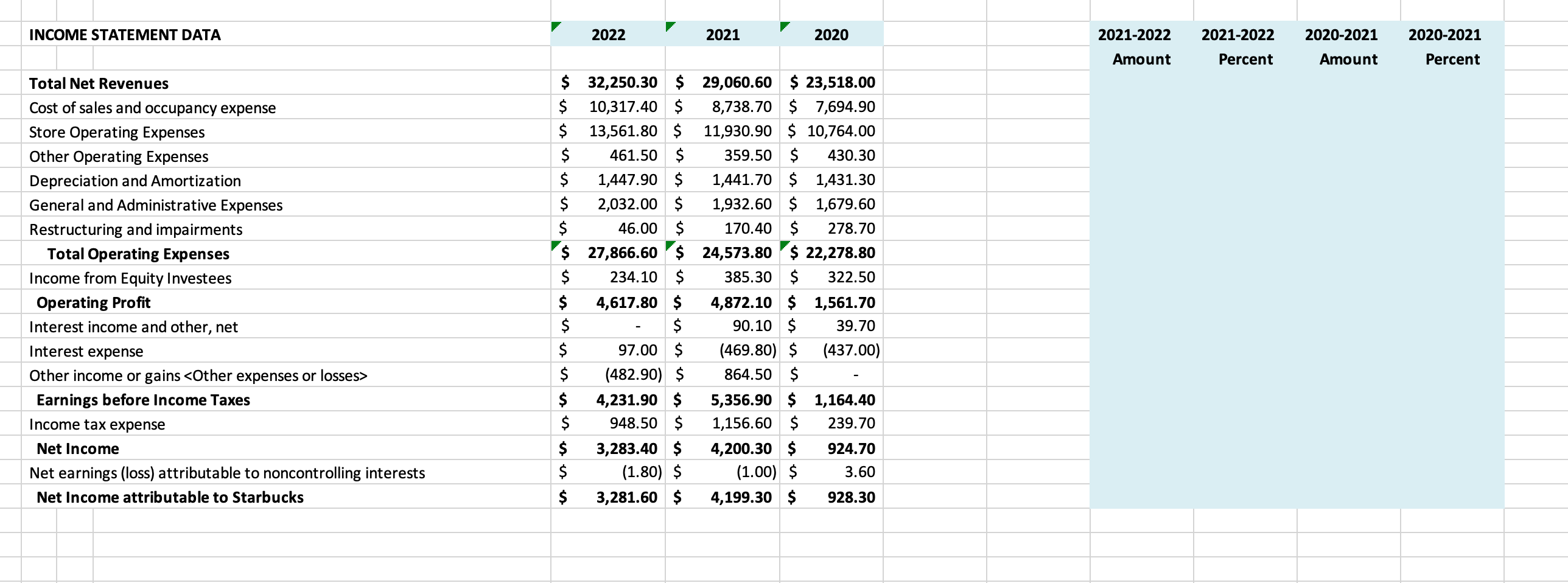

SOLVE HORIZONTAL ANALYSIS USING THE ABOVE INFORMATION? begin{tabular}{|c|c|c|c|c|c|} hline Interest expense & $ & 97.00 & $ & (469.80) & $(437.00) hline Other income

SOLVE HORIZONTAL ANALYSIS USING THE ABOVE INFORMATION?

\begin{tabular}{|c|c|c|c|c|c|} \hline Interest expense & $ & 97.00 & $ & (469.80) & $(437.00) \\ \hline Other income or gains > & $ & (482.90) & $ & 864.50 & $ \\ \hline Earnings before Income Taxes & $ & 4,231.90 & $ & 5,356.90 & $1,164.40 \\ \hline Income tax expense & $ & 948.50 & $ & 1,156.60 & $239.70 \\ \hline Net Income & $ & 3,283.40 & $ & 4,200.30 & 924.70 \\ \hline Net earnings (loss) attributable to noncontrolling interests & $ & (1.80) & $ & (1.00) & 3.60 \\ \hline Net Income attributable to Starbucks & $ & 3,281.60 & $ & 4,199.30 & 928.30 \\ \hline SUPPLEMENTAL DATA & T & 2022 & r & 2021 & 2020 \\ \hline Dividend payments & $ & (2,263.30) & $ & (2,119.00) & $(1,923.50) \\ \hline Common shares outstanding & & 1,150.00 & & 1,180.00 & 1,173.30 \\ \hline Share price at fiscal year end & $ & 82.51 & $ & 113.68 & 83.55 \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & al Common Shareholders' Equity & $ & (8,706.60) & $ & (5,321.20) & $(7,805.10) & $(6,232.20) \\ \hline & ncontrolling interests & $ & 7.90 & $ & 6.70 & 5.70 & 1.20 \\ \hline & Total Equity & $ & (8,698.70) & $ & (5,314.50) & $(7,799.40) & $(6,231.00) \\ \hline & Total Liabilities and Equity & $ & 27,978.40 & $ & 31,392.60 & $29,374.50 & $28,019.24 \\ \hline Diff & & $ & - & $ & - & $ & $ \\ \hline INC & E STATEMENT DATA & & 2022 & 1 & 2021 & 2020 & \\ \hline Tot & t Revenues & & 32.250 .30 & & 29,060.60 & $23,518.00 & \\ \hline cos & sales and occupancy expense & $ & 10,317.40 & $ & 8,738.70 & $7,694.90 & \\ \hline Sto & perating Expenses & $ & 13,561.80 & & 11,930.90 & $10,764.00 & \\ \hline Oth & perating Expenses & $ & 461.50 & $ & 359.50 & $430.30 & \\ \hline Dep & ation and Amortization & $ & 1,447.90 & $ & 1,441.70 & $1,431.30 & \\ \hline Ger & and Administrative Expenses & $ & 2,032.00 & $ & 1,932.60 & $1,679.60 & \\ \hline Res & turing and impairments & $ & 46.00 & $ & 170.40 & $278.70 & \\ \hline & Operating Expenses & $ & 27,866.60 & & 24,573.80 & $22,278.80 & \\ \hline Ince & from Equity Investees & $ & 234.10 & $ & 385.30 & $322.50 & \\ \hline & ting Profit & $ & 4,617.80 & $ & 4,872.10 & $1,561.70 & \\ \hline Inte & income and other, net & $ & - & $ & 90.10 & 39.70 & \\ \hline Inte & expense & $ & 97.00 & $ & (469.80) & $(437.00) & \\ \hline Oth & come or gains $ & (482.90) & $ & 864.50 & $ & \\ \hline \end{tabular} BALANCE SHEET DATA Assets: Current Assets: Cash and cash equivalents Short-term investments (Marketable Securities) Accounts receivable - net Inventories Prepaid expenses and other current assets Total Current Assets Fixed Assets: Long-term investments Equity and cost investments Property and equipment, Gross Less: Accumulated depreciation Property and Equipment, Net Operating Lease, Right-of-use Asset Deferred income taxes Intangible and Other assets Goodwill Total Fixed Assets Total Assets 2022 2021 2020 2019 \begin{tabular}{|c|c|c|c|c|c|} \hline$ & 2,818.40 & $ & 6,455.70 & $4,350.90 & $2,686.60 \\ \hline$ & 0 & T & 16 & 281 & 50 \\ \hline$ & 1,1 & 3 & & 88 & $ \\ \hline$ & 2,1 & $ & 0 & $1, & $1, \\ \hline$ & & 3 & & 739.50 & \\ \hline & 7,018.70 & $ & 9,756.40 & \$ 7,806.40 & \$ 5,653 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline 279.10 & $ & 281.70 & $ & 206.10 & $ & 220.00 \\ \hline 311.20 & $ & 268.50 & $ & 478.70 & $ & 396.00 \\ \hline$15,609.80 & $ & 14,828.80 & & 4,155.30 & $1 & 4,273.50 \\ \hline \end{tabular} (9,049.30)$(8,459.30)$(7,913.90)$(7,841.80) \begin{tabular}{|l|l|l|l|l|l|} $ & 6,560.50 & $ & 6,369.50 & $6,241.40 & $6,431.70 \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline$ & 8,015.60 & $ & 8,236.00 & $8,134.10 & $8,799.64 \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} $ & 1,799.70 & $ & 1,874.80 & $1,789.90 & $1,765.80 \end{tabular} \begin{tabular}{|l|l|l|l|l|l|} $ & 710.10 & $ & 928.40 & $1,120.70 & $1,261.40 \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline $20,959.70 & $21,636.20 & $21,568.10 & $22,365.34 \\ \hline \end{tabular} \begin{tabular}{ll|l|l|l} $27,978.40 & $31,392.60 & $29,374.50 & $28,019.24 \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Liabilities and Equities: & F & 2022 & & 2021 & 2020 & 2019 \\ \hline \multicolumn{7}{|l|}{ Current Liabilities: } \\ \hline Accounts payable & $ & 1,441.40 & $ & 1,211.60 & $997.90 & $1,189.70 \\ \hline Accrued liabilities & $ & 2,137.10 & $ & 2,321.20 & $1,258.90 & $3,045.40 \\ \hline Employee-related Liabilities, Current & $ & 761.70 & $ & 772.30 & $696.00 & 664.60 \\ \hline Operating Lease liability, Current & $ & 1,245.70 & $ & 1,251.30 & $1,248.80 & $1,386.72 \\ \hline Deferred Revenue, Current & $ & 1,641.90 & $ & 1,596.10 & $1,456.50 & $1,269.00 \\ \hline Short-term Debt & $ & 175.00 & $ & - & $438.80 & $ \\ \hline Long-term Debt, Current Maturities & $ & 1,749.00 & $ & 998.90 & $1,249.90 & $ \\ \hline Total Current Liabilities & $ & 9,151.80 & $ & 8,151.40 & $7,346.80 & $7,555.42 \\ \hline \multicolumn{7}{|l|}{ Long-Term Liabilities: } \\ \hline Long-term debt & & 13,119.90 & & 13,616.90 & $14,659.60 & $11,167.00 \\ \hline Operating Lease liability, Noncurrent & $ & 7,515.20 & $ & 7,738.00 & $7,661.70 & $7,412.91 \\ \hline Deferred Revenue, Noncurrent & $ & 6,279.70 & $ & 6,463.00 & $6,598.50 & $6,744.40 \\ \hline Deferred Tax and Other Liabilities, Noncurrent & $ & 610.50 & $ & 737.80 & $907.30 & $1,370.50 \\ \hline Total Long-Term Liabilities & $ & 27,525.30 & $ & 28,555.70 & $29,827.10 & $26,694.81 \\ \hline Total Liabilities & $ & 36,677.10 & $ & 36,707.10 & $37,173.90 & $34,250.24 \\ \hline \multicolumn{7}{|l|}{ Stockholders' Equity } \\ \hline Common stock + Additional paid in capital & $ & 206.40 & $ & 847.30 & $375.10 & 42.30 \\ \hline Retained earnings & $ & (8,449.80) & $ & (6,315.70) & $(7,815.60) & $(5,771.20) \\ \hline Accum. other comprehensive income & $ & (463.20) & $ & 147.20 & $(364.60) & $(503.30) \\ \hline Total Common Shareholders' Equity & $ & (8,706.60) & $ & (5,321.20) & $(7,805.10) & $(6,232.20) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started