Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve in 1 hour 20 mins i will give thumb up Question 1 (25 points) You were just appointed as the CFO for Server-IL, a

solve in 1 hour 20 mins i will give thumb up

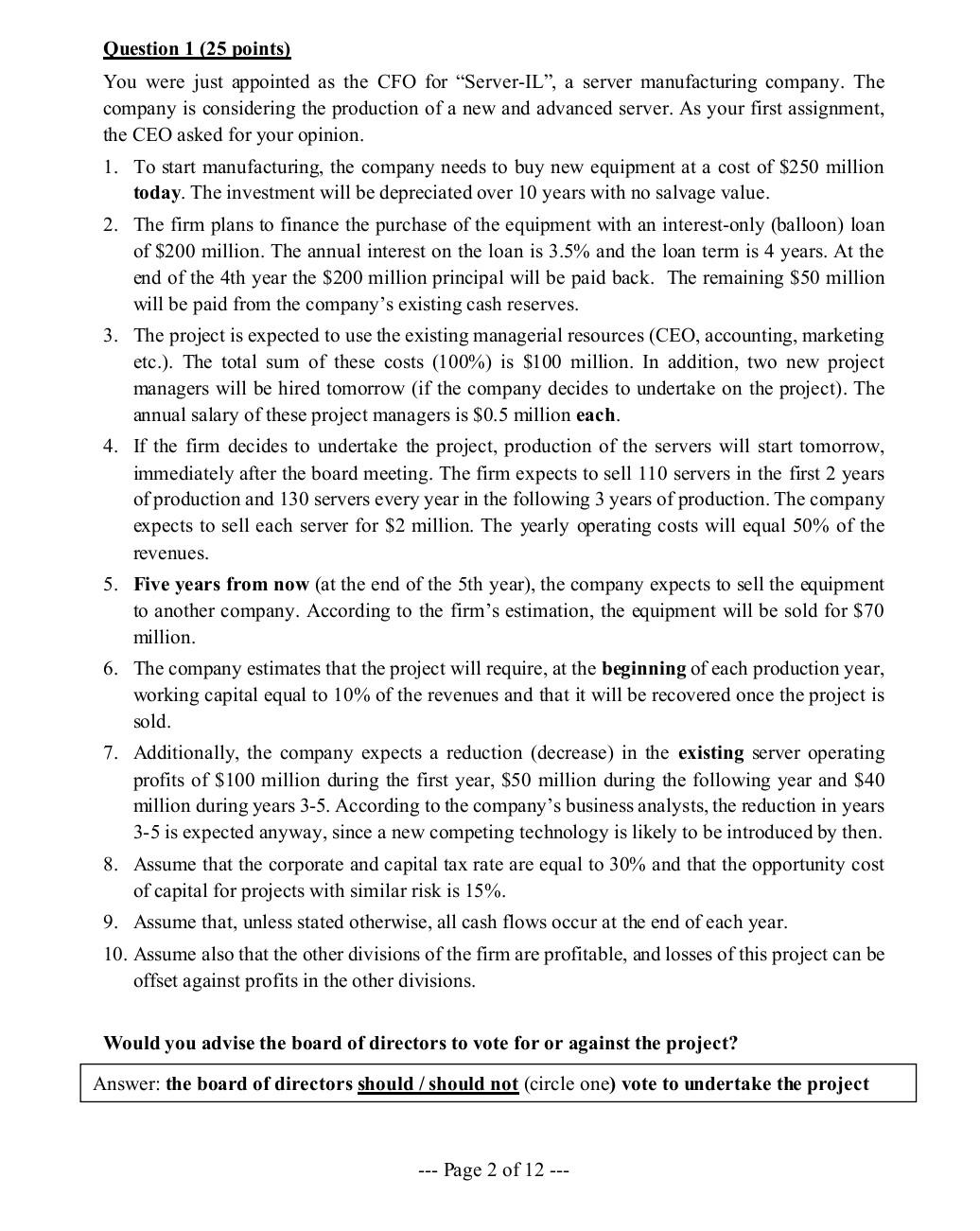

Question 1 (25 points) You were just appointed as the CFO for "Server-IL", a server manufacturing company. The company is considering the production of a new and advanced server. As your first assignment, the CEO asked for your opinion. 1. To start manufacturing, the company needs to buy new equipment at a cost of $250 million today. The investment will be depreciated over 10 years with no salvage value. 2. The firm plans to finance the purchase of the equipment with an interest-only (balloon) loan of $200 million. The annual interest on the loan is 3.5% and the loan term is 4 years. At the end of the 4th year the $200 million principal will be paid back. The remaining $50 million will be paid from the company's existing cash reserves. 3. The project is expected to use the existing managerial resources (CEO, accounting, marketing etc.). The total sum of these costs (100%) is $100 million. In addition, two new project managers will be hired tomorrow (if the company decides to undertake on the project). The annual salary of these project managers is $0.5 million each. 4. If the firm decides to undertake the project, production of the servers will start tomorrow, immediately after the board meeting. The firm expects to sell 110 servers in the first 2 years of production and 130 servers every year in the following 3 years of production. The company expects to sell each server for $2 million. The yearly operating costs will equal 50% of the revenues. 5. Five years from now (at the end of the 5th year), the company expects to sell the equipment to another company. According to the firm's estimation, the equipment will be sold for $70 million. 6. The company estimates that the project will require, at the beginning of each production year, working capital equal to 10% of the revenues and that it will be recovered once the project is sold. 7. Additionally, the company expects a reduction (decrease) in the existing server operating profits of $100 million during the first year, $50 million during the following year and $40 million during years 3-5. According to the company's business analysts, the reduction in years 3-5 is expected anyway, since a new competing technology is likely to be introduced by then. 8. Assume that the corporate and capital tax rate are equal to 30% and that the opportunity cost of capital for projects with similar risk is 15%. 9. Assume that, unless stated otherwise, all cash flows occur at the end of each year. 10. Assume also that the other divisions of the firm are profitable, and losses of this project can be offset against profits in the other divisions. Would you advise the board of directors to vote for or against the project? Answer: the board of directors should / should not (circle one) vote to undertake the project - Page 2 of 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started