Question

Solve in 1_2three hour... Good-Fit Garment Industry was established on July 01, 2018 who is manufacturing and marketing designer garments. After expiry of its first

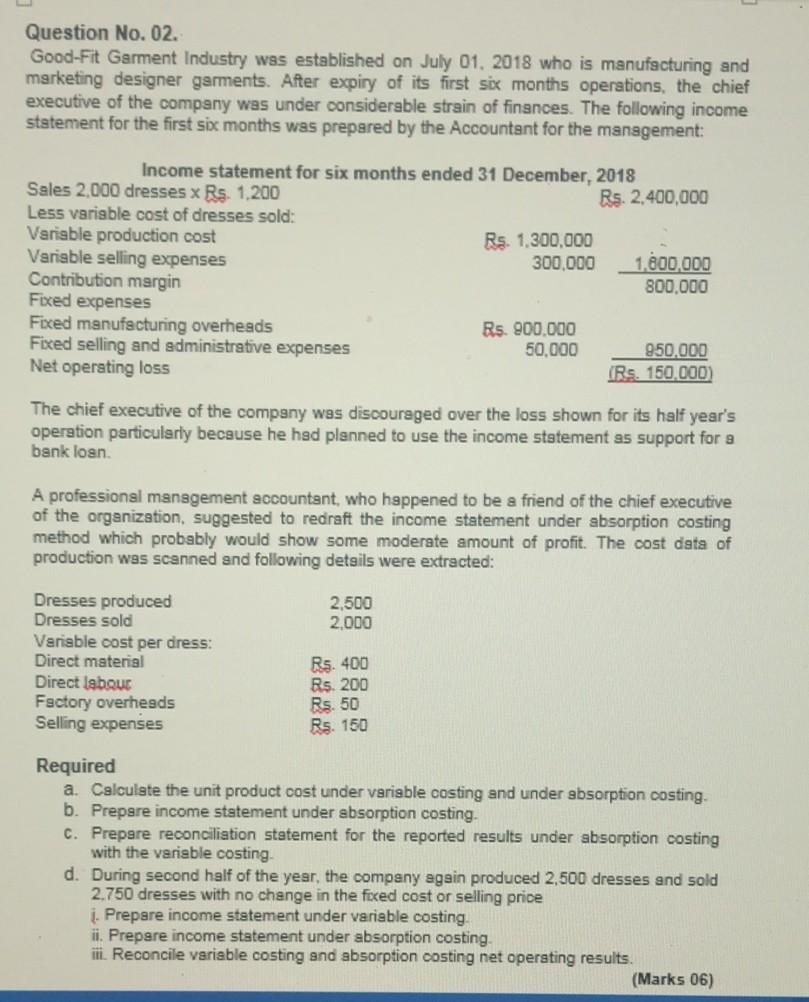

Solve in 1_2three hour... Good-Fit Garment Industry was established on July 01, 2018 who is manufacturing and marketing designer garments. After expiry of its first six months operations, the chief executive of the company was under considerable strain of finances. The following income statement for the first six months was prepared by the Accountant for the management: Income statement for six months ended 31 December, 2018 Sales 2,000 dresses x Rs. 1,200 Rs. 2,400,000 Less variable cost of dresses sold: Variable production cost Rs. 1,300,000 Variable selling expenses 300,000 1,600,000 Contribution margin 800,000 Fixed expenses Fixed manufacturing overheads Rs. 900,000 Fixed selling and administrative expenses 50,000 950,000 Net operating loss (Rs. 150,000) The chief executive of the company was discouraged over the loss shown for its half years operation particularly because he had planned to use the income statement as support for a bank loan. A professional management accountant, who happened to be a friend of the chief executive of the organization, suggested to redraft the income statement under absorption costing method which probably would show some moderate amount of profit. The cost data of production was scanned and following details were extracted: Dresses produced 2,500 Dresses sold 2,000 Variable cost per dress: Direct material Rs. 400 Direct labour Rs. 200 Factory overheads Rs. 50 Selling expenses Rs. 150 Required a. Calculate the unit product cost under variable costing and under absorption costing. b. Prepare income statement under absorption costing. c. Prepare reconciliation statement for the reported results under absorption costing with the variable costing. d. During second half of the year, the company again produced 2,500 dresses and sold 2,750 dresses with no change in the fixed cost or selling price i. Prepare income statement under variable costing. ii. Prepare income statement under absorption costing. iii. Reconcile variable costing and absorption costing net operating results.

Question No. 02. Good-Fit Garment Industry was established on July 01, 2018 who is manufacturing and marketing designer garments. After expiry of its first six months operations, the chief executive of the company was under considerable strain of finances. The following income statement for the first six months was prepared by the Accountant for the management: Income statement for six months ended 31 December, 2018 Sales 2,000 dresses x Rs. 1.200 Rs. 2,400,000 Less variable cost of dresses sold: Variable production cost Rs. 1.300,000 Variable selling expenses 300.000 1.800.000 Contribution margin 800.000 Fixed expenses Fixed manufacturing overheads Rs. 900.000 Fixed selling and administrative expenses 50.000 950.000 Net operating loss IRS. 150.000) The chief executive of the company was discouraged over the loss shown for its half year's operation particularly because he had planned to use the income statement as support for a bank loan A professional management accountant, who happened to be a friend of the chief executive of the organization, suggested to redraft the income statement under absorption costing method which probably would show some moderate amount of profit . The cost data of production was scanned and following details were extracted: 2.500 2.000 Dresses produced Dresses sold Variable cost per dress: Direct material Direct labour Factory overheads Selling expenses Rs. 400 Rs. 200 Rs. 50 Rs. 150 Required a. Calculate the unit product cost under variable costing and under absorption costing. b. Prepare income statement under absorption costing. C. Prepare reconciliation statement for the reported results under absorption costing with the variable costing d. During second half of the year, the company again produced 2.500 dresses and sold 2.750 dresses with no change in the fixed cost or selling price . Prepare income statement under variable costing ii. Prepare income statement under absorption costing fit. Reconcile variable costing and absorption costing net operating results. (Marks 06)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started