Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve in 25 mins i will give thumb up. write final answer at end of solution separately The following table shows the initial balance sheet

solve in 25 mins i will give thumb up. write final answer at end of solution separately

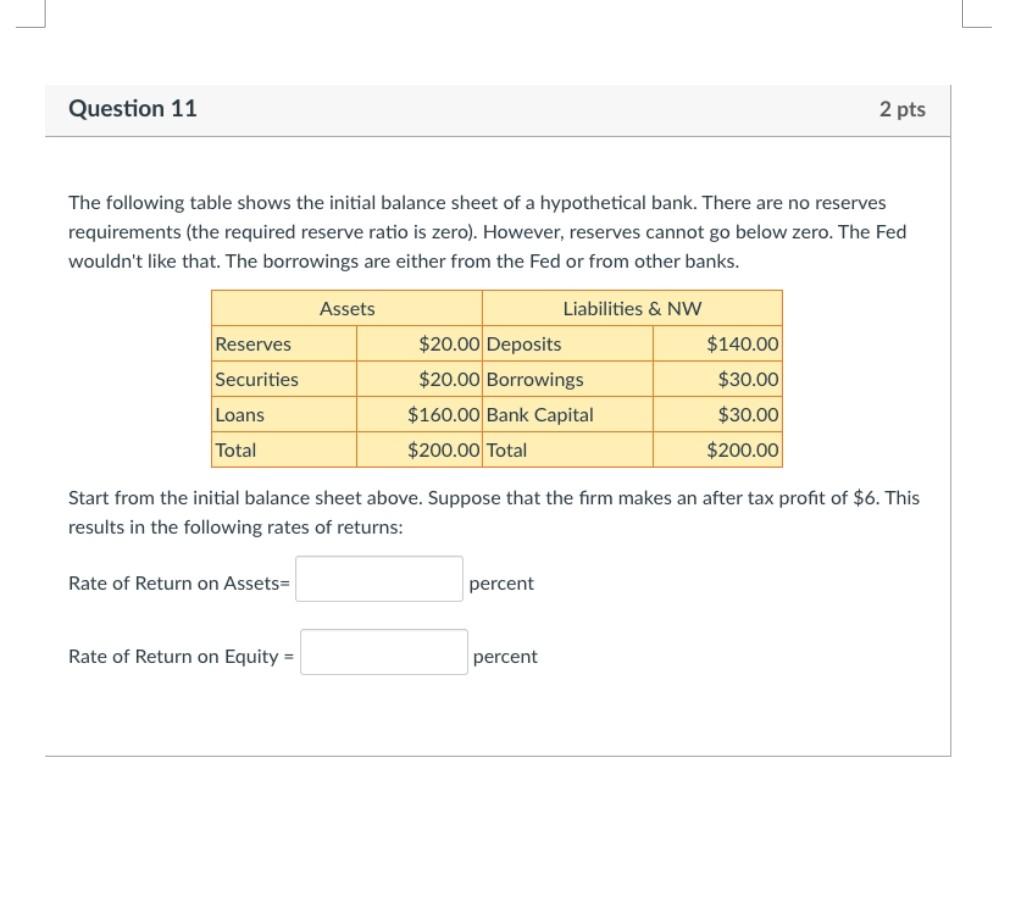

The following table shows the initial balance sheet of a hypothetical bank. There are no reserves requirements (the required reserve ratio is zero). However, reserves cannot go below zero. The Fed wouldn't like that. The borrowings are either from the Fed or from other banks. Start from the initial balance sheet above. Suppose that the firm makes an after tax profit of $6. This results in the following rates of returns: Rate of Return on Assets = percent Rate of Return on Equity = percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started