Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve in 60 mins i will thumb up 11. The following questions are related to binomial tree option pricing. [Total: 25] Information about the underlying

solve in 60 mins i will thumb up

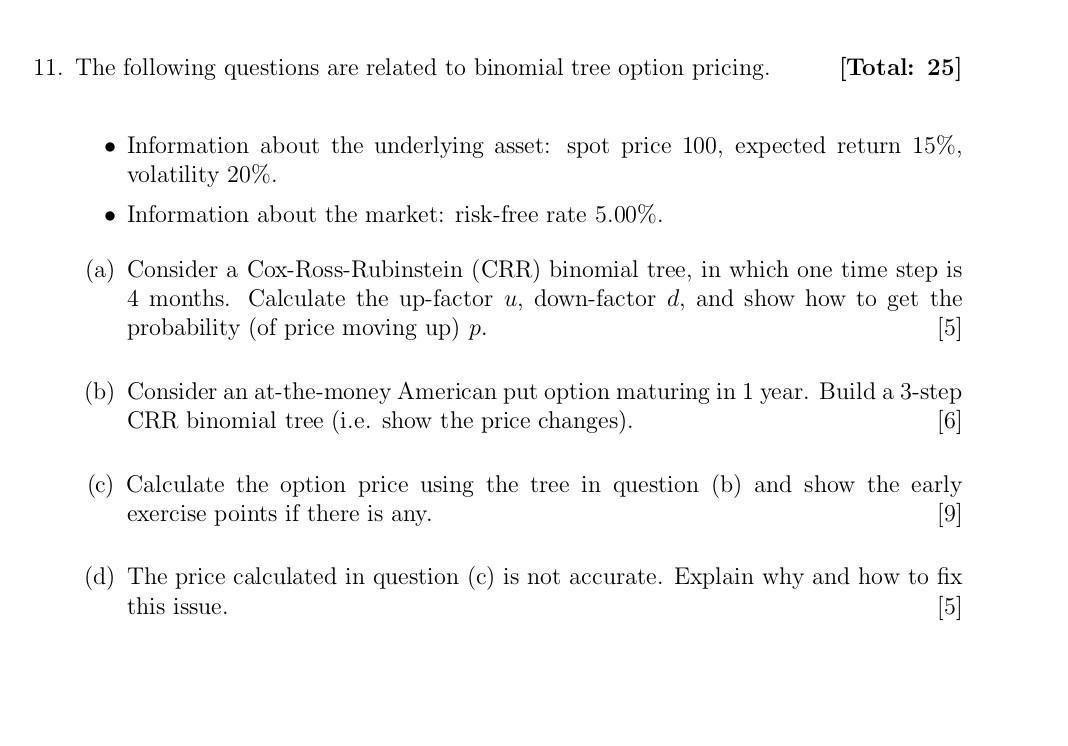

11. The following questions are related to binomial tree option pricing. [Total: 25] Information about the underlying asset: spot price 100, expected return 15%, volatility 20%. Information about the market: risk-free rate 5.00%. (a) Consider a Cox-Ross-Rubinstein (CRR) binomial tree, in which one time step is 4 months. Calculate the up-factor u, down-factor d, and show how to get the probability (of price moving up) p. [5] (b) Consider an at-the-money American put option maturing in 1 year. Build a 3-step CRR binomial tree (i.e. show the price changes). [6] (c) Calculate the option price using the tree in question (b) and show the early exercise points if there is any. [9] (d) The price calculated in question (c) is not accurate. Explain why and how to fix this issue. [5] 11. The following questions are related to binomial tree option pricing. [Total: 25] Information about the underlying asset: spot price 100, expected return 15%, volatility 20%. Information about the market: risk-free rate 5.00%. (a) Consider a Cox-Ross-Rubinstein (CRR) binomial tree, in which one time step is 4 months. Calculate the up-factor u, down-factor d, and show how to get the probability (of price moving up) p. [5] (b) Consider an at-the-money American put option maturing in 1 year. Build a 3-step CRR binomial tree (i.e. show the price changes). [6] (c) Calculate the option price using the tree in question (b) and show the early exercise points if there is any. [9] (d) The price calculated in question (c) is not accurate. Explain why and how to fix this issue. [5]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started