Solve in excel and show your work.

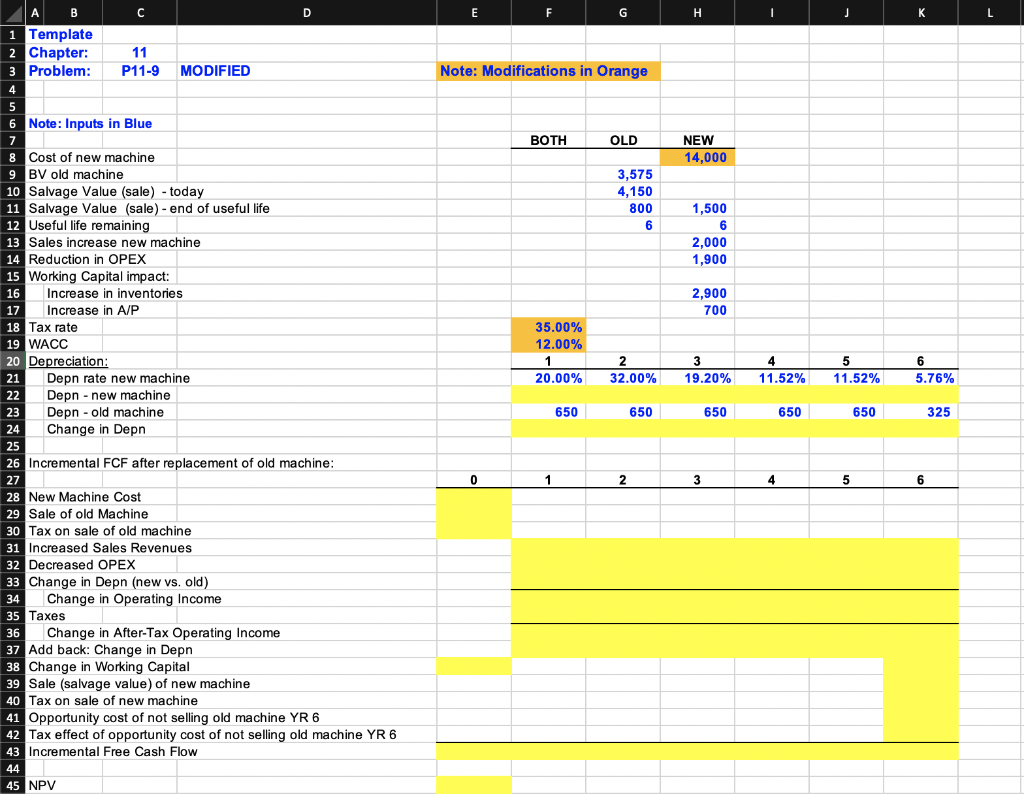

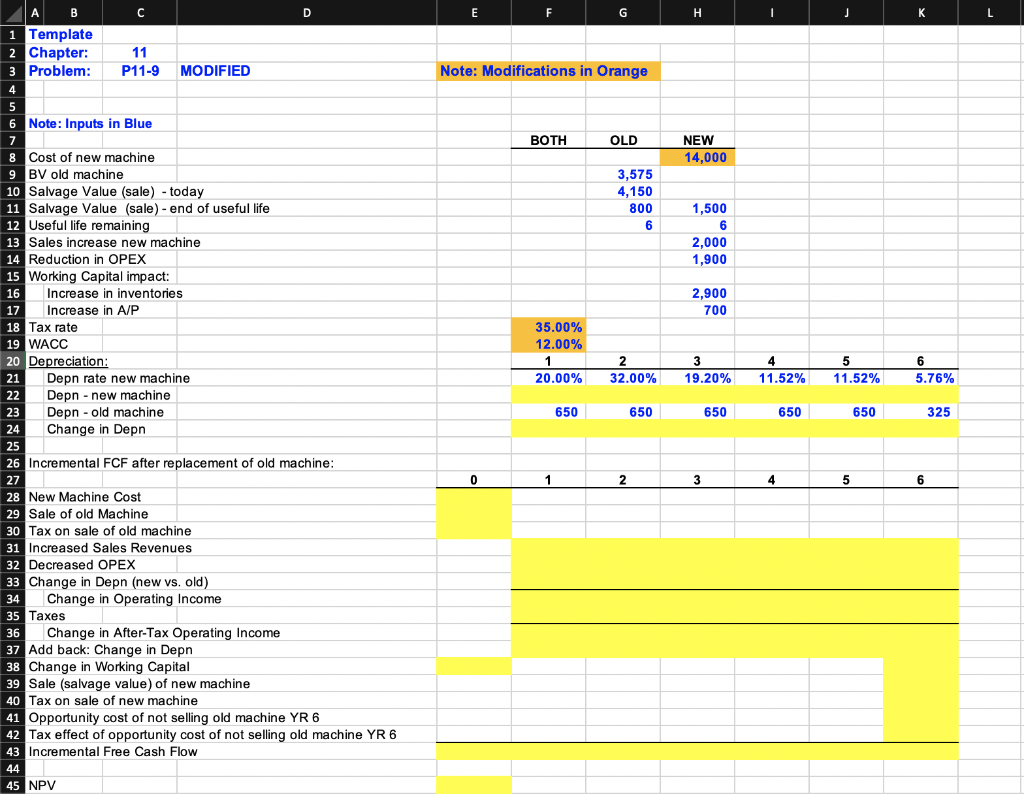

E F G H J K L Note: Modifications in Orange BOTH OLD NEW 14,000 3,575 4,150 800 6 1,500 6 2,000 1,900 2.900 700 35.00% 12.00% 1 20.00% 2 32.00% 3 19.20% 4 11.52% 5 11.52% 6 5.76% | B B C D 1 Template 2 Chapter: 11 3 Problem: P11-9 MODIFIED 4 5 6 Note: Inputs in Blue 7 8 Cost of new machine 9 BV old machine 10 Salvage Value (sale) - today 11 Salvage Value (sale) - end of useful life 12 Useful life remaining 13 Sales increase new machine 14 Reduction in OPEX 15 Working Capital impact: 16 Increase in inventories 17 Increase in A/P 18 Tax rate 19 WACC 20 Depreciation: 21 Depn rate new machine 22 Depn- new machine 23 Depn - old machine 24 Change in Depn 25 26 Incremental FCF after replacement of old machine: 27 28 New Machine Cost 29 Sale of old Machine 30 Tax on sale of old machine 31 Increased Sales Revenues 32 Decreased OPEX 33 Change in Depn (new vs. old) 34 Change in Operating Income 35 Taxes 36 Change in After-Tax Operating Income 37 Add back: Change in Depn 38 Change in Working Capital 39 Sale (salvage value) of new machine 40 Tax on sale of new machine 41 Opportunity cost of not selling old machine YR 6 42 Tax effect of opportunity cost of not selling old machine YR 6 43 Incremental Free Cash Flow 44 45 NPV 650 650 650 650 650 325 0 1 2 3 4 5 6 E F G H J K L Note: Modifications in Orange BOTH OLD NEW 14,000 3,575 4,150 800 6 1,500 6 2,000 1,900 2.900 700 35.00% 12.00% 1 20.00% 2 32.00% 3 19.20% 4 11.52% 5 11.52% 6 5.76% | B B C D 1 Template 2 Chapter: 11 3 Problem: P11-9 MODIFIED 4 5 6 Note: Inputs in Blue 7 8 Cost of new machine 9 BV old machine 10 Salvage Value (sale) - today 11 Salvage Value (sale) - end of useful life 12 Useful life remaining 13 Sales increase new machine 14 Reduction in OPEX 15 Working Capital impact: 16 Increase in inventories 17 Increase in A/P 18 Tax rate 19 WACC 20 Depreciation: 21 Depn rate new machine 22 Depn- new machine 23 Depn - old machine 24 Change in Depn 25 26 Incremental FCF after replacement of old machine: 27 28 New Machine Cost 29 Sale of old Machine 30 Tax on sale of old machine 31 Increased Sales Revenues 32 Decreased OPEX 33 Change in Depn (new vs. old) 34 Change in Operating Income 35 Taxes 36 Change in After-Tax Operating Income 37 Add back: Change in Depn 38 Change in Working Capital 39 Sale (salvage value) of new machine 40 Tax on sale of new machine 41 Opportunity cost of not selling old machine YR 6 42 Tax effect of opportunity cost of not selling old machine YR 6 43 Incremental Free Cash Flow 44 45 NPV 650 650 650 650 650 325 0 1 2 3 4 5 6