Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve it all Based on information in Question 30, how much acceptance commission will the bank receive if the applicable rate on acceptance commission is

Solve it all

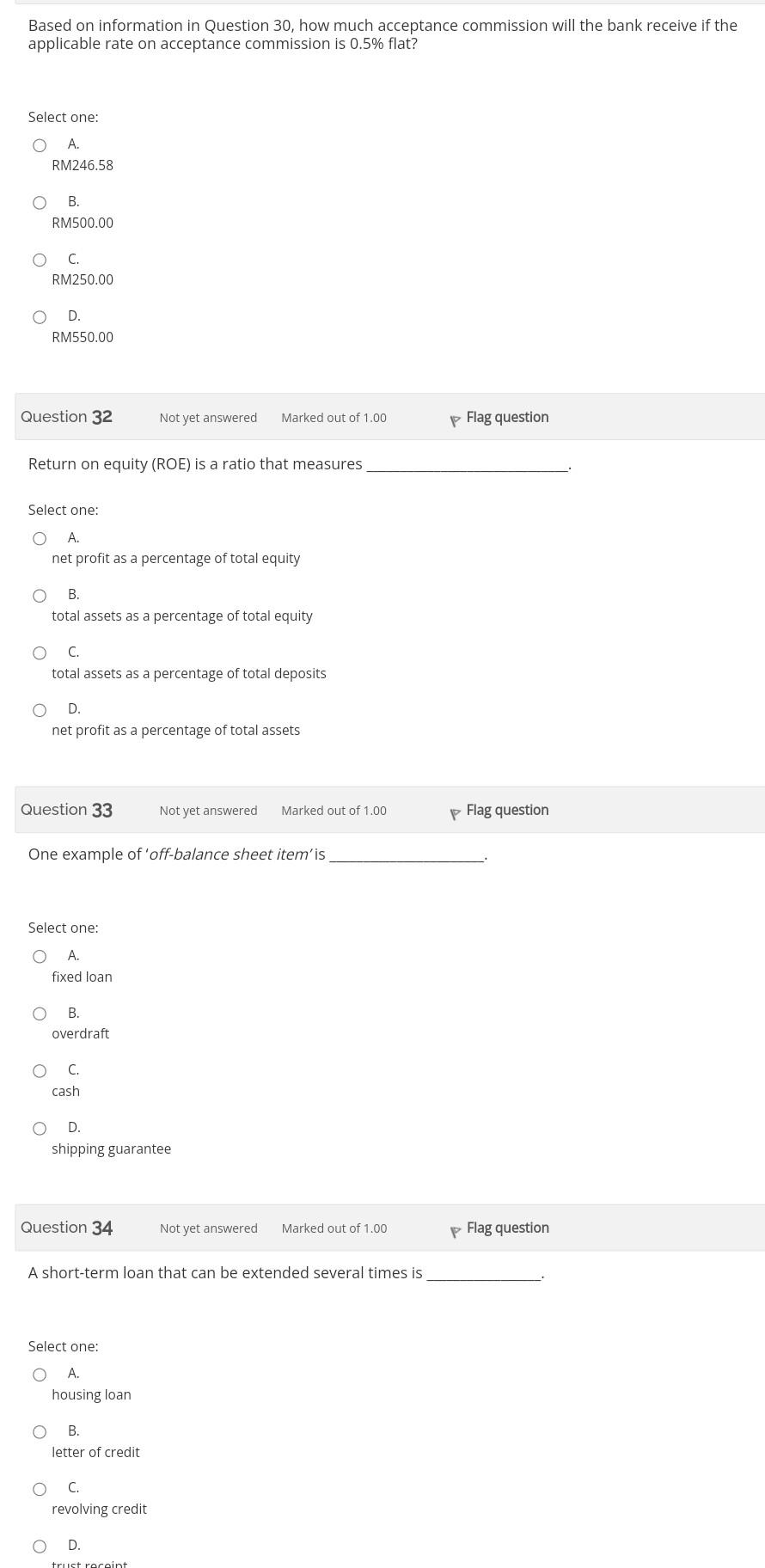

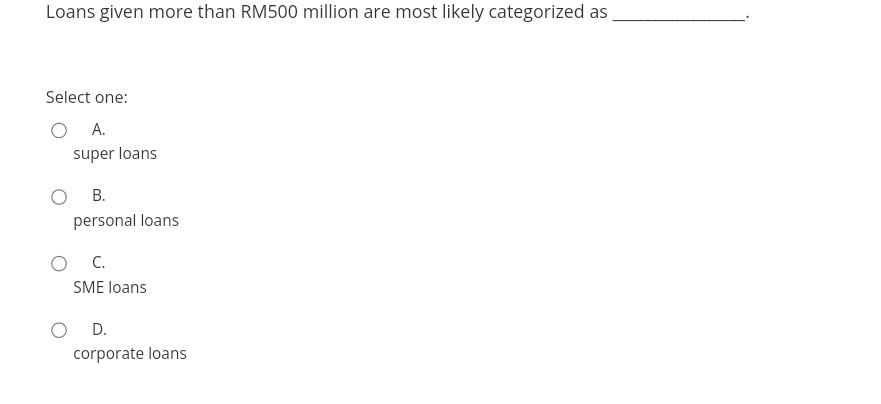

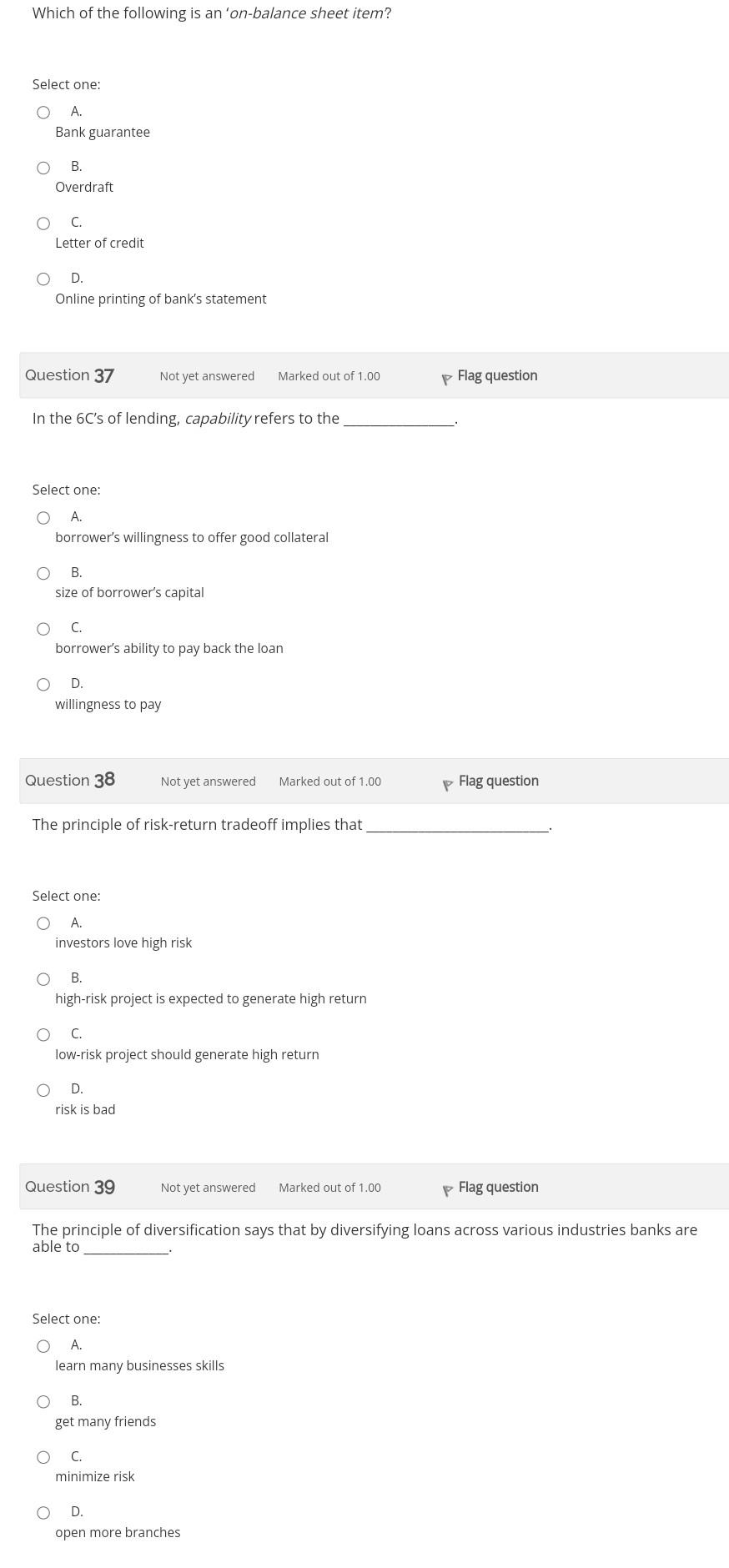

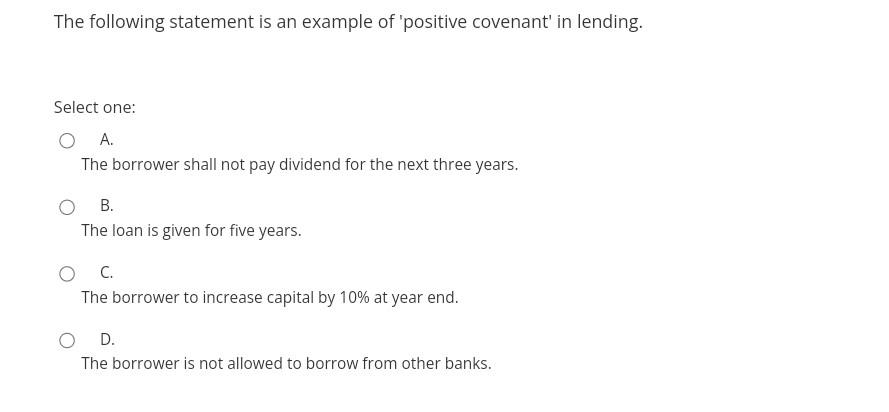

Based on information in Question 30, how much acceptance commission will the bank receive if the applicable rate on acceptance commission is 0.5% flat? Select one: A. RM246.58 B. RM500.00 C. RM250.00 D. RM550.00 Question 32 Not yet answered Marked out of 1.00 Flag question Return on equity (ROE) is a ratio that measures Select one: A. net profit as a percentage of total equity B. total assets as a percentage of total equity c. total assets as a percentage of total deposits D. net profit as a percentage of total assets Select one: A. fixed loan B. overdraft C. D. shipping guarantee Question 34 Marked out of 1.00 Plag question A short-term loan that can be extended several times is Select one: A. housing loan B. letter of credit C. revolving credit D. Loans given more than RM500 million are most likely categorized as Select one: A. super loans B. personal loans C. SME loans D. corporate loans Which of the following is an 'on-balance sheet item? Select one: A. Bank guarantee B. Overdraft C. Letter of credit D. Online printing of bank's statement Question 37 plag question In the 6C's of lending, capability refers to the Select one: A. borrower's willingness to offer good collateral B. size of borrower's capital C. borrower's ability to pay back the loan D. willingness to pay Select one: A. investors love high risk B. high-risk project is expected to generate high return C. low-risk project should generate high return D. risk is bad Question 39 Not yet answered Marked out of 1.00 Flag question The principle of diversification says that by diversifying loans across various industries banks are able to Select one: A. learn many businesses skills B. get many friends C. minimize risk D. open more branches The following statement is an example of 'positive covenant' in lending. Select one: A. The borrower shall not pay dividend for the next three years. B. The loan is given for five years. C. The borrower to increase capital by 10% at year end. D. The borrower is not allowed to borrow from other banksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started