solve it in a paper not in excel

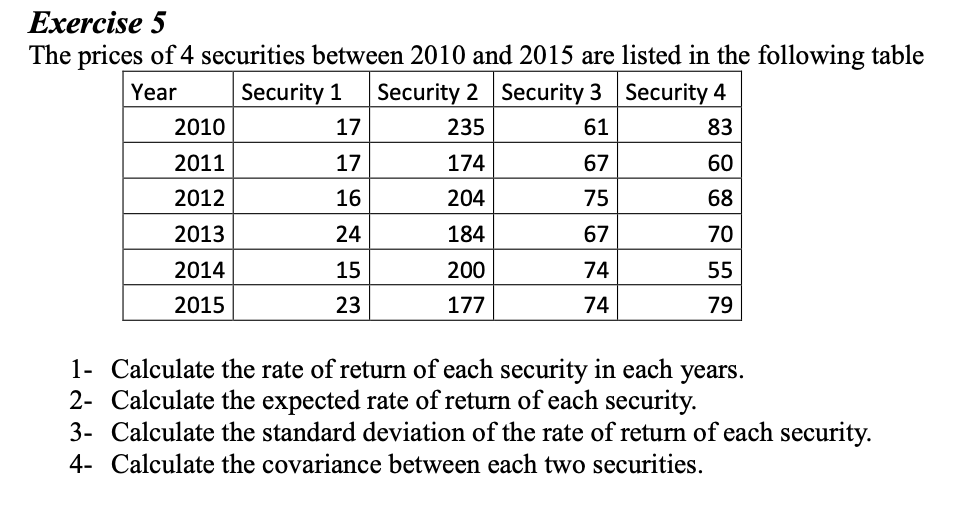

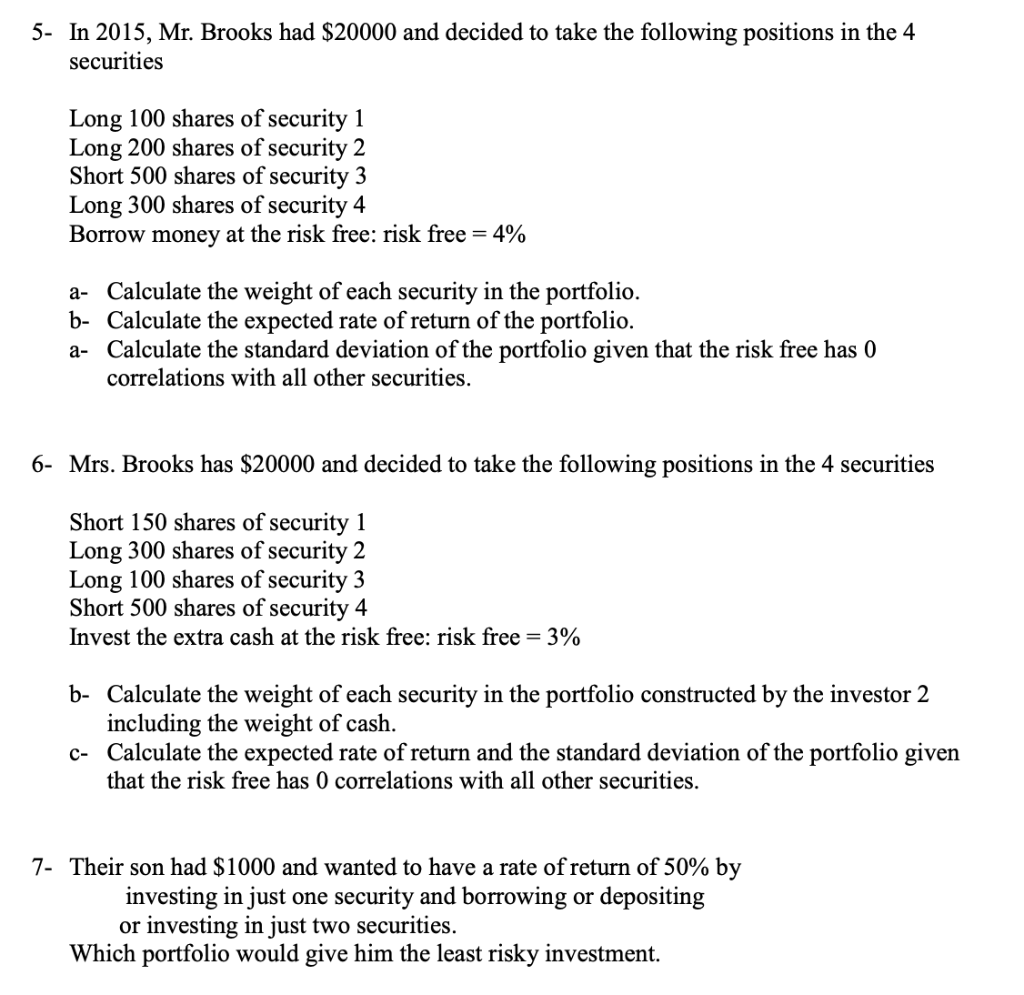

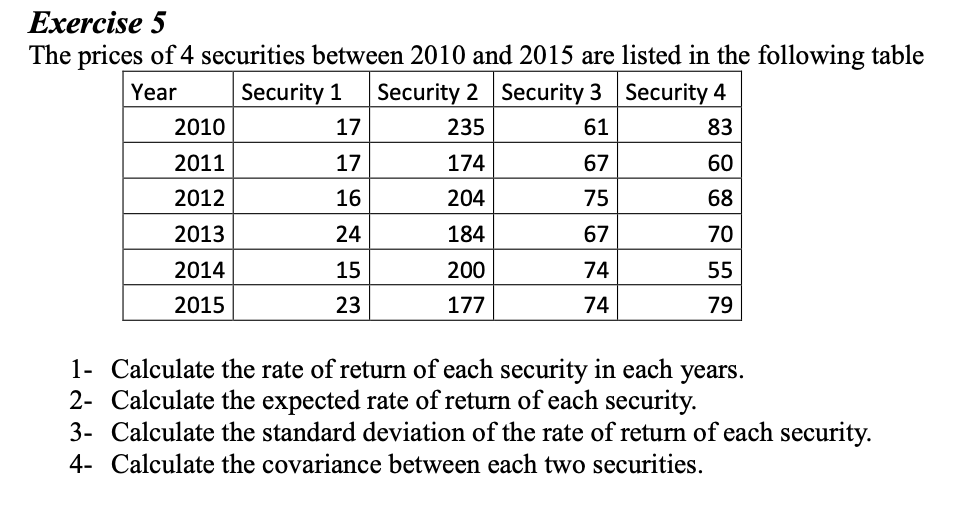

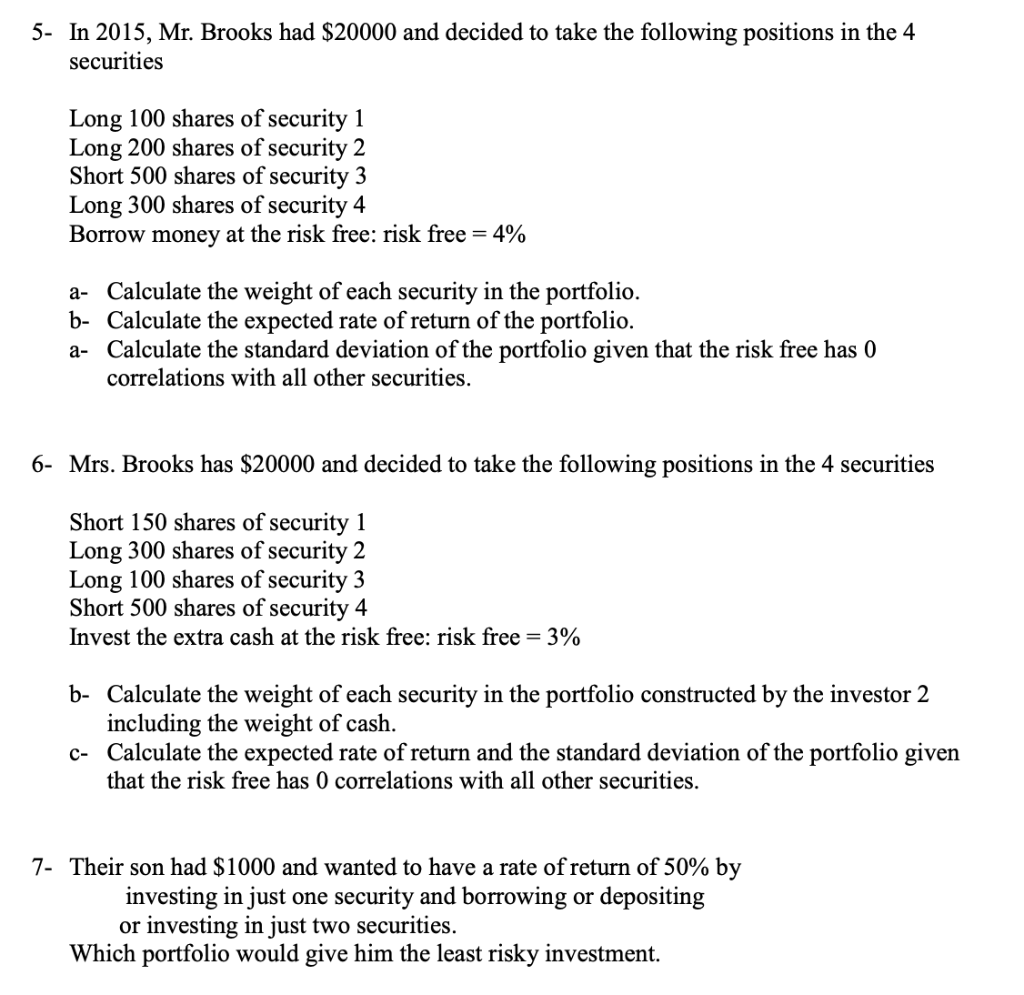

Exercise 5 The prices of 4 securities between 2010 and 2015 are listed in the following table Year Security 1 Security 2 Security 3 Security 4 2010 17 235 61 83 2011 17 174 67 60 2012 16 204 75 68 2013 24 184 67 70 15 200 74 55 2014 2015 23 177 74 79 1- Calculate the rate of return of each security in each years. 2- Calculate the expected rate of return of each security. 3- Calculate the standard deviation of the rate of return of each security. 4- Calculate the covariance between each two securities. 5- In 2015, Mr. Brooks had $20000 and decided to take the following positions in the 4 securities Long 100 shares of security 1 Long 200 shares of security 2 Short 500 shares of security 3 Long 300 shares of security 4 Borrow money at the risk free: risk free = 4% a- Calculate the weight of each security in the portfolio. b- Calculate the expected rate of return of the portfolio. a- Calculate the standard deviation of the portfolio given that the risk free has 0 correlations with all other securities. 6- Mrs. Brooks has $20000 and decided to take the following positions the 4 securities Short 150 shares of security 1 Long 300 shares of security 2 Long 100 shares of security 3 Short 500 shares of security 4 Invest the extra cash at the risk free: risk free = 3% b- Calculate the weight of each security in the portfolio constructed by the investor 2 including the weight of cash. C- Calculate the expected rate of return and the standard deviation of the portfolio given that the risk free has 0 correlations with all other securities. 7- Their son had $1000 and wanted to have a rate of return of 50% by investing in just one security and borrowing or depositing or investing in just two securities. Which portfolio would give him the least risky investment. Exercise 5 The prices of 4 securities between 2010 and 2015 are listed in the following table Year Security 1 Security 2 Security 3 Security 4 2010 17 235 61 83 2011 17 174 67 60 2012 16 204 75 68 2013 24 184 67 70 15 200 74 55 2014 2015 23 177 74 79 1- Calculate the rate of return of each security in each years. 2- Calculate the expected rate of return of each security. 3- Calculate the standard deviation of the rate of return of each security. 4- Calculate the covariance between each two securities. 5- In 2015, Mr. Brooks had $20000 and decided to take the following positions in the 4 securities Long 100 shares of security 1 Long 200 shares of security 2 Short 500 shares of security 3 Long 300 shares of security 4 Borrow money at the risk free: risk free = 4% a- Calculate the weight of each security in the portfolio. b- Calculate the expected rate of return of the portfolio. a- Calculate the standard deviation of the portfolio given that the risk free has 0 correlations with all other securities. 6- Mrs. Brooks has $20000 and decided to take the following positions the 4 securities Short 150 shares of security 1 Long 300 shares of security 2 Long 100 shares of security 3 Short 500 shares of security 4 Invest the extra cash at the risk free: risk free = 3% b- Calculate the weight of each security in the portfolio constructed by the investor 2 including the weight of cash. C- Calculate the expected rate of return and the standard deviation of the portfolio given that the risk free has 0 correlations with all other securities. 7- Their son had $1000 and wanted to have a rate of return of 50% by investing in just one security and borrowing or depositing or investing in just two securities. Which portfolio would give him the least risky investment