Answered step by step

Verified Expert Solution

Question

1 Approved Answer

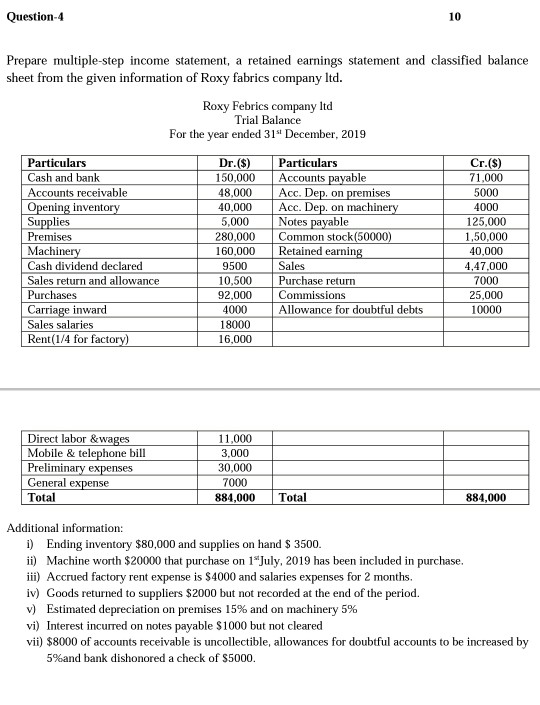

Solve me the whole question for practice please. Question-4 10 Prepare multiple-step income statement, a retained earnings statement and classified balance sheet from the given

Solve me the whole question for practice please.

Question-4 10 Prepare multiple-step income statement, a retained earnings statement and classified balance sheet from the given information of Roxy fabrics company ltd. Roxy Febrics company ltd Trial Balance For the year ended 31" December, 2019 Particulars Cash and bank Accounts receivable Opening inventory Supplies Premises Machinery Cash dividend declared Sales return and allowance Purchases Carriage inward Sales salaries Rent (1/4 for factory) Dr.($) 150,000 48,000 40,000 5,000 280,000 160,000 9500 10,500 92,000 4000 18000 16.000 Particulars Accounts payable Acc. Dep, on premises Acc. Dep. on machinery Notes payable Common stock(50000) Retained earning Sales Purchase return Commissions Allowance for doubtful debts Cr.(S) 71.000 5000 4000 125,000 1,50,000 40,000 4,47,000 7000 25,000 10000 Direct labor & wages Mobile & telephone bill Preliminary expenses General expense Total 11,000 3,000 30,000 7000 884,000 Total 884,000 Additional information: i) Ending inventory $80,000 and supplies on hand $ 3500 ii) Machine worth $20000 that purchase on 1July, 2019 has been included in purchase. iii) Accrued factory rent expense is $4000 and salaries expenses for 2 months. iv) Goods returned to suppliers $2000 but not recorded at the end of the period. v) Estimated depreciation on premises 15% and on machinery 5% vi) Interest incurred on notes payable $1000 but not cleared vii) $8000 of accounts receivable is uncollectible, allowances for doubtful accounts to be increased by 5%and bank dishonored a check of $5000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started