Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve on paper Question No. 1 (10+5+5 Marks) a) The expected returns and standard deviations of stocks A and B are: Stocks A B Expected

solve on paper

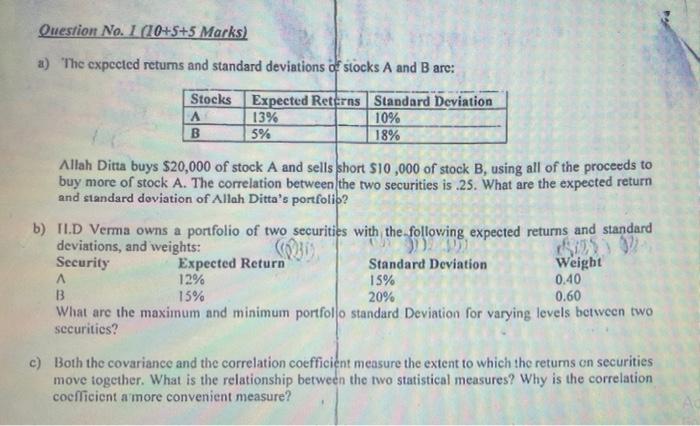

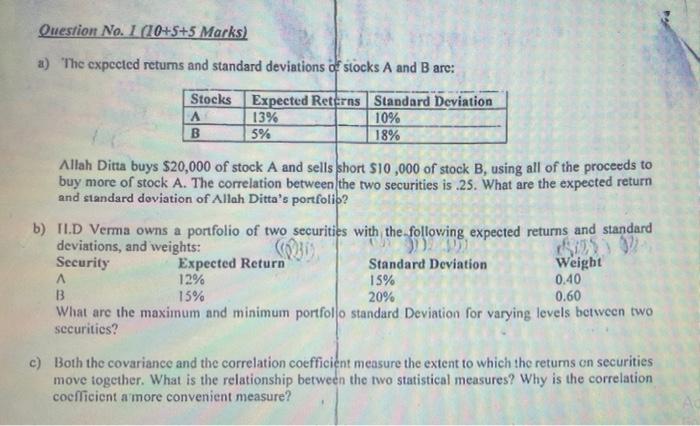

Question No. 1 (10+5+5 Marks) a) The expected returns and standard deviations of stocks A and B are: Stocks A B Expected Reterns Standard Deviation 13% 10% 5% 18% a Allah Ditta buys $20,000 of stock A and sells short $10,000 of stock B, using all of the proceeds to buy more of stock A. The correlation between the two securities is 25. What are the expected return and standard deviation of Allah Ditta's portfolib? b) TID Verma owns a portfolio of two securities with the following expected returns and standard deviations, and weights: $125392 Security Expected Return Standard Deviation Weight A 12% 15% 0.40 B 15% 20% 0.60 What are the maximum and minimum portfolo standard Deviation for varying levels between two securitics? c) Both the covariance and the correlation coefficient measure the extent to which the returns on securities move together. What is the relationship between the two statistical measures? Why is the correlation coefficient a more convenient measure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started