Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve only correct if any single amount is wrong I will down vote A2 pic supports the concept of tero technology or life cycle costing

solve only correct if any single amount is wrong I will down vote

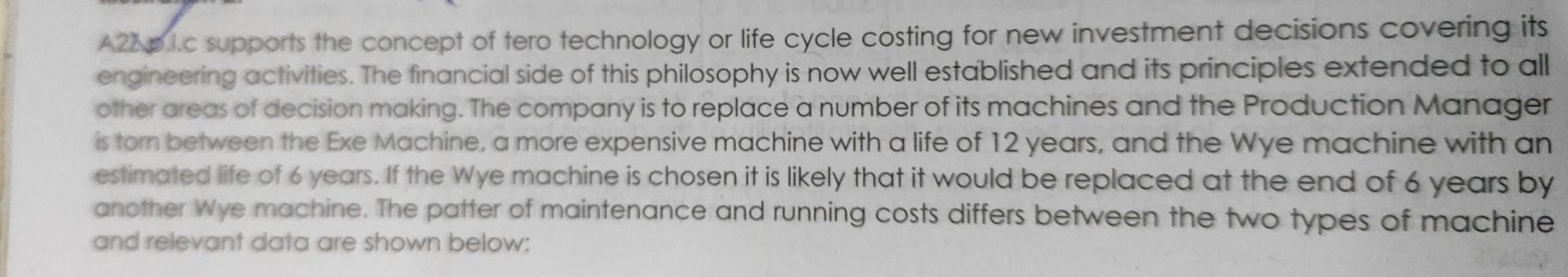

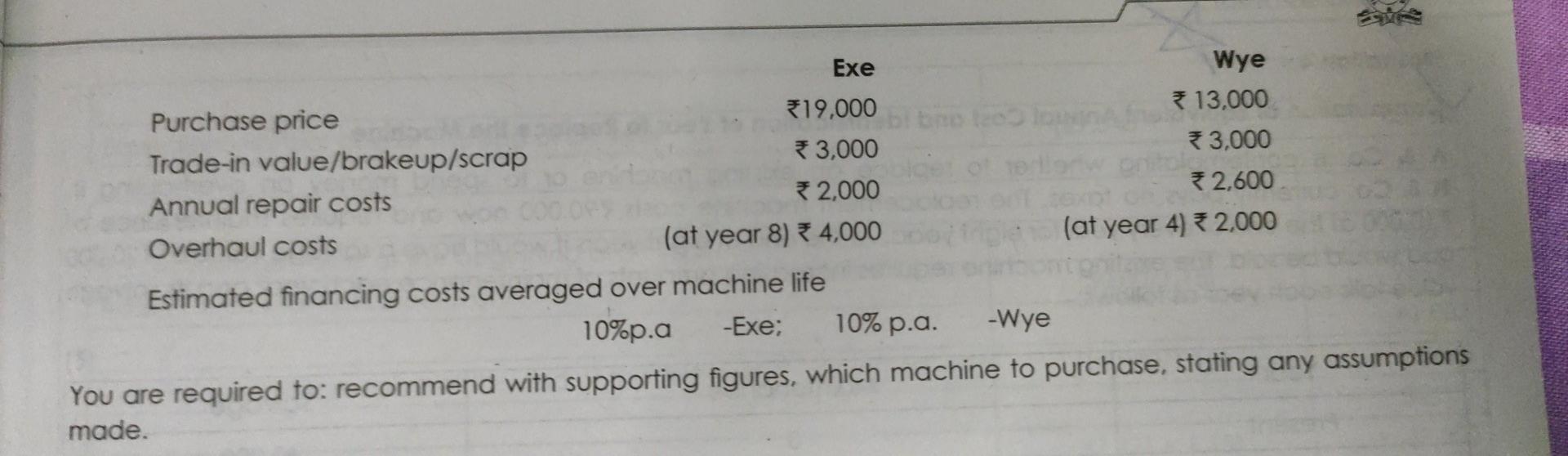

A2 pic supports the concept of tero technology or life cycle costing for new investment decisions covering its engineering activities. The financial side of this philosophy is now well established and its principles extended to all other areas of decision making. The company is to replace a number of its machines and the Production Manager is tom between the Exe Machine, a more expensive machine with a life of 12 years, and the Wye machine with an estimated life of 6 years. If the Wye machine is chosen it is likely that it would be replaced at the end of 6 years by another Wye machine. The patter of maintenance and running costs differs between the two types of machine and relevant data are shown below: Exe Wye Purchase price 19,000 13,000 bolo Trade-in value/brakeup/scrap 3,000 3,000 2,000 32,600 Annual repair costs Overhaul costs (at year 8) 4,000 (at year 4) * 2,000 Estimated financing costs averaged over machine life 10%p.a -Exe; 10% p.a. -Wye You are required to: recommend with supporting figures, which machine to purchase, stating any assumptions made. A company is considering the purchase of a machine for 3,50,000. It feels quite confident that it can sell the goods produced by the machine as to yield an annual cash surplus of 1,00,000. There is however me uncertainly as to the machine working life. A recently publish Trade Association Survey shows that members of the Association have between them owned 250 of these machines and have found the lives of the machines vary as under: No. of year of machine life 3 4 5 6 7 Total No. of machines having given life 20 50 100 70 10 250 Assuming discount rate of 10% the net present value for each different machine life is follows: Machine life 3 4 5 6 7 (1,01,000) (33,000) 29,000 86,000 1,37,000 You required to advice whether the company should purchase a machine or not. NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started