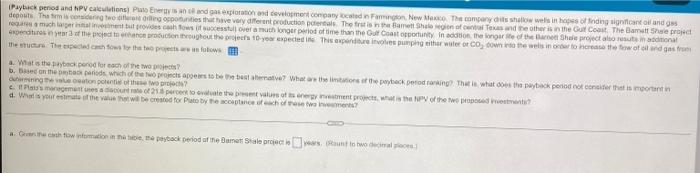

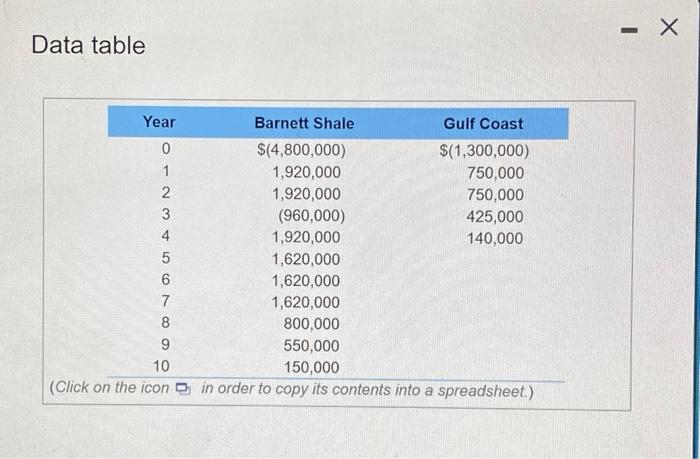

Payback penod and NPV alions) Pato Eysind gan exploration on development company cated in Form News. The company is show wel in hopes of inding significant and decout That is controller ring opportunities that have very different production portal Therinthamet Shalawiona wieder in the Gulf Coast The Bamettrale project ramach rebut des chows cessfullover a nuchonger period of time than the Gulf Coast Rounty in action the longer te of the Shule project at nadiona redtures of the projects than proton roughout there's 10 year expected to this spenditure involves pumphither water or cow the winner to create flow of oil and gas the Theth for flows a. What is the back Dored for each of the wees? b. Based on the place parede do te thonis apears to be the best teave? What are the list of the payback peredarang) That is what is the payback period of coneider that is mornin gevestonotos wor? classement ses 21 percent of the best values of the metros. what the of the promotion d. What is your state of the value will be created for to the core offre ... dh tow normation in die stack period of Buset Stale precisant to be - - Data table Year Barnett Shale Gulf Coast 0 $(4,800,000) $(1,300,000) 1 1,920,000 750,000 2 1,920,000 750,000 3 (960,000) 425,000 4 1,920,000 140,000 5 1,620,000 6 1,620,000 7 1,620,000 8 800,000 9 550,000 10 150,000 (Click on the icon in order to copy its contents into a spreadsheet.) (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The compan deposits. The firm is considering two different drilling opportunities that have very different production potentials. The first is in the Barnett Shale region of central requires a much larger initial investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the Ic expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO, the structure. The expected cash flows for the two projects are as follows: a. What is the payback period for each of the two projects? b. Based on the payback periods, which of the two projects appears to be the best alternative? What are the limitations of the payback period ranking? That is, who determining the value creation potential of those two projects? C. Plato's management uses a discount rate of 21.8 percent to evaluate the present values of its energy investment projects, what is the NPV of the two proposed d. What is your estimate of the value that will be created for Plato by the acceptance of each of these two investments? a. Given the cash flow information in the table, the payback period of the Barnett Shale project is years. (Round to two decimal places.) to Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drilts shallow wells in hopes of finding significant oil and gas drilling opportunities that have very different production potentials. The first in the Barnett Shale region of central Texas and the other is in the Gulf Coast. The Barnett Shale project ovides cash flows (if conful over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional ce production throughout the project's 10-year expected ife. This expenditure involves pumping either water or co, down into the wells in order to increase the flow of oil and gas trom two projects are as follows: two projects two projects appears to be the best alternative? What are the limitations of the payback period ranking? That is what does the payback period not consider that is important in se two projects of 218 percent to evaluate the present values of its energy investment projects, what is the NPV of the two proposed investments? be created for Plato by the acceptance of each of these two investments? the payback period of the Barnett Shale project is year. (Round to two decimal places)