Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Specs Co is a manufacturer of spectacles and contact lenses. It is evaluating four projects for investment purposes. The projects are being evaluated based on

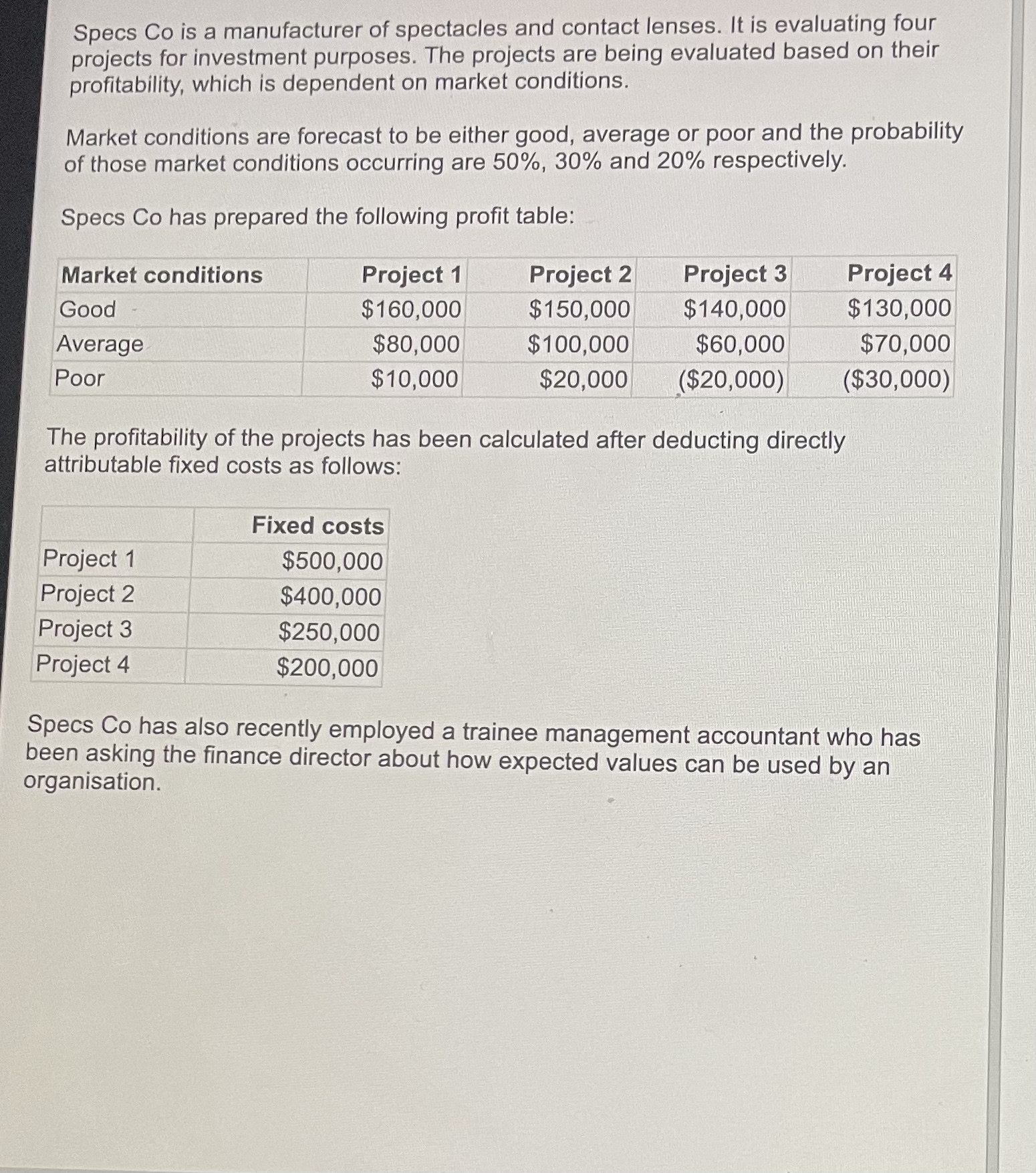

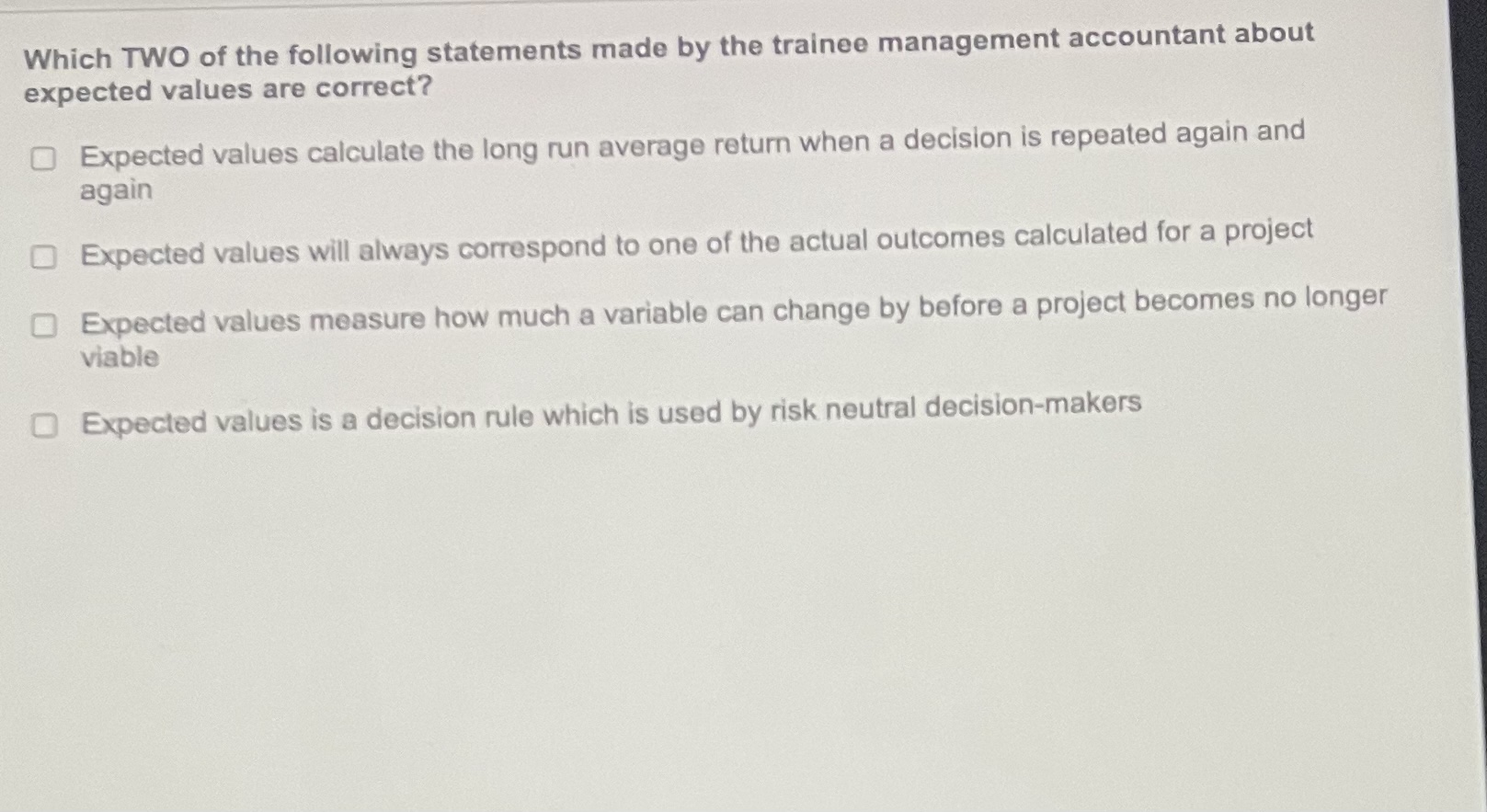

Specs Co is a manufacturer of spectacles and contact lenses. It is evaluating four projects for investment purposes. The projects are being evaluated based on their profitability, which is dependent on market conditions. Market conditions are forecast to be either good, average or poor and the probability of those market conditions occurring are 50%,30% and 20% respectively. Specs Co has prepared the following profit table: The profitability of the projects has been calculated after deducting directly attributable fixed costs as follows: Specs Co has also recently employed a trainee management accountant who has been asking the finance director about how expected values can be used by an organisation. Which TWO of the following statements made by the trainee management accountant about expected values are correct? Expected values calculate the long run average return when a decision is repeated again and again Expected values will always correspond to one of the actual outcomes calculated for a project Expected values measure how much a variable can change by before a project becomes no longer viable Expected values is a decision rule which is used by risk neutral decision-makers

Specs Co is a manufacturer of spectacles and contact lenses. It is evaluating four projects for investment purposes. The projects are being evaluated based on their profitability, which is dependent on market conditions. Market conditions are forecast to be either good, average or poor and the probability of those market conditions occurring are 50%,30% and 20% respectively. Specs Co has prepared the following profit table: The profitability of the projects has been calculated after deducting directly attributable fixed costs as follows: Specs Co has also recently employed a trainee management accountant who has been asking the finance director about how expected values can be used by an organisation. Which TWO of the following statements made by the trainee management accountant about expected values are correct? Expected values calculate the long run average return when a decision is repeated again and again Expected values will always correspond to one of the actual outcomes calculated for a project Expected values measure how much a variable can change by before a project becomes no longer viable Expected values is a decision rule which is used by risk neutral decision-makers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started