Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve part A in 25 mins thanks begin{tabular}{|l|l|l|l|} hline & multicolumn{1}{|c|}{ A } & B & D hline 1 & Question 4 hline

solve part A in 25 mins thanks

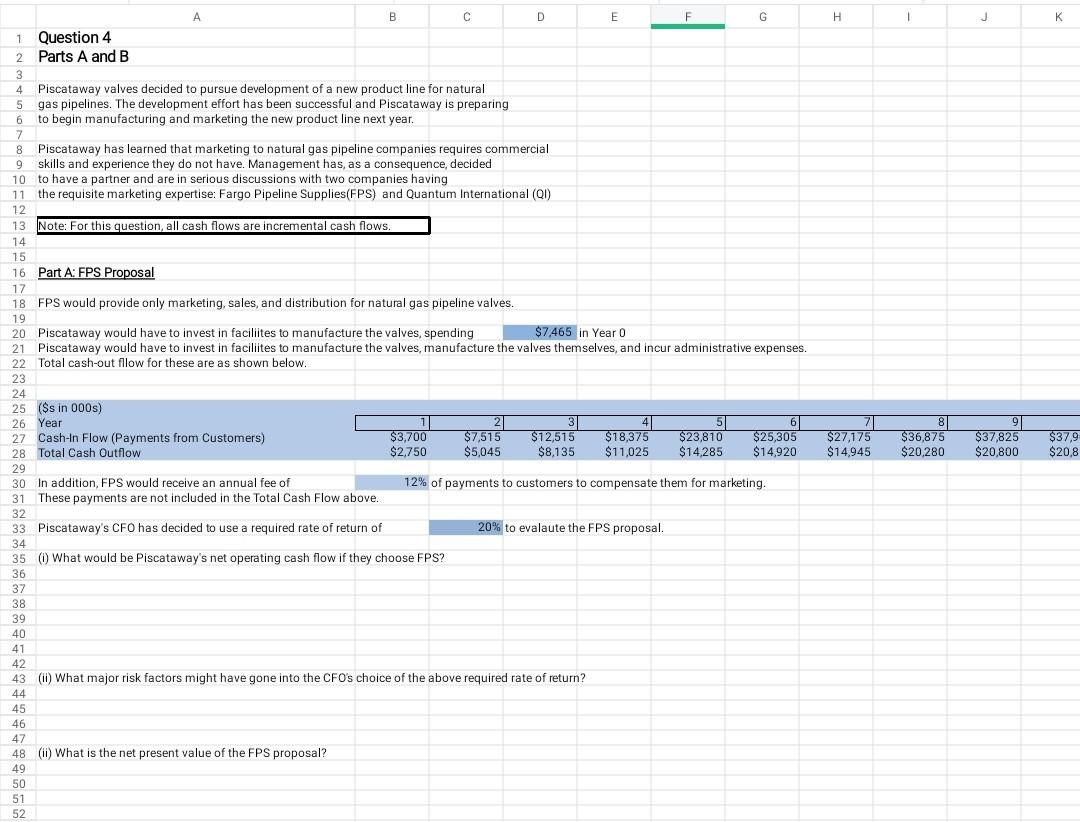

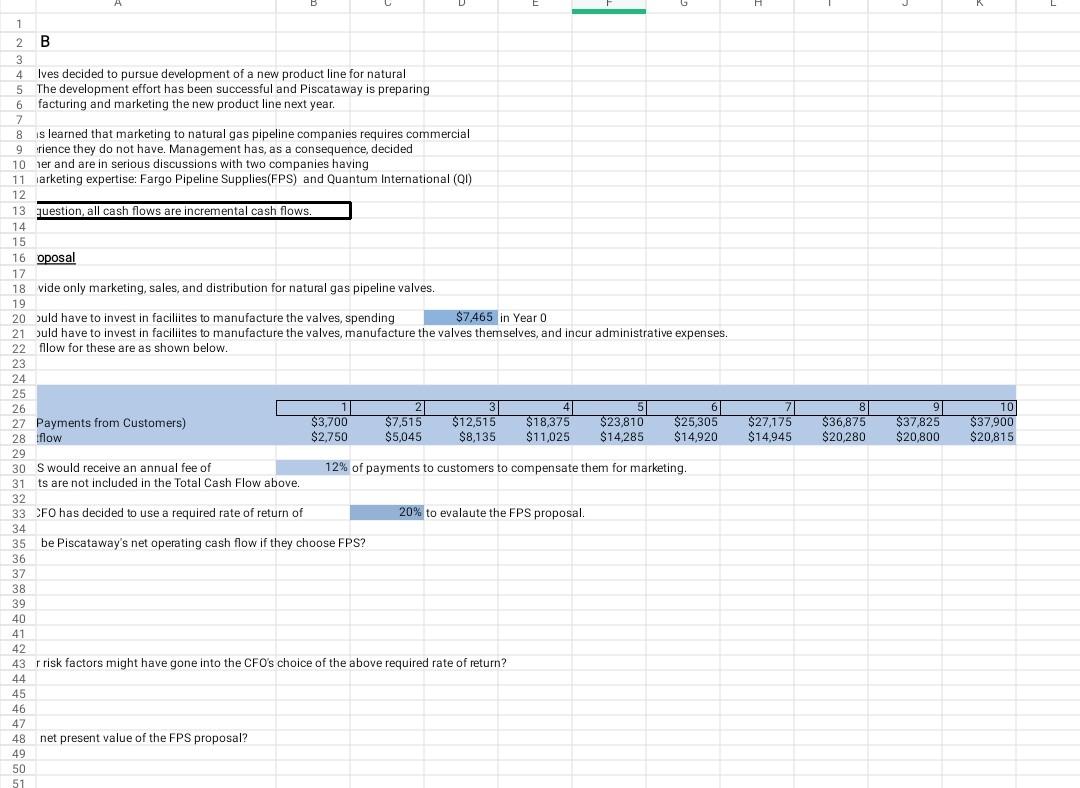

\begin{tabular}{|l|l|l|l|} \hline & \multicolumn{1}{|c|}{ A } & B & D \\ \hline 1 & Question 4 \\ \hline 2 & Parts A and B \\ 3 & Piscataway valves decided to pursue development of a new product line for natural \\ \hline 4 & gas pipelines. The development effort has been successful and Piscataway is preparing \\ \hline 6 & to begin manufacturing and marketing the new product line next year. \\ 7 & & \\ 8 & Piscataway has learned that marketing to natural gas pipeline companies requires commercial \\ \hline 9 & skills and experience they do not have. Management has, as a consequence, decided \\ \hline 10 & to have a partner and are in serious discussions with two companies having \\ \hline 11 & the requisite marketing expertise: Fargo Pipeline Supplies(FPS) and Quantum International (QI) \\ \hline 12 & \\ \hline 13 & Note: For this question, all cash flows are incremental cash flows. \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & Part A: FPS Proposal \end{tabular} 18 FPS would provide only marketing, sales, and distribution for natural gas pipeline valves. 20 Piscataway would have to invest in facilites to manufacture the valves, spending $7,465 in Year 0 21 Piscataway would have to invest in facilites to manufacture the valves, manufacture the valves them in Yelves, and incur administrative expenses. 22 Total cash-out fllow for these are as shown below. 23 25 (\$s in 000s) 26 Year 27 Cash-In Flow (Payments from Customers) 27 Total Cash Outflow 293031Inaddition,FPSwouldreceiveanannualfeeofThesepaymentsarenotincludedintheTotalCashFlowabove.12%ofpaymentstocustomerstocompensatethemformarketing. 31 These payments are not included in the Total Cash Flow above. 33 Piscataway's CFO has decided to use a required rate of return of 20% to evalaute the FPS proposal. 35 (i) What would be Piscataway's net operating cash flow if they choose FPS? \begin{tabular}{l} 35 \\ 36 \\ \hline 37 \end{tabular} 37 38 39 39 41 42 43 (ii) What major risk factors might have gone into the CFO's choice of the above required rate of return? 44 45 46 48 (ii) What is the net present value of the FPS proposal? 49 50 51 52 B Ives decided to pursue development of a new product line for natural The development effort has been successful and Piscataway is preparing facturing and marketing the new product line next year. 8 is learned that marketing to natural gas pipeline companies requires commercial 9 rience they do not have. Management has, as a consequence, decided 10 jer and are in serious discussions with two companies having 11 larketing expertise: Fargo Pipeline Supplies(FPS) and Quantum International (QI) 12 13 15 15 16 oposalion 17 18 vide only marketing, sales, and distribution for natural gas pipeline valves. 19 20 Juld have to invest in facilites to manufacture the valves, spending $7,465 in Year 0 21 Juld have to invest in facilites to manufacture the valves, manufacture the valves themselves, and incur administrative expenses. 22 flow for these are as shown below. 23 25 27 Payments from Customers) \begin{tabular}{|r|r|r|r|r|r|} \hline 1 & 2 & 3 & 4 & 5 & \\ \hline 3,700 & $7,515 & $12,515 & $18,375 & $23,810 & $25,305 \\ $2,750 & $5,045 & $8,135 & $11,025 & $14,285 & $14,920 \\ & \\ 12% & of payments to customers to compensate them for marketing. \end{tabular} 29 30 S would receive an annual fee of 31 ts are not included in the Total Cash Flow above. 31 ts are not included in the Total Cash Flow above. 32 33 :FO has decided to use a required rate of return of 20% to evalaute the FPS proposal. \begin{tabular}{|l|l|l|l|} \hline & \multicolumn{1}{|c|}{ A } & B & D \\ \hline 1 & Question 4 \\ \hline 2 & Parts A and B \\ 3 & Piscataway valves decided to pursue development of a new product line for natural \\ \hline 4 & gas pipelines. The development effort has been successful and Piscataway is preparing \\ \hline 6 & to begin manufacturing and marketing the new product line next year. \\ 7 & & \\ 8 & Piscataway has learned that marketing to natural gas pipeline companies requires commercial \\ \hline 9 & skills and experience they do not have. Management has, as a consequence, decided \\ \hline 10 & to have a partner and are in serious discussions with two companies having \\ \hline 11 & the requisite marketing expertise: Fargo Pipeline Supplies(FPS) and Quantum International (QI) \\ \hline 12 & \\ \hline 13 & Note: For this question, all cash flows are incremental cash flows. \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & Part A: FPS Proposal \end{tabular} 18 FPS would provide only marketing, sales, and distribution for natural gas pipeline valves. 20 Piscataway would have to invest in facilites to manufacture the valves, spending $7,465 in Year 0 21 Piscataway would have to invest in facilites to manufacture the valves, manufacture the valves them in Yelves, and incur administrative expenses. 22 Total cash-out fllow for these are as shown below. 23 25 (\$s in 000s) 26 Year 27 Cash-In Flow (Payments from Customers) 27 Total Cash Outflow 293031Inaddition,FPSwouldreceiveanannualfeeofThesepaymentsarenotincludedintheTotalCashFlowabove.12%ofpaymentstocustomerstocompensatethemformarketing. 31 These payments are not included in the Total Cash Flow above. 33 Piscataway's CFO has decided to use a required rate of return of 20% to evalaute the FPS proposal. 35 (i) What would be Piscataway's net operating cash flow if they choose FPS? \begin{tabular}{l} 35 \\ 36 \\ \hline 37 \end{tabular} 37 38 39 39 41 42 43 (ii) What major risk factors might have gone into the CFO's choice of the above required rate of return? 44 45 46 48 (ii) What is the net present value of the FPS proposal? 49 50 51 52 B Ives decided to pursue development of a new product line for natural The development effort has been successful and Piscataway is preparing facturing and marketing the new product line next year. 8 is learned that marketing to natural gas pipeline companies requires commercial 9 rience they do not have. Management has, as a consequence, decided 10 jer and are in serious discussions with two companies having 11 larketing expertise: Fargo Pipeline Supplies(FPS) and Quantum International (QI) 12 13 15 15 16 oposalion 17 18 vide only marketing, sales, and distribution for natural gas pipeline valves. 19 20 Juld have to invest in facilites to manufacture the valves, spending $7,465 in Year 0 21 Juld have to invest in facilites to manufacture the valves, manufacture the valves themselves, and incur administrative expenses. 22 flow for these are as shown below. 23 25 27 Payments from Customers) \begin{tabular}{|r|r|r|r|r|r|} \hline 1 & 2 & 3 & 4 & 5 & \\ \hline 3,700 & $7,515 & $12,515 & $18,375 & $23,810 & $25,305 \\ $2,750 & $5,045 & $8,135 & $11,025 & $14,285 & $14,920 \\ & \\ 12% & of payments to customers to compensate them for marketing. \end{tabular} 29 30 S would receive an annual fee of 31 ts are not included in the Total Cash Flow above. 31 ts are not included in the Total Cash Flow above. 32 33 :FO has decided to use a required rate of return of 20% to evalaute the FPS proposalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started