Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve please. Each pic shows the required method. Stop putting your email to make more moneyand actually solve it. The info is all there. Periodic

Solve please. Each pic shows the required method.

Stop putting your email to make more moneyand actually solve it. The info is all there.

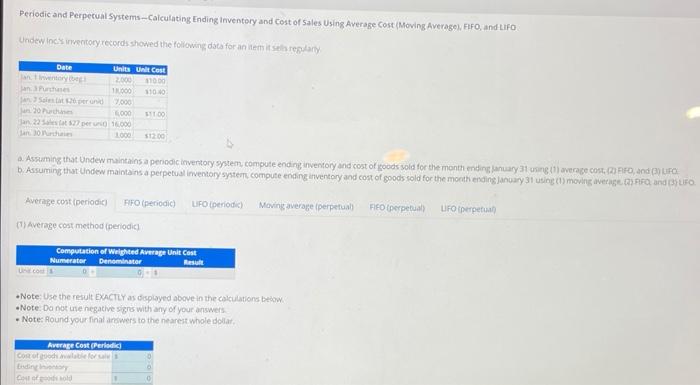

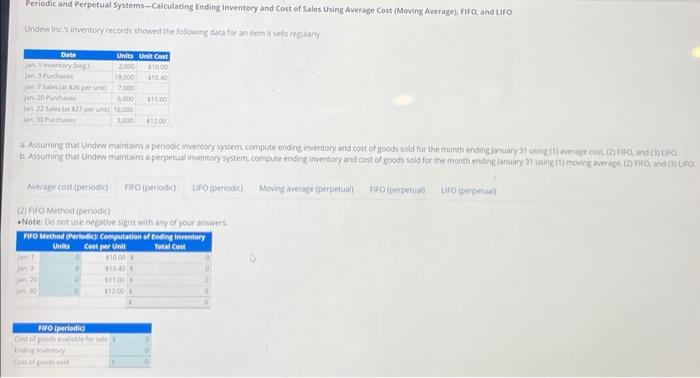

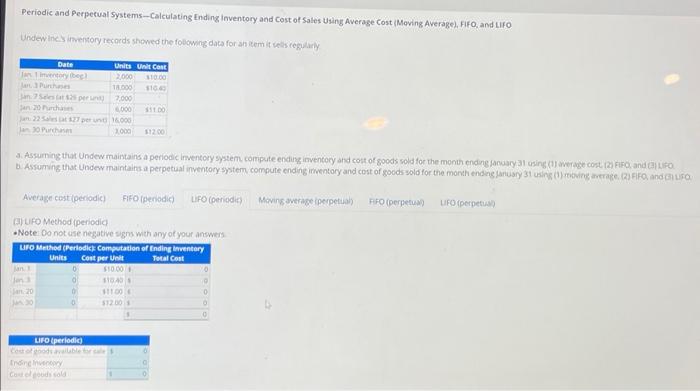

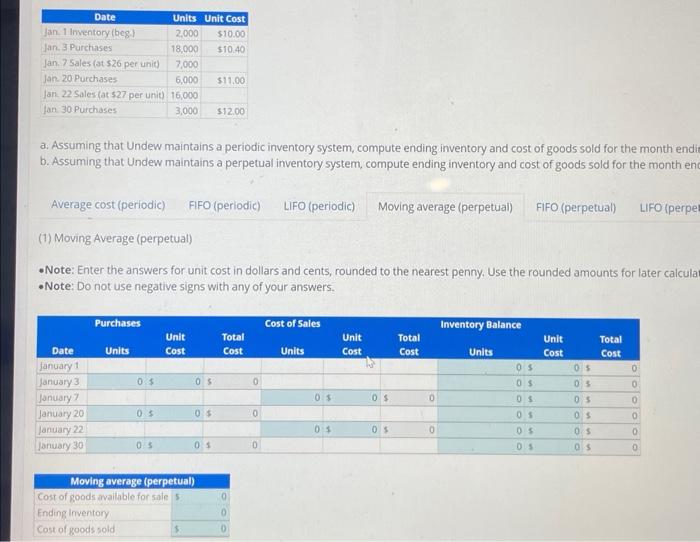

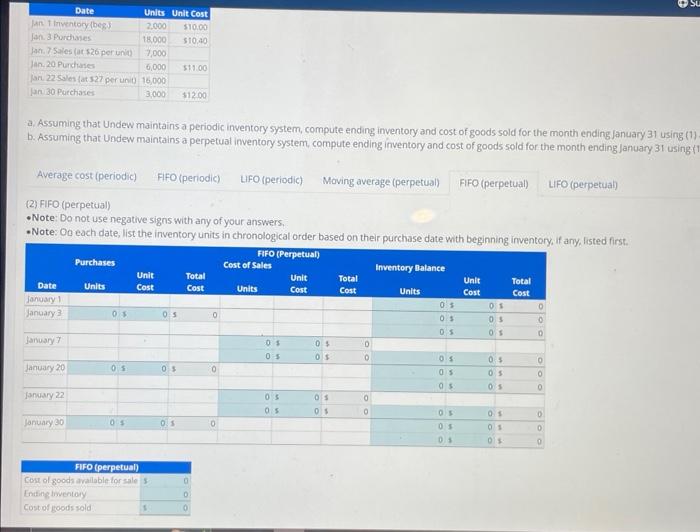

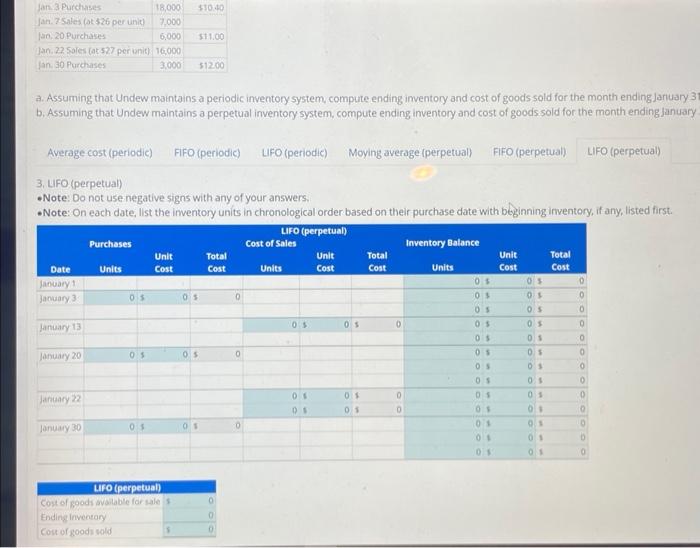

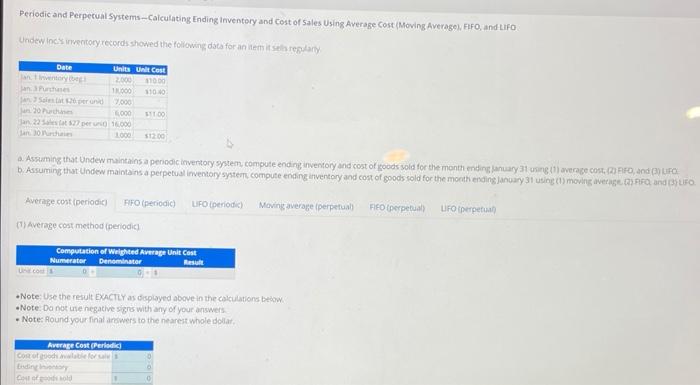

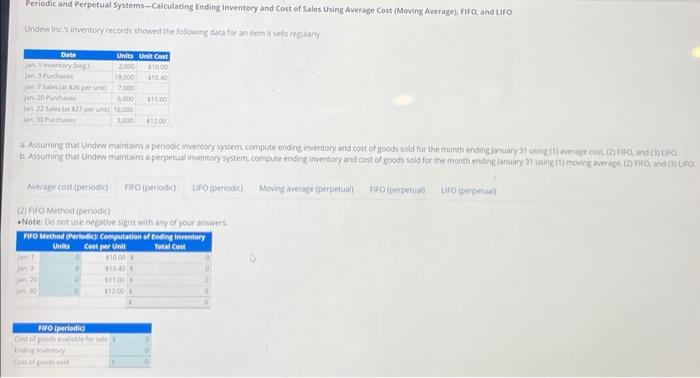

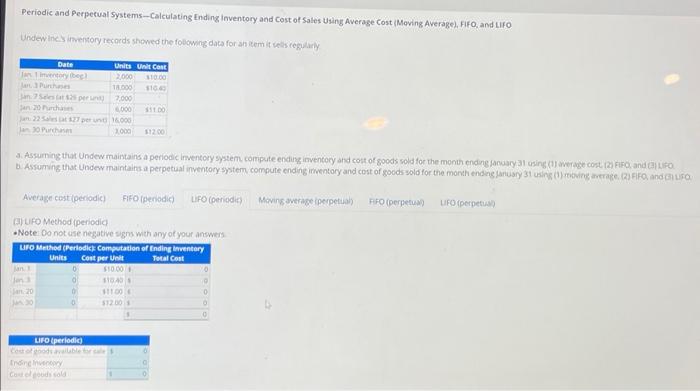

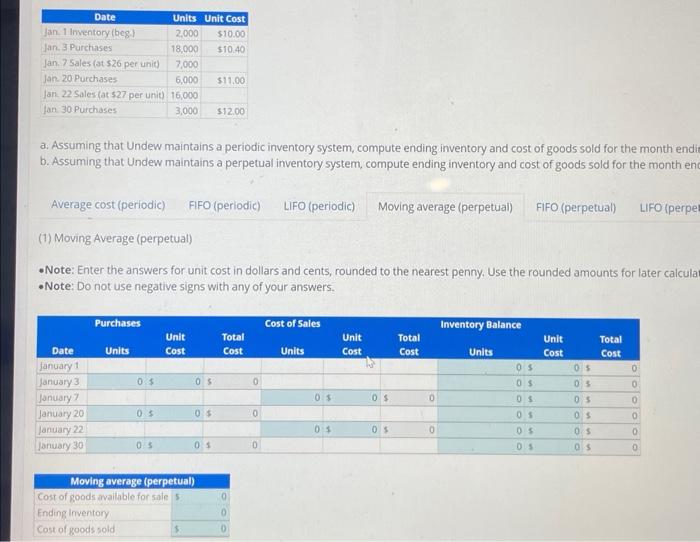

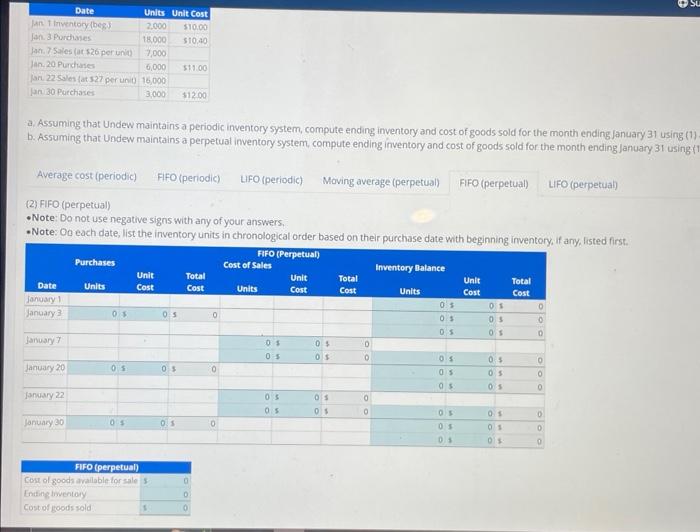

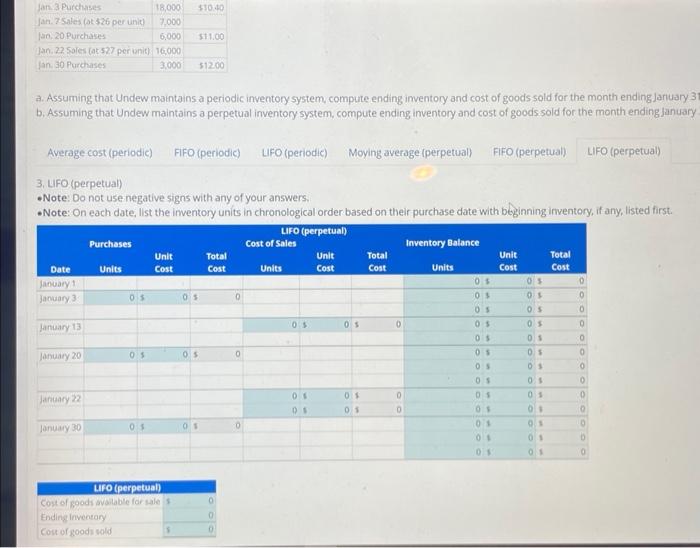

Periodic and Perperual Systems-Calculating Ending inventory and cost of Sales Using Average Cost (Moving Average), FIFO, and LiFo Undew inck inwentory records showed the following data for an ineit it siela resularty b. Assuming that Undew maintains a perpetual inventary systert compute ending inventory and cost of goodssold for the moeth enging Januay 31 using (1) moving average (ah fipa and (3) tifo (1) Average cost method (periodic) * Note: Use the result EXACTIY as dispinyed above in the colculations bebow - Note: Da nos une negative signs with any of your answets - Note: Aoundyour final anwers to the neareit whole dollar. Periodic and Perpetual Systems-Calculating Ending inventory and Cost of Sales Using Average Cost (Moving Average), FrFo, and ufo Undew inc: imwentocy records showed the following data for an item it sels reculaty (2) FFO Methad (periodic) - Note Do not use neguve siens with any of your answer. Periodic and Perpecual Systems-Calculating Ending inventory and Cost of Sales using Average cost (Moving Average), Fifo, and LIFo Undew ines imentory records showed the followng data for an iem it seks cegularly (3) Lifo Method ipenodic - Note Do not use negative sgro with any of your answers a. Assuming that Undew maintains a periodic inventory system, compute ending inventory and cost of goods sold for the month end b. Assuming that Undew maintains a perpetual inventory system, compute ending inventory and cost of goods sold for the month er (1) Moving Average (perpetual) -Note: Enter the answers for unit cost in dollars and cents, rounded to the nearest penny. Use the rounded amounts for later calcul. - Note: Do not use negative signs with any of your answers. a. Assuming that Undew maintains a periodic inventory system, compute ending inventory and cost of goods sold for the month ending January 31 using b. Assuming that Undew maintains a perpetual inventory system, compute ending inventory and cost of goods sold for the month ending January 31 usin (2) FIFO (perpetual) - Note: Do not use negative signs with any of your answers. - Note: Oo each date, list the inventory units in chronological order based on their purchase date with beginning inventorv. if any, listed first. a. Assuming that Undew maintains a periodic inventory system, compute ending inventory and cost of goods sold for the month ending January b. Assuming that Undew maintains a perpetual inventory system, compute ending, inventory and cost of goods sold for the month ending Januar 3. LFO (perpetual) -Note: Do not use negative signs with any of your answers. - Note: On each date, list the inventory units in chronological order based on their purchase date with beginning inventory, if any, listed first. Periodic and Perperual Systems-Calculating Ending inventory and cost of Sales Using Average Cost (Moving Average), FIFO, and LiFo Undew inck inwentory records showed the following data for an ineit it siela resularty b. Assuming that Undew maintains a perpetual inventary systert compute ending inventory and cost of goodssold for the moeth enging Januay 31 using (1) moving average (ah fipa and (3) tifo (1) Average cost method (periodic) * Note: Use the result EXACTIY as dispinyed above in the colculations bebow - Note: Da nos une negative signs with any of your answets - Note: Aoundyour final anwers to the neareit whole dollar. Periodic and Perpetual Systems-Calculating Ending inventory and Cost of Sales Using Average Cost (Moving Average), FrFo, and ufo Undew inc: imwentocy records showed the following data for an item it sels reculaty (2) FFO Methad (periodic) - Note Do not use neguve siens with any of your answer. Periodic and Perpecual Systems-Calculating Ending inventory and Cost of Sales using Average cost (Moving Average), Fifo, and LIFo Undew ines imentory records showed the followng data for an iem it seks cegularly (3) Lifo Method ipenodic - Note Do not use negative sgro with any of your answers a. Assuming that Undew maintains a periodic inventory system, compute ending inventory and cost of goods sold for the month end b. Assuming that Undew maintains a perpetual inventory system, compute ending inventory and cost of goods sold for the month er (1) Moving Average (perpetual) -Note: Enter the answers for unit cost in dollars and cents, rounded to the nearest penny. Use the rounded amounts for later calcul. - Note: Do not use negative signs with any of your answers. a. Assuming that Undew maintains a periodic inventory system, compute ending inventory and cost of goods sold for the month ending January 31 using b. Assuming that Undew maintains a perpetual inventory system, compute ending inventory and cost of goods sold for the month ending January 31 usin (2) FIFO (perpetual) - Note: Do not use negative signs with any of your answers. - Note: Oo each date, list the inventory units in chronological order based on their purchase date with beginning inventorv. if any, listed first. a. Assuming that Undew maintains a periodic inventory system, compute ending inventory and cost of goods sold for the month ending January b. Assuming that Undew maintains a perpetual inventory system, compute ending, inventory and cost of goods sold for the month ending Januar 3. LFO (perpetual) -Note: Do not use negative signs with any of your answers. - Note: On each date, list the inventory units in chronological order based on their purchase date with beginning inventory, if any, listed first Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started