Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve please with format on the second photo on the excel sheet. Can you also show all your work please. Thanks 420. (Analyzing market value)

solve please with format on the second photo on the excel sheet. Can you also show all your work please. Thanks

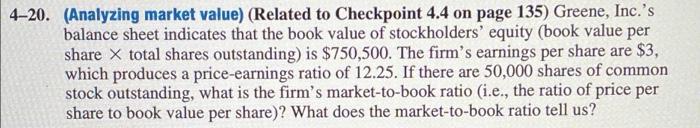

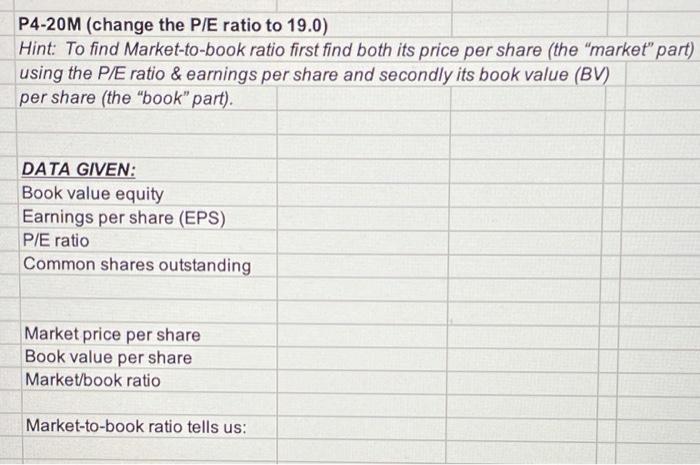

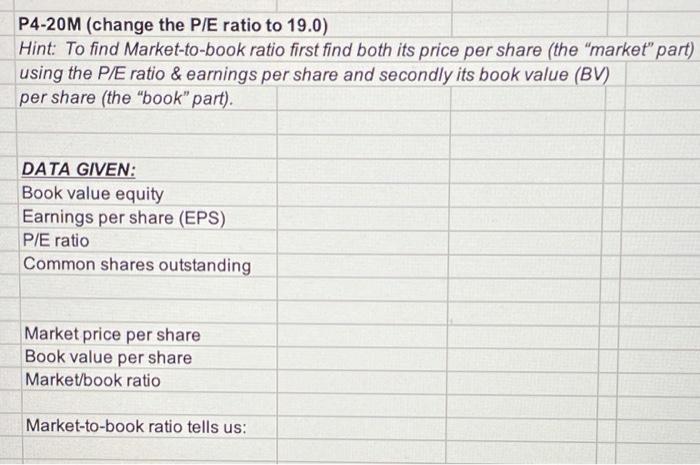

420. (Analyzing market value) (Related to Checkpoint 4.4 on page 135) Greene, Inc.'s balance sheet indicates that the book value of stockholders' equity (book value per share X total shares outstanding) is $750,500. The firm's earnings per share are $3, which produces a price-earnings ratio of 12.25. If there are 50,000 shares of common stock outstanding, what is the firm's market-to-book ratio (i.e., the ratio of price per share to book value per share)? What does the market-to-book ratio tell us? P4-20M (change the P/E ratio to 19.0) Hint: To find Market-to-book ratio first find both its price per share (the "market" part) using the P/E ratio & earnings per share and secondly its book value (BV) per share (the "book" part). DATA GIVEN: Book value equity Earnings per share (EPS) P/E ratio Common shares outstanding Market price per share Book value per share Market/book ratio Market-to-book ratio tells us

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started