Answered step by step

Verified Expert Solution

Question

1 Approved Answer

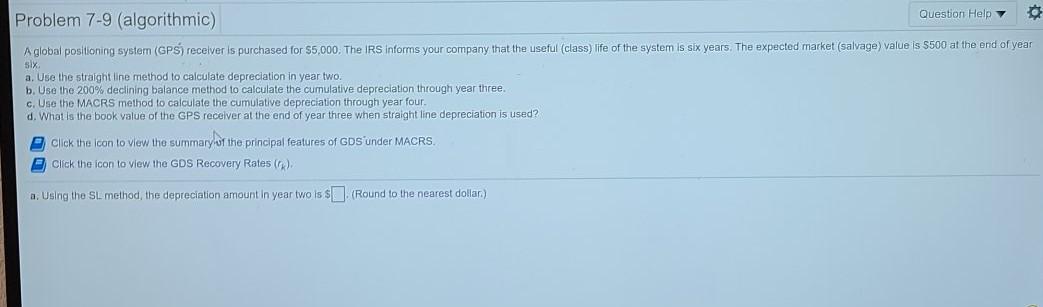

solve Problem 7-9 (algorithmic) Question Help A global positioning system (GPS) receiver is purchased for $5,000. The IRS informs your company that the useful (class)

solve

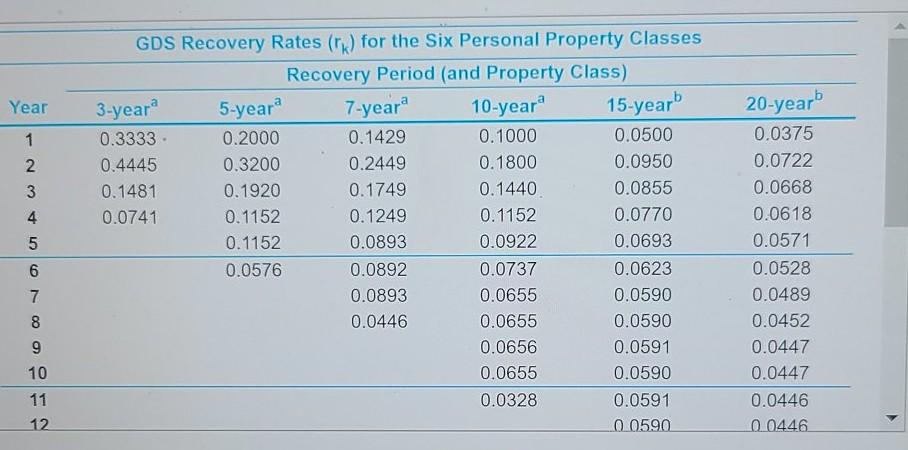

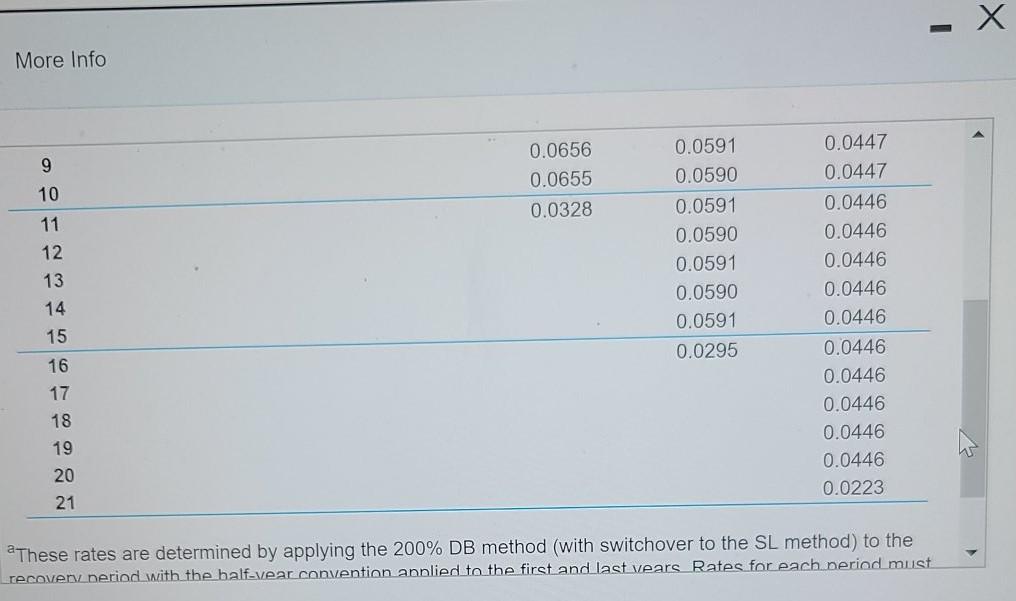

Problem 7-9 (algorithmic) Question Help A global positioning system (GPS) receiver is purchased for $5,000. The IRS informs your company that the useful (class) life of the system is six years. The expected market (salvage) value is $500 at the end of year six a. Use the straight line method to calculate depreciation in year two. b. Use the 200% declining balance method to calculate the cumulative depreciation through year three. c. Use the MACRS method to calculate the cumulative depreciation through year four. d. What is the book value of the GPS receiver at the end of year three when straight line depreciation is used? Click the icon to view the summary of the principal features of GDS under MACRS. Click the icon to view the GDS Recovery Rates). a. Using tho Sl method, the depreciation amount in year two is $(Round to the nearest dollar) Year 1 2 3 4 5 6 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 3-year 5-year 7-year 10-year 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 20-year 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0 0446 7 8 9 10 11 12 More Info 9 0.0656 0.0655 0.0328 10 11 12 0.0591 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 13 14 15 16 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 17 18 19 20 21 These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention anplied to the first and last years Rates for each period must a These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000. "These rates are determined with the 150% De method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four desimal places. Problem 7-9 (algorithmic) Question Help A global positioning system (GPS) receiver is purchased for $5,000. The IRS informs your company that the useful (class) life of the system is six years. The expected market (salvage) value is $500 at the end of year six a. Use the straight line method to calculate depreciation in year two. b. Use the 200% declining balance method to calculate the cumulative depreciation through year three. c. Use the MACRS method to calculate the cumulative depreciation through year four. d. What is the book value of the GPS receiver at the end of year three when straight line depreciation is used? Click the icon to view the summary of the principal features of GDS under MACRS. Click the icon to view the GDS Recovery Rates). a. Using tho Sl method, the depreciation amount in year two is $(Round to the nearest dollar) Year 1 2 3 4 5 6 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 3-year 5-year 7-year 10-year 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0.0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 20-year 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0 0446 7 8 9 10 11 12 More Info 9 0.0656 0.0655 0.0328 10 11 12 0.0591 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 13 14 15 16 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 17 18 19 20 21 These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention anplied to the first and last years Rates for each period must a These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000. "These rates are determined with the 150% De method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four desimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started