Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE QUESTION 13 sSOLVE QUESTION 13 d 12 Charlotte maintains a provision for doubtful debts at 2% of her trade receivables at the end of

SOLVE QUESTION 13

sSOLVE QUESTION 13

sSOLVE QUESTION 13

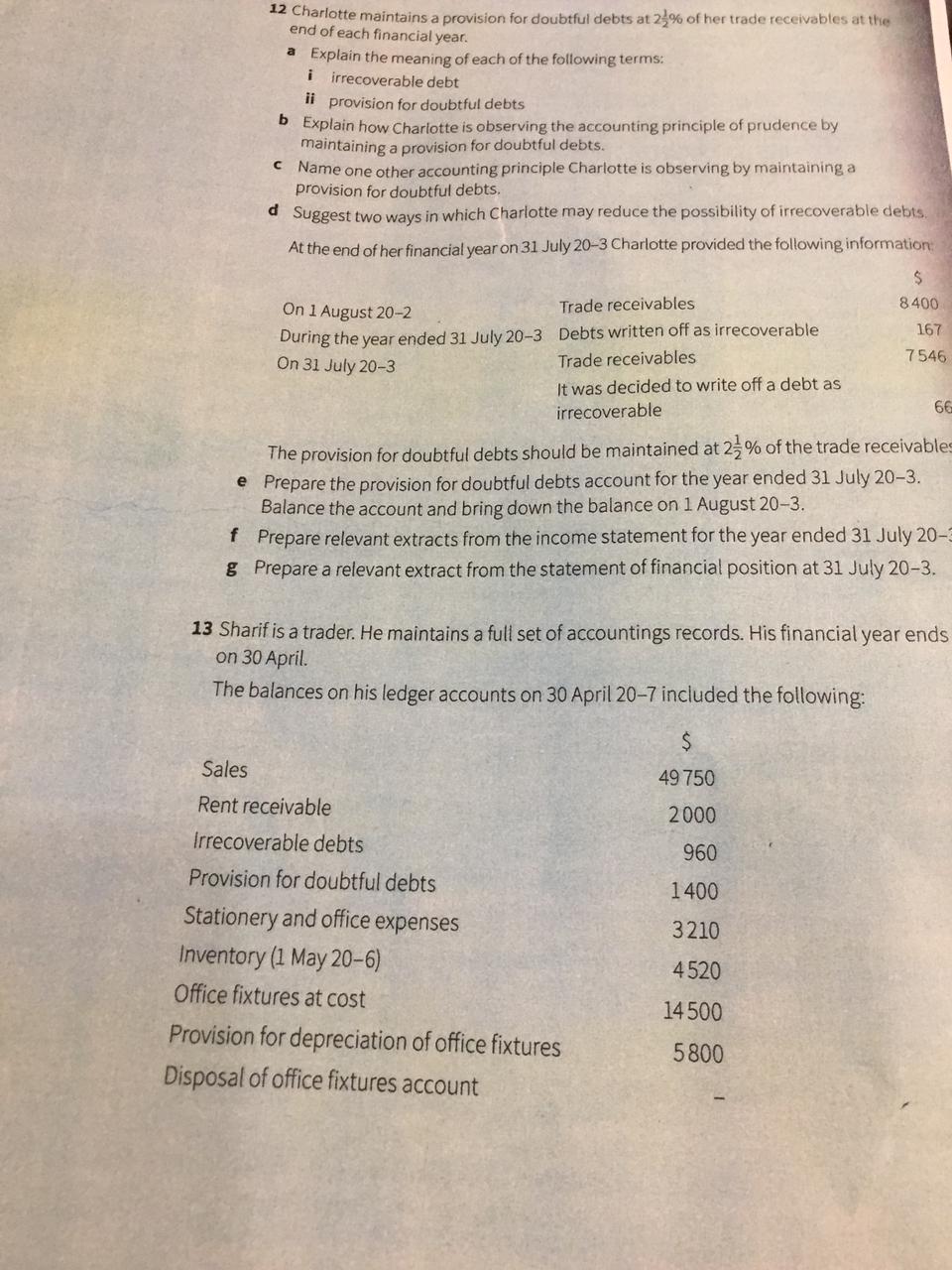

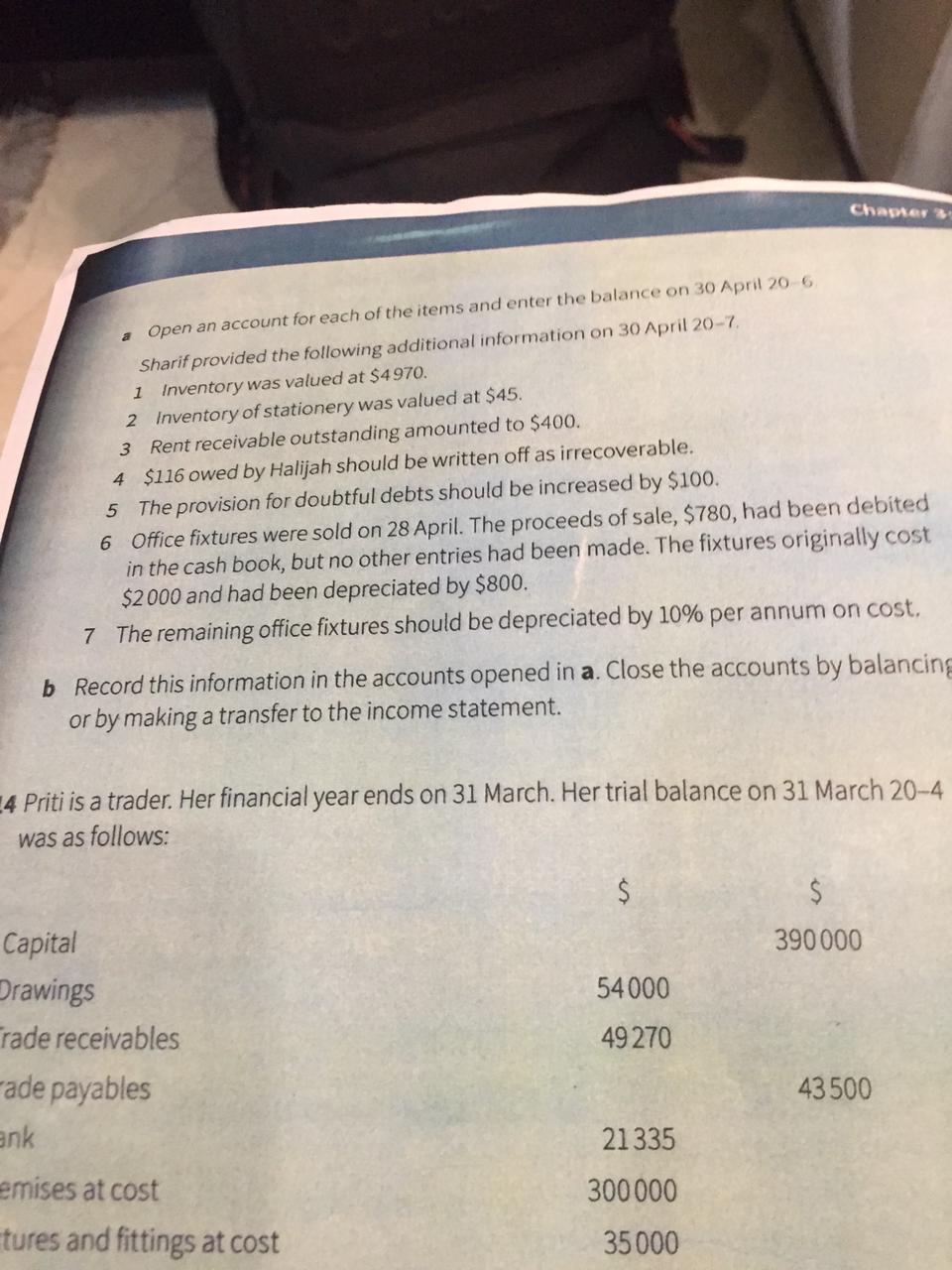

d 12 Charlotte maintains a provision for doubtful debts at 2% of her trade receivables at the end of each financial year. a Explain the meaning of each of the following terms: i irrecoverable debt ii provision for doubtful debts b Explain how Charlotte is observing the accounting principle of prudence by maintaining a provision for doubtful debts. Name one other accounting principle Charlotte is observing by maintaining a provision for doubtful debts. Suggest two ways in which Charlotte may reduce the possibility of irrecoverable debts. At the end of her financial year on 31 July 20-3 Charlotte provided the following information: $ 8400 On 1 August 20-2 Trade receivables 167 During the year ended 1 July 20-3 Debts written off as irrecoverable On 31 July 20-3 Trade receivables 7546 It was decided to write off a debt as irrecoverable 66 The provision for doubtful debts should be maintained at 21% of the trade receivables e Prepare the provision for doubtful debts account for the year ended 31 July 20-3. Balance the account and bring down the balance on 1 August 20-3. f Prepare relevant extracts from the income statement for the year ended 31 July 20-3 g Prepare a relevant extract from the statement of financial position at 31 July 20-3. 13 Sharif is a trader. He maintains a full set of accountings records. His financial year ends on 30 April The balances on his ledger accounts on 30 April 20-7 included the following: 49 750 2000 960 Sales Rent receivable Irrecoverable debts Provision for doubtful debts Stationery and office expenses Inventory (1 May 20-6) Office fixtures at cost Provision for depreciation of office fixtures Disposal of office fixtures account 1400 3210 4520 14500 5800 Chapter a Open an account for each of the items and enter the balance on 30 April 20. 6 Sharif provided the following additional information on 30 April 20-7 1 Inventory was valued at $4970. 2 Inventory of stationery was valued at $45. 3 Rent receivable outstanding amounted to $400. 4 $116 owed by Halijah should be written off as irrecoverable. 5 The provision for doubtful debts should be increased by $100. 6 Office fixtures were sold on 28 April. The proceeds of sale, $780, had been debited in the cash book, but no other entries had been made. The fixtures originally cost $2000 and had been depreciated by $800. 7 The remaining office fixtures should be depreciated by 10% per annum on cost, b Record this information in the accounts opened in a. Close the accounts by balancing or by making a transfer to the income statement. 24 Priti is a trader. Her financial year ends on 31 March. Her trial balance on 31 March 20-4 was as follows: $ $ 390 000 54000 Capital Drawings rade receivables -ade payables 49270 43500 ank 21335 emises at cost tures and fittings at cost 300000 35000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started