Solve Question 2 / 11:52am

clear pictures / Question 2 / took (hour & half to respond) 1:05pm

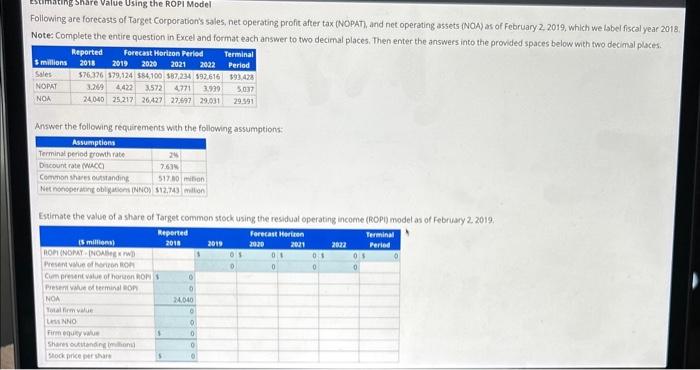

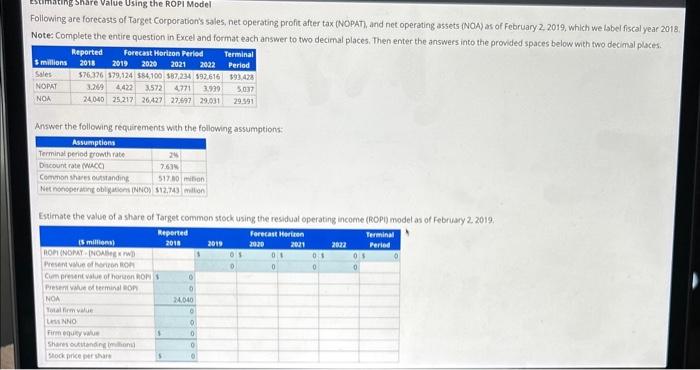

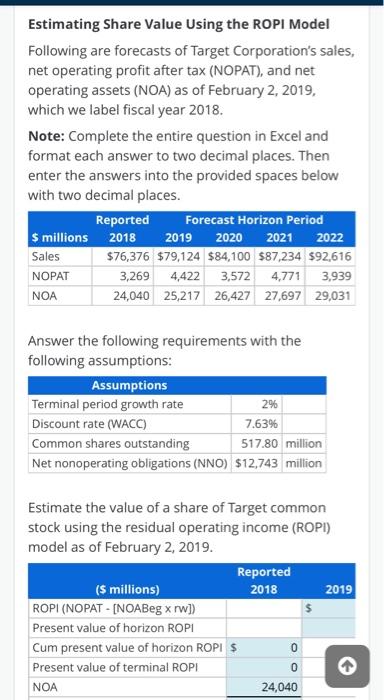

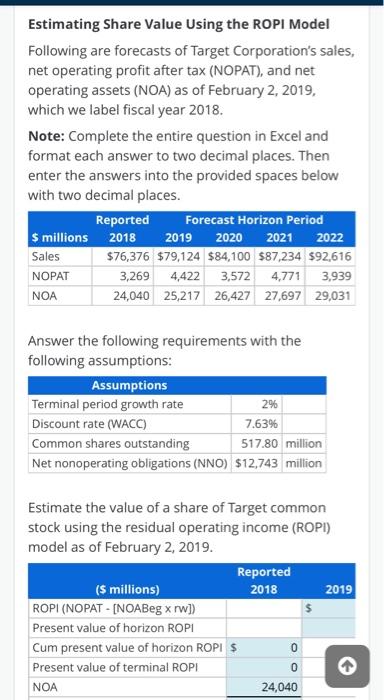

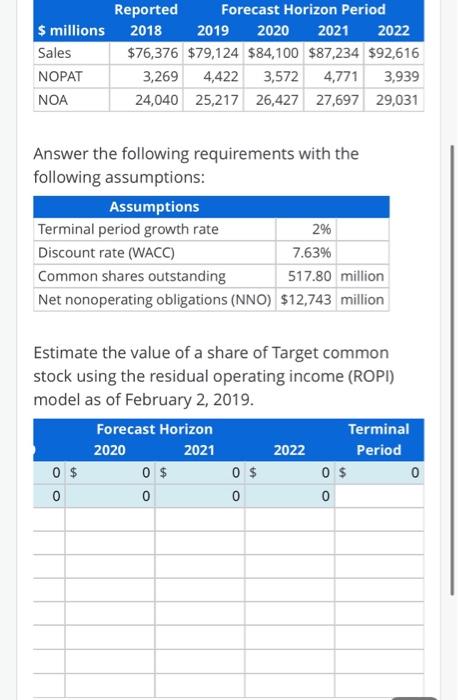

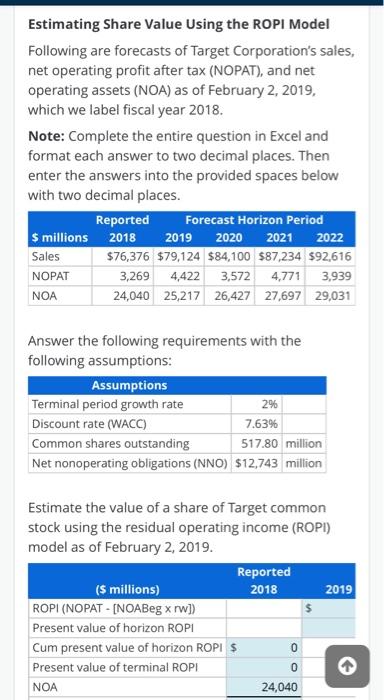

Following are forecasts of Target Corporabion's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2.2019, which we isbel fiscal yeat 2018 Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below mith two decimal places. Answer the following requirements wah the following assumptions: Estimating Share Value Using the ROPI Model Following are forecasts of Target Corporation's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2019, which we label fiscal year 2018. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Answer the following requirements with the following assumptions: Estimate the value of a share of Target common stock using the residual operating income (ROPI) model as of February 2, 2019. Answer the following requirements with the following assumptions: Estimate the value of a share of Target common stock using the residual operating income (ROPI) model as of February 2, 2019. Following are forecasts of Target Corporabion's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2.2019, which we isbel fiscal yeat 2018 Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below mith two decimal places. Answer the following requirements wah the following assumptions: Estimating Share Value Using the ROPI Model Following are forecasts of Target Corporation's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of February 2, 2019, which we label fiscal year 2018. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Answer the following requirements with the following assumptions: Estimate the value of a share of Target common stock using the residual operating income (ROPI) model as of February 2, 2019. Answer the following requirements with the following assumptions: Estimate the value of a share of Target common stock using the residual operating income (ROPI) model as of February 2, 2019