solve question 3 please

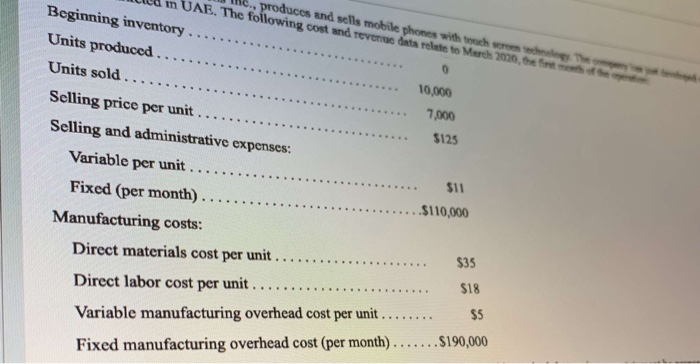

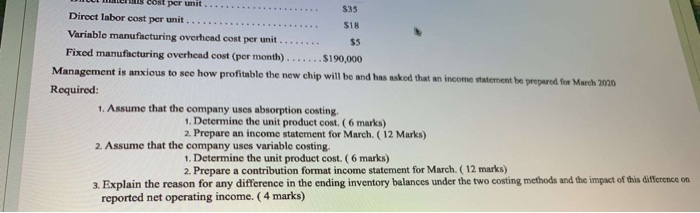

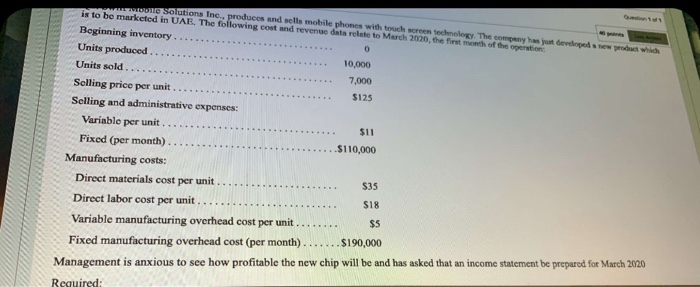

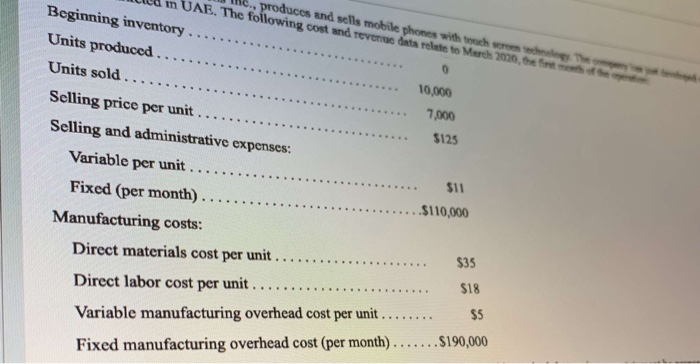

518 DHULMALLIS cost per unit $35 Direct labor cost per unit .......... Variable manufacturing overhead cost per unit ........ 55 Fixed manufacturing overhead cost (per month) ....... 5190,000 Management is anxious to see how profitable the new chip will be and has asked that an income statement be for March 2006 Required: 1. Assume that the company uses absorption costing, 1. Determine the unit product cost. (6 marks) 2. Prepare an income statement for March (12 Marks) 2. Assume that the company uses variable costing. 1. Determine the unit product cost. (6 marks) 2. Prepare a contribution format income statement for March (12 marks) 3. Explain the reason for any difference in the ending inventory balances under the two costing methods and the impact of this difference on reported net operating income. (4 marks) Solutions Inc., produces and sells mobile phones with touch screen technology. The company has yet developed a new is to be marketed in UAE. The following cost and revenue data relate to March 2020, the first month of the persone Beginning inventory.... which 0 Units produced..... ... 10,000 Units sold.... .......... 7,000 Selling price per unit ........ $125 Selling and administrative expenses: Variable per unit.... $11 Fixed (per month)...... .....$110,000 Manufacturing costs: Direct materials cost per unit...... $35 Direct labor cost per unit......... Variable manufacturing overhead cost per unit...... Fixed manufacturing overhead cost (per month).......$190,000 Management is anxious to see how profitable the new chip will be and has asked that an income statement be prepared for March 2020 Required: $18 $5 Inc., produces and sells mobile phones with Beginning inventory .... Units produced ....... chro t h ** 10,000 ..... $125 Units sold Selling price per unit.... ***.............. 7,000 Selling and administrative expenses: Variable per unit.... Fixed (per month)....... .....$110,000 Manufacturing costs: Direct materials cost per unit.... ............. Direct labor cost per unit.... ... $11 $35 $18 Variable manufacturing overhead cost per unit ........ $5 Fixed manufacturing overhead cost (per month).......$190,000

solve question 3 please

solve question 3 please