Solve question # 4 in its entirety.

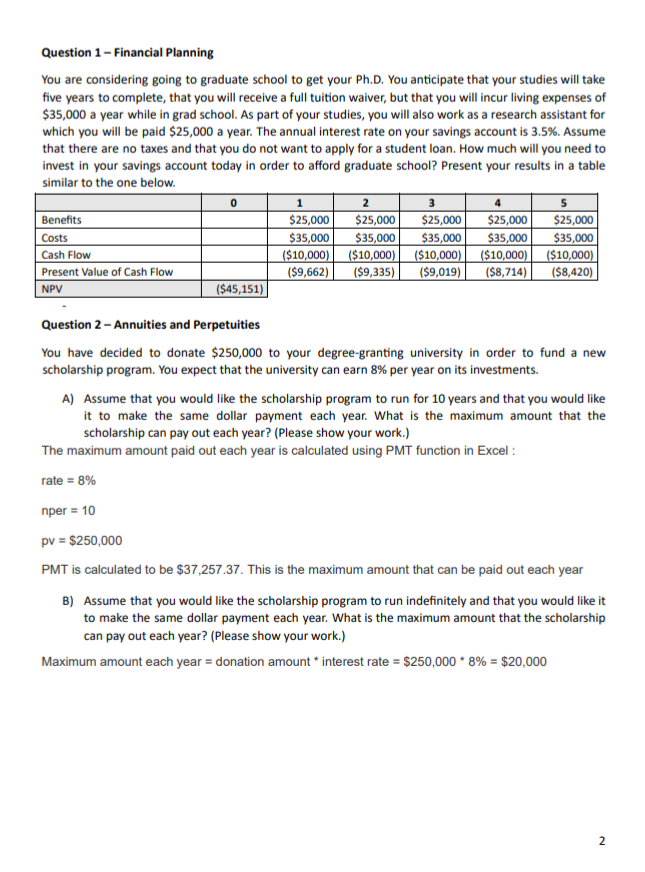

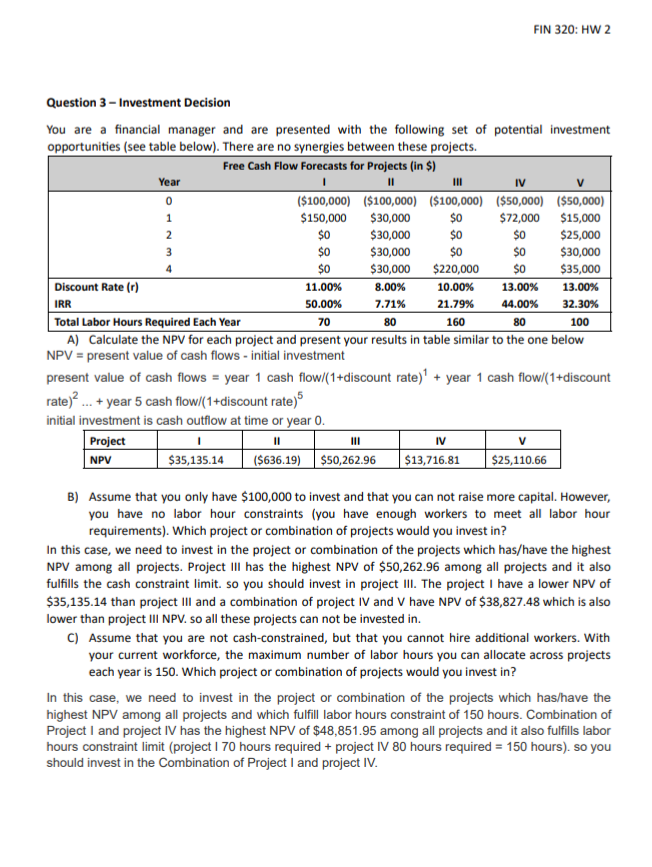

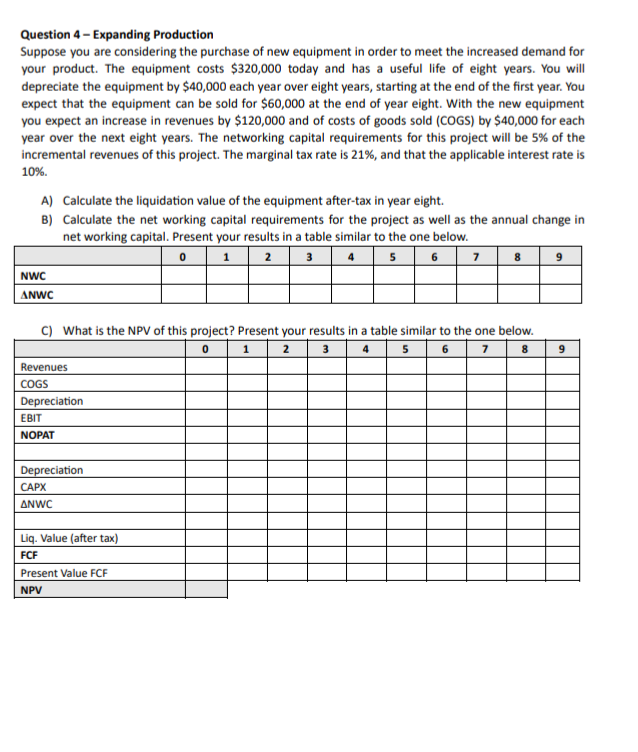

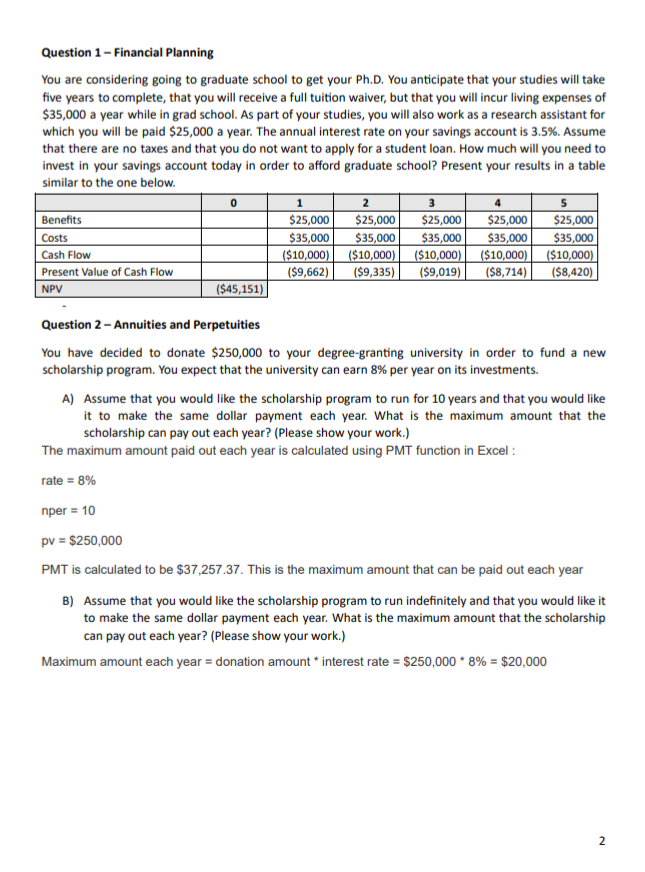

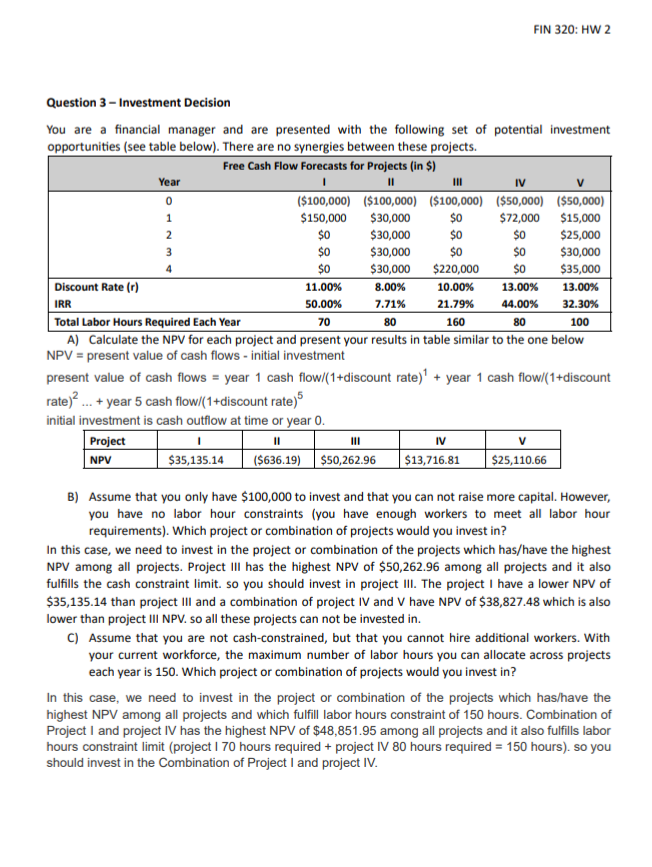

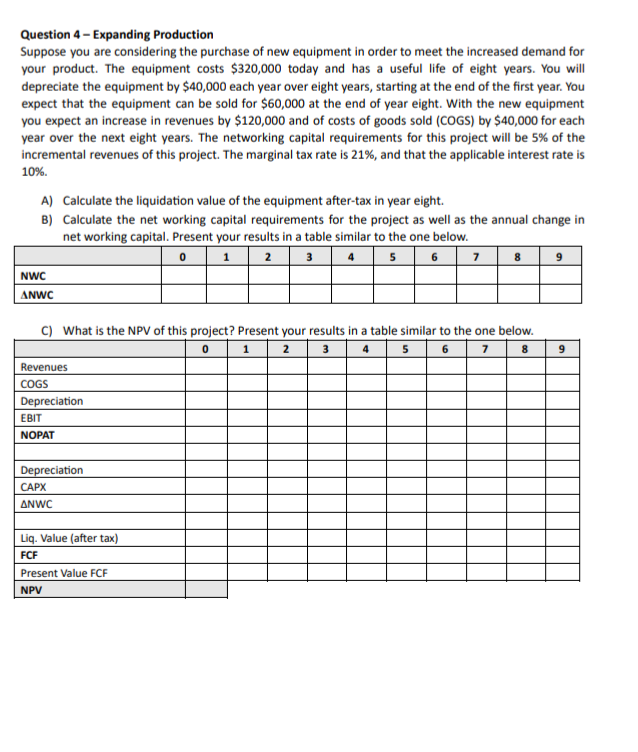

Question 1 - Financial Planning You are considering going to graduate school to get your Ph.D. You anticipate that your studies will take five years to complete, that you will receive a full tuition waiver, but that you will incur living expenses of $35,000 a year while in grad school. As part of your studies, you will also work as a research assistant for which you will be paid $25,000 a year. The annual interest rate on your savings account is 3.5%. Assume that there are no taxes and that you do not want to apply for a student loan. How much will you need to invest in your savings account today in order to afford graduate school? Present your results in a table similar to the one below. 0 1 2 3 4 5 Benefits $25,000 $25,000 $25,000 $25,000 $25,000 Costs $35,000 $35,000 $35,000 $35,000 $35,000 Cash Flow ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) Present Value of Cash Flow ($9,662) ($9,335) ($9,019) ($8,714) ($8,420) NPV ($45,151) Question 2 - Annuities and Perpetuities You have decided to donate $250,000 to your degree-granting university in order to fund a new scholarship program. You expect that the university can earn 8% per year on its investments. A) Assume that you would like the scholarship program to run for 10 years and that you would like it to make the same dollar payment each year. What is the maximum amount that the scholarship can pay out each year? (Please show your work.) The maximum amount paid out each year is calculated using PMT function in Excel rate = 8% nper = 10 pv = $250,000 PMT is calculated to be $37,257.37. This is the maximum amount that can be paid out each year B) Assume that you would like the scholarship program to run indefinitely and that you would like it to make the same dollar payment each year. What is the maximum amount that the scholarship can pay out each year? (Please show your work.) Maximum amount each year = donation amount * interest rate = $250,000 8% = $20,000 FIN 320: HW 2 Question 3 - Investment Decision Year V WNO $0 SO You are a financial manager and are presented with the following set of potential investment opportunities (see table below). There are no synergies between these projects. Free Cash Flow Forecasts for Projects (in $) Il III IV ($100,000) ($100,000) ($100,000) ($50,000) ($50,000) $150,000 $30,000 $72,000 $15,000 $30,000 $25,000 $30,000 $0 $0 $30,000 $30,000 $220,000 $0 $35,000 Discount Rate (r) 11.00% 8.00% 10.00% 13.00% 13.00% 50.00% 7.71% 21.79% 44.00% 32.30% Total Labor Hours Required Each Year 80 1 60 80 100 A) Calculate the NPV for each project and present your results in table similar to the one below NPV = present value of cash flows - initial investment present value of cash flows = year 1 cash flow/(1+discount rate) + year 1 cash flow/(1+discount rate)? ... + year 5 cash flow/(1+discount rate) initial investment is cash outflow at time or year 0. Project I II III IV V 135.14 ($636.19) $50,262.96 $13,716.81 $25,110.66 IRR 70 B) Assume that you only have $100,000 to invest and that you can not raise more capital. However, you have no labor hour constraints (you have enough workers to meet all labor hour requirements). Which project or combination of projects would you invest in? In this case, we need to invest in the project or combination of the projects which has/have the highest NPV among all projects. Project III has the highest NPV of $50,262.96 among all projects and it also fulfills the cash constraint limit. so you should invest in project III. The project I have a lower NPV of $35,135.14 than project III and a combination of project IV and V have NPV of $38,827.48 which is also lower than project III NPV. so all these projects can not be invested in. C) Assume that you are not cash-constrained, but that you cannot hire additional workers. With your current workforce, the maximum number of labor hours you can allocate across projects each year is 150. Which project or combination of projects would you invest in? In this case, we need to invest in the project or combination of the projects which has/have the highest NPV among all projects and which fulfill labor hours constraint of 150 hours. Combination of Project I and project IV has the highest NPV of $48,851.95 among all projects and it also fulfills labor hours constraint limit (project I 70 hours required + project IV 80 hours required = 150 hours). so you should invest in the Combination of Project I and project IV. Question 4 - Expanding Production Suppose you are considering the purchase of new equipment in order to meet the increased demand for your product. The equipment costs $320,000 today and has a useful life of eight years. You will depreciate the equipment by $40,000 each year over eight years, starting at the end of the first year. You expect that the equipment can be sold for $60,000 at the end of year eight. With the new equipment you expect an increase in revenues by $120,000 and of costs of goods sold (COGS) by $40,000 for each year over the next eight years. The networking capital requirements for this project will be 5% of the incremental revenues of this project. The marginal tax rate is 21%, and that the applicable interest rate is 10% A) Calculate the liquidation value of the equipment after-tax in year eight. B) Calculate the net working capital requirements for the project as well as the annual change in net working capital. Present your results in a table similar to the one below. 5 NWC ANWC C) What is the NPV of this project? Present your results in a table similar to the one below. 0 1 2 3 4 5 6 7 8 Revenues COGS Depreciation EBIT NOPAT Depreciation ANWC Liq. Value (after tax) FCF Present Value FCF NPV