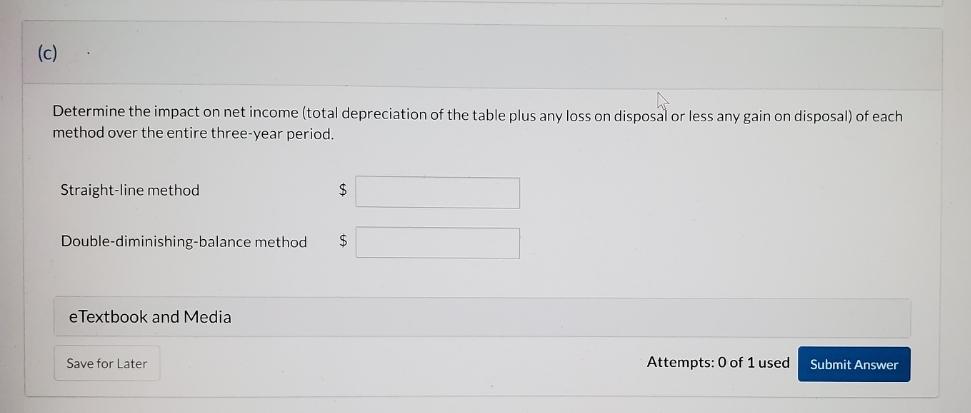

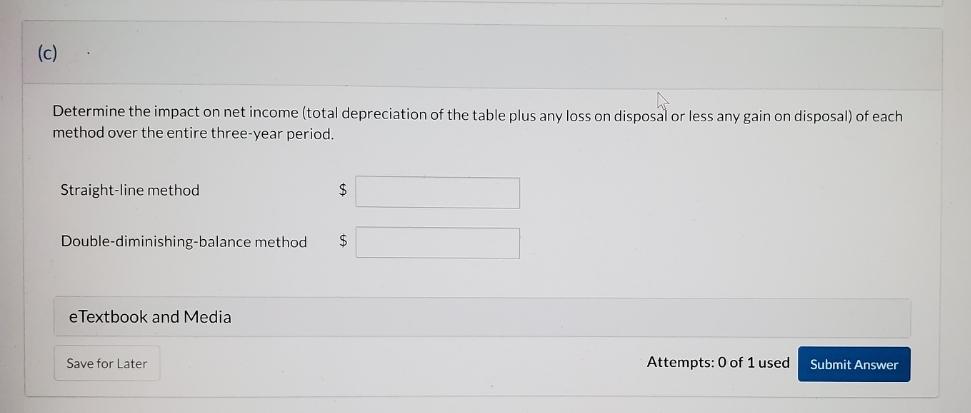

Solve question "C"

Solve question "C"

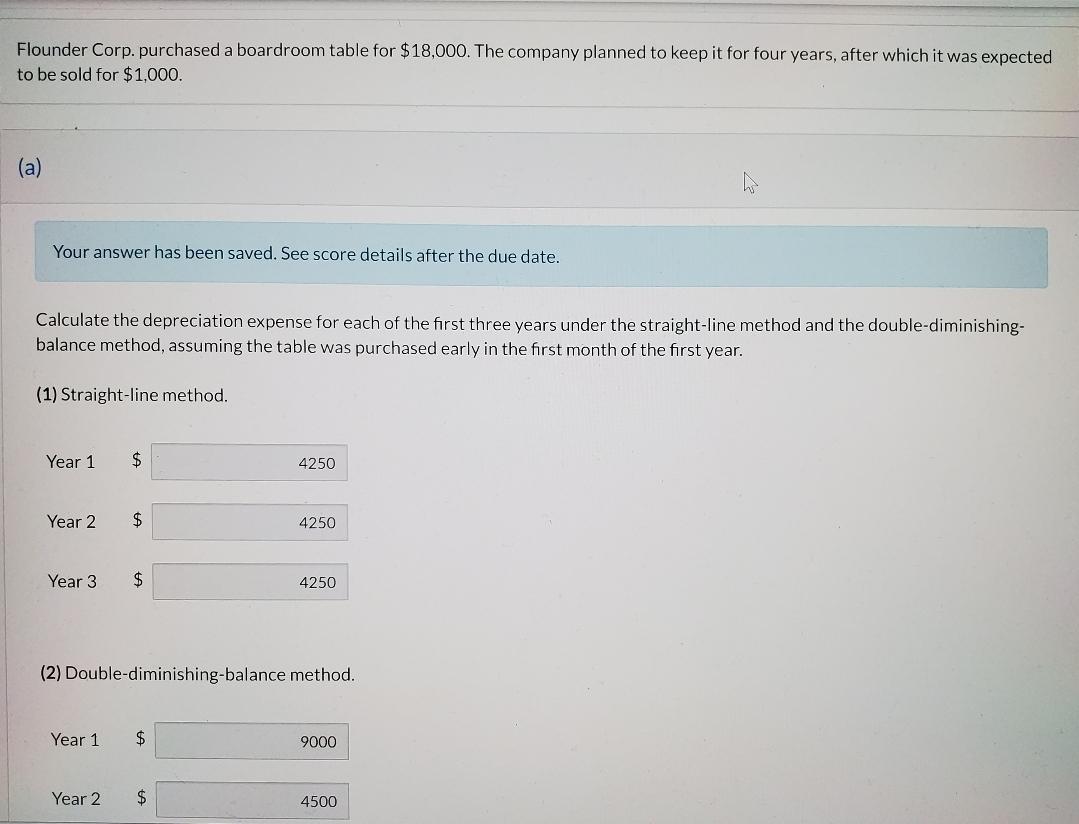

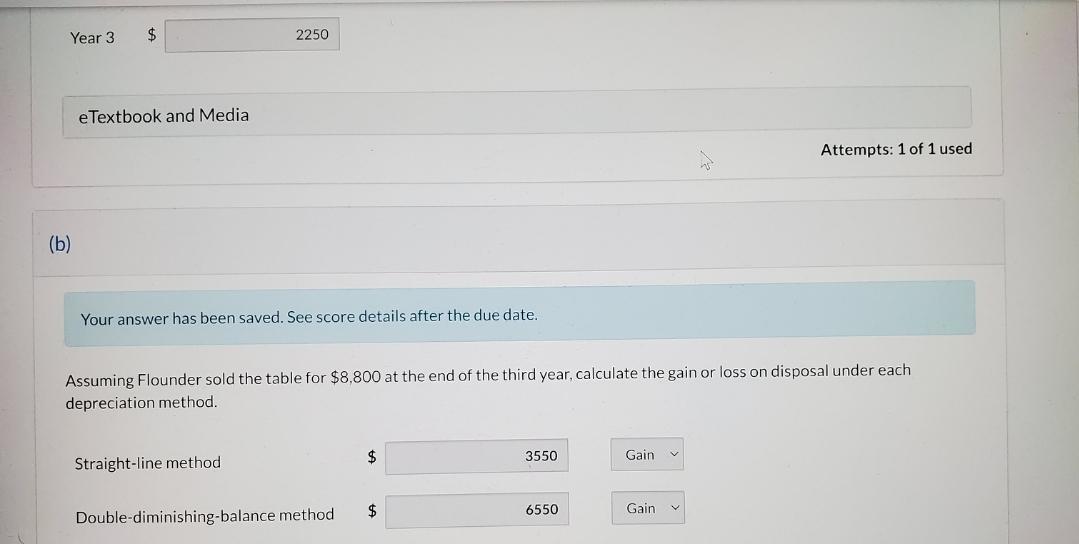

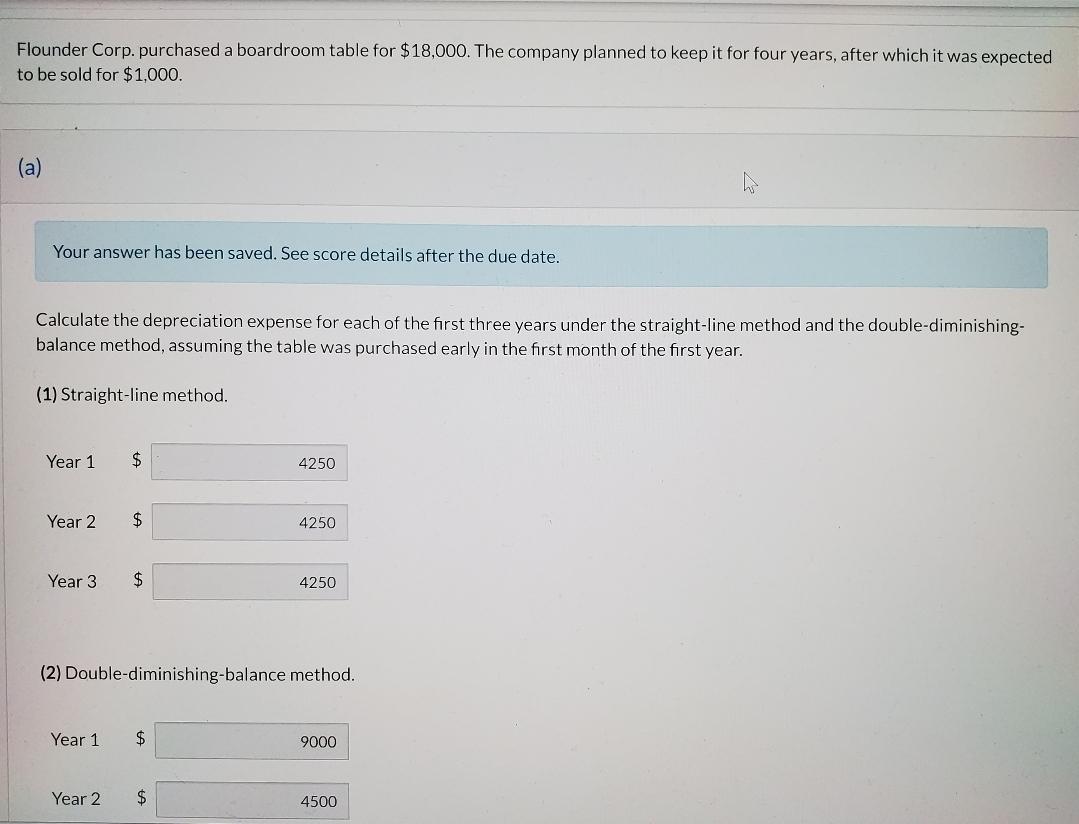

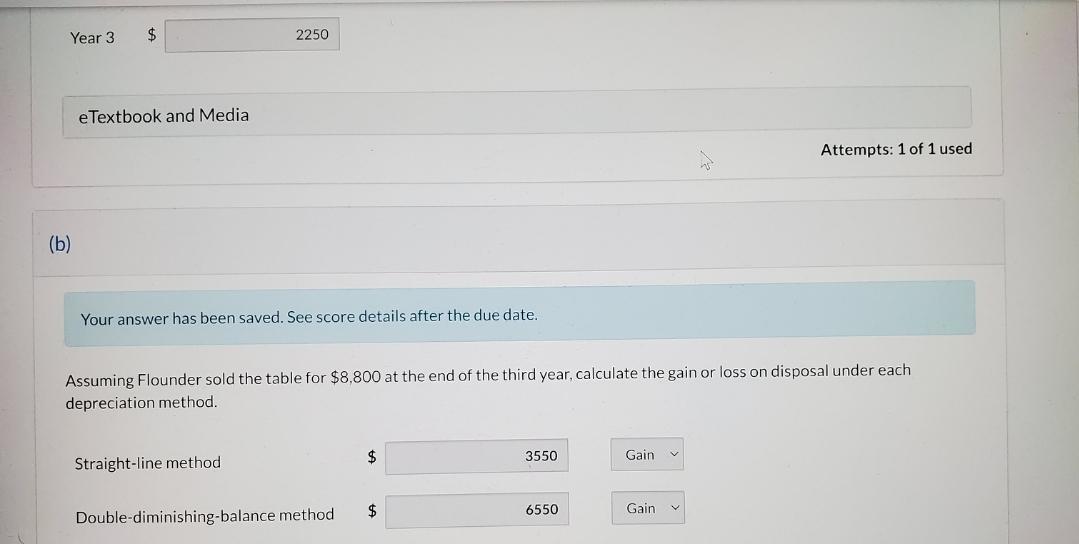

Flounder Corp. purchased a boardroom table for $18,000. The company planned to keep it for four years, after which it was expected to be sold for $1,000. (a) Your answer has been saved. See score details after the due date. Calculate the depreciation expense for each of the first three years under the straight-line method and the double-diminishingbalance method, assuming the table was purchased early in the first month of the first year. (1) Straight-line method. Year 1$ Year 2$ Year 3$ (2) Double-diminishing-balance method. Year 1$ Year2$ eTextbook and Media Attempts: 1 of 1 us Your answer has been saved. See score details after the due date. Assuming Flounder sold the table for $8,800 at the end of the third year, calculate the gain or loss on disposal under each depreciation method. Double-diminishing-balance method Determine the impact on net income (total depreciation of the table plus any loss on disposal or less any gain on disposal) of each method over the entire three-year period. Straight-line method $ Double-diminishing-balance method \$ eTextbook and Media Flounder Corp. purchased a boardroom table for $18,000. The company planned to keep it for four years, after which it was expected to be sold for $1,000. (a) Your answer has been saved. See score details after the due date. Calculate the depreciation expense for each of the first three years under the straight-line method and the double-diminishingbalance method, assuming the table was purchased early in the first month of the first year. (1) Straight-line method. Year 1$ Year 2$ Year 3$ (2) Double-diminishing-balance method. Year 1$ Year2$ eTextbook and Media Attempts: 1 of 1 us Your answer has been saved. See score details after the due date. Assuming Flounder sold the table for $8,800 at the end of the third year, calculate the gain or loss on disposal under each depreciation method. Double-diminishing-balance method Determine the impact on net income (total depreciation of the table plus any loss on disposal or less any gain on disposal) of each method over the entire three-year period. Straight-line method $ Double-diminishing-balance method \$ eTextbook and Media

Solve question "C"

Solve question "C"