Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE QUESTIONS FOLLOWING THE IMAGE Calculate the share price return for each of the stocks in question #1 and #2 (image above) assuming no changes

SOLVE QUESTIONS FOLLOWING THE IMAGE

-

Calculate the share price return for each of the stocks in question #1 and #2 (image above) assuming no changes in the P/E multiples over the next year. Use the appropriate P/E multiplier.

-

In question 1 and 2 (image above), are there any discrepancies you noticed? If so what were they and briefly explain what you noticed.

-

Which individual stock would you purchase based on the information given above in question 1 and 2(image above)? (Brief explanation).

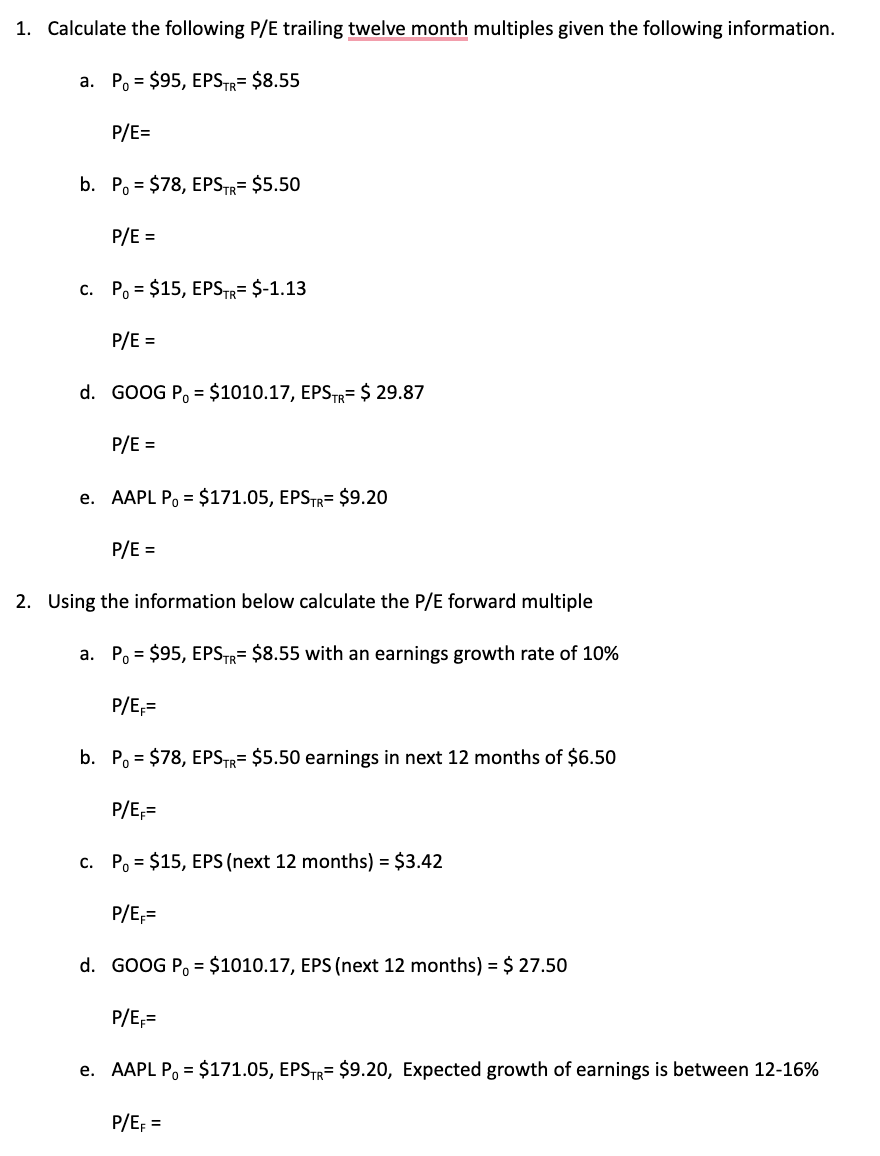

1. Calculate the following P/E trailing twelve month multiples given the following information. a. Po = $95, EPSTR= $8.55 P/E= b. Po = $78, EPSTR= $5.50 P/E = c. Po = $15, EPSTR= $-1.13 P/E = d. GOOG P. = $1010.17, EPSTR= $ 29.87 P/E = e. AAPL Po = $171.05, EPSTR= $9.20 P/E = 2. Using the information below calculate the P/E forward multiple a. Po = $95, EPSTR= $8.55 with an earnings growth rate of 10% P/EF= b. Po = $78, EPSTR= $5.50 earnings in next 12 months of $6.50 P/E = c. Po = $15, EPS (next 12 months) = $3.42 P/EF= d. GOOG P = $1010.17, EPS (next 12 months) = $ 27.50 P/EF= e. AAPL P= $171.05, EPSTR= $9.20, Expected growth of earnings is between 12-16% P/EF= 1. Calculate the following P/E trailing twelve month multiples given the following information. a. Po = $95, EPSTR= $8.55 P/E= b. Po = $78, EPSTR= $5.50 P/E = c. Po = $15, EPSTR= $-1.13 P/E = d. GOOG P. = $1010.17, EPSTR= $ 29.87 P/E = e. AAPL Po = $171.05, EPSTR= $9.20 P/E = 2. Using the information below calculate the P/E forward multiple a. Po = $95, EPSTR= $8.55 with an earnings growth rate of 10% P/EF= b. Po = $78, EPSTR= $5.50 earnings in next 12 months of $6.50 P/E = c. Po = $15, EPS (next 12 months) = $3.42 P/EF= d. GOOG P = $1010.17, EPS (next 12 months) = $ 27.50 P/EF= e. AAPL P= $171.05, EPSTR= $9.20, Expected growth of earnings is between 12-16% P/EF=

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started