Question

Solve Robotics Inc. is a U.S. company that reconfigures existing robots and sells them to U.S.manufacturers of computer circuit boards. One of their key suppliers

Solve Robotics Inc. is a U.S. company that reconfigures existing robots and sells them to U.S.manufacturers of computer circuit boards. One of their key suppliers is MiTac based in Taiwan. On November 20, 2012 Solve Robotics Inc. purchased 7,000 manufacturing arm robots from MiTac for 29,000,000 TWD (New Taiwan Dollar) The agreed upon settlement date is January 15, 2013

| 20-Nov-12 | 0.0355 | ||||

| 31-Dec-12 | 0.0375 | ||||

| 15-Jan-13 | 0.0365 |

Q1. The purchasing clerk initially posted the entry using just two decimal places (.04). Why did the Solve Robotics Inc. C.F.O. require the clerk to correct the entry (correct entry above) and use the actual spot rate (.0355) on November 20th?

Q2. What would the U.S. dollar amount been if the entry was not corrected? Show your work. Q3. The November 20, 2012 is defined as the __________________ date.

Q4. Does Solve Robotics Inc. need to make an accounting entry at year-end (balance sheet date)? Explain why or why not. Include in your explanation the impact of the entry on the Income Statement (if any).

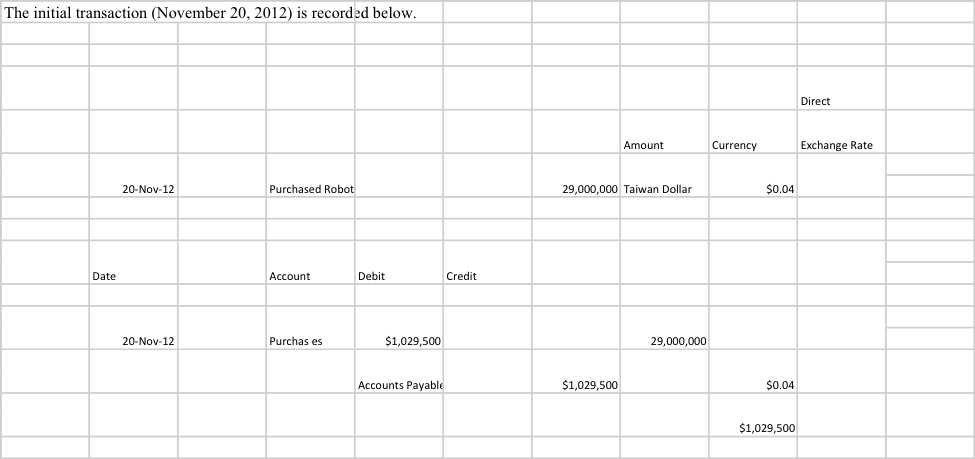

The initial transaction (November 20, 2012) is recorded below. Direct Amount Curr ncy Exchange Rate 20-Nov-12 Purchased Robot 29,000,000 Taiwan Dollar $0.04 Date Account Debit Credit 20-Nov-12 Purchas es 1,029,500 29,000,000 Accounts Payable $1,029,500 0.04 1,029,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started