Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE SHENZHEN JIT TECHNOLOGY: ACCOUNTS RECEIVABLE MANAGEMENT ISSUES &IvEy Publishing W17204 SHENZHEN JIT TECHNOLOGY:ACCOUNTS RECEIVABLE MANAGEMENT ISSUES D hi Chu and Li Wang wiote is

SOLVE SHENZHEN JIT TECHNOLOGY: ACCOUNTS RECEIVABLE MANAGEMENT ISSUES

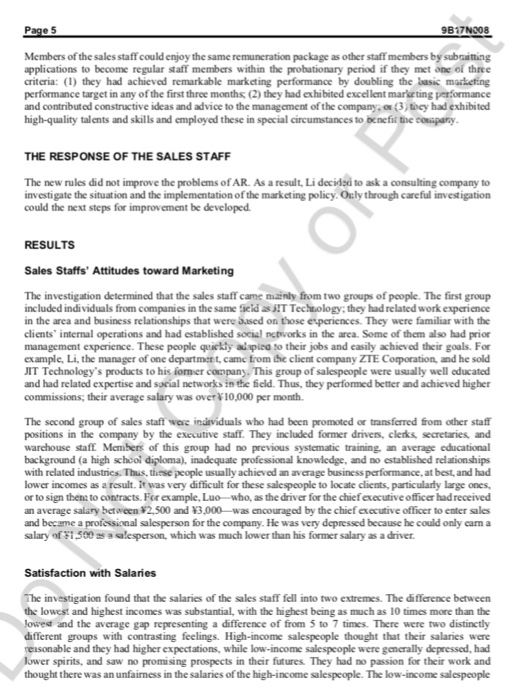

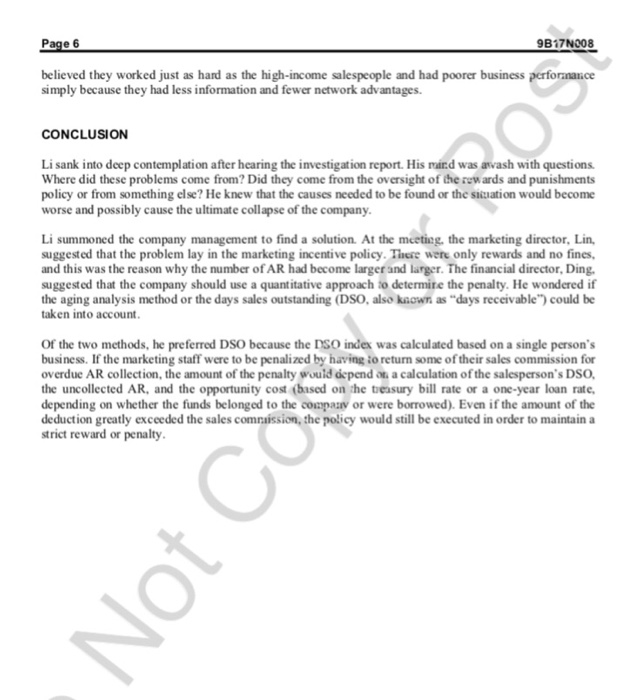

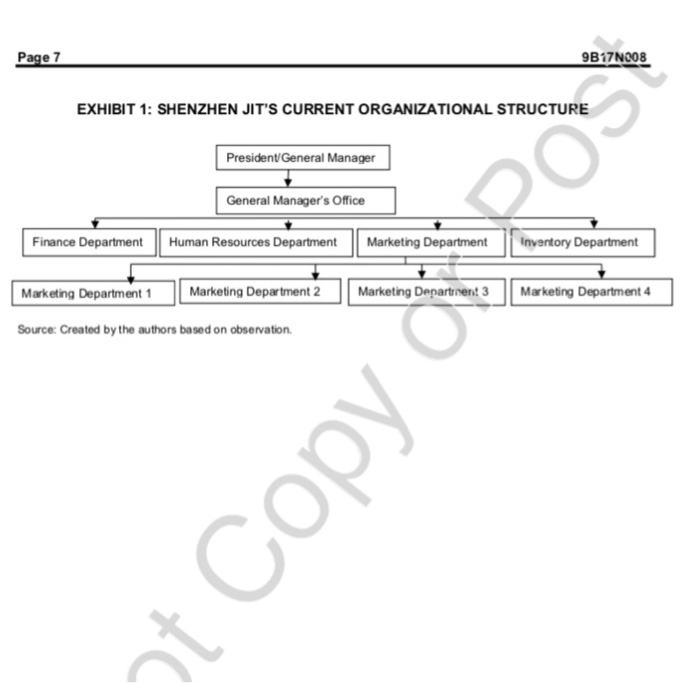

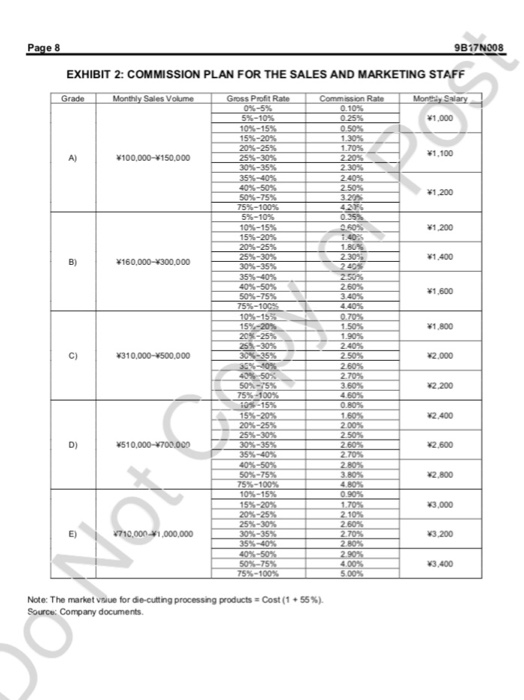

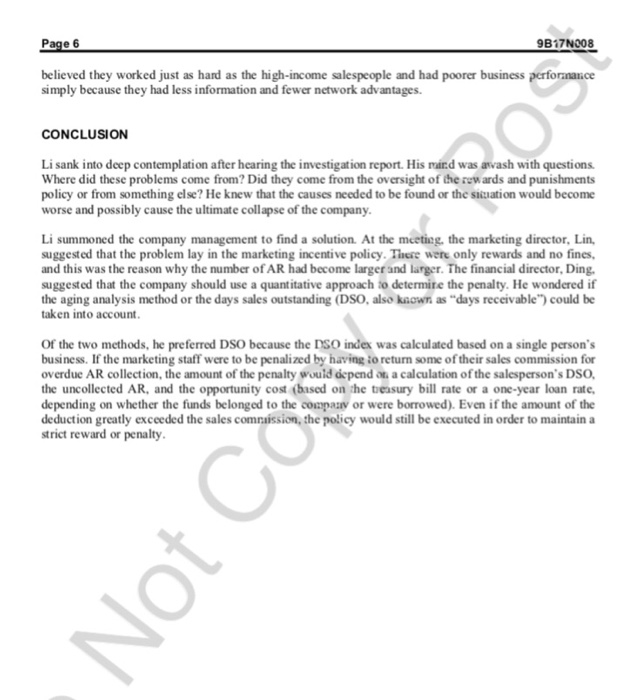

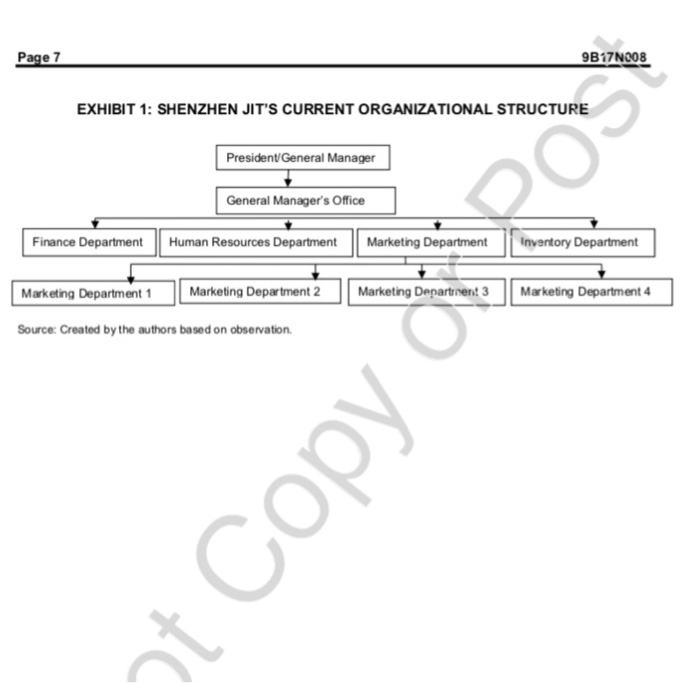

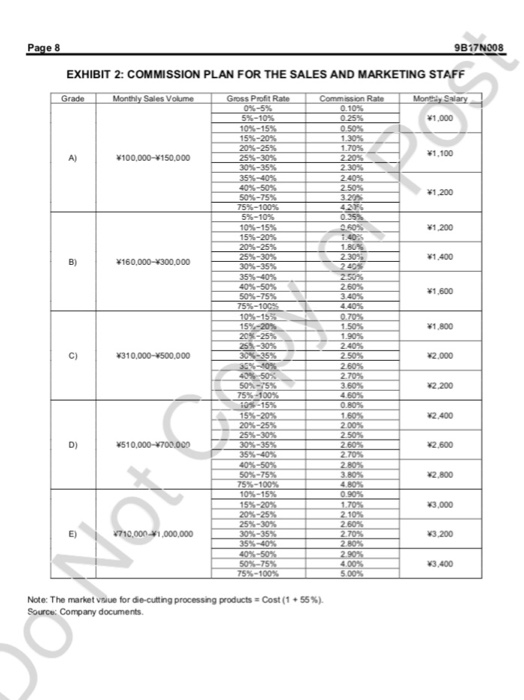

&IvEy Publishing W17204 SHENZHEN JIT TECHNOLOGY:ACCOUNTS RECEIVABLE MANAGEMENT ISSUES D hi Chu and Li Wang wiote is case solely to provide material for class discussin. The anhors do not infend to lustrate ether effective or ineflective handing of a managerial situation. The authors may hove disguisad cortan names and other identifying nformation to protect confidenbalty This publication may nof be transmited photocopied digitized or otherwise repraducetn any fom or by any means without the ariabon To order pes or request permsson to reproduce mater aic contad lvey Pahi.g bvey Buuness SchooL western Unversty. London, Otaro, Canada. N6G 0N1: (0 519 661 320E (e) casas0vey ca. www Neycases com On March 5, 2012, Feng Li, the president of Shenzhen JIT Tec sitting in his office in Longhua District, Shcazhen, Chins He was reading the company's 2011 statement of financial position, which the director of finance had given to Li. The company had a high level of accounts receivables (AR) in 2010 a total of Y20,637.946 accounted for 60 per cent of the company's working capital. In 2011, the AR figure had risca to 27,977,006, accounting for 63 per cent of working capital. Meanwhile, profit after tax for te years 2010 and 201l were Y4,654,176 and 14,748,265 respectively. Moreover, the nunber of turnover days for AR, a very important index, was not promising. As the AR figure increased, the tiee it took to settle them was also increasing from 45-60 days to 90 and sometimes even 120 days or more. (The average AR tunover rate for the manufacturing industry was about 4.08 and the average AR amover days overall was about 90 days.) These factors made the company's operation and managemenm of funds difficult. The company was a small sole proprictorship, and Li hacd recently had to borrow money fow the company using his own property as collateral in order to solve the cash-flow shortae.Atiotime, the one-year loan rate was about 6.5 per cent. What should Li do to solve these problems? Co, Ltd. (JIT Technology), was BACKGROUND JIT Technology was established in 1999. The company provided a range of electronics, chemical materials, ancillary equipment, and precision adhesive products for the electrical and electronics industries. The core products included insulating materials, glue, coating equipment, adhesives, and organic silicon materials. IT Tech nology was a small private company established solely by Li, who was Singaporean. The company ind only 1 million in registered capital and fewer than 100 cmployees, some of whom were Li's relatives CNY Chrese yuan mmntc all currency armounts are unless oterase speci et US$ 1 629 n March 2012 The Industrial and Commercial Financial Index of Listed Companies 2012, accessed March 3, 3017 htps://wenku baidu.comMiew Ocbe98da856a561252036c9 htmi. For comparison, the one-year Chinese treasury bill rate at the time-for those who had spare capital to invest was 3.85 per cent B17NO08 or friends Its organizational structure included four main departments under the general manager's oftice: finance, human resources, marketing, and inventory (see Exhibit I). EVOLUTION OF AR POLICY AT JIT TECHNOLOGY The sales and financial staff explained that there had been fewer than ten staif members when the company was first established. As was the practice in most Chinese companies, sales sta at JIT Technology who were authonized to extend credit to customers were also responsible for collecting accounts receivable. However, there were no rewards or penalties associated with collecting these receivables IT Technology management staff were unaware of the serious problem of high AR until 2002, when the collection period for AR became longer and longer with increasing saies volomes and an increasing number of sales personnel. A new regulation was established that kept sallespouple responsible for collecting AR but asked senior leaders to urge the marketing staff to collect AR as soon as possible. However, at that time, there were still no specific quantitative terms that associated the AR coliection period with any reward or penalty GENERAL RULES When the problem of AR became more serious, JIT Technology 'inally formulated a written reward and penalty policy for the marketing staff, based on its own stanton and the methods of other companies in the same industry, and introduced this to the marketng staff at the end of 2009. This policy was developed by the company and the marketing staff,d was ttended to provide incentives and motivation to the marketing staff and eliminate theia concerns about the future. The policy was formalized in writing and applied to all staff members involved with misrketing The policy included the salary system (a basic salary plus commission), the assessment system, the payment collection requirements, and the rcievant aules, and used the following formulas Gross Profit-Net Sales - Costs Note: Costs imcluded material costs, customs duties, and freight costs for delivery to Hong Kong and outside the provinoe Net Sales- Total Sales- (Miscellaneous Costs +Delivery Costs) oteMiscellancous costs included entertainment costs and commissions; delivery costs included delivery to Hong Kong and out side the province. Gross Prof it Margin- Gross ProfitNet Sales 9B17N008 The maximum commission was 2 per cent for transactions under 5,000, regardless of the gross prufit margin. Salespeople would be paid a fixed salary of 1,500 if sales were less than 100.000 per mort. and this base salary would increase as monthly sales volumes and profit rates increased (see Exhibit 2 Here are some examples of how JIT Technology's sales commission policy was If salesperson A's monthly sales volume was 150,000 and the comespundog gross profit margin was 30 per cent, the sales cornmission would be (VI 50,000 x 30% x 22%)-V00 If salesperson B's monthly sales volume was 210,000 and the corresponding gross profit margin was 35 per cent, the sales commission would be 1,764 lf salesperson C's monthly sales volume was 260,000 and the coresponding gross profit margin was 50 per cent, the sales commission would be 3510 * * * .If salesperson D's monthly sales volume was 500,000 and the corespon Eng gross profit margin was .If salesperson E's monthly sales volume was 1920,000 and the correaponding gross profit margin was The commission structure would be revised yearly er whenever the managing staff thought that it was 22 per cent, the sales commission would be $2200 77 per cent, the sales commission would be 135,420. necessary to do so. The board of directors of JIT Technology isarved the right of final explanation. Performance As sessment and Calculation The is, those whose sales revenue was less than V50000)the basic salary ranged from 500 to 1,000. depending on the individual's marketing experience and the company's needs at the time. New sales staff who achieved monthly sales over 50,000 received the same basic salary and commission rate as established salespeople period for new sales staff was three months. For those who sold few orders or none (that New staff members were not assessed in the first month, but their performance was assessed each month beginning in the second enth. The company paid commission bonuses month-by-month. Travel expenses were claimed at cost. Rules for Payment Collection The confirmation of clients was an essential ep m the sales and payment process. When they concluded their firs: deal with the client, salespeople asked each client to fill in an application form outlining company profile details. These details were entered into the client information system. Salespeople needed to ensure that all basic ciient information was documented, including the exact address, the amount of registered capital, the legai representatives, the business scope, the size of the manufacturing field, the relationship of r Tochnology's products to the client, and the potential amount of business t could be expected from the client. The final steps in the procedure for client confirmation included obtaining approval from the narketing manager and the executive manager. After these approvals, the client would be entered into the salesperson's business client list, and the salesperson would receive the total commission from managing ail of the client's sales activity with the company Payments for goods delivered were to be collected as specified in the sales agreement, excluding the month when the goods were delivered. For example, if the payment term was 30 days the payment for goods 9B17NO08 delivered in January had to be collected before March 2, with postponement possible if the die daie ell during a holiday Sales staff would still receive their commission when payment collection was delayed dueto product quality problems, but the staff member needed to submit a written application to delay coliating the payinent. This application had to include the date the problem would be solved, confirmatioa from quality control (QC), and permission from the manager and executive manager The responsibility of the sales staff to collect payments was established and emphasized in the policy previously mentioned, and in the following rules, which were also intended to strengthen the capital turnover ra te and protect the company from bad debts. Sales staff would receive 90 per cent of their commission if they coliccted payment for goods within one month after the payment collection date. They would receive 80 per cent of the commission if they collected payment within two months after the payment collection date, bt this commission payment would be postponed until the payment date for the next month's commission. Sales staff would receive 70 per cent of the commission if they collected payment within three raonths; this commission payment would also be postponed until the payment date for the next month's conmission. For payments that were not collected within three months, the sales staff would receive only 50 per cent of the commission, which would be released the month following the collection of the finai payn.aet for goods. For payments that were not collected after three months, the relevant supervisors and managers would take action to solve the problem and would decide who would take responsibiliay for managing dhe payment collection These rules were listed separately Rewards and Penalties The general rules for rewards and penalties applied to the sales staff. Every salesperson had to collect payments for goods on time and would receive feedback about the payment collection from the financial staff. Rewards such as promotions went to sales staff with remarkable performances. Sales staff could also be downgraded and would have to lake responsibility for the consequences caused by poor business performance especialily for not collecting payments for goods, for causing bad debts, and for losses to the company because of fraid The marketing staff had to ciaim responsibility for any outstanding payments still uncollected two months over the AR recovery date. They would be penalized by being required to return 20 per cent of the sales commission awarded to thein. If their supervisors succeeded in collecting their overdue AR, then that 20 per cent sales commission would be paid to the supervisors. In the case of bad debt, 30 per cent of the bad debt, based on the company's basic cost, would be deducted from the salesperson's earnings; another 10 per cent would be deducted from the supervisor's earnings; and 5 per cent would be deducted from the earnings of the manager, the finance manager, and the exccutive irector, respectively. The company would assume 45 per cent of the bad debt The coranission for each salesperson for the previous month had to be accurately calculated before the 12th day of each month. Each salesperson's commission from two months prior would be released on the 15th day of each month (for example, the com ission for July would be released on October 15)The inancial staff would inform the sales manager and salesperson in advance if the commission could not be released on that date. If this was not done, a penalty of 1300 would be issued to the involved financial staff member and managing staff member B17NO08 Members of the sales staff could enjoy the same remuneration package as other staff members by subraitting applications to become regular staff members within the probationary period if they met one e three criteria: (1) they had achieved remarkable marketing performance by doubling the basic marketing performance target in any of the first three months (2) they had exhibited excellent marketing performance and contributed constructive ideas and advice to the management of the companyo3) tney had exhibited high-quality talents and skills and employed these in special circumstances to bcnefii the couipany THE RESPONSE OF THE SALES STAFF The new rules did not improve the problems of AR. As a result, Li decided to ask a consulting company to investigate the situation and the implementation of the marketing policy.Oly through careful investigation could the next steps for improvement be developed RESULTS Sales Staffs' Attitudes toward Marketing The investigation determined that the sales staff came mainly from two groups of people. The first group included individuals from companies in the same fieid as JIT Technology: they had related work experience in the area and business relationships that were Sased on those e periences. They were familiar with the clients" internal operations and had established social nctvorks in the area. Some of them also had prior management experience. These pecople quiekty auapiea to their jobs and easily achieved their goals. For example, Li, the manager of one departmert, came from the client company ZTE Coporation, and he sold JIT Technology's products to his fornier company. This group of salespeople were usually well educated and had related expertise and social networks in the field. Thus, they performed better and achieved higher commissions; their average salary was over V10,000 per month. The second group of sales staff were inividuals who had been promoted or transferred from other staff positions in the company by the executive staff. They included former drivers, clerks, secretaries, and warehouse staff Members of this group had no previous systematic training, an average educational background (a high schcol diploma), inadequate professional knowledge, and no established relationships with related industries. Thus, these people usually achieved an average business performance, at best, and had lower incomes as a result. it was very difficult for these salespeople to locate clients, particularly large ones, or to sign then: to contracts. For example, Luo who, as the driver for the chief executive officer had received an average salary between 2.500 and 3,000-was encouraged by the chief executive officer to enter sales and became a professional salesperson for the company. He was very depressed because he could only carn a salary of Fi500 saalesperson, which was much lower than his former salary as a driver Satisfaction with Salaries investigation found that the salaries of the sales staff fell into two extremes. The difference between the lowest and highest incomes was substantial, with the highest being as much as 10 times more than the lowed and the average gap representing a difference of from 5 to 7 times. There were two distinctly different groups with contrasting feelings. High-income salespeople thought that their salaries were reisonable and they had higher expectations, while low-income salespeople were gencrally depressed, had lower spirits, and saw no promising prospects in their futures They had no passion for their work and thought there was an unfairness in the salaries of the high-income salespeople. The low-income salespeople 9B17N008 believed they worked just as hard as the high-income salespeople and had poorer business perfornaice simply because they had less information and fewer network advantages. CONCLUSION Li sank into deep contemplation after hearing the investigation report. His mird was anvash with questions Where did these problems come from? Did they come from the oversight of the rew ards and punishments policy or from something else? He knew that the causes needed to be found or the siciation would become worse and possibly cause the ultimate collapse of the company Li summoned the company management to find a solution. At the meeting, the marketing director, Lin, suggested that the problem lay in the marketing incentive policy. There were only rewards and no fines, and this was the reason why the number of AR had become larger and larger. The financial director, Ding. suggested that the company should use a quantitative approach to determite the penalty. He wondered if the aging analysis method or the days sales outstanding (DSO, also known as "days receivable") could be taken into account Of the two methods, he preferred DSO because the DSO index was calculated based on a single person's business. If the marketing staff were to be penalized by having to return some of their sales commission for overdue AR collection, the amount ofthe penalty would&pend a calculation ofthe salesperson's DSO. the uncollected AR, and the opportunity cost (based on the tbeasury bill rate or a one-year loan rate depending on whether the funds belonged to the compaav or were borrowed). Even if the amount of the deduction greatly exceeded the sales commaission, the policy would still be executed in order to maintain a strict reward or penalty Page 7 9B17N008 EXHIBIT 1: SHENZHEN JIT'S CURRENT ORGANIZATIONAL STRUCTURE President/General Manager General Manager's Office Finance Department Human Resources Department Marketing Department Inventory Department Marketing Department 1 Marketing Department 2Marketing Department 3 Marketing Department 4 Source: Created by the authors based on observation 9B17N008 EXHIBIT 2: COMMISSION PLAN FOR THE SALES AND MARKETING STAFF 0%-5% 1,000 1,100 A) 25%-30% 1,200 75%-1 5%-10% 15% 25%-30% 1,200 #1,400 B) 1,600 75%-1 1,800 25% C) 42.000 #2.200 15% #2400 D) 30%-35 2,600 75% 2.800 3,000 E) v710,00n.xi ,000,000 #3.200 75% 3.400 Note: The market vue for decuting processing products Source Company documents Ost (1 + 55%). &IvEy Publishing W17204 SHENZHEN JIT TECHNOLOGY:ACCOUNTS RECEIVABLE MANAGEMENT ISSUES D hi Chu and Li Wang wiote is case solely to provide material for class discussin. The anhors do not infend to lustrate ether effective or ineflective handing of a managerial situation. The authors may hove disguisad cortan names and other identifying nformation to protect confidenbalty This publication may nof be transmited photocopied digitized or otherwise repraducetn any fom or by any means without the ariabon To order pes or request permsson to reproduce mater aic contad lvey Pahi.g bvey Buuness SchooL western Unversty. London, Otaro, Canada. N6G 0N1: (0 519 661 320E (e) casas0vey ca. www Neycases com On March 5, 2012, Feng Li, the president of Shenzhen JIT Tec sitting in his office in Longhua District, Shcazhen, Chins He was reading the company's 2011 statement of financial position, which the director of finance had given to Li. The company had a high level of accounts receivables (AR) in 2010 a total of Y20,637.946 accounted for 60 per cent of the company's working capital. In 2011, the AR figure had risca to 27,977,006, accounting for 63 per cent of working capital. Meanwhile, profit after tax for te years 2010 and 201l were Y4,654,176 and 14,748,265 respectively. Moreover, the nunber of turnover days for AR, a very important index, was not promising. As the AR figure increased, the tiee it took to settle them was also increasing from 45-60 days to 90 and sometimes even 120 days or more. (The average AR tunover rate for the manufacturing industry was about 4.08 and the average AR amover days overall was about 90 days.) These factors made the company's operation and managemenm of funds difficult. The company was a small sole proprictorship, and Li hacd recently had to borrow money fow the company using his own property as collateral in order to solve the cash-flow shortae.Atiotime, the one-year loan rate was about 6.5 per cent. What should Li do to solve these problems? Co, Ltd. (JIT Technology), was BACKGROUND JIT Technology was established in 1999. The company provided a range of electronics, chemical materials, ancillary equipment, and precision adhesive products for the electrical and electronics industries. The core products included insulating materials, glue, coating equipment, adhesives, and organic silicon materials. IT Tech nology was a small private company established solely by Li, who was Singaporean. The company ind only 1 million in registered capital and fewer than 100 cmployees, some of whom were Li's relatives CNY Chrese yuan mmntc all currency armounts are unless oterase speci et US$ 1 629 n March 2012 The Industrial and Commercial Financial Index of Listed Companies 2012, accessed March 3, 3017 htps://wenku baidu.comMiew Ocbe98da856a561252036c9 htmi. For comparison, the one-year Chinese treasury bill rate at the time-for those who had spare capital to invest was 3.85 per cent B17NO08 or friends Its organizational structure included four main departments under the general manager's oftice: finance, human resources, marketing, and inventory (see Exhibit I). EVOLUTION OF AR POLICY AT JIT TECHNOLOGY The sales and financial staff explained that there had been fewer than ten staif members when the company was first established. As was the practice in most Chinese companies, sales sta at JIT Technology who were authonized to extend credit to customers were also responsible for collecting accounts receivable. However, there were no rewards or penalties associated with collecting these receivables IT Technology management staff were unaware of the serious problem of high AR until 2002, when the collection period for AR became longer and longer with increasing saies volomes and an increasing number of sales personnel. A new regulation was established that kept sallespouple responsible for collecting AR but asked senior leaders to urge the marketing staff to collect AR as soon as possible. However, at that time, there were still no specific quantitative terms that associated the AR coliection period with any reward or penalty GENERAL RULES When the problem of AR became more serious, JIT Technology 'inally formulated a written reward and penalty policy for the marketing staff, based on its own stanton and the methods of other companies in the same industry, and introduced this to the marketng staff at the end of 2009. This policy was developed by the company and the marketing staff,d was ttended to provide incentives and motivation to the marketing staff and eliminate theia concerns about the future. The policy was formalized in writing and applied to all staff members involved with misrketing The policy included the salary system (a basic salary plus commission), the assessment system, the payment collection requirements, and the rcievant aules, and used the following formulas Gross Profit-Net Sales - Costs Note: Costs imcluded material costs, customs duties, and freight costs for delivery to Hong Kong and outside the provinoe Net Sales- Total Sales- (Miscellaneous Costs +Delivery Costs) oteMiscellancous costs included entertainment costs and commissions; delivery costs included delivery to Hong Kong and out side the province. Gross Prof it Margin- Gross ProfitNet Sales 9B17N008 The maximum commission was 2 per cent for transactions under 5,000, regardless of the gross prufit margin. Salespeople would be paid a fixed salary of 1,500 if sales were less than 100.000 per mort. and this base salary would increase as monthly sales volumes and profit rates increased (see Exhibit 2 Here are some examples of how JIT Technology's sales commission policy was If salesperson A's monthly sales volume was 150,000 and the comespundog gross profit margin was 30 per cent, the sales cornmission would be (VI 50,000 x 30% x 22%)-V00 If salesperson B's monthly sales volume was 210,000 and the corresponding gross profit margin was 35 per cent, the sales commission would be 1,764 lf salesperson C's monthly sales volume was 260,000 and the coresponding gross profit margin was 50 per cent, the sales commission would be 3510 * * * .If salesperson D's monthly sales volume was 500,000 and the corespon Eng gross profit margin was .If salesperson E's monthly sales volume was 1920,000 and the correaponding gross profit margin was The commission structure would be revised yearly er whenever the managing staff thought that it was 22 per cent, the sales commission would be $2200 77 per cent, the sales commission would be 135,420. necessary to do so. The board of directors of JIT Technology isarved the right of final explanation. Performance As sessment and Calculation The is, those whose sales revenue was less than V50000)the basic salary ranged from 500 to 1,000. depending on the individual's marketing experience and the company's needs at the time. New sales staff who achieved monthly sales over 50,000 received the same basic salary and commission rate as established salespeople period for new sales staff was three months. For those who sold few orders or none (that New staff members were not assessed in the first month, but their performance was assessed each month beginning in the second enth. The company paid commission bonuses month-by-month. Travel expenses were claimed at cost. Rules for Payment Collection The confirmation of clients was an essential ep m the sales and payment process. When they concluded their firs: deal with the client, salespeople asked each client to fill in an application form outlining company profile details. These details were entered into the client information system. Salespeople needed to ensure that all basic ciient information was documented, including the exact address, the amount of registered capital, the legai representatives, the business scope, the size of the manufacturing field, the relationship of r Tochnology's products to the client, and the potential amount of business t could be expected from the client. The final steps in the procedure for client confirmation included obtaining approval from the narketing manager and the executive manager. After these approvals, the client would be entered into the salesperson's business client list, and the salesperson would receive the total commission from managing ail of the client's sales activity with the company Payments for goods delivered were to be collected as specified in the sales agreement, excluding the month when the goods were delivered. For example, if the payment term was 30 days the payment for goods 9B17NO08 delivered in January had to be collected before March 2, with postponement possible if the die daie ell during a holiday Sales staff would still receive their commission when payment collection was delayed dueto product quality problems, but the staff member needed to submit a written application to delay coliating the payinent. This application had to include the date the problem would be solved, confirmatioa from quality control (QC), and permission from the manager and executive manager The responsibility of the sales staff to collect payments was established and emphasized in the policy previously mentioned, and in the following rules, which were also intended to strengthen the capital turnover ra te and protect the company from bad debts. Sales staff would receive 90 per cent of their commission if they coliccted payment for goods within one month after the payment collection date. They would receive 80 per cent of the commission if they collected payment within two months after the payment collection date, bt this commission payment would be postponed until the payment date for the next month's commission. Sales staff would receive 70 per cent of the commission if they collected payment within three raonths; this commission payment would also be postponed until the payment date for the next month's conmission. For payments that were not collected within three months, the sales staff would receive only 50 per cent of the commission, which would be released the month following the collection of the finai payn.aet for goods. For payments that were not collected after three months, the relevant supervisors and managers would take action to solve the problem and would decide who would take responsibiliay for managing dhe payment collection These rules were listed separately Rewards and Penalties The general rules for rewards and penalties applied to the sales staff. Every salesperson had to collect payments for goods on time and would receive feedback about the payment collection from the financial staff. Rewards such as promotions went to sales staff with remarkable performances. Sales staff could also be downgraded and would have to lake responsibility for the consequences caused by poor business performance especialily for not collecting payments for goods, for causing bad debts, and for losses to the company because of fraid The marketing staff had to ciaim responsibility for any outstanding payments still uncollected two months over the AR recovery date. They would be penalized by being required to return 20 per cent of the sales commission awarded to thein. If their supervisors succeeded in collecting their overdue AR, then that 20 per cent sales commission would be paid to the supervisors. In the case of bad debt, 30 per cent of the bad debt, based on the company's basic cost, would be deducted from the salesperson's earnings; another 10 per cent would be deducted from the supervisor's earnings; and 5 per cent would be deducted from the earnings of the manager, the finance manager, and the exccutive irector, respectively. The company would assume 45 per cent of the bad debt The coranission for each salesperson for the previous month had to be accurately calculated before the 12th day of each month. Each salesperson's commission from two months prior would be released on the 15th day of each month (for example, the com ission for July would be released on October 15)The inancial staff would inform the sales manager and salesperson in advance if the commission could not be released on that date. If this was not done, a penalty of 1300 would be issued to the involved financial staff member and managing staff member B17NO08 Members of the sales staff could enjoy the same remuneration package as other staff members by subraitting applications to become regular staff members within the probationary period if they met one e three criteria: (1) they had achieved remarkable marketing performance by doubling the basic marketing performance target in any of the first three months (2) they had exhibited excellent marketing performance and contributed constructive ideas and advice to the management of the companyo3) tney had exhibited high-quality talents and skills and employed these in special circumstances to bcnefii the couipany THE RESPONSE OF THE SALES STAFF The new rules did not improve the problems of AR. As a result, Li decided to ask a consulting company to investigate the situation and the implementation of the marketing policy.Oly through careful investigation could the next steps for improvement be developed RESULTS Sales Staffs' Attitudes toward Marketing The investigation determined that the sales staff came mainly from two groups of people. The first group included individuals from companies in the same fieid as JIT Technology: they had related work experience in the area and business relationships that were Sased on those e periences. They were familiar with the clients" internal operations and had established social nctvorks in the area. Some of them also had prior management experience. These pecople quiekty auapiea to their jobs and easily achieved their goals. For example, Li, the manager of one departmert, came from the client company ZTE Coporation, and he sold JIT Technology's products to his fornier company. This group of salespeople were usually well educated and had related expertise and social networks in the field. Thus, they performed better and achieved higher commissions; their average salary was over V10,000 per month. The second group of sales staff were inividuals who had been promoted or transferred from other staff positions in the company by the executive staff. They included former drivers, clerks, secretaries, and warehouse staff Members of this group had no previous systematic training, an average educational background (a high schcol diploma), inadequate professional knowledge, and no established relationships with related industries. Thus, these people usually achieved an average business performance, at best, and had lower incomes as a result. it was very difficult for these salespeople to locate clients, particularly large ones, or to sign then: to contracts. For example, Luo who, as the driver for the chief executive officer had received an average salary between 2.500 and 3,000-was encouraged by the chief executive officer to enter sales and became a professional salesperson for the company. He was very depressed because he could only carn a salary of Fi500 saalesperson, which was much lower than his former salary as a driver Satisfaction with Salaries investigation found that the salaries of the sales staff fell into two extremes. The difference between the lowest and highest incomes was substantial, with the highest being as much as 10 times more than the lowed and the average gap representing a difference of from 5 to 7 times. There were two distinctly different groups with contrasting feelings. High-income salespeople thought that their salaries were reisonable and they had higher expectations, while low-income salespeople were gencrally depressed, had lower spirits, and saw no promising prospects in their futures They had no passion for their work and thought there was an unfairness in the salaries of the high-income salespeople. The low-income salespeople 9B17N008 believed they worked just as hard as the high-income salespeople and had poorer business perfornaice simply because they had less information and fewer network advantages. CONCLUSION Li sank into deep contemplation after hearing the investigation report. His mird was anvash with questions Where did these problems come from? Did they come from the oversight of the rew ards and punishments policy or from something else? He knew that the causes needed to be found or the siciation would become worse and possibly cause the ultimate collapse of the company Li summoned the company management to find a solution. At the meeting, the marketing director, Lin, suggested that the problem lay in the marketing incentive policy. There were only rewards and no fines, and this was the reason why the number of AR had become larger and larger. The financial director, Ding. suggested that the company should use a quantitative approach to determite the penalty. He wondered if the aging analysis method or the days sales outstanding (DSO, also known as "days receivable") could be taken into account Of the two methods, he preferred DSO because the DSO index was calculated based on a single person's business. If the marketing staff were to be penalized by having to return some of their sales commission for overdue AR collection, the amount ofthe penalty would&pend a calculation ofthe salesperson's DSO. the uncollected AR, and the opportunity cost (based on the tbeasury bill rate or a one-year loan rate depending on whether the funds belonged to the compaav or were borrowed). Even if the amount of the deduction greatly exceeded the sales commaission, the policy would still be executed in order to maintain a strict reward or penalty Page 7 9B17N008 EXHIBIT 1: SHENZHEN JIT'S CURRENT ORGANIZATIONAL STRUCTURE President/General Manager General Manager's Office Finance Department Human Resources Department Marketing Department Inventory Department Marketing Department 1 Marketing Department 2Marketing Department 3 Marketing Department 4 Source: Created by the authors based on observation 9B17N008 EXHIBIT 2: COMMISSION PLAN FOR THE SALES AND MARKETING STAFF 0%-5% 1,000 1,100 A) 25%-30% 1,200 75%-1 5%-10% 15% 25%-30% 1,200 #1,400 B) 1,600 75%-1 1,800 25% C) 42.000 #2.200 15% #2400 D) 30%-35 2,600 75% 2.800 3,000 E) v710,00n.xi ,000,000 #3.200 75% 3.400 Note: The market vue for decuting processing products Source Company documents Ost (1 + 55%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started