Answered step by step

Verified Expert Solution

Question

1 Approved Answer

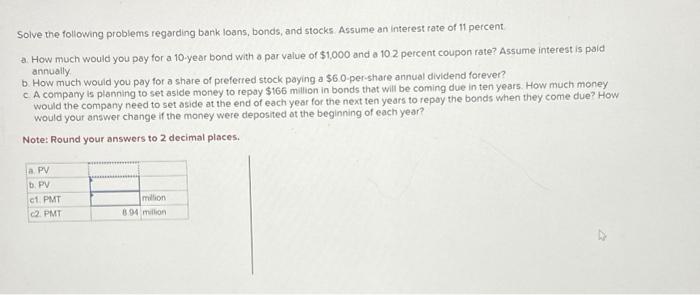

Solve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of 1 1 percent a . How much would you poy

Solve the following problems regarding bank loans, bonds, and stocks. Assume an interest rate of percent

a How much would you poy for a year bond with o par value of $ and a percent coupon rate? Assume interest is paid

annually.

b How much would you pay for a share of preferred stock paying a $pershare annual dividend forever?

c A company is plonning to set aside money to repay $ million in bonds that will be coming due in ten years. How much money

would the company need to set aside at the end of each year for the next ten years to repoy the bonds when they come due? How

would your answer change if the money were deposited ot the beginning of each year?

Note: Round your answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started