solve the following question

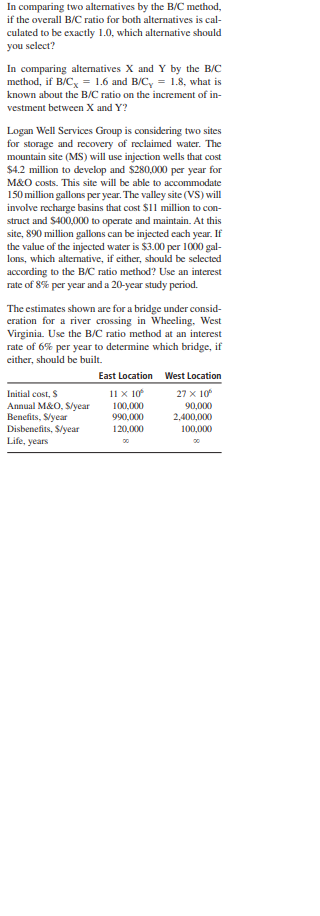

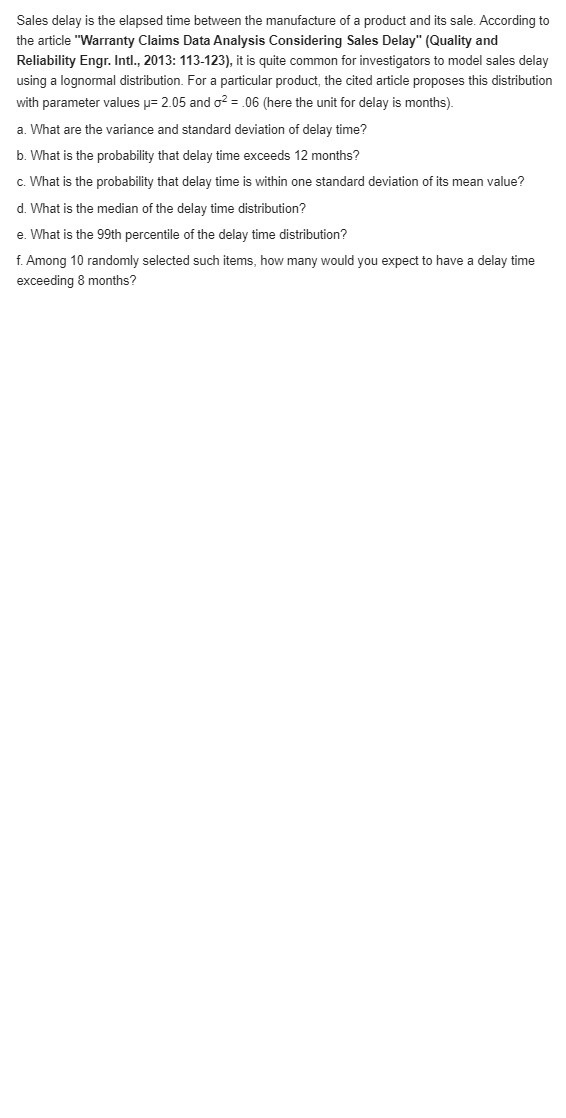

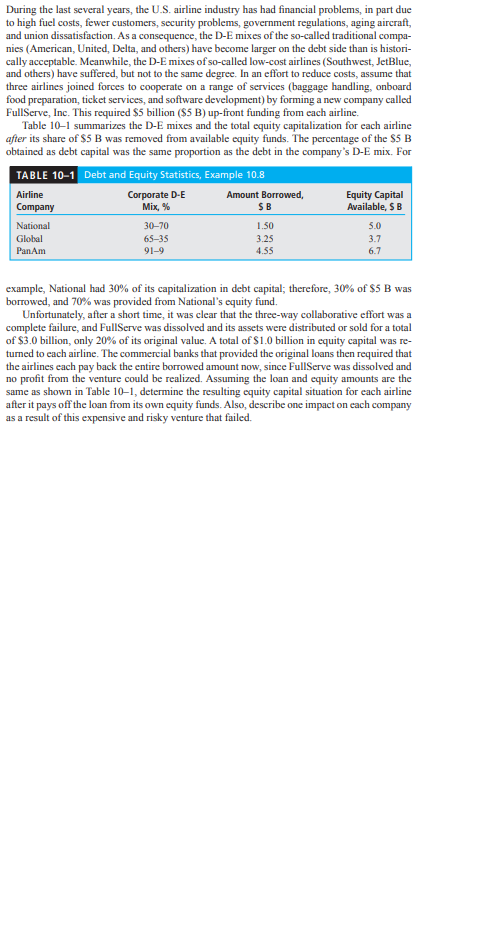

An instructor has given a short quiz consisting of two parts. For a randomly selected student, let X = the number of points earned on the first part and Y=the number of points earned on the second part. Suppose that the joint pmf of X and Y is given in the accompanying table. y p(x, y) 0 5 10 15 02 .06 .02 .10 X .04 .15 .20 .10 10 01 .15 .14 01 a. If the score recorded in the grade book is the total number of points earned on the two parts, what is the expected recorded score E(X + Y)? b. If the maximum of the two scores is recorded, what is the expected recorded score?A project to extend irrigation canals into an area that was recently cleared of mesquite trees (a nui- sance tree in Texas) and large weeds is projected to have a capital cost of $2,000,000. Annual mainte- nance and operation costs will be $100,000 per year. Annual favorable consequences to the gen- cral public of $820,000 per year will be offset to some extent by annual adverse consequences of $400,000 to a portion of the general public. If the project is assumed to have a 20-year life, what is the B/C ratio at an interest rate of 8% per year? Calculate the B/C ratio for the following cash flow estimates at a discount rate of 7% per year. tem Cash Flow FW of benefits, $ 30,800,000 AW of disbenefits, $ per year 105,000 First cost, $ 1,200,000 M&O costs, $ per year 400,000 Life of project, years 20 The benefits associated with a nuclear power plant cooling water filtration project located on the Ohio River are $10,000 per year forever, starting in year 1. The costs are $50,000 in year 0 and $50,000 at the end of year 2. Calculate the B/C ratio at i = 10% per year.In comparing two alternatives by the B/C method, if the overall B/C ratio for both alternatives is cal- culated to be exactly 1.0, which alternative should you select? In comparing alternatives X and Y by the B/C method, if B/Cy = 1.6 and B/Cy = 1.8, what is known about the B/C ratio on the increment of in- vestment between X and Y? Logan Well Services Group is considering two sites for storage and recovery of reclaimed water. The mountain site (MS) will use injection wells that cost $4.2 million to develop and $280.000 per year for M&O costs. This site will be able to accommodate 150 million gallons per year. The valley site (VS) will involve recharge basins that cost $11 million to con- struct and $400,000 to operate and maintain. At this site, 890 million gallons can be injected each year. If the value of the injected water is $3.00 per 1000 gal- Ions, which alternative, if either, should be selected according to the B/C ratio method? Use an interest rate of 8% per year and a 20-year study period. The estimates shown are for a bridge under consid cration for a river crossing in Wheeling, West Virginia. Use the B/C ratio method at an interest rate of 6% per year to determine which bridge, if either, should be built. East Location West Location Initial cost, $ 11 x 10 27 x 10 Annual M&O, $/year 100,000 90,000 Benefits, $/year 990.000 2,400,000 Disbenefits, $/year 120,000 100,000 Life, years DOSales delay is the elapsed time between the manufacture of a product and its sale. According to the article "Warranty Claims Data Analysis Considering Sales Delay" (Quality and Reliability Engr. Intl., 2013: 113-123), it is quite common for investigators to model sales delay using a lognormal distribution. For a particular product, the cited article proposes this distribution with parameter values p= 2.05 and of = .06 (here the unit for delay is months). a. What are the variance and standard deviation of delay time? b. What is the probability that delay time exceeds 12 months? c. What is the probability that delay time is within one standard deviation of its mean value? d. What is the median of the delay time distribution? e. What is the 99th percentile of the delay time distribution? f. Among 10 randomly selected such items, how many would you expect to have a delay time exceeding 8 months?The article "Response of SiCf/Si3N4 Composites UnderStatic and Cyclic Loading-An Experimental and Statistical Analysis" (J. of Engr. Materials and Technology, 1997: 186-193) suggests that tensile strength (MPa) of composites under specified conditions can be modeled by a Weibull distribution with a = 9and B = 180. a. Sketch a graph of the density function. b. What is the probability that the strength of a randomly selected specimen will exceed 175? Will be between 150 and 175? c. If two randomly selected specimens are chosen and their strengths are independent of one another, what is the probability that at least one has a strength between 150 and 175? d. What strength value separates the weakest 10% of all specimens from the remaining 90%?During the last several years, the U.S. airline industry has had financial problems, in part due to high fuel costs, fewer customers, security problems, government regulations, aging aircraft, and union dissatisfaction. As a consequence, the D-E mixes of the so-called traditional compa- nies (American, United, Delta, and others) have become larger on the debt side than is histori- cally acceptable. Meanwhile, the D-E mixes of so-called low-cost airlines (Southwest, JetBlue, and others) have suffered, but not to the same degree. In an effort to reduce costs, assume that three airlines joined forces to cooperate on a range of services (baggage handling, onboard food preparation, ticket services, and software development) by forming a new company called FullServe, Inc. This required $5 billion ($5 B) up-front funding from each airline. Table 10-1 summarizes the D-E mixes and the total equity capitalization for each airline after its share of $5 B was removed from available equity funds. The percentage of the $5 B obtained as debt capital was the same proportion as the debt in the company's D-E mix. For TABLE 10-1 Debt and Equity Statistics, Example 10.8 Airline Corporate D-E Amount Borrowed, Equity Capital Company Mix, % $ B Available, $ B National 30-70 1.50 5.0 Global 65-35 3.25 3.7 PanAm 91-9 1.55 6.7 example, National had 30% of its capitalization in debt capital; therefore, 30% of $5 B was borrowed, and 70% was provided from National's equity fund. Unfortunately, after a short time, it was clear that the three-way collaborative effort was a complete failure, and FullServe was dissolved and its assets were distributed or sold for a total of $3.0 billion, only 20% of its original value. A total of $1.0 billion in equity capital was re- turned to each airline. The commercial banks that provided the original loans then required that the airlines each pay back the entire borrowed amount now, since FullServe was dissolved and no profit from the venture could be realized. Assuming the loan and equity amounts are the same as shown in Table 10-1, determine the resulting equity capital situation for each airline after it pays off the loan from its own equity funds. Also, describe one impact on each company as a result of this expensive and risky venture that failed.A stockroom currently has 30 components of a certain type, of which 8 were provided by supplier 1, 10 by supplier 2, and 12 by supplier 3. Six of these are to be randomly selected for a particular assembly. Let X = the number of supplier 1's components selected, Y = the number of supplier 2's components selected, and p(x, y) denote the joint pmf of X and Y. a. What is p(3, 2)? [Hint: Each sample of size 6 is equally likely to be selected. Therefore, p(3, 2) = (number of outcomes with X = 3 and Y = 2)/(total number of outcomes). Now use the product rule for counting to obtain the numerator and denominator.] b. Using the logic of part (a), obtain p(x, y). (This can be thought of as a multivariate hypergeometric distribution-sampling without replacement from a finite population consisting of more than two categories.)