Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2019, Concord Company finished consulting services and accepted in exchange a promissory note with a face value of $865,000, a due

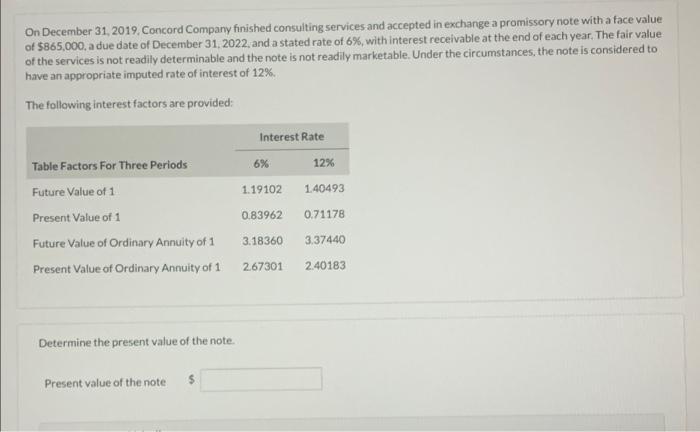

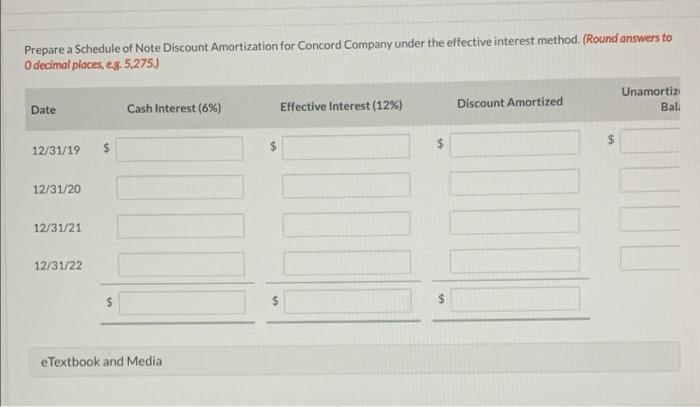

On December 31, 2019, Concord Company finished consulting services and accepted in exchange a promissory note with a face value of $865,000, a due date of December 31, 2022, and a stated rate of 6%, with interest receivable at the end of each year. The fair value of the services is not readily determinable and the note is not readily marketable. Under the circumstances, the note is considered to have an appropriate imputed rate of interest of 12%. The following interest factors are provided: Table Factors For Three Periods Future Value of 1 Present Value of 1 Future Value of Ordinary Annuity of 1 Present Value of Ordinary Annuity of 1 Determine the present value of the note. Present value of the note Interest Rate 6% 1.19102 1.40493 0.71178 3.37440 2.67301 2.40183 0.83962 12% 3.18360 Prepare a Schedule of Note Discount Amortization for Concord Company under the effective interest method. (Round answers to O decimal places, e.g. 5,275.) Date 12/31/19 12/31/20 12/31/21 12/31/22 $ Cash Interest (6%) eTextbook and Media $ Effective Interest (12%) Discount Amortized 5 Unamortiz Bali

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The answer has been presented in the supporting shee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started