Solve the following questions

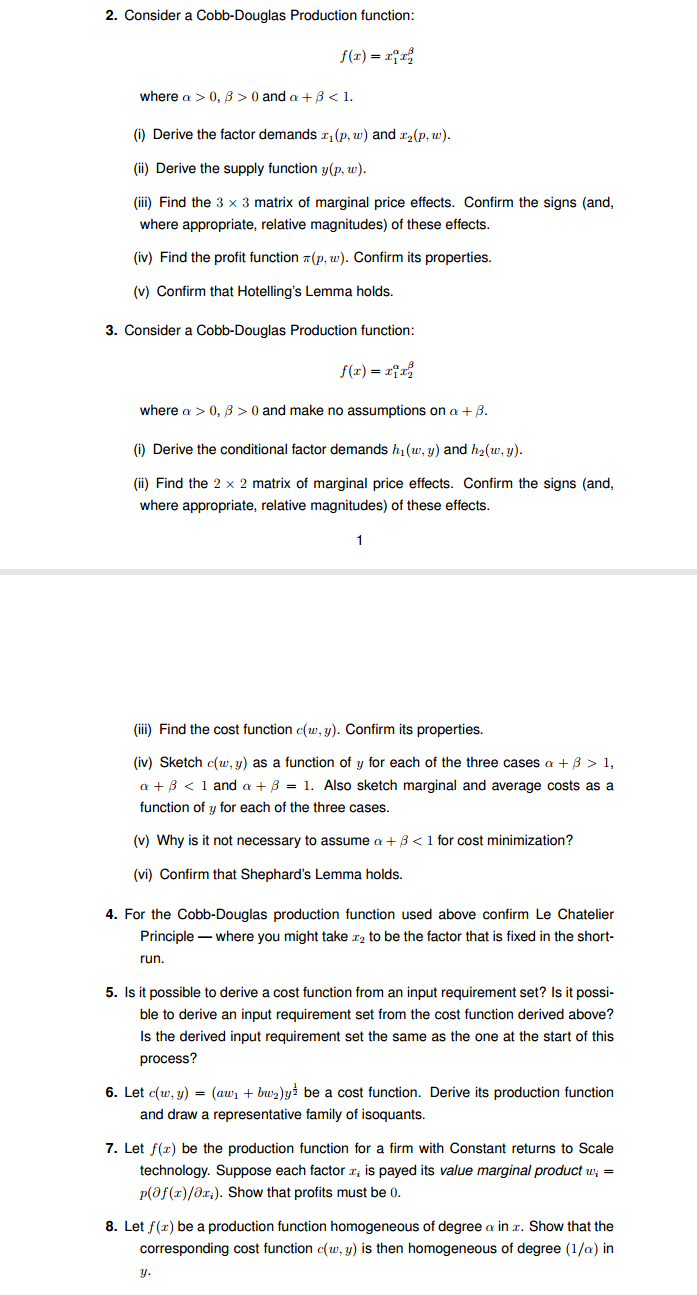

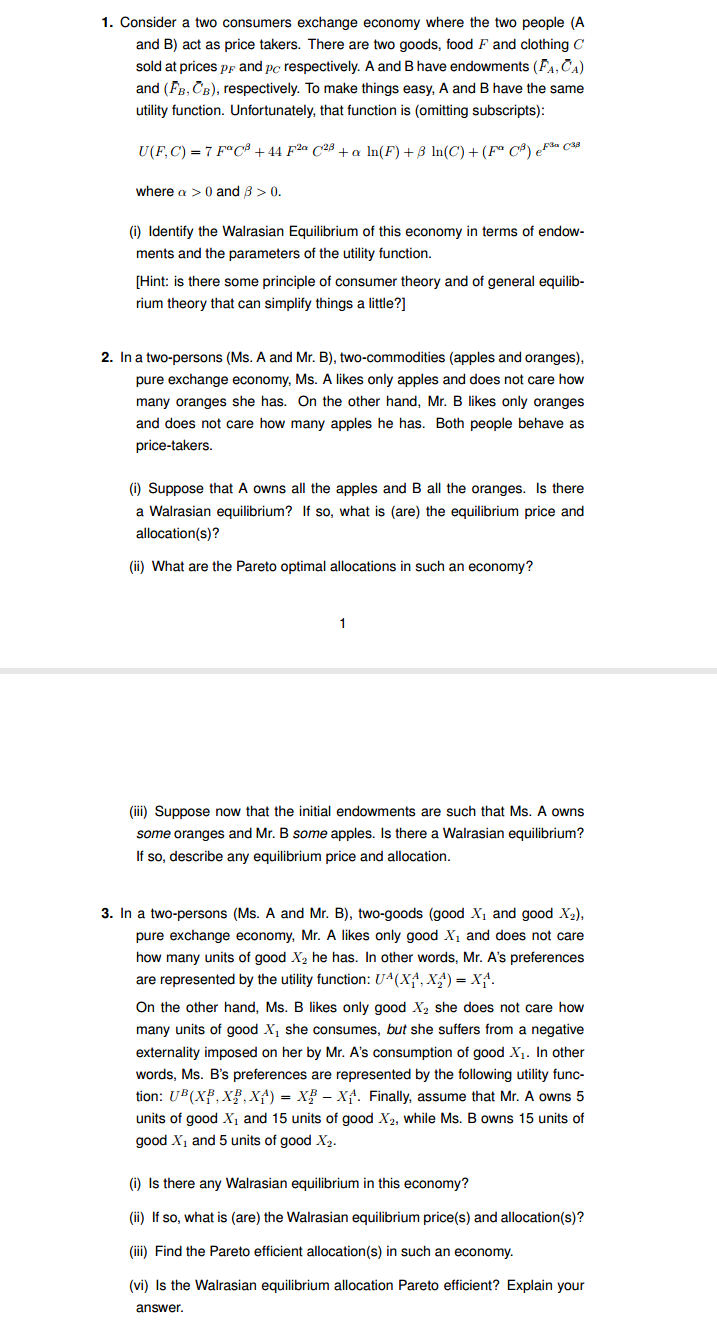

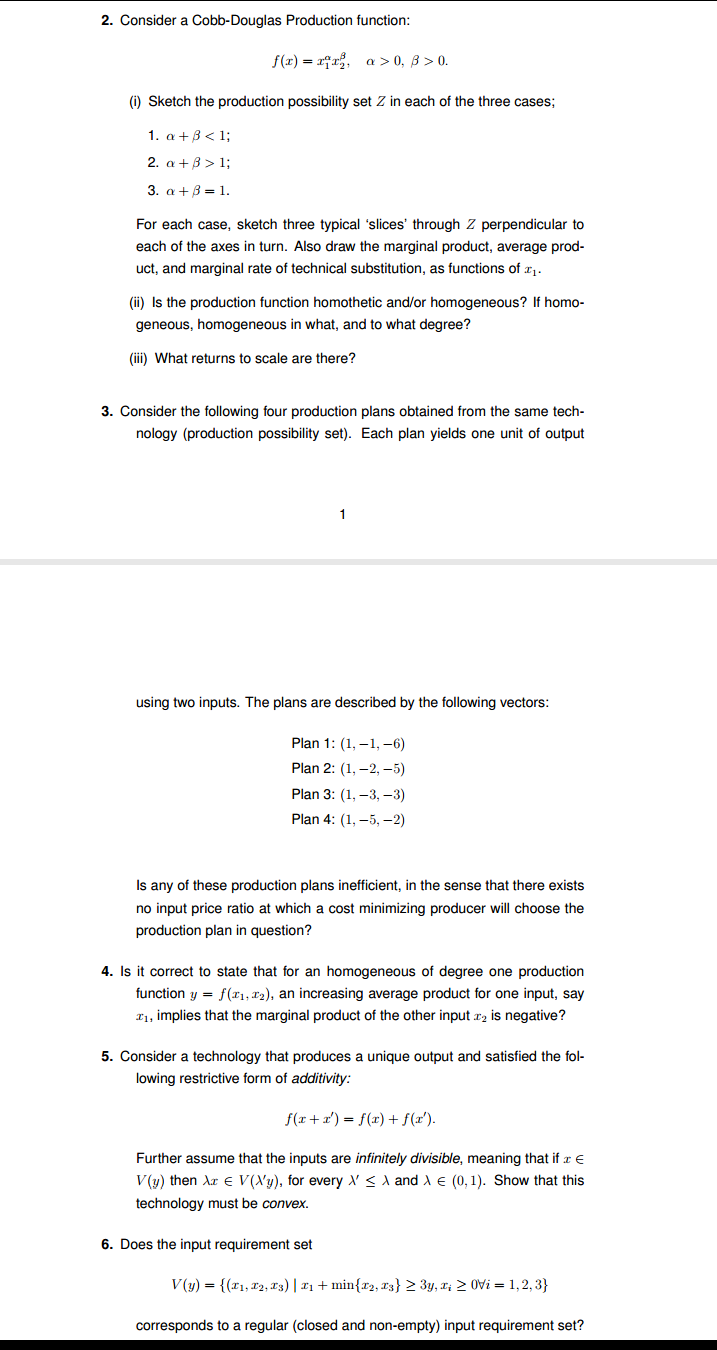

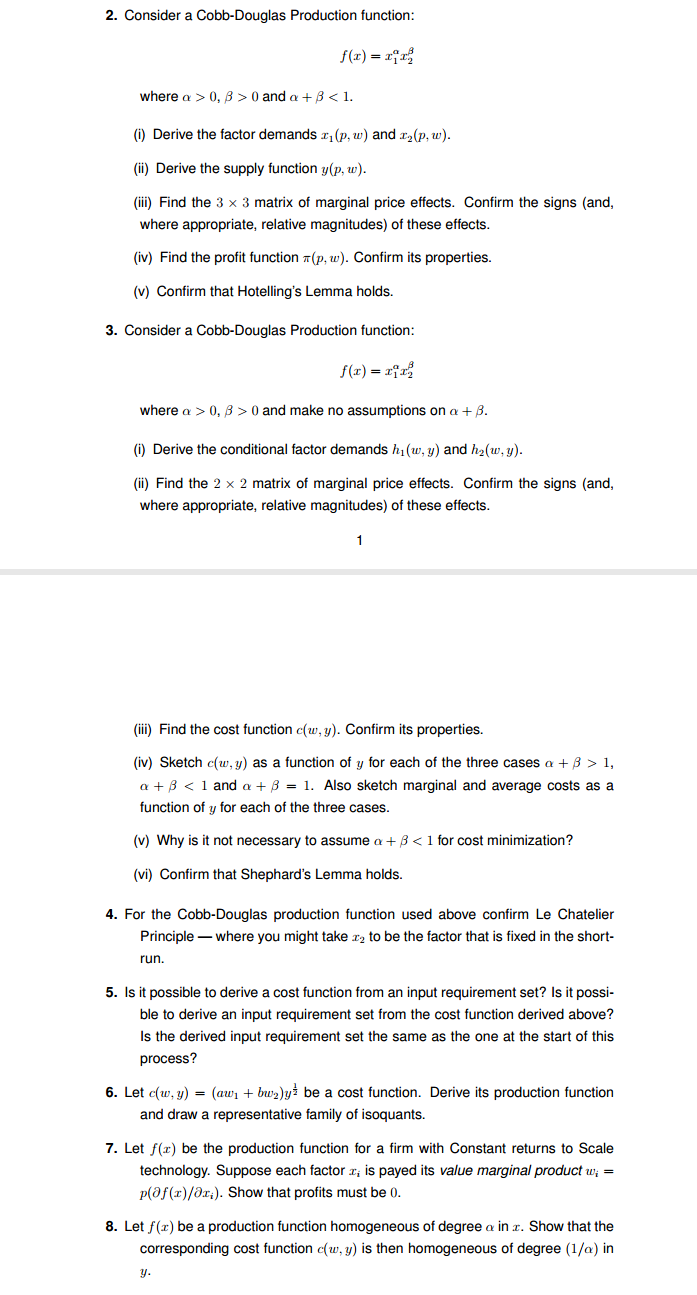

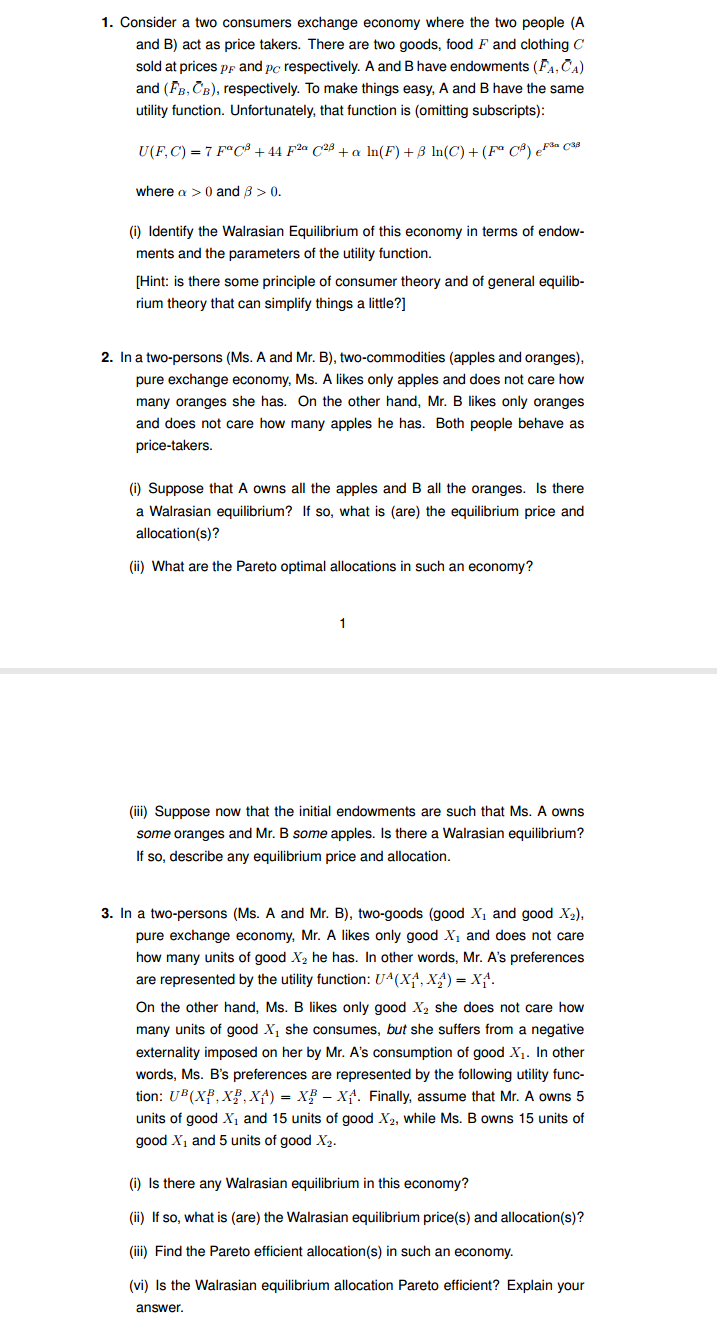

2. Consider a Cobb-Douglas Production function: f(I) = 1412, a >0, 8>0. (i) Sketch the production possibility set Z in each of the three cases; 1. a+ 8 1; 3. at3 =1. For each case, sketch three typical 'slices' through Z perpendicular to each of the axes in turn. Also draw the marginal product, average prod- uct, and marginal rate of technical substitution, as functions of 1. (i) Is the production function homothetic and/or homogeneous? If homo- geneous, homogeneous in what, and to what degree? (iii) What returns to scale are there? 3. Consider the following four production plans obtained from the same tech- nology (production possibility set). Each plan yields one unit of output using two inputs. The plans are described by the following vectors: Plan 1: (1, -1, -6) Plan 2: (1, -2, -5) Plan 3: (1, -3, -3) Plan 4: (1, -5, -2) Is any of these production plans inefficient, in the sense that there exists no input price ratio at which a cost minimizing producer will choose the production plan in question? 4. Is it correct to state that for an homogeneous of degree one production function y = f(I1, 12), an increasing average product for one input, say 31, implies that the marginal product of the other input r2 is negative? 5. Consider a technology that produces a unique output and satisfied the fol- lowing restrictive form of additivety: f(x + x') = f(x) + f(z'). Further assume that the inputs are infinitely divisible, meaning that if a E V(y) then Ar E V()'y), for every >' and A E (0, 1). Show that this technology must be convex. 6. Does the input requirement set V(y) = {(21, 12, 23) | 21 + min (12, 23} 2 3y, 1; 2 0Vi = 1,2,3} corresponds to a regular (closed and non-empty) input requirement set?2. Consider a Cobb-Douglas Production function: f(x) = 1412 where a > 0, 8 > 0 and a + 8 0, 8 > 0 and make no assumptions on a + B. (i) Derive the conditional factor demands hi(w, y) and hz(w, y). (ii) Find the 2 x 2 matrix of marginal price effects. Confirm the signs (and, where appropriate, relative magnitudes) of these effects. (iii) Find the cost function c(w, y). Confirm its properties. (iv) Sketch c(w, y) as a function of y for each of the three cases o + 8 > 1, a + 0 and B > 0. (i) Identify the Walrasian Equilibrium of this economy in terms of endow- ments and the parameters of the utility function. [Hint: is there some principle of consumer theory and of general equilib rium theory that can simplify things a little?] 2. In a two-persons (MS. A and Mr. B), two-commodities (apples and oranges), pure exchange economy, Ms. A likes only apples and does not care how many oranges she has. On the other hand, Mr. B likes only oranges and does not care how many apples he has. Both people behave as price-takers. (i) Suppose that A owns all the apples and B all the oranges. Is there a Walrasian equilibrium? If so, what is (are) the equilibrium price and allocation(s)? (ii) What are the Pareto optimal allocations in such an economy? (iii) Suppose now that the initial endowments are such that Ms. A owns some oranges and Mr. B some apples. Is there a Walrasian equilibrium? If so, describe any equilibrium price and allocation. 3. In a two-persons (MS. A and Mr. B), two-goods (good X, and good X2), pure exchange economy, Mr. A likes only good X, and does not care how many units of good X2 he has. In other words, Mr. A's preferences are represented by the utility function: UA(XA, XA) = Xf. On the other hand, Ms. B likes only good X, she does not care how many units of good X, she consumes, but she suffers from a negative externality imposed on her by Mr. A's consumption of good X1. In other words, Ms. B's preferences are represented by the following utility func- tion: UB(XP, XP, XA) = XP - Xf. Finally, assume that Mr. A owns 5 units of good X, and 15 units of good X2, while Ms. B owns 15 units of good X1 and 5 units of good X2. (i) Is there any Walrasian equilibrium in this economy? (ii) If so, what is (are) the Walrasian equilibrium price(s) and allocation(s)? (iii) Find the Pareto efficient allocation(s) in such an economy. (vi) Is the Walrasian equilibrium allocation Pareto efficient? Explain your