Answered step by step

Verified Expert Solution

Question

1 Approved Answer

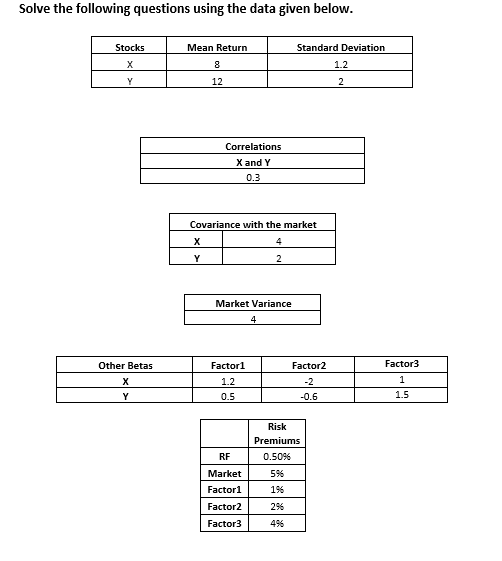

Solve the following questions using the data given below. Stocks X Y Other Betas X Y Mean Return 8 12 X Y Correlations X

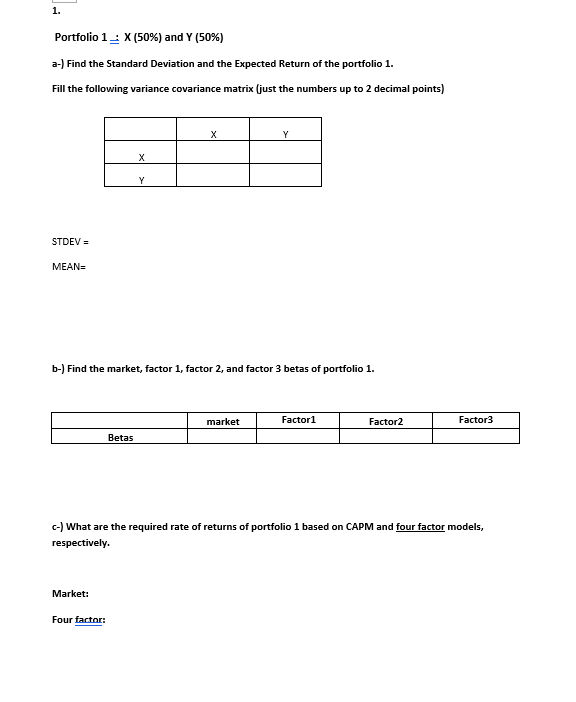

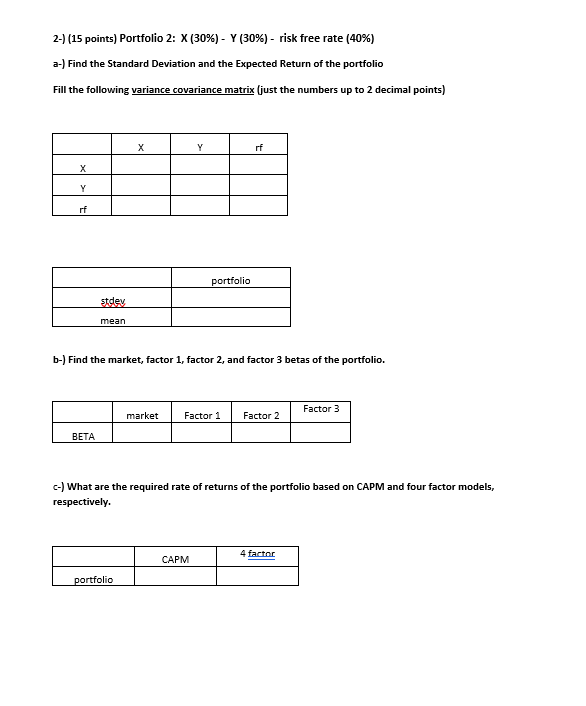

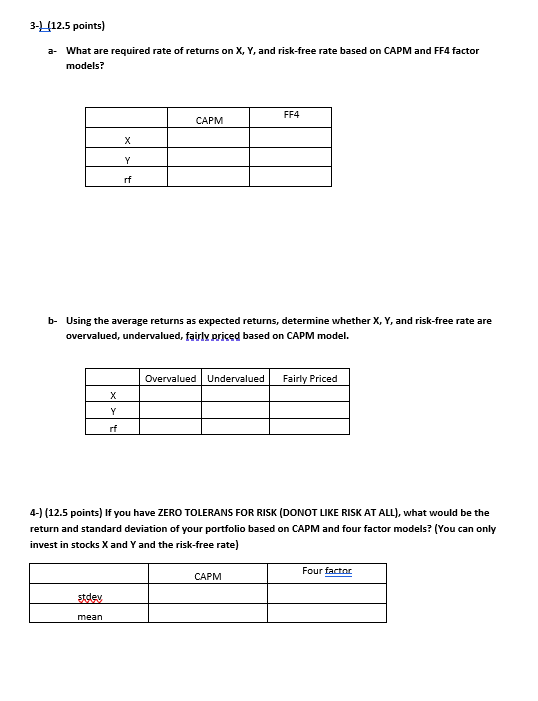

Solve the following questions using the data given below. Stocks X Y Other Betas X Y Mean Return 8 12 X Y Correlations X and Y 0.3 Covariance with the market 4 2 Market Variance Factor1 1.2 0.5 RF Market Factor1 Factor2 Factor3 Standard Deviation 4 Factor2 -2 -0.6 Risk Premiums 0.50% 5% 1% 2% 4% 1.2 2 Factor3 1 1.5 1. Portfolio 1 X (50%) and Y (50%) a-) Find the Standard Deviation and the Expected Return of the portfolio 1. Fill the following variance covariance matrix (just the numbers up to 2 decimal points) STDEV = MEAN= Market: X Betas Four factor: Y b-) Find the market, factor 1, factor 2, and factor 3 betas of portfolio 1. X Y market Factor1 Factor2 c-) What are the required rate of returns of portfolio 1 based on CAPM and four factor models, respectively. Factor3 2-) (15 points) Portfolio 2: X (30%) - Y (30%) - risk free rate (40%) a-) Find the Standard Deviation and the Expected Return of the portfolio Fill the following variance covariance matrix (just the numbers up to 2 decimal points) X Y stdev BETA mean b-) Find the market, factor 1, factor 2, and factor 3 betas of the portfolio. market portfolio Y portfolio rf CAPM Factor 1 Factor 2 c-) What are the required rate of returns of the portfolio based on CAPM and four factor models, respectively. Factor 3 4 factor 3-) (12.5 points) a- What are required rate of returns on X, Y, and risk-free rate based on CAPM and FF4 factor models? stdev X Y rf b- Using the average returns as expected returns, determine whether X, Y, and risk-free rate are overvalued, undervalued, fairly priced based on CAPM model. X Y rf mean CAPM FF4 4-) (12.5 points) If you have ZERO TOLERANS FOR RISK (DONOT LIKE RISK AT ALL), what would be the return and standard deviation of your portfolio based on CAPM and four factor models? (You can only invest in stocks X and Y and the risk-free rate) Overvalued Undervalued Fairly Priced CAPM Four factor

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Portfolio 1 Analysis X 50 Y 50 a Standard Deviation and Expected Return Variance Covariance Matrix Since we have the individual standard deviations SD and correlation of X and Y we can calculate the v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started