Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve the given problem question A B and C in the given detail using excel. please provide complete solution for all questions Tiffany owns an

solve the given problem question A B and C in the given detail using excel. please provide complete solution for all questions

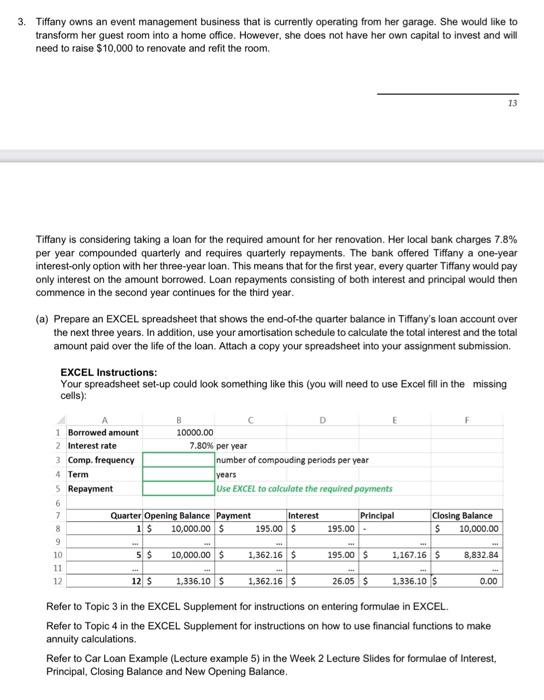

Tiffany owns an event management business that is currently operating from her garage. She would like to transform her guest room into a home office. However, she does not have her own capital to invest and will need to raise $10,000 to renovate and refit the room.

Tiffany is considering taking a loan for the required amount for her renovation. Her local bank charges 7.8% per year compounded quarterly and requires quarterly repayments. The bank offered Tiffany a one-year interest-only option with her three-year loan. This means that for the first year, every quarter Tiffany would pay only interest on the amount borrowed. Loan repayments consisting of both interest and principal would then commence in the second year continues for the third year.

(a) Prepare an EXCEL spreadsheet that shows the end-of-the quarter balance in Tiffanys loan account over the next three years. In addition, use your amortisation schedule to calculate the total interest and the total amount paid over the life of the loan. Attach a copy your spreadsheet into your assignment submission.

EXCEL Instructions:

Your spreadsheet set-up could look something like this (you will need to use Excel fill in the missing cells):

Refer to Topic 3 in the EXCEL Supplement for instructions on entering formulae in EXCEL.

Refer to Topic 4 in the EXCEL Supplement for instructions on how to use financial functions to make annuity calculations.

Refer to Car Loan Example (Lecture example 5) in the Week 2 Lecture Slides for formulae of Interest, Principal, Closing Balance and New Opening Balance.

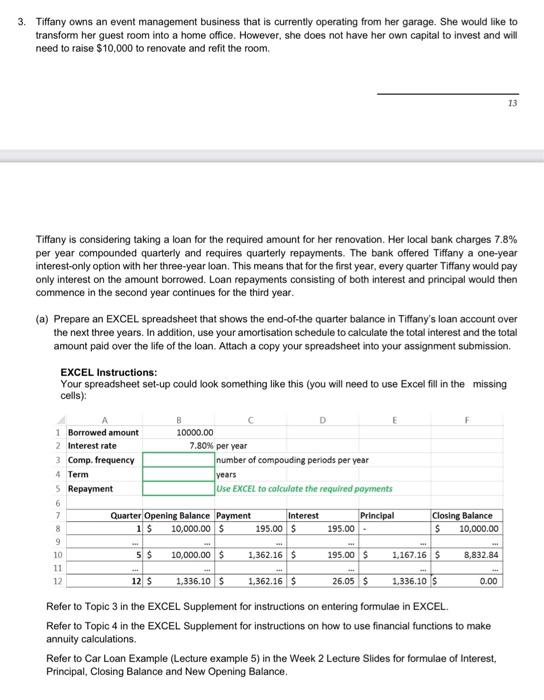

(b) A wealthy family friend nicknamed Lecce had offered to help Tiffany and has made an alternative offer for her to obtain the $10,000 loan. Lecce has proposed the following loan terms over a 12-month period. He claims this is a cheaper and simple with everything paid off at the end of the renovation.

Lecce will give her the $10,000 at the start of the month and Tiffany will start pay $900 at the each of each month for until the end of the loan period. He claims he is entitled to $800 in interest, which will be paid to him under his proposed conditions.

Tiffany would like to know the interest rate Lecce is charging her and they would also like to verify the total amount of interest ($800) he claims he is entitled to.

To answer this question, follow all EXCEL instructions below including the instructions given in the two diagrams. Also show your calculation for the total interest Tiffany paid under this arrangement.

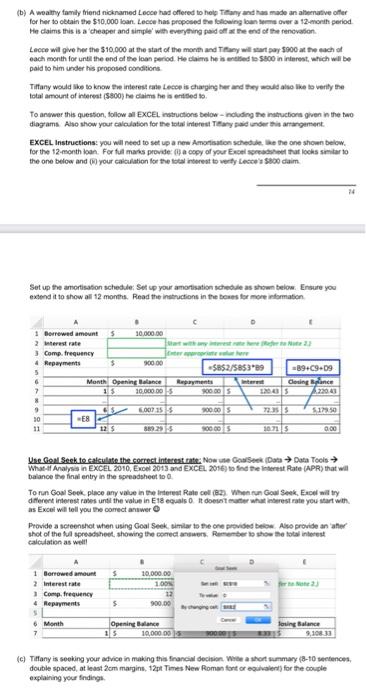

EXCEL Instructions: you will need to set up a new Amortisation schedule, like the one shown below, for the 12-month loan. For full marks provide: (i) a copy of your Excel spreadsheet that looks similar to the one below and (ii) your calculation for the total interest to verify Lecces $800 claim.

Set up the amortisation schedule: Set up your amortisation schedule as shown below. Ensure you extend it to show all 12 months. Read the instructions in the boxes for more information.

Use Goal Seek to calculate the correct interest rate: Now use GoalSeek (DataData Tools What-If Analysis in EXCEL 2010, Excel 2013 and EXCEL 2016) to find the Interest Rate (APR) that will balance the final entry in the spreadsheet to 0.

To run Goal Seek, place any value in the Interest Rate cell (B2). When run Goal Seek, Excel will try different interest rates until the value in E18 equals 0. It doesnt matter what interest rate you start with, as Excel will tell you the correct answer J

Provide a screenshot when using Goal Seek, similar to the one provided below. Also provide an after shot of the full spreadsheet, showing the correct answers. Remember to show the total interest calculation aswell.

(c) Tiffanyisseekingyouradviceinmakingthisfinancialdecision.Writeashortsummary(8-10sentences, double spaced, at least 2cm margins, 12pt Times New Roman font or equivalent) for the couple explaining your findings.

thats the whole question. what more information is needed please specify

3. Tiffany owns an event management business that is currently operating from her garage. She would like to transform her guest room into a home office. However, she does not have her own capital to invest and will need to raise $10,000 to renovate and refit the room. 13 Tiffany is considering taking a loan for the required amount for her renovation. Her local bank charges 7.8% per year compounded quarterly and requires quarterly repayments. The bank offered Tiffany a one-year interest-only option with her three-year loan. This means that for the first year, every quarter Tiffany would pay only interest on the amount borrowed. Loan repayments consisting of both interest and principal would then commence in the second year continues for the third year. (a) Prepare an EXCEL spreadsheet that shows the end-of-the quarter balance in Tiffany's loan account over the next three years. In addition, use your amortisation schedule to calculate the total interest and the total amount paid over the life of the loan. Attach a copy your spreadsheet into your assignment submission EXCEL Instructions: Your spreadsheet set-up could look something like this (you will need to use Excel fill in the missing cells): D F 1 Borrowed amount 10000.00 2 Interest rate 7.80% per year 3 Comp. frequency number of compouding periods per year 4 Term years 5 Repayment Use EXCEL to calculate the required payments 6 7 Quarter Opening Balance Payment Interest Principal Closing Balance 8 10,000.00 $ 195.00 $ 195.00 $ 10,000.00 9 10 5 $ 10,000.00 $ 1,362.16 S 195.00 S 1,167.16 S 8,832.84 1$ 12 12 $ 1,336.10 S 1,362.16 $ 26.05 $ 1,336.10 $ 0.00 Refer to Topic 3 in the EXCEL Supplement for instructions on entering formulae in EXCEL Refer to Topic 4 in the EXCEL Supplement for instructions on how to use financial functions to make annuity calculations Refer to Car Loan Example (Lecture example 5) in the Week 2 Lecture Slides for formulae of Interest, Principal, Closing Balance and New Opening Balance. (b) A wealthy family friend nicknamed Lecce has offered to help any and has made an alternative offer for her to obtain the $10,000 loan. Lecce has proposed the following for over a 12 month period He claims this is a cheaper and simple with everything paid off the end of the renovation Lecce will give her the $10,000 at the start of the month and Thay will start pay $900 at the each of each month for until the end of the loan period. He claims he is entitled to 5800 in interest, which will be paid to him under his proposed conditions Titany would like to know the interest rate Lecce is charging her and they would to like to verify the total amount of interest ($800) he claims he is entitled to To anwer this question, follow all EXCEL instructions belownluding the instruction given in the two diagrams. Also show your calculation for the total interest any paid under this arrangement EXCEL Instructions: you will need to set up a new Amortisation schedule the one shown below. for the 12-month loan. Forful mans provide a copy of your Excel spreadsheet Putlooks siirto the one below and your calculation for the total interest to very Lecce $800 daim 24 Set up the amortisation schedule Set up your amortisation schedule as shown below. Ensure you extend it to show all 12 months. Read the instructions in the boxes for more information 1 Borrowed amounts 10,000.00 2 Interest rate 3 Comp. frequency #Repayment $ 00:00 5 6 Month Opening Balance 7 35 10.000.00 8 9 800215 30 -E8 125 $B$2/885389 Repayments 120 -89+09.09 Closing Dance 220.00 900.00 72.35 $179,50 105 0.00 Use Goal Seek to calculate the correct interest rate: Now use Golek Data Data Tools What Analysis in EXCEL 2010, Excel 2013 and EXCEL 2016) to find the interest Rate (APR) that wil balance the final entry in the spreadsheet to To run Goal Sook place any value in the Interest Rate cel(82) When Goal Seek Excel wiltry different interest rates until the value in E18 equals It doesn't matter whaterest rate you start win as Excel will tell you the correct answer Provide a screenshot when using Goal Seek, similar to the one provided below. Also provide an ather shot of the spreadsheet showing the correct answers, Rumenter to show the total interest calculation as well! $ 10.000.00 1 Borrowed amount 2 Interest rate 1 Comp. Frequency 4 Repayments 5 6 Month $ 900.00 Opening Balance 35 10,000.00 losing Balance MOOTS (c) Tiffany is seeking your advice in making this financial decision. We a short summary (8-10 sentences double spaced, at least 2cm margins, 12pt Times New Roman fort or equivalent for the couple explaining your findings (b) A wealthy family friend nicknamed Lecce has offered to help any and has made an alternative offer for her to obtain the $10,000 loan. Lecce has proposed the following for over a 12 month period He claims this is a cheaper and simple with everything paid off the end of the renovation Lecce will give her the $10,000 at the start of the month and Thay will start pay $900 at the each of each month for until the end of the loan period. He claims he is entitled to 5800 in interest, which will be paid to him under his proposed conditions Titany would like to know the interest rate Lecce is charging her and they would to like to verify the total amount of interest ($800) he claims he is entitled to To anwer this question, follow all EXCEL instructions belownluding the instruction given in the two diagrams. Also show your calculation for the total interest any paid under this arrangement EXCEL Instructions: you will need to set up a new Amortisation schedule the one shown below. for the 12-month loan. Forful mans provide a copy of your Excel spreadsheet Putlooks siirto the one below and your calculation for the total interest to very Lecce $800 daim 24 Set up the amortisation schedule Set up your amortisation schedule as shown below. Ensure you extend it to show all 12 months. Read the instructions in the boxes for more information 1 Borrowed amounts 10,000.00 2 Interest rate 3 Comp. frequency #Repayment $ 00:00 5 6 Month Opening Balance 7 35 10.000.00 8 9 800215 30 -E8 125 $B$2/885389 Repayments 120 -89+09.09 Closing Dance 220.00 900.00 72.35 $179,50 105 0.00 Use Goal Seek to calculate the correct interest rate: Now use Golek Data Data Tools What Analysis in EXCEL 2010, Excel 2013 and EXCEL 2016) to find the interest Rate (APR) that wil balance the final entry in the spreadsheet to To run Goal Sook place any value in the Interest Rate cel(82) When Goal Seek Excel wiltry different interest rates until the value in E18 equals It doesn't matter whaterest rate you start win as Excel will tell you the correct answer Provide a screenshot when using Goal Seek, similar to the one provided below. Also provide an ather shot of the spreadsheet showing the correct answers, Rumenter to show the total interest calculation as well! $ 10.000.00 1 Borrowed amount 2 Interest rate 1 Comp. Frequency 4 Repayments 5 6 Month $ 900.00 Opening Balance 35 10,000.00 losing Balance MOOTS (c) Tiffany is seeking your advice in making this financial decision. We a short summary (8-10 sentences double spaced, at least 2cm margins, 12pt Times New Roman fort or equivalent for the couple explaining your findings 3. Tiffany owns an event management business that is currently operating from her garage. She would like to transform her guest room into a home office. However, she does not have her own capital to invest and will need to raise $10,000 to renovate and refit the room. 13 Tiffany is considering taking a loan for the required amount for her renovation. Her local bank charges 7.8% per year compounded quarterly and requires quarterly repayments. The bank offered Tiffany a one-year interest-only option with her three-year loan. This means that for the first year, every quarter Tiffany would pay only interest on the amount borrowed. Loan repayments consisting of both interest and principal would then commence in the second year continues for the third year. (a) Prepare an EXCEL spreadsheet that shows the end-of-the quarter balance in Tiffany's loan account over the next three years. In addition, use your amortisation schedule to calculate the total interest and the total amount paid over the life of the loan. Attach a copy your spreadsheet into your assignment submission EXCEL Instructions: Your spreadsheet set-up could look something like this (you will need to use Excel fill in the missing cells): D F 1 Borrowed amount 10000.00 2 Interest rate 7.80% per year 3 Comp. frequency number of compouding periods per year 4 Term years 5 Repayment Use EXCEL to calculate the required payments 6 7 Quarter Opening Balance Payment Interest Principal Closing Balance 8 10,000.00 $ 195.00 $ 195.00 $ 10,000.00 9 10 5 $ 10,000.00 $ 1,362.16 S 195.00 S 1,167.16 S 8,832.84 1$ 12 12 $ 1,336.10 S 1,362.16 $ 26.05 $ 1,336.10 $ 0.00 Refer to Topic 3 in the EXCEL Supplement for instructions on entering formulae in EXCEL Refer to Topic 4 in the EXCEL Supplement for instructions on how to use financial functions to make annuity calculations Refer to Car Loan Example (Lecture example 5) in the Week 2 Lecture Slides for formulae of Interest, Principal, Closing Balance and New Opening Balance. (b) A wealthy family friend nicknamed Lecce has offered to help any and has made an alternative offer for her to obtain the $10,000 loan. Lecce has proposed the following for over a 12 month period He claims this is a cheaper and simple with everything paid off the end of the renovation Lecce will give her the $10,000 at the start of the month and Thay will start pay $900 at the each of each month for until the end of the loan period. He claims he is entitled to 5800 in interest, which will be paid to him under his proposed conditions Titany would like to know the interest rate Lecce is charging her and they would to like to verify the total amount of interest ($800) he claims he is entitled to To anwer this question, follow all EXCEL instructions belownluding the instruction given in the two diagrams. Also show your calculation for the total interest any paid under this arrangement EXCEL Instructions: you will need to set up a new Amortisation schedule the one shown below. for the 12-month loan. Forful mans provide a copy of your Excel spreadsheet Putlooks siirto the one below and your calculation for the total interest to very Lecce $800 daim 24 Set up the amortisation schedule Set up your amortisation schedule as shown below. Ensure you extend it to show all 12 months. Read the instructions in the boxes for more information 1 Borrowed amounts 10,000.00 2 Interest rate 3 Comp. frequency #Repayment $ 00:00 5 6 Month Opening Balance 7 35 10.000.00 8 9 800215 30 -E8 125 $B$2/885389 Repayments 120 -89+09.09 Closing Dance 220.00 900.00 72.35 $179,50 105 0.00 Use Goal Seek to calculate the correct interest rate: Now use Golek Data Data Tools What Analysis in EXCEL 2010, Excel 2013 and EXCEL 2016) to find the interest Rate (APR) that wil balance the final entry in the spreadsheet to To run Goal Sook place any value in the Interest Rate cel(82) When Goal Seek Excel wiltry different interest rates until the value in E18 equals It doesn't matter whaterest rate you start win as Excel will tell you the correct answer Provide a screenshot when using Goal Seek, similar to the one provided below. Also provide an ather shot of the spreadsheet showing the correct answers, Rumenter to show the total interest calculation as well! $ 10.000.00 1 Borrowed amount 2 Interest rate 1 Comp. Frequency 4 Repayments 5 6 Month $ 900.00 Opening Balance 35 10,000.00 losing Balance MOOTS (c) Tiffany is seeking your advice in making this financial decision. We a short summary (8-10 sentences double spaced, at least 2cm margins, 12pt Times New Roman fort or equivalent for the couple explaining your findings (b) A wealthy family friend nicknamed Lecce has offered to help any and has made an alternative offer for her to obtain the $10,000 loan. Lecce has proposed the following for over a 12 month period He claims this is a cheaper and simple with everything paid off the end of the renovation Lecce will give her the $10,000 at the start of the month and Thay will start pay $900 at the each of each month for until the end of the loan period. He claims he is entitled to 5800 in interest, which will be paid to him under his proposed conditions Titany would like to know the interest rate Lecce is charging her and they would to like to verify the total amount of interest ($800) he claims he is entitled to To anwer this question, follow all EXCEL instructions belownluding the instruction given in the two diagrams. Also show your calculation for the total interest any paid under this arrangement EXCEL Instructions: you will need to set up a new Amortisation schedule the one shown below. for the 12-month loan. Forful mans provide a copy of your Excel spreadsheet Putlooks siirto the one below and your calculation for the total interest to very Lecce $800 daim 24 Set up the amortisation schedule Set up your amortisation schedule as shown below. Ensure you extend it to show all 12 months. Read the instructions in the boxes for more information 1 Borrowed amounts 10,000.00 2 Interest rate 3 Comp. frequency #Repayment $ 00:00 5 6 Month Opening Balance 7 35 10.000.00 8 9 800215 30 -E8 125 $B$2/885389 Repayments 120 -89+09.09 Closing Dance 220.00 900.00 72.35 $179,50 105 0.00 Use Goal Seek to calculate the correct interest rate: Now use Golek Data Data Tools What Analysis in EXCEL 2010, Excel 2013 and EXCEL 2016) to find the interest Rate (APR) that wil balance the final entry in the spreadsheet to To run Goal Sook place any value in the Interest Rate cel(82) When Goal Seek Excel wiltry different interest rates until the value in E18 equals It doesn't matter whaterest rate you start win as Excel will tell you the correct answer Provide a screenshot when using Goal Seek, similar to the one provided below. Also provide an ather shot of the spreadsheet showing the correct answers, Rumenter to show the total interest calculation as well! $ 10.000.00 1 Borrowed amount 2 Interest rate 1 Comp. Frequency 4 Repayments 5 6 Month $ 900.00 Opening Balance 35 10,000.00 losing Balance MOOTS (c) Tiffany is seeking your advice in making this financial decision. We a short summary (8-10 sentences double spaced, at least 2cm margins, 12pt Times New Roman fort or equivalent for the couple explaining your findings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started