solve the question

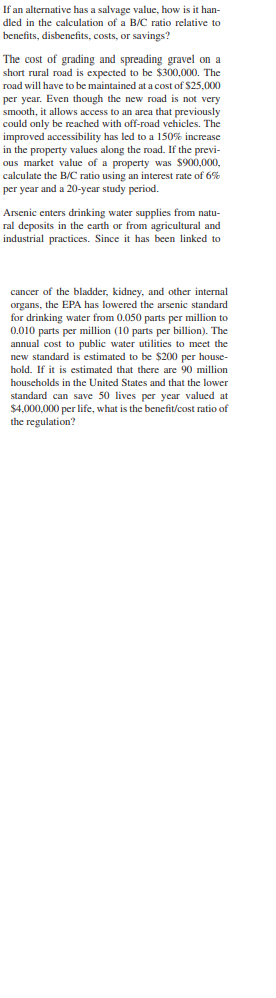

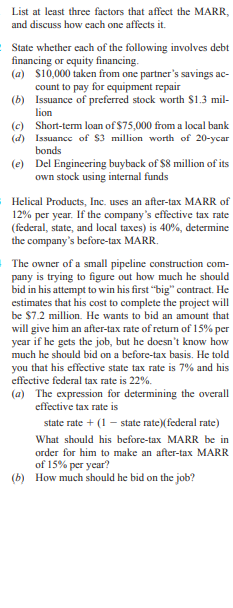

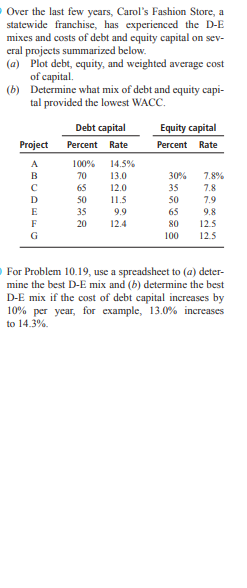

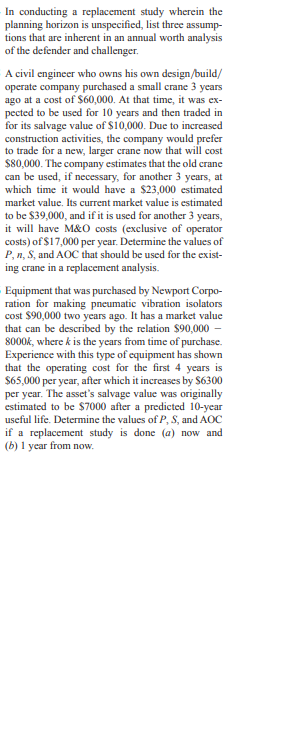

If an alternative has a salvage value, how is it han- dled in the calculation of a B/C ratio relative to benefits, disbenefits, costs, or savings? The cost of grading and spreading gravel on a short rural road is expected to be $300,000. The road will have to be maintained at a cost of $25,000 per year. Even though the new road is not very smooth, it allows access to an area that previously could only be reached with off-road vehicles. The improved accessibility has led to a 150% increase in the property values along the road. If the previ- ous market value of a property was $900,000, calculate the B/C ratio using an interest rate of 6% per year and a 20-year study period. Arsenic enters drinking water supplies from natu- ral deposits in the earth or from agricultural and industrial practices. Since it has been linked to cancer of the bladder, kidney, and other internal organs, the EPA has lowered the arsenic standard for drinking water from 0.050 parts per million to 0.010 parts per million (10 parts per billion). The annual cost to public water utilities to meet the new standard is estimated to be $200 per house- hold. If it is estimated that there are 90 million households in the United States and that the lower standard can save 50 lives per year valued at $4,000,000 per life, what is the benefit/cost ratio of the regulation?List at least three factors that affect the MARK, and discuss how each one affects it. State whether each of the following involves debt financing or equity financing. (a) $10,000 taken from one partner's savings ac- count to pay for equipment repair (b) Issuance of preferred stock worth $1.3 mil- lion (c) Short-term loan of $75,000 from a local bank (d) Issuance of $3 million worth of 20-year bonds (e) Del Engineering buyback of $8 million of its own stock using internal funds Helical Products, Inc. uses an after-tax MARR of 12% per year. If the company's effective tax rate (federal, state, and local taxes) is 40%, determine the company's before-tax MARK. The owner of a small pipeline construction com- pany is trying to figure out how much he should bid in his attempt to win his first "big" contract. He estimates that his cost to complete the project will be $7.2 million. He wants to bid an amount that will give him an after-tax rate of return of 15% per year if he gets the job, but he doesn't know how much he should bid on a before-tax basis. He told you that his effective state tax rate is 7% and his effective federal tax rate is 22%. (a) The expression for determining the overall effective tax rate is state rate + (1 - state rate)(federal rate) What should his before-tax MARR be in order for him to make an after-tax MARK of 15% per year? (b) How much should he bid on the job?The tensile strength of silicone rubber is thought to be a function of curing temperature. A study was carried out in which samples of 12 specimens of the rubber were prepared using curing temperatures of 20 C and 45 C. The data below show the tensile strength values in megapascals. 20 C: 2.07 2.14 2.22 2.03 2.21 2.03 2.05 2.18 2.09 2.14 2.11 2.02 45"C: 2.52 2.15 2.49 2.03 2.37 2.05 1.99 2.42 2.08 2.42 2.29 2.01 (a) Show a dot plot of the data with both low and high temperature tensile strength values. (b) Compute sample mean tensile strength for both samples. (c) Does it appear as if curing temperature has an influence on tensile strength, based on the plot? Comment further. (d) Does anything else appear to be influenced by an increase in curing temperature? Explain.Over the last few years, Carol's Fashion Store, a statewide franchise, has experienced the D-E mixes and costs of debt and equity capital on sev- eral projects summarized below. (a) Plot debt, equity, and weighted average cost of capital. (b) Determine what mix of debt and equity capi- tal provided the lowest WACC. Debt capital Equity capital Project Percent Rate Percent Rate A 100% 14.5% B 70 13.0 30% 7.8% C 65 12.0 35 7.8 50 11.5 7.9 35 9.9 65 9.8 20 12.4 20 125 100 12 5 For Problem 10.19, use a spreadsheet to (a) deter- mine the best D-E mix and (b) determine the best D-E mix if the cost of debt capital increases by 10% per year, for example, 13.0% increases to 14.3%In conducting a replacement study wherein the planning horizon is unspecified, list three assump- tions that are inherent in an annual worth analysis of the defender and challenger. A civil engineer who owns his own design/build/ operate company purchased a small crane 3 years ago at a cost of $60,000. At that time, it was ex- pected to be used for 10 years and then traded in for its salvage value of $10,000. Due to increased construction activities, the company would prefer to trade for a new, larger crane now that will cost $80,000. The company estimates that the old crane can be used, if necessary, for another 3 years, at which time it would have a $23,000 estimated market value. Its current market value is estimated to be $39,000, and if it is used for another 3 years, it will have M&O costs (exclusive of operator costs) of $17,000 per year. Determine the values of P, n, S, and AOC that should be used for the exist- ing crane in a replacement analysis. Equipment that was purchased by Newport Corpo- ration for making pneumatic vibration isolators cost $90,000 two years ago. It has a market value that can be described by the relation $90,000 - 8000k, where & is the years from time of purchase. Experience with this type of equipment has shown that the operating cost for the first 4 years is $65,000 per year, after which it increases by $6300 per year. The asset's salvage value was originally estimated to be $7000 after a predicted 10-year useful life. Determine the values of P, S, and AOC if a replacement study is done (a) now and (b) 1 year from now.A continuous random variable X that can assume values between x = 2 and x = 5 has a density function given by f(x) = 2(1 + x)/27. Find (a) P(X 0, y>0, elsewhere, find P(0