solve the required please. thank you.

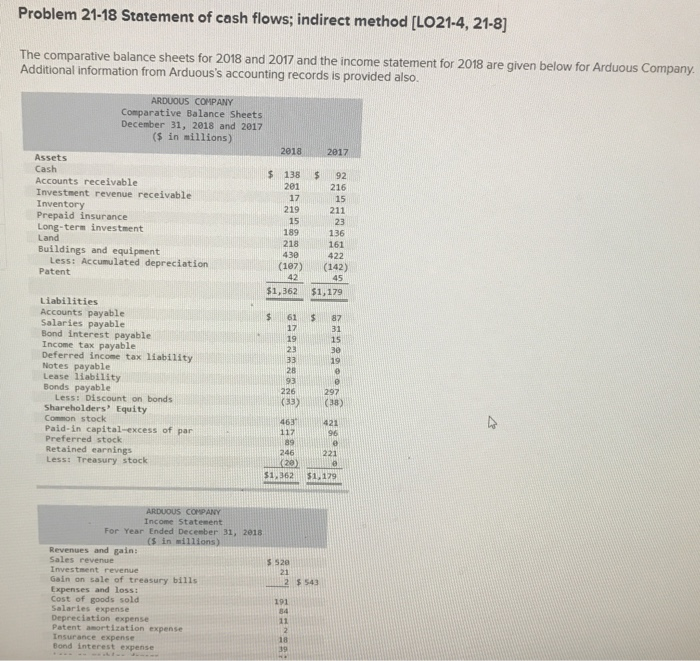

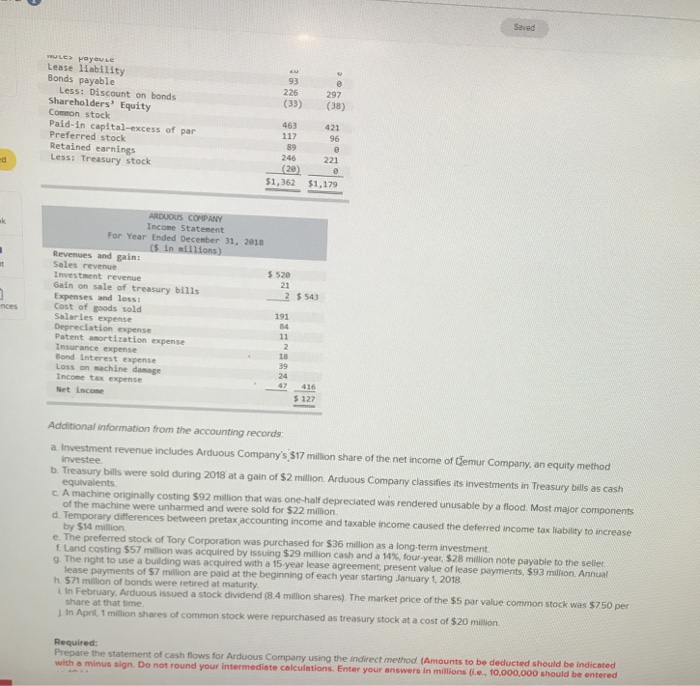

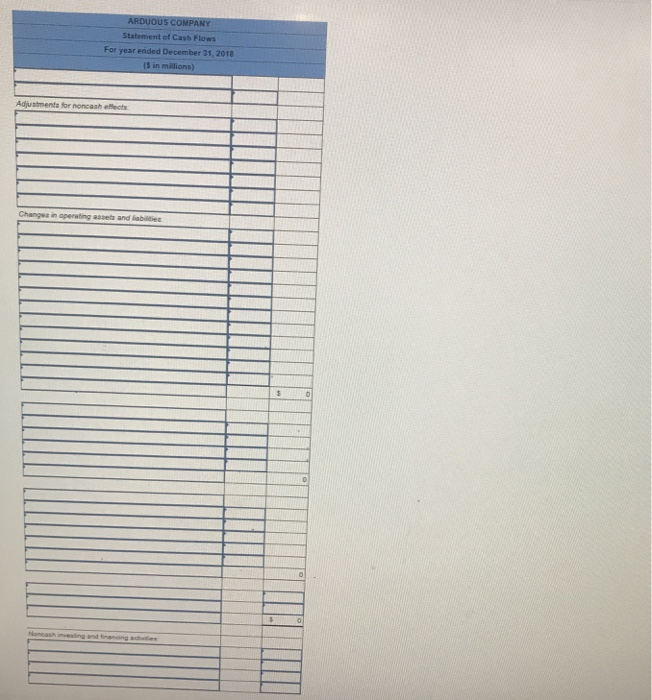

Problem 21-18 Statement of cash flows; indirect method [LO21-4, 21-8] The comparative balance sheets for 2018 and 2017 and the income statement for 2018 are given below for Additional information from Arduous's accounting records is provided also. Arduous Com ARDUOUS COMP. Comparative Balance Sheets December 31, 2018 and 2017 (S in millions) 182017 Assets Cash Accounts receivable Investment revenue receivable Inventory Prepaid insurance Long-term investment s 138 s 92 201216 15 211 23 136 161 438 422 17 219 15 189 218 Buildings and equipment Less: Accumulated depreciation Patent (107) (142) $1,362 $1,179 Liabilities Accounts payable Salaries payable Bond interest payable Income tax payable Deferred income tax liability Notes payable Lease liability Bonds payable $ 61 87 31 15 30 17 19 23 28 93 226 297 (33)38) 463 421 Less: Discount on bonds Shareholders Equity Common stock Paid-in capital-excess of par Preferred stock Retained earnings Less: Treasury stock 221 $1 362 $1,179 Income Statement For Year Ended December 31, 2018 (S in millions) Revenues and gain: Sales revenue Investment revenue Gain on sale of treasury bills Expenses and loss: Cost of goods sold Salaries expense Depreciation expense Patent amortization expense Insurance expense Bond interest expense 3 520 21 191 19 Lease liability Bonds payable 93 226 (33) 297 (38) Less: Discount on bonds Shareholders' Equity Common stock Paid-in capital-excess of par Preferred stock Retained earnings Less: Treasury stock 421 96 463 117 89 246 221 $1,362 $1,179 Income Statement For Year Ended December 31, 2018 Revenues and gain: Sales revenue Investment revenue Gain on sale of treasury bil1s Expenses and losst Cost of goods sold Salaries expense Depreciation expense Patent amortization expense 520 21 191 84 18 39 Bond interest expense Loss on machine danage Income tax expense Net income s 127 Additional information from the accounting records a Investment revenue includes Arduous Company's $17 million share of the net income of Cemur Company, an equity method b. Treasury bills were sold during 2018 at a gain of $2 million. Arduous Company classifies ats investments in Treasury bills as cash c A mac ne originally costing S92 ma on that was one-half depreciated was rendered unusable by a nood Most ma r co ponents of the machine were unharmed and were sold for $22 million by $14 million t Land costing S57 million was acquired by issuing S29 million cash and a 14%four-year S28 million note payable to the sele income and taxable income caused the deferred income tax liability to increase e. The preferred stock of Tory Corporation was purchased for $36 million as a long-term investment g. The right to use a building was acquired with a 15 year lease agreement present value of lease payments, $93 milion. Annuat h lease payments of $7 million are paid at the beginning of each year starting January 1, 2018 $71 million of bonds were retired at maturity Arduous issued a stock dividend 8 4 million shares) The market price of the $5 par value common stock was $750 per share at that time J In Apri, 1 miltion shares of common stock were repurchased as treasury stock at a cost of $20 million. of cash flows for Arduous Company using the indirect method. (Amounts to be deducted should be indicated ations. Enter your answers in millions (ie., 10.000,000 should be entered Prepare the statement with a minus sign. Do not round your intermediate celculations. Enter your Statement of Cash Flows For year ended December 31, 2018 Adjustmenta for noncaah efflects Changes in operating assets and liabidies Noncash invesing and tinaneing aivities