Solve the second part only

same this

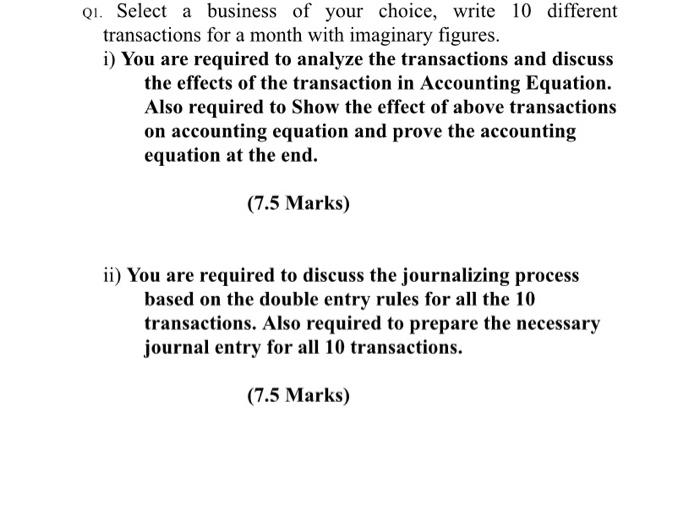

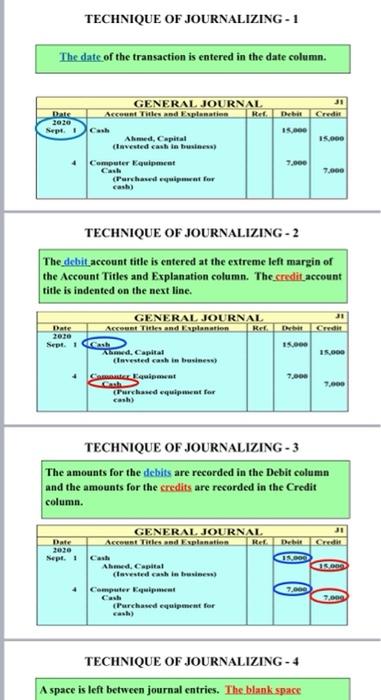

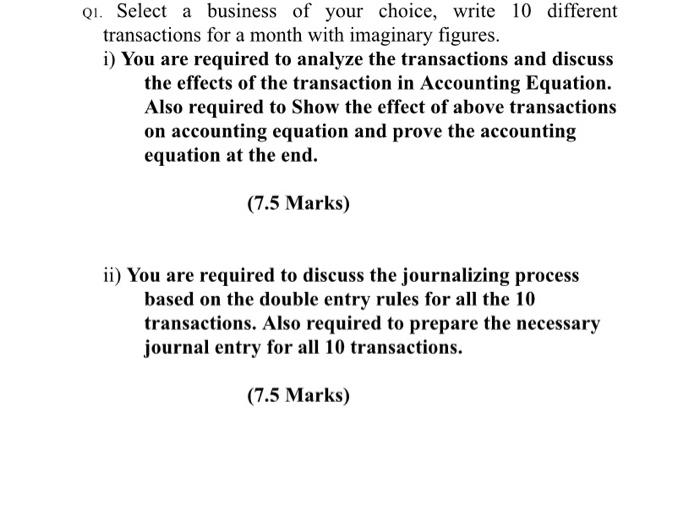

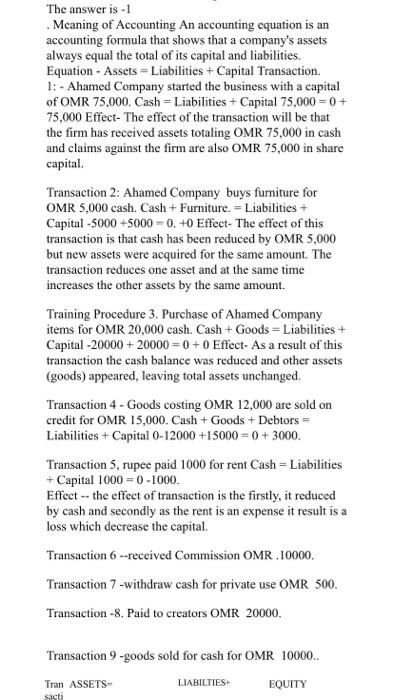

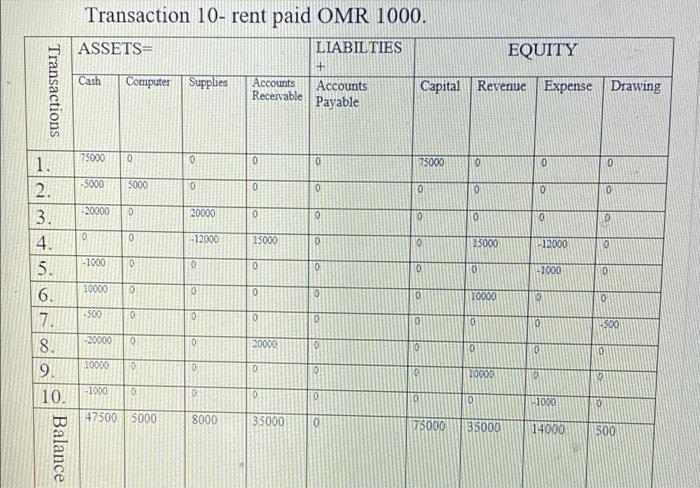

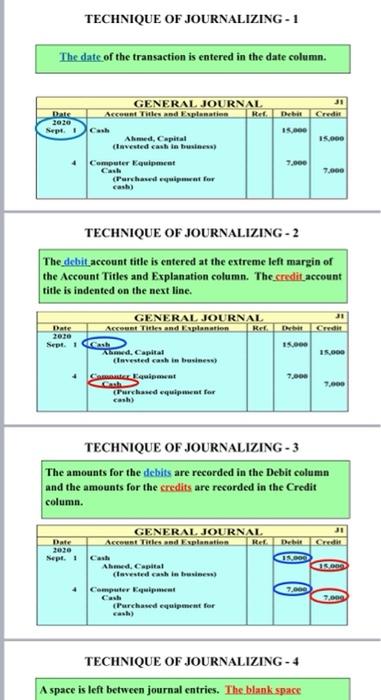

Q1. Select a business of your choice, write 10 different transactions for a month with imaginary figures. i) You are required to analyze the transactions and discuss the effects of the transaction in Accounting Equation. Also required to Show the effect of above transactions on accounting equation and prove the accounting equation at the end. (7.5 Marks) ii) You are required to discuss the journalizing process based on the double entry rules for all the 10 transactions. Also required to prepare the necessary journal entry for all 10 transactions. (7.5 Marks) The answer is - 1 Meaning of Accounting An accounting equation is an accounting formula that shows that a company's assets always equal the total of its capital and liabilities. Equation - Assets = Liabilities + Capital Transaction. 1:- Ahamed Company started the business with a capital of OMR 75.000. Cash Liabilities + Capital 75,000 = 0 + 75,000 Effect- The effect of the transaction will be that the firm has received assets totaling OMR 75,000 in cash and claims against the firm are also OMR 75,000 in share capital. Transaction 2: Ahamed Company buys furniture for OMR 5,000 cash. Cash + Furniture. = Liabilities + Capital -5000 +5000 = 0. +0 Effect- The effect of this transaction is that cash has been reduced by OMR 5,000 but new assets were acquired for the same amount. The transaction reduces one asset and at the same time increases the other assets by the same amount. Training Procedure 3. Purchase of Ahamed Company items for OMR 20,000 cash. Cash + Goods = Liabilities + Capital -20000 + 20000 = 0 + 0 Effect- As a result of this transaction the cash balance was reduced and other assets (goods) appeared, leaving total assets unchanged. Transaction 4 - Goods costing OMR 12,000 are sold on credit for OMR 15,000. Cash + Goods + Debtors = Liabilities + Capital 0-12000 +15000 = 0 + 3000. Transaction 5, rupee paid 1000 for rent Cash = Liabilities + Capital 1000 = 0 -1000. Effect -- the effect of transaction is the firstly, it reduced by cash and secondly as the rent is an expense it result is a loss which decrease the capital. Transaction 6 --received Commission OMR 10000. Transaction 7 -withdraw cash for private use OMR 500. Transaction-8. Paid to creators OMR 20000. Transaction 9 -goods sold for cash for OMR 10000.. LIABILTIES+ EQUITY Tran ASSETS- sacti Transaction 10- rent paid OMR 1000. ASSETS= LIABILTIES EQUITY + Cash Transactions Computer Supplies Accounts Receivable Accounts Payable Capital Revenue Expense Drawing 75000 0 0 0 0 75000 0 0 0 -5000 S000 0 0 0 0 0 0 0 -20000 0 20000 0 0 0 0 0 12000 15000 0 0 25000 12000 3 -1000 lololo 0 0 0 ol 0 -1000 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 0 10000 0 0 0 10000 -500 0 0 0 0 10 0 500 -20000 0 O 20000 O 0 10 0 0 10000 0 0 10000 0 -1000 10 0 0 0 0 11030 0 47500 3000 8000 35000 0 75000 35000 14000 500 Balance TECHNIQUE OF JOURNALIZING - 1 The date of the transaction is entered in the date column. GENERAL JOURNAL JI Dats Account Titles and Explanation Rele Credit 2020 Sept! Cash 15.000 Ahmed, Capital 15.000 clavested cash in business) 4 Computer Equipment 7.000 Cash 7.000 (Purchased it for cash) TECHNIQUE OF JOURNALIZING - 2 The_debit_account title is entered at the extreme left margin of the Account Titles and Explanation column. The credit account title is indented on the next line. 15.00 GENERAL JOURNAL Date Account Titles and Explanation Kerheit 2020 Sept. Ish 15.000 Ad Capital invested cash in business) Ce quipment 7.000 Purchased equipment for cash) 7.000 TECHNIQUE OF JOURNALIZING - 3 The amounts for the debits are recorded in the Debit column and the amounts for the credits are recorded in the Credit column. Date 2020 Sept. 1 GENERAL JOURNAL Account Titles pod Explanation RelDeCredit Cash TOOD Abd. Capital 15 (taxested cash intrusiness) Computer Equipment 7.000 7.000 (Purchased equipment for TECHNIQUE OF JOURNALIZING - 4 A space is left between journal entries. The blank space

Solve the second part only

Solve the second part only

same this

same this