Answered step by step

Verified Expert Solution

Question

1 Approved Answer

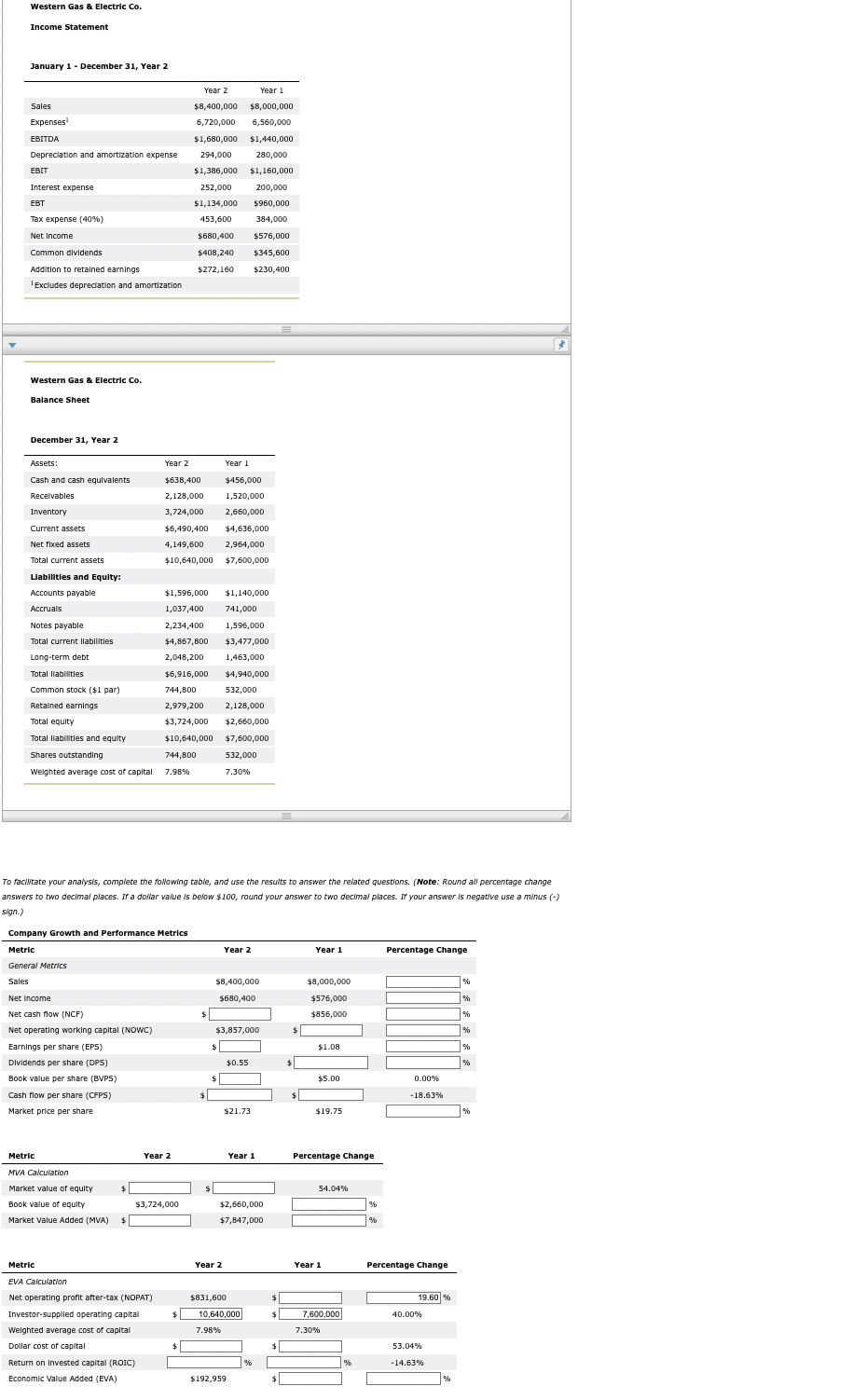

Solve the tables above and these questions: Using the change in Western G&E s EVA as the decision criterion, which type of investment recommendation should

Solve the tables above and these questions:

Using the change in Western G&Es EVA as the decision criterion, which type of investment recommendation should you make to your clients?

A buy recommendation

A sell recommendation

A hold recommendation

Which of the following statements are correct? Check all that apply.

For any given year, one way to compute Western G&Es EVA is as the difference between its NOPAT and the product of its operating capital and its weighted average cost of capital.

The percentage change in Western G&Es EVA indicates that management has decreased its value.

An increase in the number of common shares outstanding must increase the market value of the firms equity.

The percentage change in Western G&Es MVA indicates that its management has increased the firms value.

Western G&Es NCF is calculated by adding its annual interest expense to the corresponding years net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started