Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve the three scenarios and write which scenario Montague should pick. Think of what should the perspective of the Italian headquarters be. In addition, Montague

Solve the three scenarios and write which scenario Montague should pick. Think of what should the perspective of the Italian headquarters be. In addition, Montague has other options to manage currency changes. What other options does he have? If the exchange rate movement is permanent/temporary, what strategies are better?

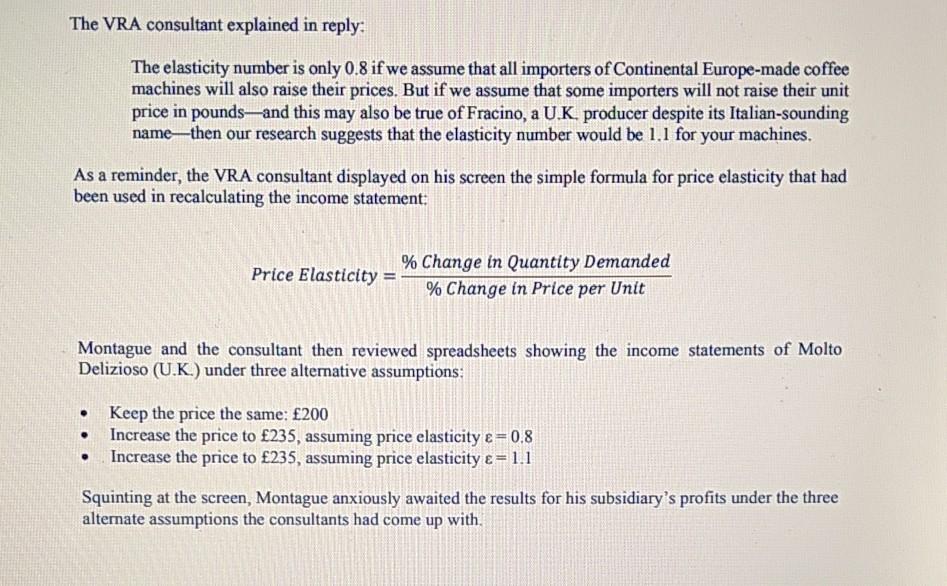

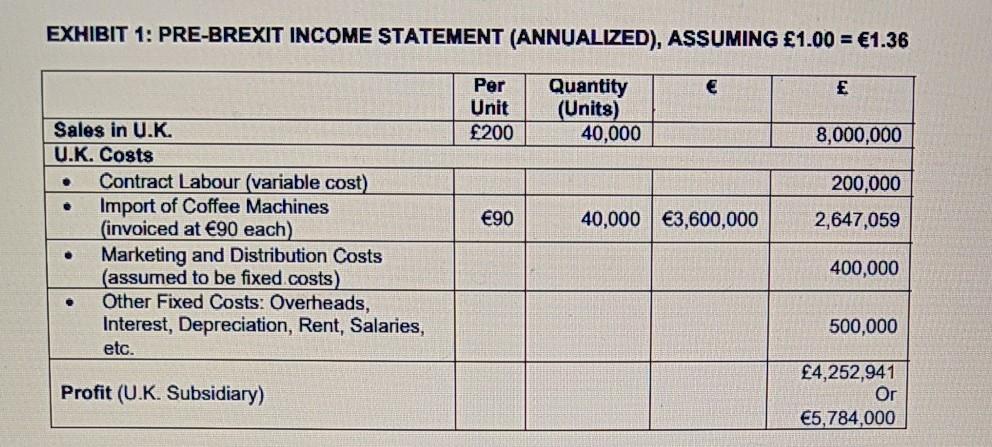

The VRA consultant explained in reply: The elasticity number is only 0.8 if we assume that all importers of Continental Europe-made coffee machines will also raise their prices. But if we assume that some importers will not raise their unit price in poundsand this may also be true of Fracino, a UK producer despite its Italian-sounding namethen our research suggests that the elasticity number would be 1.1 for your machines. As a reminder, the VRA consultant displayed on his screen the simple formula for price elasticity that had been used in recalculating the income statement: Price Elasticity = % Change in Quantity Demanded % Change in Price per Unit Montague and the consultant then reviewed spreadsheets showing the income statements of Molto Delizioso (U.K.) under three alternative assumptions: . Keep the price the same: 200 Increase the price to 235, assuming price elasticity e=0.8 Increase the price to 235, assuming price elasticity = 1.1 Squinting at the screen, Montague anxiously awaited the results for his subsidiary's profits under the three alternate assumptions the consultants had come up with, EXHIBIT 1: PRE-BREXIT INCOME STATEMENT (ANNUALIZED), ASSUMING 1.00 = 1.36 E Per Unit 200 Quantity (Units) 40,000 8,000,000 200,000 90 40,000 3,600,000 2,647,059 Sales in U.K. U.K. Costs Contract Labour (variable cost) Import of Coffee Machines (invoiced at 90 each) Marketing and Distribution Costs (assumed to be fixed costs) Other Fixed Costs: Overheads, Interest, Depreciation, Rent, Salaries, etc . 400,000 . 500,000 Profit (U.K. Subsidiary) 4,252,941 Or 5,784,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started