Answered step by step

Verified Expert Solution

Question

1 Approved Answer

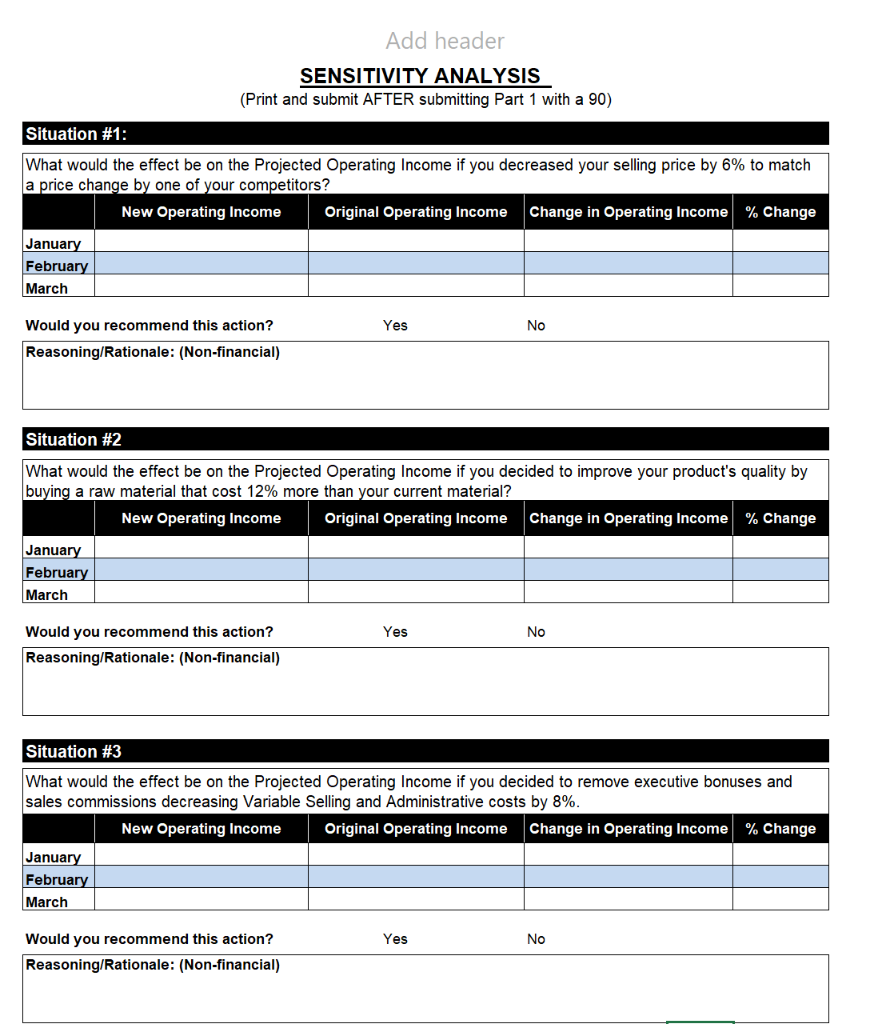

Solve the three situations in the sensitivity analysis and SHOW STEP-BY-STEP WORK PLEASE THE PROJECTED INCOME STATEMENT IS FOR REFERENCE NOT TO SOLVE. Add header

Solve the three situations in the sensitivity analysis and SHOW STEP-BY-STEP WORK PLEASE

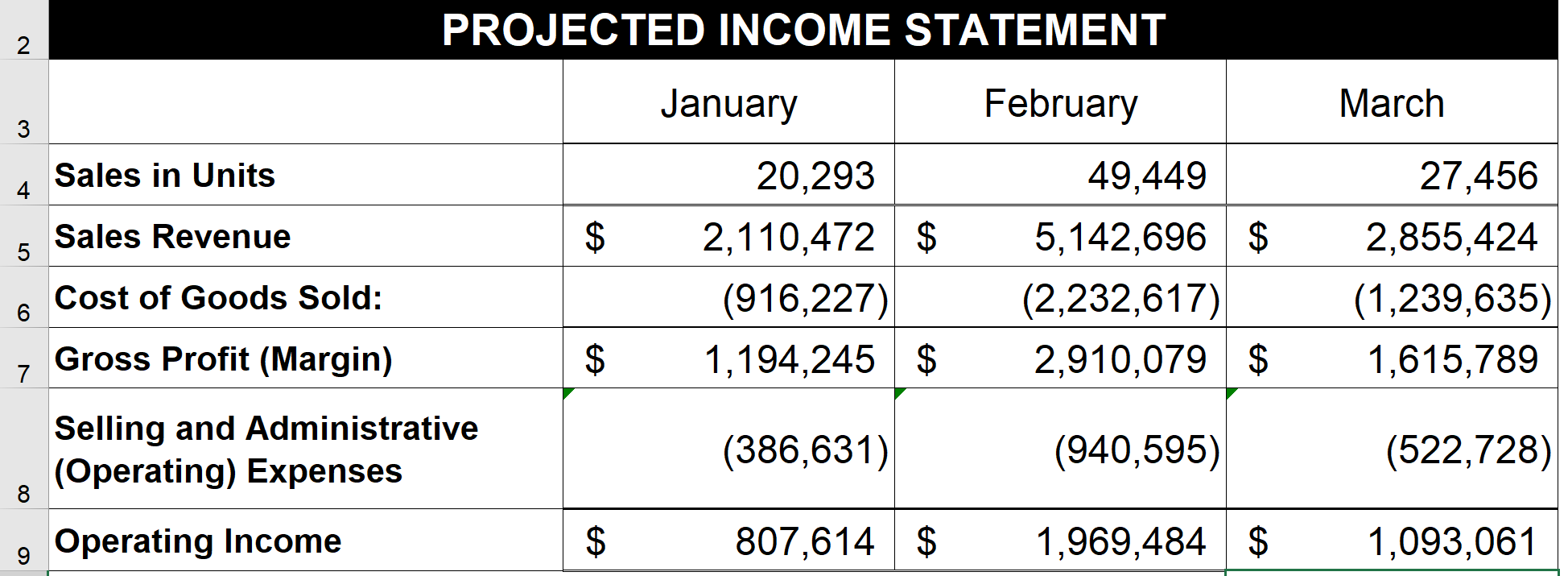

THE PROJECTED INCOME STATEMENT IS FOR REFERENCE NOT TO SOLVE.

Add header SENSITIVITY ANALYSIS (Print and submit AFTER submitting Part 1 with a 90) Situation #1: What would the effect be on the Projected Operating Income if you decreased your selling price by 6% to match a price change by one of your competitors? New Operating Income Original Operating Income Change in Operating Income % Change January February March Yes No Would you recommend this action? Reasoning/Rationale: (Non-financial) Situation #2 What would the effect be on the Projected Operating Income if you decided to improve your product's quality by buying a raw material that cost 12% more than your current material? New Operating Income Original Operating Income Change in Operating Income % Change January February March Yes No Would you recommend this action? Reasoning/Rationale: (Non-financial) Situation #3 What would the effect be on the Projected Operating Income if you decided to remove executive bonuses and sales commissions decreasing Variable Selling and Administrative costs by 8%. New Operating Income Original Operating Income Change in Operating Income % Change January February March Yes No Would you recommend this action? Reasoning/Rationale: (Non-financial) PROJECTED INCOME STATEMENT 2 January February March 3 Sales in Units 4 Sales Revenue $ 5 20,293 2,110,472 $ (916,227) 1,194,245 $ 49,449 5,142,696 $ (2,232,617) 2,910,079 $ 27,456 2,855,424 (1,239,635) 1,615,789 Cost of Goods Sold: 6 Gross Profit (Margin) $ 7 Selling and Administrative (Operating) Expenses (386,631) (940,595) (522,728) 8 Operating Income $ 807,614 $ 1,969,484 $ 1,093,061 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started