Solve These:-

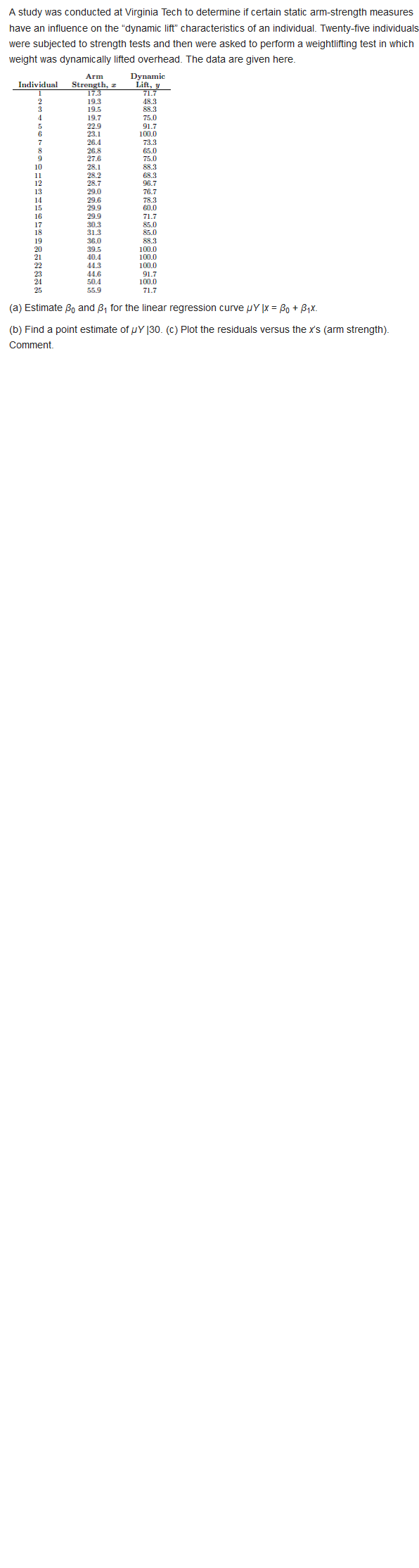

A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsA crashing machine that is a basic component of a metal recycling operation is wearing out faster than expected. The machine was purchased 2 years ago for $400,000. At that time, the buyer thought the machine would serve its needs for at least 5 years, at which time the machine would be sold to a smaller independent recycler for $30,000. Now, however, the company thinks the market value of the diminished machine is only $50,000. If it is kept, the machine's operating cost will be $37,000 per year for the next 2 years, after which it will be scrapped for $1000. If it is kept for only 1 year, the market value is estimated to be $10,000. Altema- tively, the company can of nice the process now for a fixed cost of $56,000 per year. At an interest rate of 10%% per year, should the company continue with the current machine or o arce the process? The data associated with operating and maintain- ing an asset are shown below. The company man- ager has already decided to keep the machine for I more year (ie., until the end of year 1), but you have been asked to determine the cost of keeping it more year after that. At an interest rate of 10% ber year, estimate the AW of keeping the machine from year I to year 2. Operating Cost. Year Market Value, $ $ per Year 30,000 -15,000 25,000 -15,000 14,000 -15,000 10,000 -15,000BinHealth, a biodevice systems leasing company, is considering a new equipment purchase to re- place a currently owned asset that was purchased 2 years ago for $250,000, It is appraised at a cur- rent market value of only $50,000. An upgrade is possible for $200,000 now that would be adequate for another 3 years of lease rights, after which the entire system could be sold on the international circuit for an estimated $40,000. The challenger, which can be purchased for $300,000, has an ex- pected life of 10 years and a $50,000 salvage value. Determine whether the company should up- grade or replace at a MARR of 12%% per year. As- summe the AOC estimates are the same for both alternatives. For the estimates in Problem 11.30, use a spreadsheet-based analysis to determine the first cost for the augmentation of the current system that will make the defender and challenger break even. Is this a maximum of minimum for the up- grade, if the current system is to be retained? Herald Richter and Associates, 3 years ago, pur- chased for $45,000 a microwave signal graphical plotter for corrosion detection in concrete struce bores. It is expected to have the market values and annual operating costs shown below for its rc- maining usefial life of up to 3 years. It could be traded now at an appraised market value of $8000. Market Value AOC at End of Year, $ $ per Year 6000 -50,000 4000 DOO'ES A replacement plotter with new Internet-based, digital technology costing $125,000 has an esti- mated $10,000 salvage value after its 3-year life and an AOC of $31,000 per year. At an interest rate of 15%% per year, determine how many more years\f\f