Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve these Essay Questions Question 1(2 points) The ABC company wants to invest in two risky assets over the next 12 months. Analysts predict that

solve these

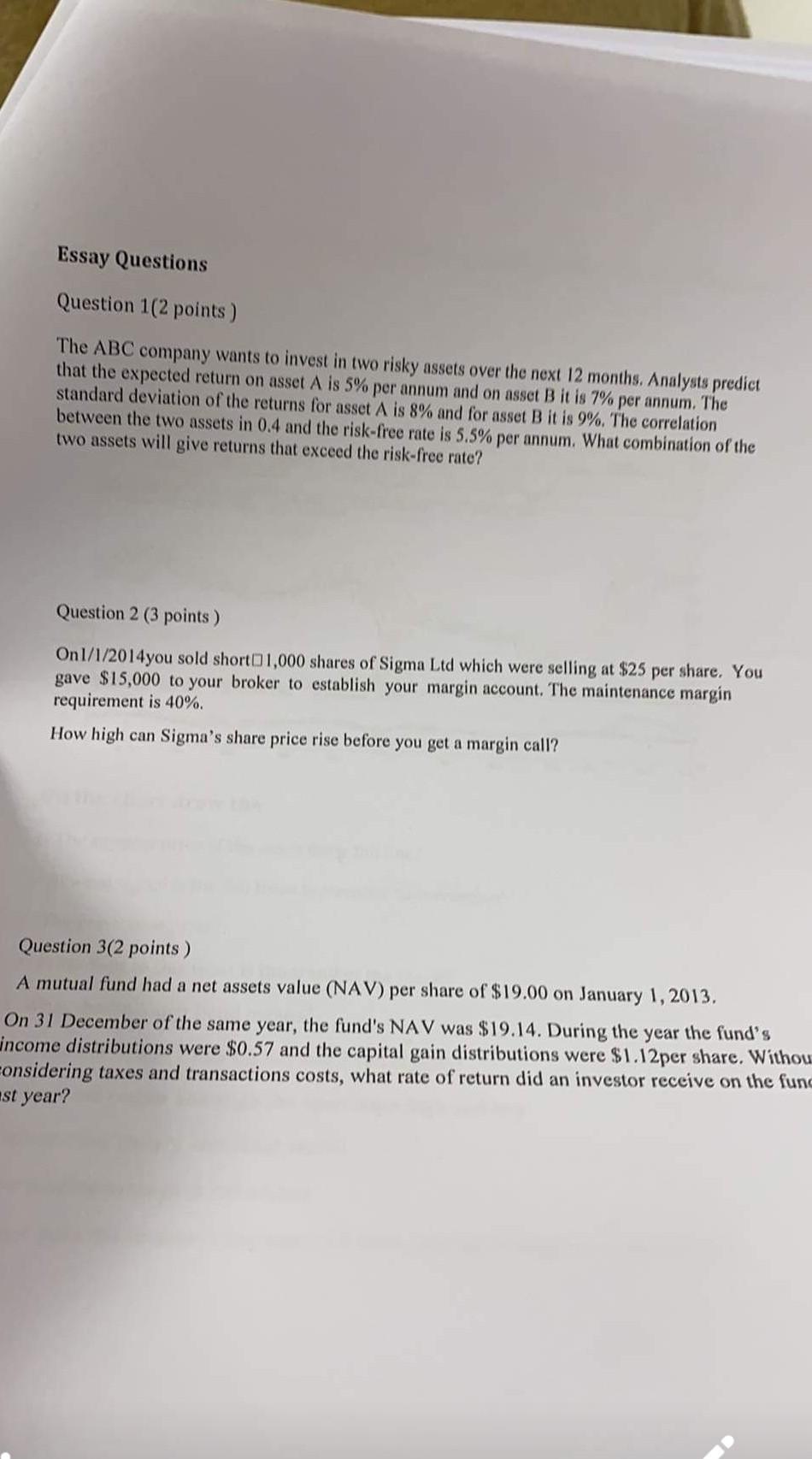

Essay Questions Question 1(2 points) The ABC company wants to invest in two risky assets over the next 12 months. Analysts predict that the expected return on asset A is 5% per annum and on B it is 7% per annum. The standard deviation of the returns for asset A is 8% and for asset B it is 9%. The correlation between the two assets in 0.4 and the risk-free rate is 5.5% per annum. What combination of the two assets will give returns that exceed the risk-free rate? Question 2 (3 points) On1/1/2014you sold short1,000 shares of Sigma Ltd which were selling at $25 per share. You gave $15,000 to your broker to establish your margin account. The maintenance margin requirement is 40%. How high can Sigma's share price rise before you get a margin call? Question 3(2 points) A mutual fund had a net assets value (NAV) per share of $19.00 on January 1, 2013. On 31 December of the same year, the fund's NAV was $19.14. During the year the fund's income distributions were $0.57 and the capital gain distributions were $1.12per share. Withou considering taxes and transactions costs, what rate of return did an investor receive on the func ast yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started