solve these problems:-

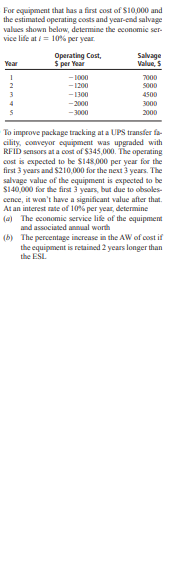

A machine that cost $120,000 three years ago can be sold now for $34,000. Its market value for the next 2 years is expected to be $40,000 and $20,000 one year and 2 years from now, respectively. Its operating cost was $18,000 for the first 3 years of its life, but the M&( cost is expected to be $23,000 for the next 2 years. A new improved ma- chine that can be purchased for $138,000 will have an economic life of 5 years, an operating cost of $9000 per year, and a salvage value of $32,000 after 5 years. At an interest rate of 10% per year, determine if the presently owned ma- chine should be replaced now, I year from now, or 2 years from now. The projected market value and MA( costs asso- ciated with a presently owned machine are shown (next page). An outside vendor of services has of- fered to provide the service of the existing ma- chine at a fixed price per year. If the presently owned machine is replaced now, the cost of the fixed-price contract will be $33,000 for each of the next 3 years. If the presently owned machine isIn 2008, Amphenol Industrial purchased a new quality inspection system for $530,000. The esti- mated salvage value was $30,000 after 8 years. Currently the expected remaining life is 3 years with an AOC of $27,000 per year and an estimated salvage value of $30,000. The new president has recommended early replacement of the system with one that costs $400,000 and has a 5-year economic service life, a $45,000 salvage value, and an estimated AOC of $50,000 per year. If the MARR for the corporation is 12% per year, find the minimum trade-in value now necessary to make the president's re economically advantageous A CNC milling machine purchased by Proto Tool and Die 10 years ago for $75,000 can be used for } more years. Estimates are an annual operating cost of $63,000 and a salvage value of $25,000. A chal- longer will cost $130,000 with an economic life of 6 years and an operating cost of $32,000 per year Its salvage value will be $45,000. On the basis of\fFor equipment that has a first cost of $10 000 and the estimated operating costs and year-end salvage values shown below, determine the economic ser- vice life at f = 10% per year Operating Cost, Salvage Year $ per Year Value, $ - 1030 7000 - 1700 5000 - 1300 4500 -2000 3000 2000 To improve package tracking at a UPS transfer fa- cility, conveyor equipment was upgraded with RFID sensors at a cost of $345,000. The operating cost is expected to be $148 000 per year for the first 3 years and $210,000 for the next 3 years. The salvage value of the equipment is expected to be $140,000 for the first 3 years, but due to obsoles- cence, it won't have a significant value after that. At an interest rate of 10% per year, determine (al The economic service life of the equipment and associated annual worth (b) The percentage increase in the AW of cost if the equipment is retained 2 years longer than the ESL