Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve these questions please Problem 7-2A Determine the acquisition cost of equipment (L07-1) Great Harvest Bakery purchased bread ovens from New Morning Bakery, New Morning

solve these questions please

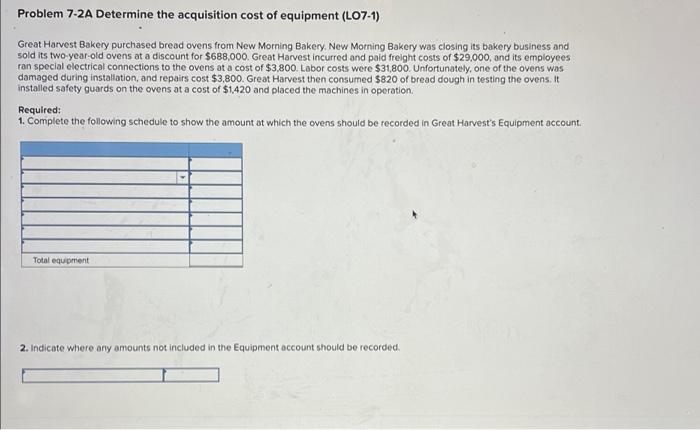

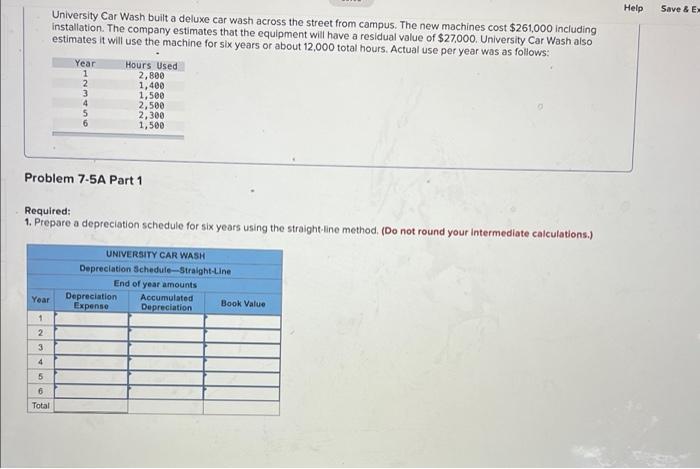

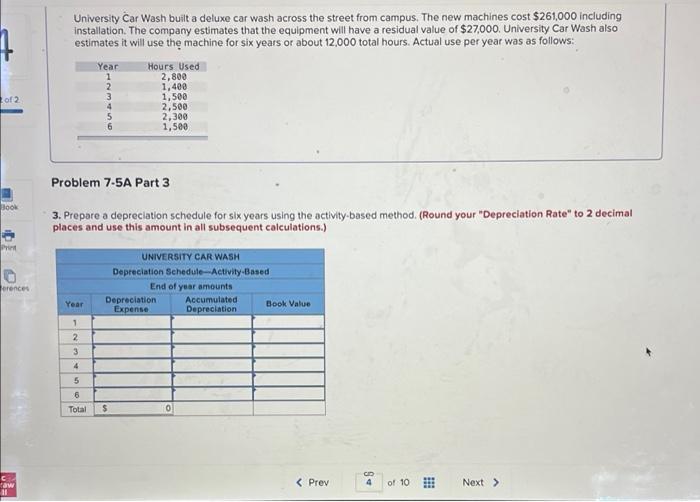

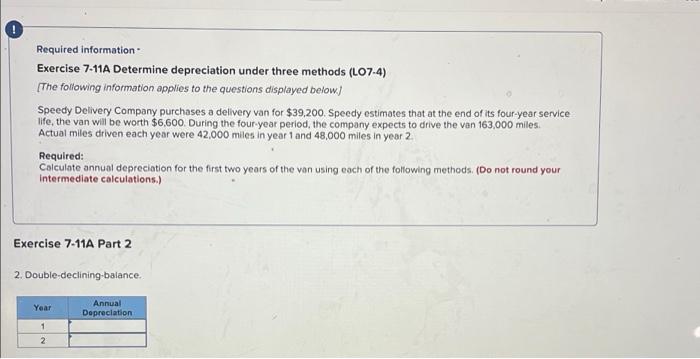

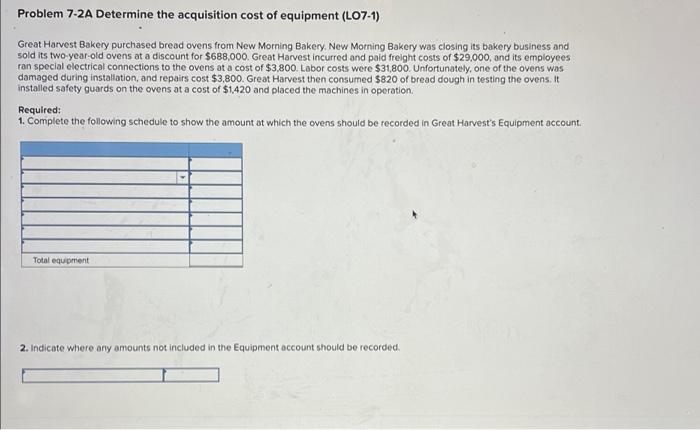

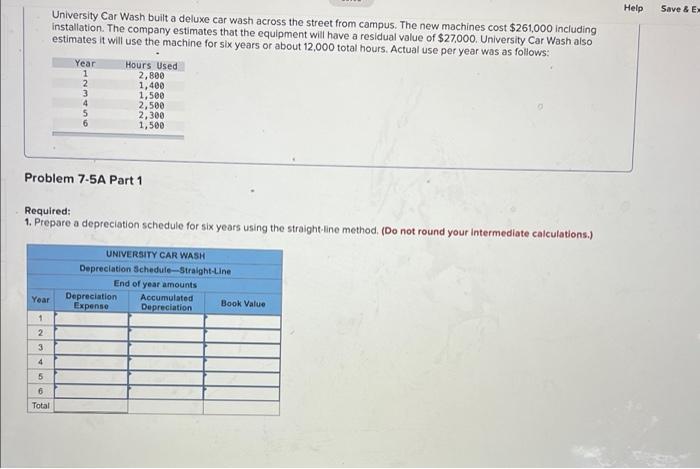

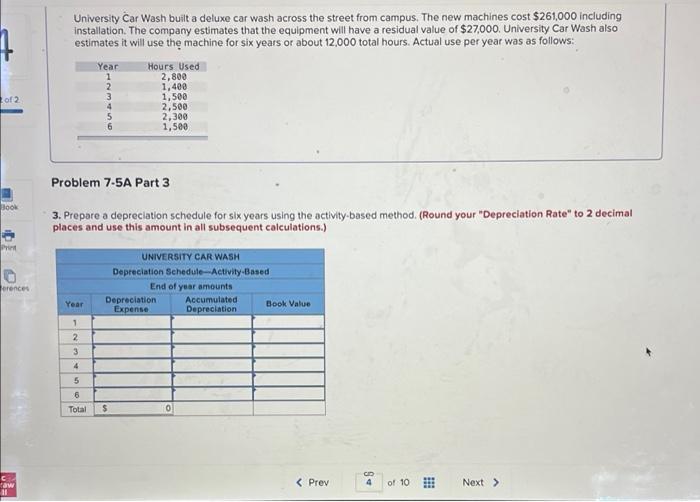

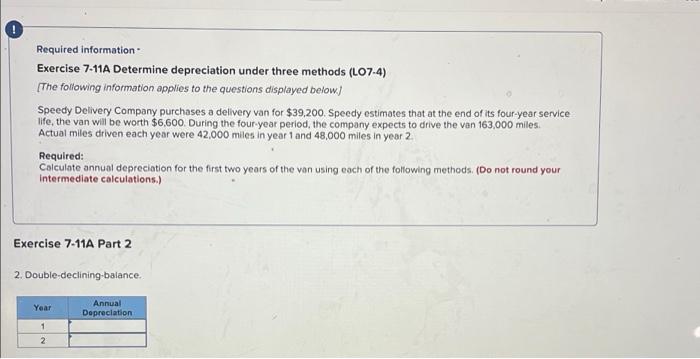

Problem 7-2A Determine the acquisition cost of equipment (L07-1) Great Harvest Bakery purchased bread ovens from New Morning Bakery, New Morning Bakery was closing its bakery business and sold its two-year-old ovens at a discount for $688,000. Great Harvest incurred and paid freight costs of $29,000, and its employees ran special electrical connections to the ovens at a cost of $3,800. Labor costs were $31,800. Unfortunately, one of the ovens was damaged during installation, and repairs cost $3,800. Great Harvest then consumed $820 of bread dough in testing the ovens. It installed safety guards on the ovens at a cost of $1.420 and placed the machines in operation Required: 1. Complete the following schedule to show the amount at which the ovens should be recorded in Great Harvest's Equipment account. Total equipment 2. Indicate where any amounts not included in the Equipment account should be recorded. Help Save & E University Car Wash built a deluxe car wash across the street from campus. The new machines cost $261,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Year Hours Used 1 2,800 2 1,400 3 1,500 2,500 5 2,300 6 1,500 OWN 4 Problem 7.5A Part 1 Required: 1. Prepare a depreciation schedule for six years using the straight line method. round your Intermediate calculations.) UNIVERSITY CAR WASH Depreciation Schedule--Straight-Line End of year amounts Depreciation Accumulated Book Value Expense Depreciation Yoar 1 2 3 4 5 6 Total University Car Wash built a deluxe car wash across the street from campus. The new machines cost $261,000 including Installation. The company estimates that the equipment will have a residual value of $27,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Year Hours Used 2,800 1,400 1,500 2,500 2,300 1,500 2 of 2 4 Problem 7-5A Part 3 Book P 3. Prepare a depreciation schedule for six years using the activity-based method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations.) UNIVERSITY CAR WASH Depreciation Schedule-Activity-Based End of year amounts Depreciation Expense Depreciation erences Year Accumulated Book Value 1 2 3 4 5 6 Total $ 0 C aw 11 Required information Exercise 7-11A Determine depreciation under three methods (L07.4) [The following information applies to the questions displayed below) Speedy Delivery Company purchases a delivery van for $39,200 Speedy estimates that at the end of its four-year service life, the van will be worth $6,600. During the four year period, the company expects to drive the van 163,000 miles Actual miles driven each year were 42,000 miles in year 1 and 48,000 miles in year 2 Required: Calculate annual depreciation for the first two years of the von using each of the following methods. (Do not round your intermediate calculations.) Exercise 7-11A Part 2 2. Double-declining balance Year Annual Depreciation 1 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started