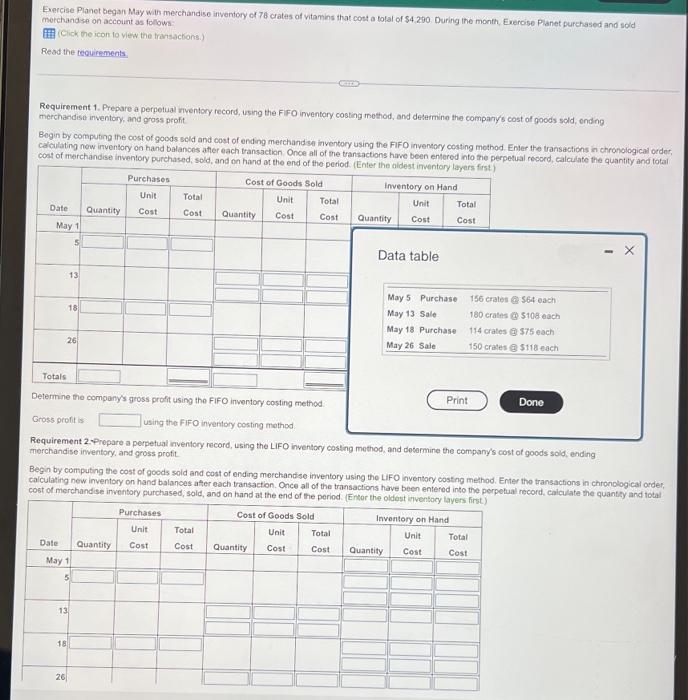

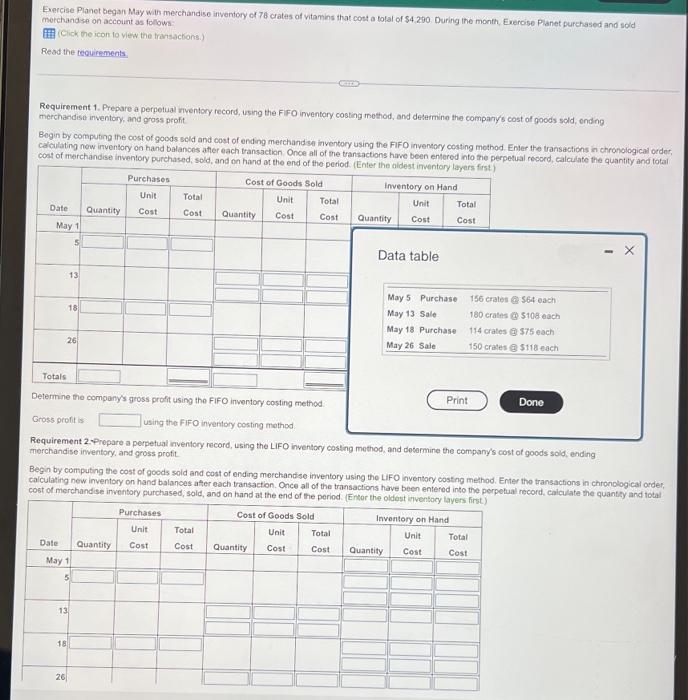

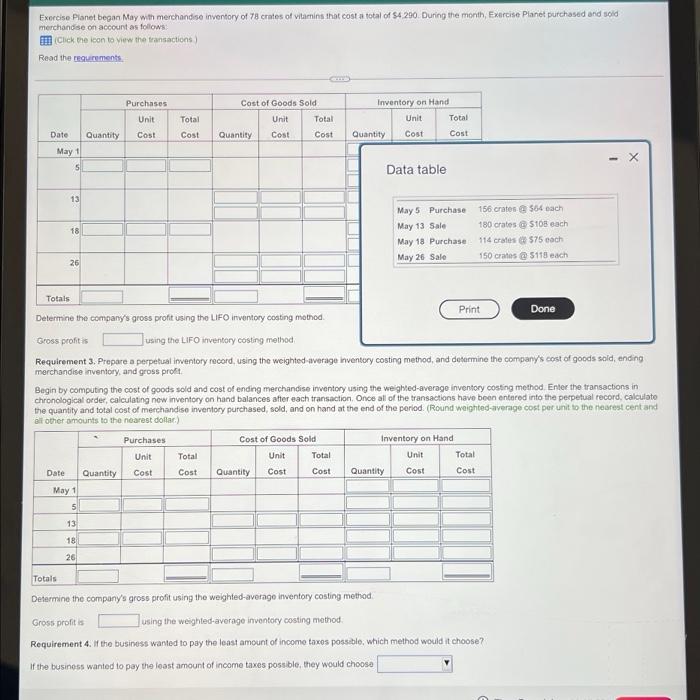

Exercise Planet began May with merchandise inventory of 78 crates of vitamins that cost a total of $4.290. During the month, Exercise Planet purchased and sold merchandise on account as follows: (Click the icon to view the transactions.) Read the requirements. Requirement 1. Prepare a perpetual inventory record, using the FIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit Begin by computing the cost of goods sold and cost of ending merchandise inventory using the FIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) Purchases Inventory on Hand Unit Cost of Goods Sold Total Unit Cost Quantity Cost Total Unit Date Quantity Cost Total Cost Cost Quantity Cost May 1 5 Data table May 5 Purchase May 13 Sale 156 crates @ $64 each 180 crates@ $108 each May 18 Purchase 114 crates @ $75 each 150 crates @ $118 each May 26 Sale Totals Determine the company's gross profit using the FIFO inventory costing method Print Done Gross profit is using the FIFO inventory costing method Requirement 2. Prepare a perpetual inventory record, using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the LIFO inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first) Purchases Cost of Goods Sold Inventory on Hand Unit Unit Total Unit Total Total Cost Date Quantity Cost Cost Cost Quantity Cost Cost 13 18 26 May 1 5 13 18 26 Quantity Exercise Planet began May with merchandise inventory of 78 crates of vitamins that cost a total of $4.290. During the month, Exercise Planet purchased and sold merchandise on account as follows: (Click the icon to view the transactions) Read the requirements Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Unit Cost Date Quantity Cost Cost Quantity Quantity Cost May 1 May 5 Purchase May 13 Sale 156 crates @ $64 each 180 crates $108 each May 18 Purchase 114 crates $75 each May 26 Sale 150 crates@ $118 each Totals Print Done Determine the company's gross profit using the LIFO inventory costing method. Gross profit is using the LIFO inventory costing method Requirement 3. Prepare a perpetual inventory record, using the weighted-average inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. Begin by computing the cost of goods sold and cost of ending merchandise inventory using the weighted-average inventory costing method. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Round weighted-average cost per unit to the nearest cent and all other amounts to the nearest dollar) Purchases Unit Total Cost Cost of Goods Sold Unit Total Quantity Cost Cost Inventory on Hand Unit Quantity Cost Total Cost Date Cost Quantity 5 13 18 26 Totals Determine the company's gross profit using the weighted-average inventory costing method. Gross profit is using the weighted-average inventory costing method. Requirement 4. If the business - to pay the least amount of income taxes possible, which method would it choose? If the business wanted to pay the least amount of income taxes possible, they would choose 51 13 26 May 1 Total Cost Data table Total Cost X