Answered step by step

Verified Expert Solution

Question

1 Approved Answer

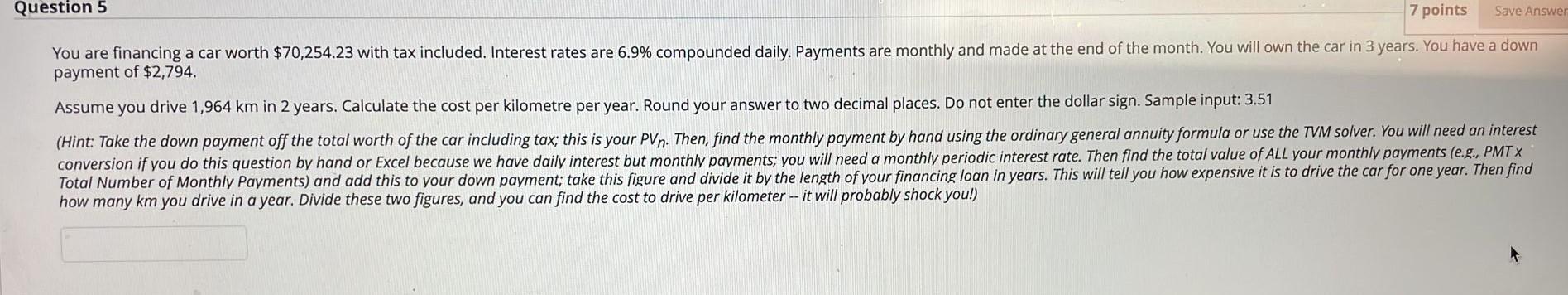

solve this asap Save Answer Question 5 7 points You are financing a car worth $70,254.23 with tax included. Interest rates are 6.9% compounded daily.

solve this asap

Save Answer Question 5 7 points You are financing a car worth $70,254.23 with tax included. Interest rates are 6.9% compounded daily. Payments are monthly and made at the end of the month. You will own the car in 3 years. You have a down payment of $2,794. Assume you drive 1,964 km in 2 years. Calculate the cost per kilometre per year. Round your answer to two decimal places. Do not enter the dollar sign. Sample input: 3.51 (Hint: Take the down payment off the total worth of the car including tax; this is your PVn. Then, find the monthly payment by hand using the ordinary general annuity formula or use the TVM solver. You will need an interest conversion if you do this question by hand or Excel because we have daily interest but monthly payments; you will need a monthly periodic interest rate. Then find the total value of ALL your monthly payments (e.g., PMTX Total Number of Monthly Payments) and add this to your down payment; take this figure and divide it by the length of your financing loan in years. This will tell you how expensive it is to drive the car for one year. Then find how many km you drive in a year. Divide these two figures, and you can find the cost to drive per kilometer -- it will probably shock you!)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started