Answered step by step

Verified Expert Solution

Question

1 Approved Answer

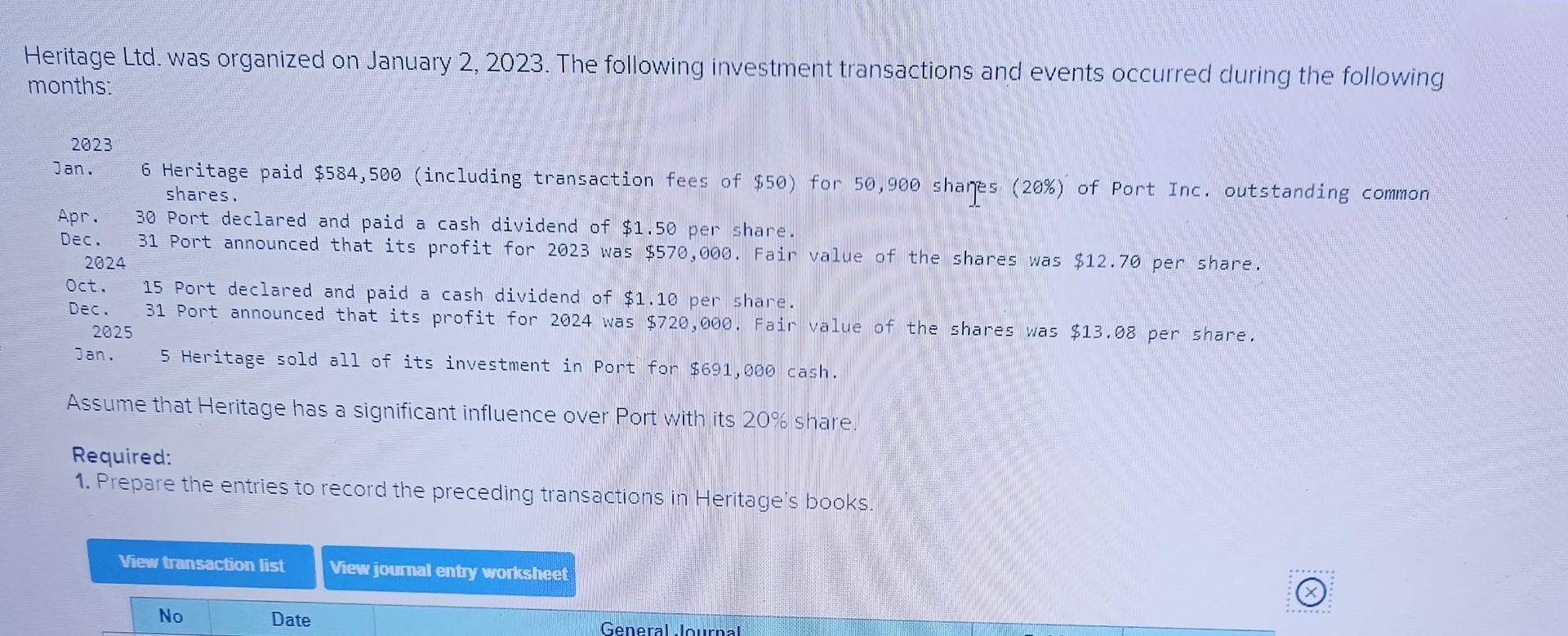

Solve this asap...I will be right back Heritage Ltd. was organized on January 2, 2023. The following investment transactions and events occurred during the following

Solve this asap...I will be right back

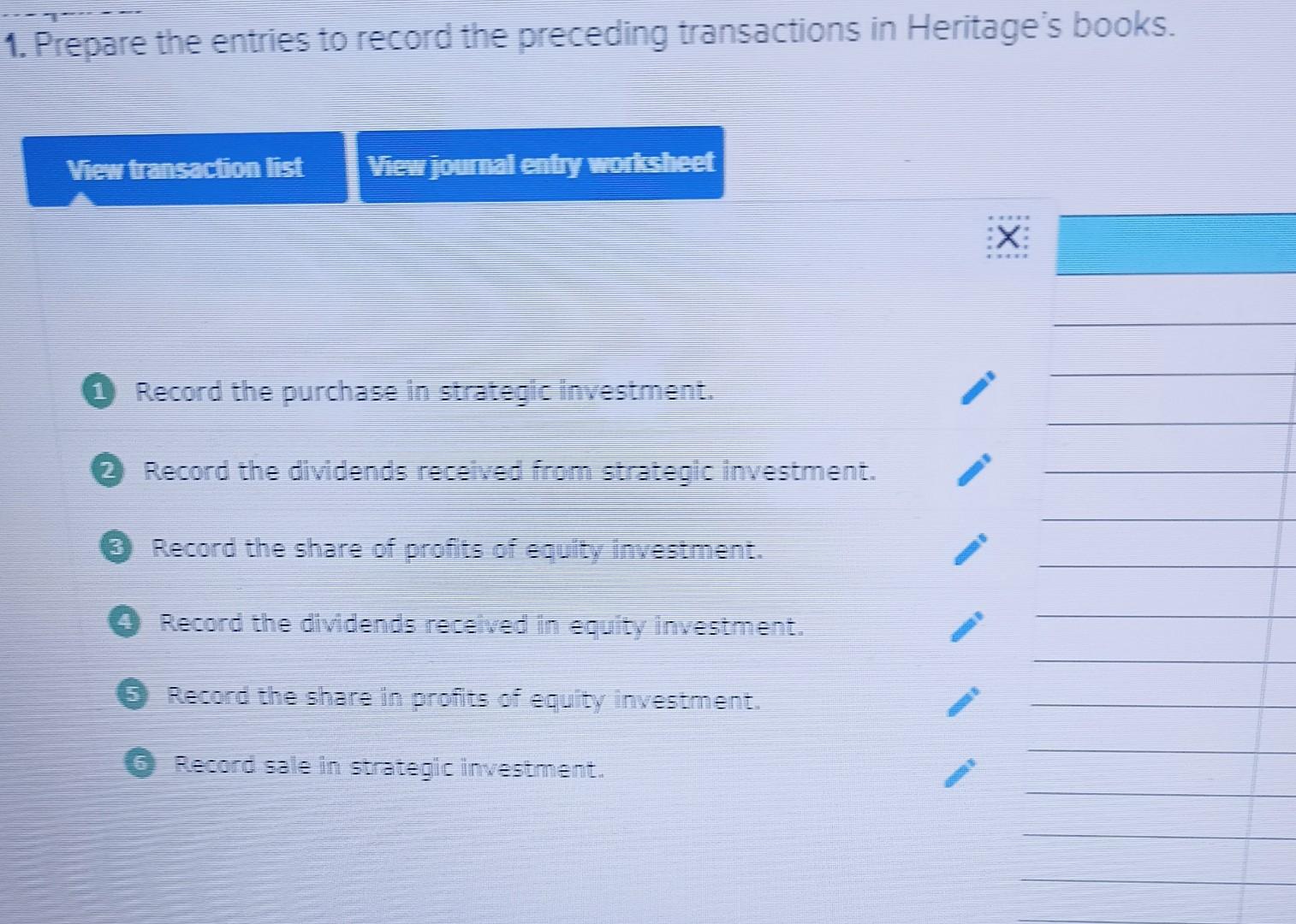

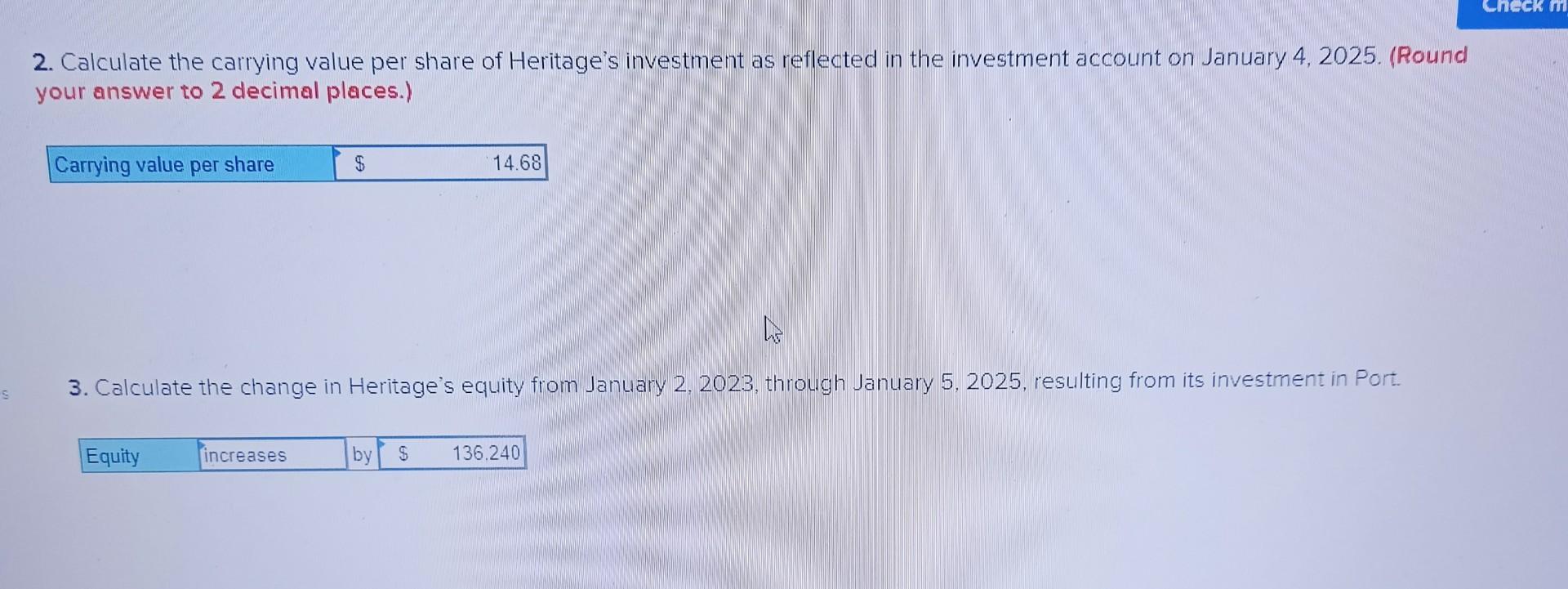

Heritage Ltd. was organized on January 2, 2023. The following investment transactions and events occurred during the following months: 2023 Jan. 6 Heritage paid \\( \\$ 584,500 \\) (including transaction fees of \\( \\$ 50 \\) ) for 50,900 shares (20\\%) of Port Inc. outstanding common shares. Apr. 30 Port declared and paid a cash dividend of \\( \\$ 1.50 \\) per share. Dec. 31 Port announced that its profit for 2023 was \\( \\$ 570,000 \\). Fair value of the shares was \\( \\$ 12.70 \\) per share. 2024 oct. 15 Port declared and paid a cash dividend of \\( \\$ 1.10 \\) per share. Dec. 31 Port announced that its profit for 2024 was \\( \\$ 720,000 \\). Fair value of the shares was \\( \\$ 13.08 \\) per share. 2025 Heritage sold all of its investment in Port for \\( \\$ 691,000 \\) cash. Assume that Heritage has a significant influence over Port with its \20 share. Required: 1. Prepare the entries to record the preceding transactions in Heritage's books. Prepare the entries to record the preceding transactions in Heritage's books. Record the purchase in strategic investment. Record the dividends recelved from strategic investment. Record the share of profits of equity investment. Record the dividends received in equity investment. Record the shara in profits of equity investment. Record sale in strategic investment. 2. Calculate the carrying value per share of Heritage's investment as reflected in the investment account on January 4, 2025. (Round your answer to 2 decimal places.) 3. Calculate the change in Heritage's equity from January 2, 2023, through January 5, 2025, resulting from its investment in PortStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started