solve this case:)

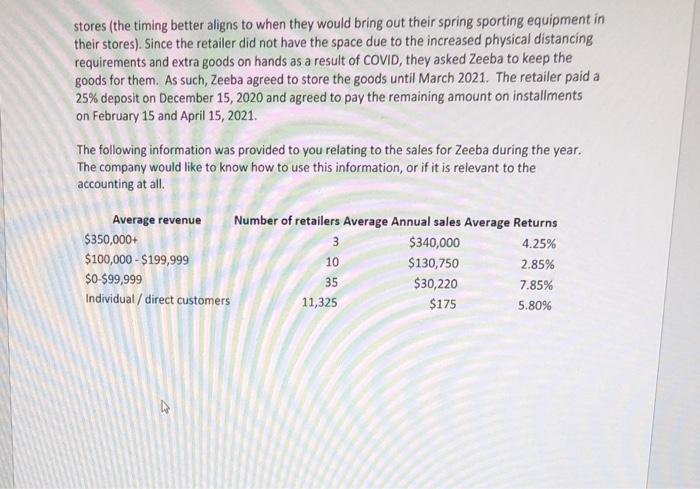

Zeeba is a Canadian manufacturer of a bikes, scooters and skateboards. Zeeba is currently owned and operated by two individuals Shayleigh Rose and Chris Wong. Historically Zeeba only sold its products to large retailers. However, in the last year Zeeba piloted a new sales model where they were able to sell products direct to customers through Amazon The owners of Zeeba have recently been in talks with another large manufacturing company that is looking to invest $2.25 million into the company in exchange for a 30% ownership stake. This partnership will allow Zeeba to move into the U.S. market and expand their distribution channels. As a result, Zeeba has been trying to ensure that they have a strong set of financial statements. The company has been aggressively trying to both improve their bottom line, and to show revenue growth. You currently work in the accounting department of Zeeba and have been asked that you prepare the preliminary analysis of some new contracts that they company entered into during the year. This information will be presented to the owners and new management at the next meeting around the purchase. All the information will be used to determine an appropriate price for the business. It has not yet decided if revenue or net income will be used as a base for the purchase price . Zeeba spent a considerable amount of money when negotiating the new online direct to customer process. The following items were expensed in the period: $64,500 - costs spent on the new procurement system, including testing and integration. These costs were needed in order to allow the company to create a seamless ordering process $32,000 - legal costs incurred on the proposal $5,500-othe costs incurred relating to meetings, travel and reimbursing expenses incurred by Shayleigh and Chris The money was considered well spent as a contract was secured with Amazon in April. Zeeba has already seen an improvement in their sales. . As part of the agreement with Amazon and a requirement of their agreement, Zeeba charges a SS shipping fee on all orders. Amazon requires that this fee be charged and remitted to them. Zeeba records this amount along with the sale price of the products sold. Then, they include the line item as "shipping expense" since the full amount is remitted back to Amazon In November 2020, Zeeba secured its largest corporate sale to date. A large retailer purchased $1.2 million of bikes and scooters. One stipulation of the sale, was the requirement to hold the order in Zeeba's warehouse until February. In February, Zeeba would ship the products to the retailers warehouse and then they would distribute it across the country to the respective stores (the timing better aligns to when they would bring out their spring sporting equipment in their stores). Since the retailer did not have the space due to the increased physical distancing requirements and extra goods on hands as a result of COVID, they asked Zeeba to keep the goods for them. As such, Zeeba agreed to store the goods until March 2021. The retailer paid a 25% deposit on December 15, 2020 and agreed to pay the remaining amount on installments on February 15 and April 15, 2021. The following information was provided to you relating to the sales for Zeeba during the year. The company would like to know how to use this information, or if it is relevant to the accounting at all. Average revenue Number of retailers Average Annual sales Average Returns $350,000+ 3 $340,000 4.25% $100,000 - $199,999 10 $130,750 2.85% $0-$99,999 35 $30,220 7.85% Individual / direct customers 11,325 $175 5.80% Zeeba is a Canadian manufacturer of a bikes, scooters and skateboards. Zeeba is currently owned and operated by two individuals Shayleigh Rose and Chris Wong. Historically Zeeba only sold its products to large retailers. However, in the last year Zeeba piloted a new sales model where they were able to sell products direct to customers through Amazon The owners of Zeeba have recently been in talks with another large manufacturing company that is looking to invest $2.25 million into the company in exchange for a 30% ownership stake. This partnership will allow Zeeba to move into the U.S. market and expand their distribution channels. As a result, Zeeba has been trying to ensure that they have a strong set of financial statements. The company has been aggressively trying to both improve their bottom line, and to show revenue growth. You currently work in the accounting department of Zeeba and have been asked that you prepare the preliminary analysis of some new contracts that they company entered into during the year. This information will be presented to the owners and new management at the next meeting around the purchase. All the information will be used to determine an appropriate price for the business. It has not yet decided if revenue or net income will be used as a base for the purchase price . Zeeba spent a considerable amount of money when negotiating the new online direct to customer process. The following items were expensed in the period: $64,500 - costs spent on the new procurement system, including testing and integration. These costs were needed in order to allow the company to create a seamless ordering process $32,000 - legal costs incurred on the proposal $5,500-othe costs incurred relating to meetings, travel and reimbursing expenses incurred by Shayleigh and Chris The money was considered well spent as a contract was secured with Amazon in April. Zeeba has already seen an improvement in their sales. . As part of the agreement with Amazon and a requirement of their agreement, Zeeba charges a SS shipping fee on all orders. Amazon requires that this fee be charged and remitted to them. Zeeba records this amount along with the sale price of the products sold. Then, they include the line item as "shipping expense" since the full amount is remitted back to Amazon In November 2020, Zeeba secured its largest corporate sale to date. A large retailer purchased $1.2 million of bikes and scooters. One stipulation of the sale, was the requirement to hold the order in Zeeba's warehouse until February. In February, Zeeba would ship the products to the retailers warehouse and then they would distribute it across the country to the respective stores (the timing better aligns to when they would bring out their spring sporting equipment in their stores). Since the retailer did not have the space due to the increased physical distancing requirements and extra goods on hands as a result of COVID, they asked Zeeba to keep the goods for them. As such, Zeeba agreed to store the goods until March 2021. The retailer paid a 25% deposit on December 15, 2020 and agreed to pay the remaining amount on installments on February 15 and April 15, 2021. The following information was provided to you relating to the sales for Zeeba during the year. The company would like to know how to use this information, or if it is relevant to the accounting at all. Average revenue Number of retailers Average Annual sales Average Returns $350,000+ 3 $340,000 4.25% $100,000 - $199,999 10 $130,750 2.85% $0-$99,999 35 $30,220 7.85% Individual / direct customers 11,325 $175 5.80%