Answered step by step

Verified Expert Solution

Question

1 Approved Answer

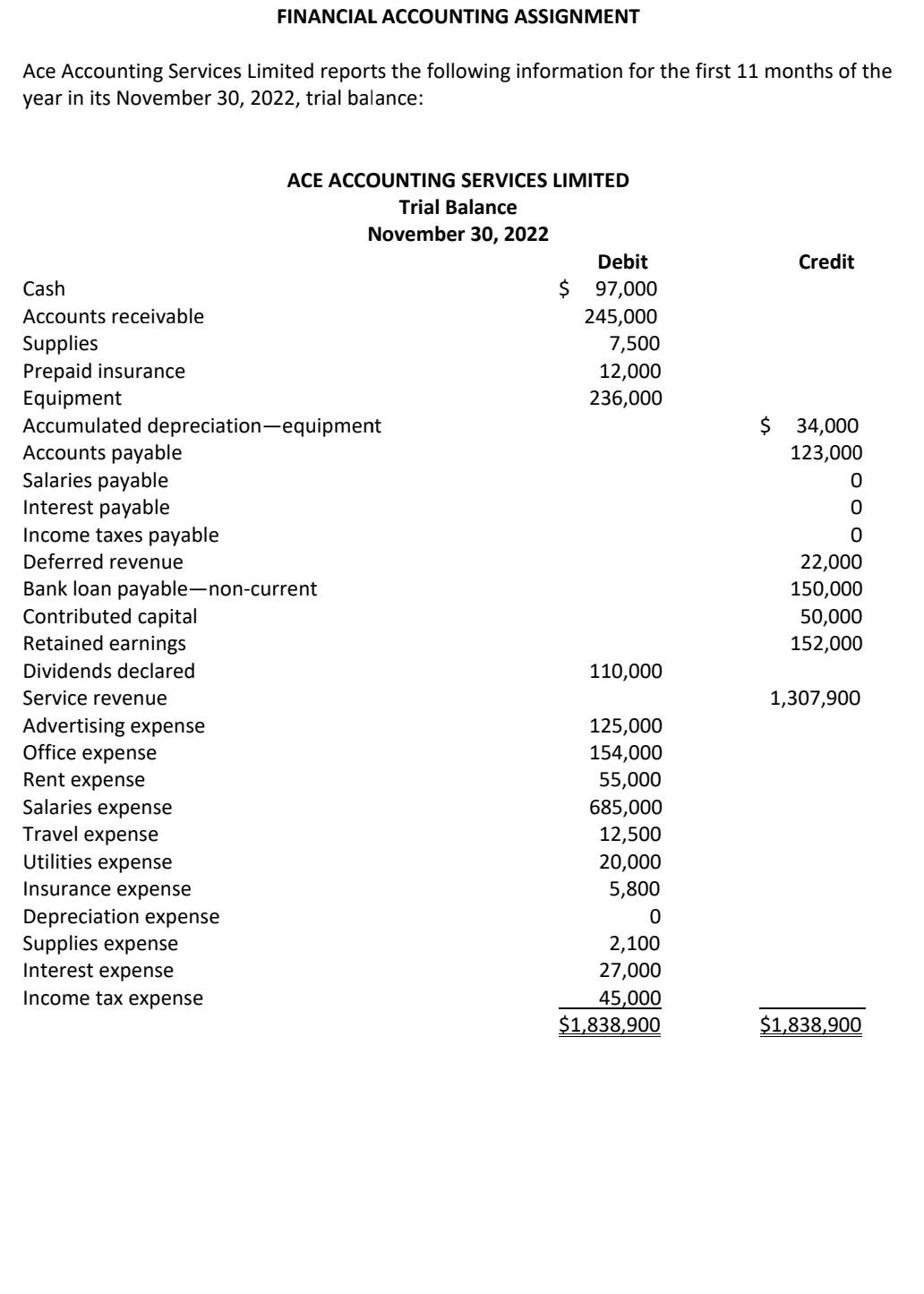

solve this question please Ace Accounting Services Limited reports the following information for the first 11 months of the year in its November 30,2022 ,

solve this question please

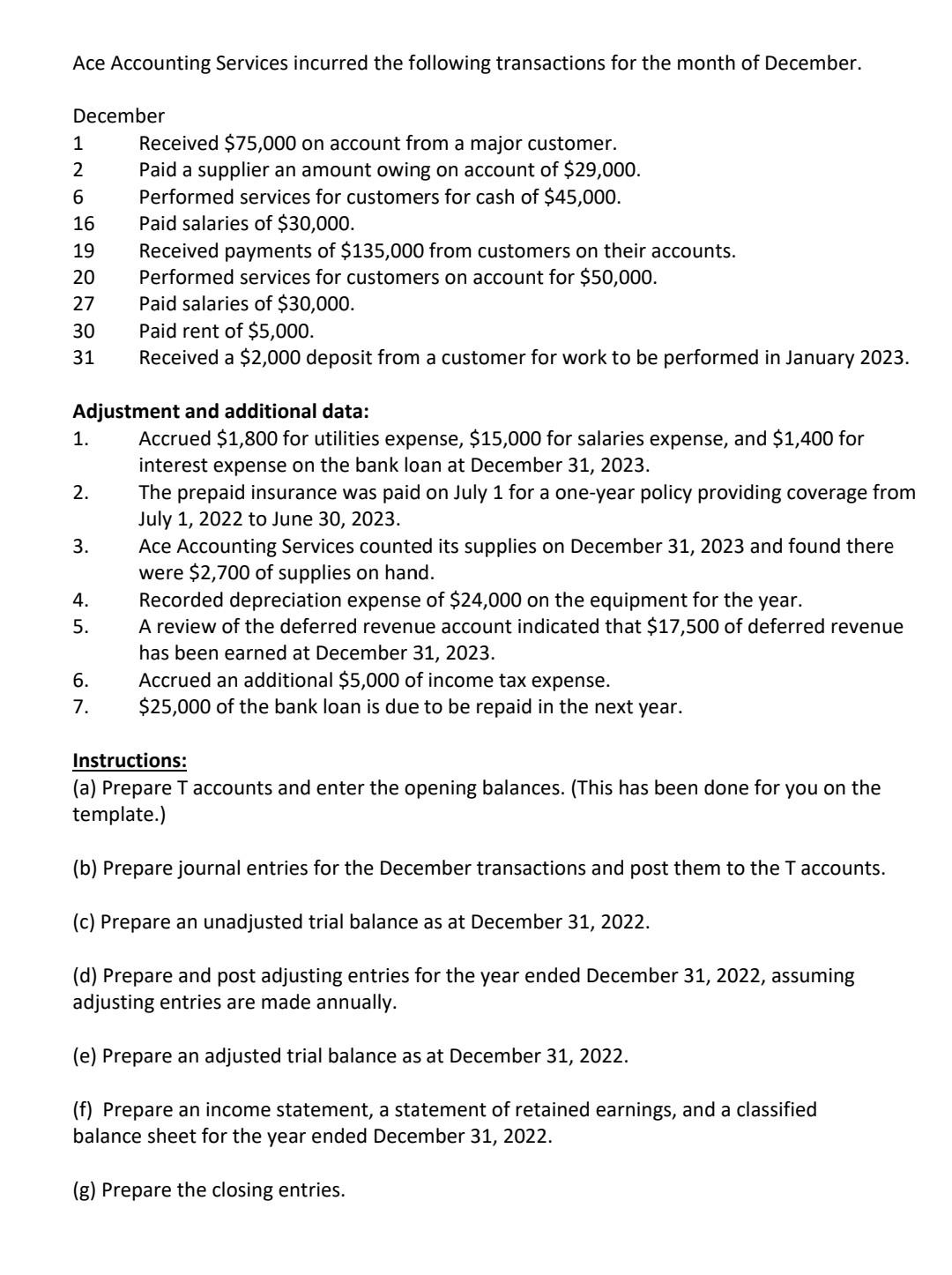

Ace Accounting Services Limited reports the following information for the first 11 months of the year in its November 30,2022 , trial balance: Ace Accounting Services incurred the following transactions for the month of December. December 1 Received $75,000 on account from a major customer. Paid a supplier an amount owing on account of $29,000. Performed services for customers for cash of $45,000. Paid salaries of $30,000. Received payments of $135,000 from customers on their accounts. Performed services for customers on account for $50,000. Paid salaries of $30,000. Paid rent of $5,000. Received a \$2,000 deposit from a customer for work to be performed in January 2023. Adjustment and additional data: 1. Accrued $1,800 for utilities expense, $15,000 for salaries expense, and $1,400 for interest expense on the bank loan at December 31, 2023. 2. The prepaid insurance was paid on July 1 for a one-year policy providing coverage from July 1, 2022 to June 30, 2023. 3. Ace Accounting Services counted its supplies on December 31, 2023 and found there were $2,700 of supplies on hand. 4. Recorded depreciation expense of $24,000 on the equipment for the year. 5. A review of the deferred revenue account indicated that $17,500 of deferred revenue has been earned at December 31, 2023. 6. Accrued an additional $5,000 of income tax expense. 7. $25,000 of the bank loan is due to be repaid in the next year. Instructions: (a) Prepare T accounts and enter the opening balances. (This has been done for you on the template.) (b) Prepare journal entries for the December transactions and post them to the T accounts. (c) Prepare an unadjusted trial balance as at December 31, 2022. (d) Prepare and post adjusting entries for the year ended December 31, 2022, assuming adjusting entries are made annually. (e) Prepare an adjusted trial balance as at December 31, 2022. (f) Prepare an income statement, a statement of retained earnings, and a classified balance sheet for the year ended December 31, 2022. (g) Prepare the closing entries. Ace Accounting Services Limited reports the following information for the first 11 months of the year in its November 30,2022 , trial balance: Ace Accounting Services incurred the following transactions for the month of December. December 1 Received $75,000 on account from a major customer. Paid a supplier an amount owing on account of $29,000. Performed services for customers for cash of $45,000. Paid salaries of $30,000. Received payments of $135,000 from customers on their accounts. Performed services for customers on account for $50,000. Paid salaries of $30,000. Paid rent of $5,000. Received a \$2,000 deposit from a customer for work to be performed in January 2023. Adjustment and additional data: 1. Accrued $1,800 for utilities expense, $15,000 for salaries expense, and $1,400 for interest expense on the bank loan at December 31, 2023. 2. The prepaid insurance was paid on July 1 for a one-year policy providing coverage from July 1, 2022 to June 30, 2023. 3. Ace Accounting Services counted its supplies on December 31, 2023 and found there were $2,700 of supplies on hand. 4. Recorded depreciation expense of $24,000 on the equipment for the year. 5. A review of the deferred revenue account indicated that $17,500 of deferred revenue has been earned at December 31, 2023. 6. Accrued an additional $5,000 of income tax expense. 7. $25,000 of the bank loan is due to be repaid in the next year. Instructions: (a) Prepare T accounts and enter the opening balances. (This has been done for you on the template.) (b) Prepare journal entries for the December transactions and post them to the T accounts. (c) Prepare an unadjusted trial balance as at December 31, 2022. (d) Prepare and post adjusting entries for the year ended December 31, 2022, assuming adjusting entries are made annually. (e) Prepare an adjusted trial balance as at December 31, 2022. (f) Prepare an income statement, a statement of retained earnings, and a classified balance sheet for the year ended December 31, 2022. (g) Prepare the closing entriesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started