Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve using excel and provide screenshots ABC Inc is considering a new project. In order to undertake the new project ABC Inc. would need to

solve using excel and provide screenshots

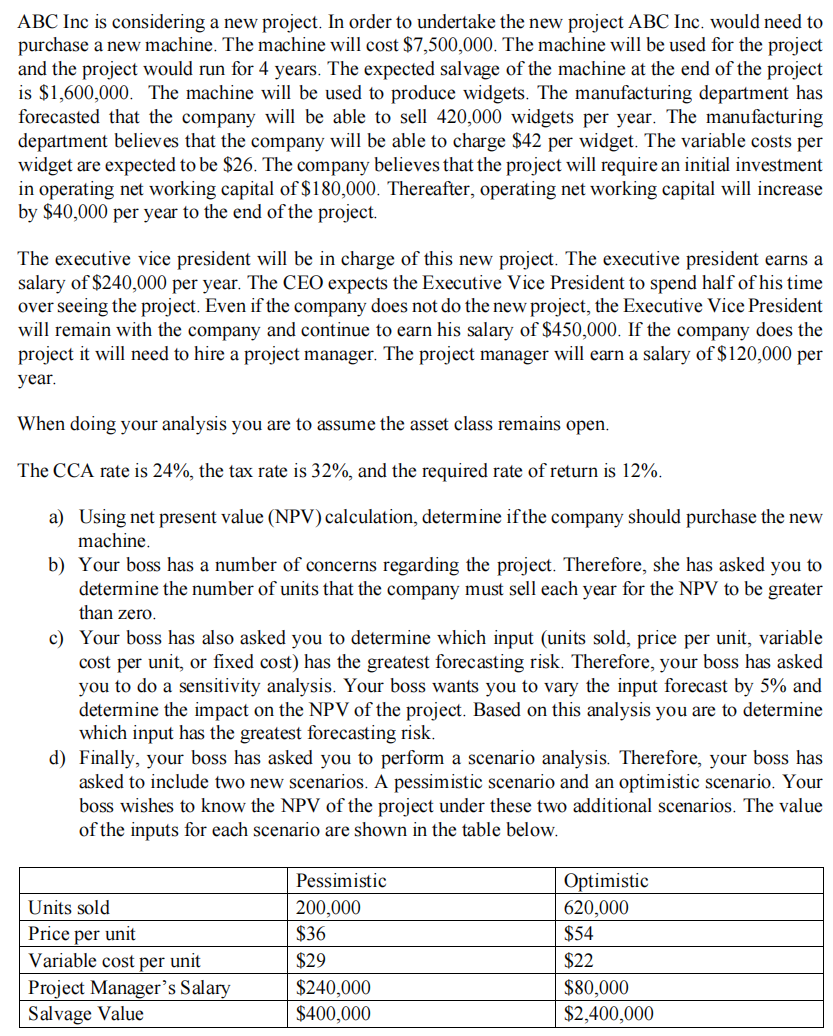

ABC Inc is considering a new project. In order to undertake the new project ABC Inc. would need to purchase a new machine. The machine will cost $7,500,000. The machine will be used for the project and the project would run for 4 years. The expected salvage of the machine at the end of the project is $1,600,000. The machine will be used to produce widgets. The manufacturing department has forecasted that the company will be able to sell 420,000 widgets per year. The manufacturing department believes that the company will be able to charge $42 per widget. The variable costs per widget are expected to be $26. The company believes that the project will require an initial investment in operating net working capital of $180,000. Thereafter, operating net working capital will increase by $40,000 per year to the end of the project. The executive vice president will be in charge of this new project. The executive president earns a salary of $240,000 per year. The CEO expects the Executive Vice President to spend half of his time over seeing the project. Even if the company does not do the new project, the Executive Vice President will remain with the company and continue to earn his salary of $450,000. If the company does the project it will need to hire a project manager. The project manager will earn a salary of $120,000 per year. When doing your analysis you are to assume the asset class remains open. The CCA rate is 24%, the tax rate is 32%, and the required rate of return is 12%. a) Using net present value (NPV) calculation, determine if the company should purchase the new machine. b) Your boss has a number of concerns regarding the project. Therefore, she has asked you to determine the number of units that the company must sell each year for the NPV to be greater than zero. c) Your boss has also asked you to determine which input (units sold, price per unit, variable cost per unit, or fixed cost) has the greatest forecasting risk. Therefore, your boss has asked you to do a sensitivity analysis. Your boss wants you to vary the input forecast by 5% and determine the impact on the NPV of the project. Based on this analysis you are to determine which input has the greatest forecasting risk. d) Finally, your boss has asked you to perform a scenario analysis. Therefore, your boss has asked to include two new scenarios. A pessimistic scenario and an optimistic scenario. Your boss wishes to know the NPV of the project under these two additional scenarios. The value of the inputs for each scenario are shown in the table belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started