Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve using excel and provide screenshots begin{tabular}{|l|r|r|r|} hline & multicolumn{3}{|c|}{ AAA Inc Income Statement } hline & multicolumn{2}{|c|}{ For Year Ended Dec ( 31^{text

solve using excel and provide screenshots

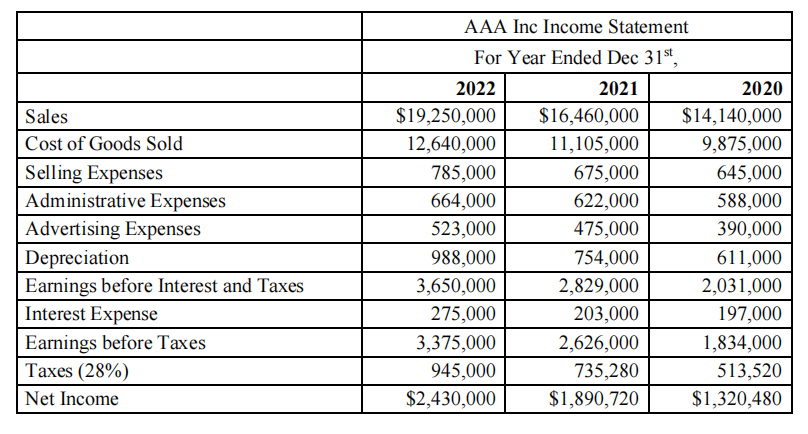

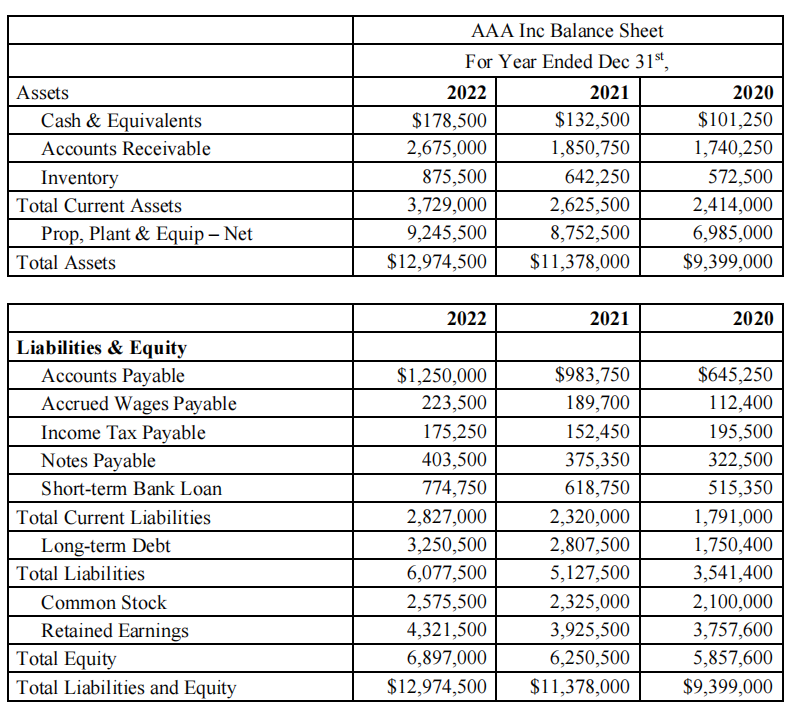

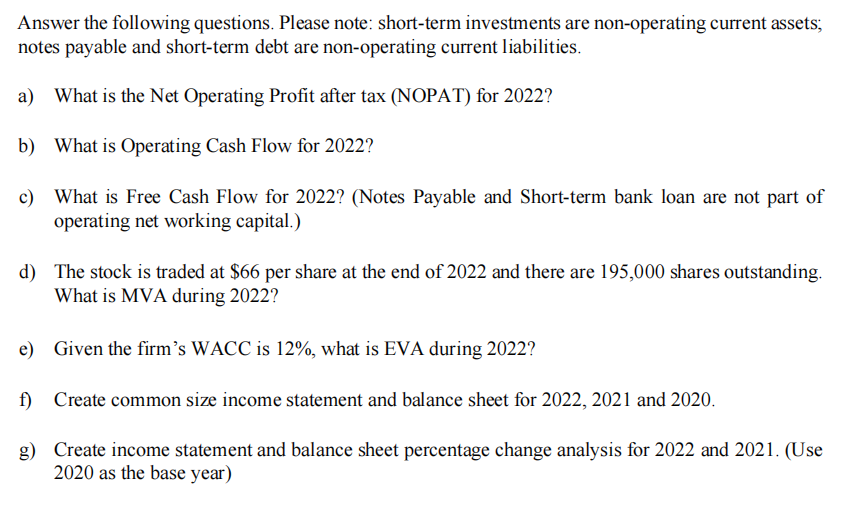

\begin{tabular}{|l|r|r|r|} \hline & \multicolumn{3}{|c|}{ AAA Inc Income Statement } \\ \hline & \multicolumn{2}{|c|}{ For Year Ended Dec \( 31^{\text {st }}} \), \\ \hline Sales & 2022 & 2021 & 2020 \\ \hline Cost of Goods Sold & $19,250,000 & $16,460,000 & $14,140,000 \\ \hline Selling Expenses & 12,640,000 & 11,105,000 & 9,875,000 \\ \hline Administrative Expenses & 785,000 & 675,000 & 645,000 \\ \hline Advertising Expenses & 664,000 & 622,000 & 588,000 \\ \hline Depreciation & 523,000 & 475,000 & 390,000 \\ \hline Earnings before Interest and Taxes & 988,000 & 754,000 & 611,000 \\ \hline Interest Expense & 3,650,000 & 2,829,000 & 2,031,000 \\ \hline Earnings before Taxes & 275,000 & 203,000 & 197,000 \\ \hline Taxes (28\%) & 3,375,000 & 2,626,000 & 1,834,000 \\ \hline Net Income & 945,000 & 735,280 & 513,520 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline & \multicolumn{3}{|c|}{ AAA Inc Balance Sheet } \\ \hline & \multicolumn{2}{|c|}{ For Year Ended Dec \( 31^{\text {st }}} \), \\ \hline Assets & 2022 & 2021 & 2020 \\ \hline Cash \& Equivalents & $178,500 & $132,500 & $101,250 \\ \hline Accounts Receivable & 2,675,000 & 1,850,750 & 1,740,250 \\ \hline Inventory & 875,500 & 642,250 & 572,500 \\ \hline Total Current Assets & 3,729,000 & 2,625,500 & 2,414,000 \\ \hline Prop, Plant \& Equip - Net & 9,245,500 & 8,752,500 & 6,985,000 \\ \hline Total Assets & $12,974,500 & $11,378,000 & $9,399,000 \\ \hline \end{tabular} \begin{tabular}{|c|r|r|r|} \hline & 2022 & 2021 & 2020 \\ \hline Liabilities \& Equity & & & \\ \hline Accounts Payable & $1,250,000 & $983,750 & $645,250 \\ \hline Accrued Wages Payable & 223,500 & 189,700 & 112,400 \\ \hline Income Tax Payable & 175,250 & 152,450 & 195,500 \\ \hline Notes Payable & 403,500 & 375,350 & 322,500 \\ \hline Short-term Bank Loan & 774,750 & 618,750 & 515,350 \\ \hline Total Current Liabilities & 2,827,000 & 2,320,000 & 1,791,000 \\ \hline Long-term Debt & 3,250,500 & 2,807,500 & 1,750,400 \\ \hline Total Liabilities & 6,077,500 & 5,127,500 & 3,541,400 \\ \hline Common Stock & 2,575,500 & 2,325,000 & 2,100,000 \\ \hline Retained Earnings & 4,321,500 & 3,925,500 & 3,757,600 \\ \hline Total Equity & 6,897,000 & 6,250,500 & 5,857,600 \\ \hline Total Liabilities and Equity & $12,974,500 & $11,378,000 & $9,399,000 \\ \hline \end{tabular} Answer the following questions. Please note: short-term investments are non-operating current assets; notes payable and short-term debt are non-operating current liabilities. a) What is the Net Operating Profit after tax (NOPAT) for 2022? b) What is Operating Cash Flow for 2022 ? c) What is Free Cash Flow for 2022? (Notes Payable and Short-term bank loan are not part of operating net working capital.) d) The stock is traded at $66 per share at the end of 2022 and there are 195,000 shares outstanding. What is MVA during 2022? e) Given the firm's WACC is 12%, what is EVA during 2022? f) Create common size income statement and balance sheet for 2022, 2021 and 2020. g) Create income statement and balance sheet percentage change analysis for 2022 and 2021. (Use 2020 as the base year)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started