Answered step by step

Verified Expert Solution

Question

1 Approved Answer

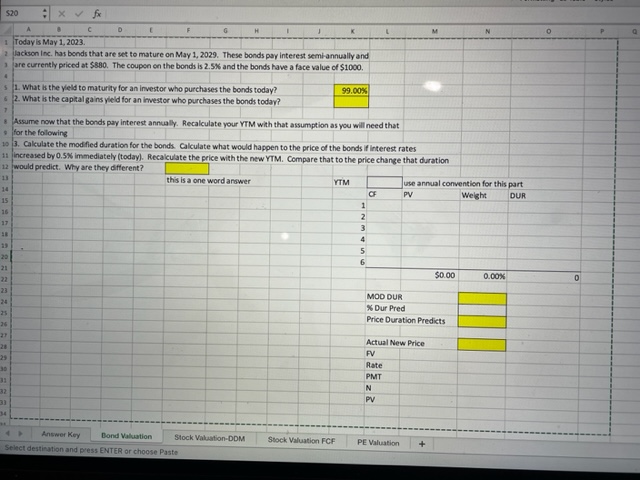

SOLVE USING EXCEL, BOND VALUATION !!! $20=fx Todayis May 1, 2023. are currently priced at $880. The coupen en the bonds is 2.5W and the

SOLVE USING EXCEL, BOND VALUATION !!!

$20=fx Todayis May 1, 2023. are currently priced at $880. The coupen en the bonds is 2.5W and the bonds have a face value of $1000. 1. What is the yeld to maturity for an investor who purchases the bonds today? 2. What is the capial gains yield for an investor who purchayes the bonds today? Assume now that the bonds pay interest annually. Recalculate your VTM with that assumption as you willi need that for the following 3. Calculate the modfied duration for the bondx. Calculate what would happen to the price of the bonds If interest rates increased by 0.5% immediately (today). Recalculate the price with the new YTM. Compare that to the price change that duration 12 would predict. Why are they different? $20=fx Todayis May 1, 2023. are currently priced at $880. The coupen en the bonds is 2.5W and the bonds have a face value of $1000. 1. What is the yeld to maturity for an investor who purchases the bonds today? 2. What is the capial gains yield for an investor who purchayes the bonds today? Assume now that the bonds pay interest annually. Recalculate your VTM with that assumption as you willi need that for the following 3. Calculate the modfied duration for the bondx. Calculate what would happen to the price of the bonds If interest rates increased by 0.5% immediately (today). Recalculate the price with the new YTM. Compare that to the price change that duration 12 would predict. Why are they differentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started